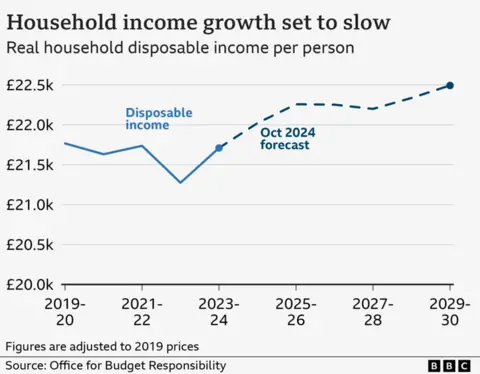

Getty ImagesWorkers had been warned their pay shall be hit by means of Funds tax rises geared toward employers.Corporations will endure the brunt of the Funds’s £40bn general tax upward thrust because of an build up within the Nationwide Insurance coverage fee for employers in addition to a discount within the threshold at which they begin paying it.Companies are prone to reply by means of conserving again on pay rises, influential assume tanks, the federal government’s unbiased forecaster and the chancellor herself have all mentioned.”It’s going to imply that companies should take in a few of this thru earnings and it’s prone to imply that salary will increase could be somewhat lower than they another way would had been,” Chancellor Rachel Reeves instructed the BBC.James Smith, analysis director on the Solution Basis assume tank which objectives to strengthen dwelling requirements for low-to-middle source of revenue households, agreed. “Despite the fact that it does not display up in pay packets from day one, it’ll sooner or later feed thru to decrease wages,” he mentioned.”That is unquestionably a tax on running folks, let’s be very transparent about that.”Different Funds measures, together with a large spice up to spending on public services and products are anticipated to lift inflation within the brief time period, which might save you rates of interest falling extra briefly.That may even have a knock-on impact on folks’s spending energy.The federal government has pledged to make financial enlargement its precedence and mentioned folks would have extra “kilos of their wallet” by means of the top of the parliament.In its common election manifesto, Labour promised to not build up taxes on “running folks” – explicitly ruling out a upward thrust in VAT, Nationwide Insurance coverage or source of revenue tax.The pledge has come beneath scrutiny, with some claiming that Labour have damaged it with the upward thrust in employer’s Nationwide Insurance coverage Contributions (NICs), one thing the federal government has denied.The Funds has sparked a debate over how a lot of the tax upward thrust corporations can take in.The Administrative center for Funds Accountability (OBR) forecasts that by means of 2026-27, some 76% of the overall price of the NICs build up shall be handed on thru a squeeze on staff’ pay rises and greater costs.The OBR expects that because of the Funds, moderate family source of revenue – which incorporates the have an effect on of tax adjustments without delay and not directly, and advantages – will build up simplest slowly over the parliament.

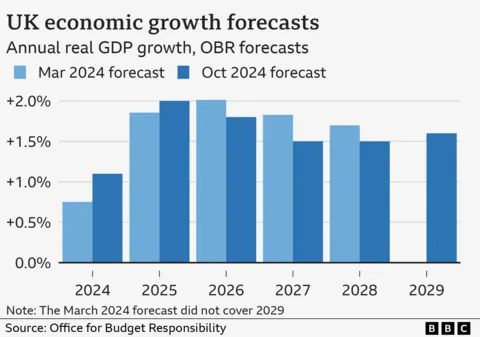

Getty ImagesWorkers had been warned their pay shall be hit by means of Funds tax rises geared toward employers.Corporations will endure the brunt of the Funds’s £40bn general tax upward thrust because of an build up within the Nationwide Insurance coverage fee for employers in addition to a discount within the threshold at which they begin paying it.Companies are prone to reply by means of conserving again on pay rises, influential assume tanks, the federal government’s unbiased forecaster and the chancellor herself have all mentioned.”It’s going to imply that companies should take in a few of this thru earnings and it’s prone to imply that salary will increase could be somewhat lower than they another way would had been,” Chancellor Rachel Reeves instructed the BBC.James Smith, analysis director on the Solution Basis assume tank which objectives to strengthen dwelling requirements for low-to-middle source of revenue households, agreed. “Despite the fact that it does not display up in pay packets from day one, it’ll sooner or later feed thru to decrease wages,” he mentioned.”That is unquestionably a tax on running folks, let’s be very transparent about that.”Different Funds measures, together with a large spice up to spending on public services and products are anticipated to lift inflation within the brief time period, which might save you rates of interest falling extra briefly.That may even have a knock-on impact on folks’s spending energy.The federal government has pledged to make financial enlargement its precedence and mentioned folks would have extra “kilos of their wallet” by means of the top of the parliament.In its common election manifesto, Labour promised to not build up taxes on “running folks” – explicitly ruling out a upward thrust in VAT, Nationwide Insurance coverage or source of revenue tax.The pledge has come beneath scrutiny, with some claiming that Labour have damaged it with the upward thrust in employer’s Nationwide Insurance coverage Contributions (NICs), one thing the federal government has denied.The Funds has sparked a debate over how a lot of the tax upward thrust corporations can take in.The Administrative center for Funds Accountability (OBR) forecasts that by means of 2026-27, some 76% of the overall price of the NICs build up shall be handed on thru a squeeze on staff’ pay rises and greater costs.The OBR expects that because of the Funds, moderate family source of revenue – which incorporates the have an effect on of tax adjustments without delay and not directly, and advantages – will build up simplest slowly over the parliament. Alternatively, projected source of revenue enlargement is somewhat quicker than the 0.3% annual moderate between 2019 and 2024, a length which noticed a chain of financial blows together with Brexit, the pandemic and effort worth rises following Russia’s invasion of Ukraine.The impact of an growing older inhabitants could also be striking extra rigidity on public budget, particularly thru upper call for for well being services and products.Via 2028 actual weekly wages – with worth rises taken into consideration – could have grown by means of simply £13 during the last 20 years, consistent with the Solution Basis.’Similar foolish video games’The Institute for Fiscal Research (IFS) mentioned the upward thrust in employer NICs will impact better corporations hiring folks on low wages essentially the most, and may just result in fewer minimal salary jobs being to be had in long term.It additionally warned that decrease pay rises may just imply the measure raises considerably lower than a forecast £25bn.It highlighted a forecast by means of the OBR that it might finally end up elevating “simply” £16bn if, for instance, companies award smaller salary rises. Paul Johnson, head of the IFS, additionally warned of most probably additional spending and tax will increase phase approach in the course of the parliament.He accused the chancellor of enjoying the “identical foolish video games” as earlier governments by means of “pencilling in implausibly low spending will increase for the long run as a way to make the fiscal mathematics stability”.”I think we’ll finally end up with much more spending, perhaps significantly extra spending than is recently deliberate,” he mentioned.”That may almost certainly imply, until she will get fortunate with enlargement, extra tax rises to come back subsequent 12 months or the 12 months after.”Financial forecasts printed by means of the OBR along the Funds counsel UK enlargement will pick out up over the following two years, however then fall again to a extra reasonable tempo, largely because of Funds measures which might be prone to push up costs and rates of interest.Mr Johnson described the forecasts as “lovely terrible”.

Alternatively, projected source of revenue enlargement is somewhat quicker than the 0.3% annual moderate between 2019 and 2024, a length which noticed a chain of financial blows together with Brexit, the pandemic and effort worth rises following Russia’s invasion of Ukraine.The impact of an growing older inhabitants could also be striking extra rigidity on public budget, particularly thru upper call for for well being services and products.Via 2028 actual weekly wages – with worth rises taken into consideration – could have grown by means of simply £13 during the last 20 years, consistent with the Solution Basis.’Similar foolish video games’The Institute for Fiscal Research (IFS) mentioned the upward thrust in employer NICs will impact better corporations hiring folks on low wages essentially the most, and may just result in fewer minimal salary jobs being to be had in long term.It additionally warned that decrease pay rises may just imply the measure raises considerably lower than a forecast £25bn.It highlighted a forecast by means of the OBR that it might finally end up elevating “simply” £16bn if, for instance, companies award smaller salary rises. Paul Johnson, head of the IFS, additionally warned of most probably additional spending and tax will increase phase approach in the course of the parliament.He accused the chancellor of enjoying the “identical foolish video games” as earlier governments by means of “pencilling in implausibly low spending will increase for the long run as a way to make the fiscal mathematics stability”.”I think we’ll finally end up with much more spending, perhaps significantly extra spending than is recently deliberate,” he mentioned.”That may almost certainly imply, until she will get fortunate with enlargement, extra tax rises to come back subsequent 12 months or the 12 months after.”Financial forecasts printed by means of the OBR along the Funds counsel UK enlargement will pick out up over the following two years, however then fall again to a extra reasonable tempo, largely because of Funds measures which might be prone to push up costs and rates of interest.Mr Johnson described the forecasts as “lovely terrible”. The Solution Basis additionally warned that the verdict to frontload will increase to spending on public services and products into this 12 months and subsequent manner the Spending Overview within the Spring shall be tricky.Reeves has additionally left herself with a “quite narrow margin of headroom”, it mentioned.The chancellor’s new debt rule permits more space for manoeuvre however maximum of that cash has already been used up, which means that that even a small financial downturn may just drive the federal government to extend taxes additional one day, the assume tank mentioned.Opposition events had been fast to criticise Reeves, with shadow chancellor Jeremy Hunt pronouncing she had taken the “simple course” by means of “choosing the wallet of companies” to fund public spending.He mentioned the method would result in “decrease enlargement, decrease dwelling requirements, decrease wages, companies using fewer folks.“It’s companies paying their taxes that pay for our public services and products and what we didn’t pay attention the day prior to this is a plan to develop the economic system and that’s what we’d like,” he mentioned.Liberal Democrats chief Ed Davey mentioned the chancellor used to be repeating the errors of her Conservative predecessors.“Elevating employer’s Nationwide Insurance coverage is a tax on jobs and Top Streets, and it’ll make the well being and care disaster worse by means of hitting hundreds of small care suppliers,” he mentioned.Talking to journalists on Thursday, the High Minister, Sir Keir Starmer, mentioned his govt had taken a “accountable” way as a way to “repair the principles” of the economic system.

The Solution Basis additionally warned that the verdict to frontload will increase to spending on public services and products into this 12 months and subsequent manner the Spending Overview within the Spring shall be tricky.Reeves has additionally left herself with a “quite narrow margin of headroom”, it mentioned.The chancellor’s new debt rule permits more space for manoeuvre however maximum of that cash has already been used up, which means that that even a small financial downturn may just drive the federal government to extend taxes additional one day, the assume tank mentioned.Opposition events had been fast to criticise Reeves, with shadow chancellor Jeremy Hunt pronouncing she had taken the “simple course” by means of “choosing the wallet of companies” to fund public spending.He mentioned the method would result in “decrease enlargement, decrease dwelling requirements, decrease wages, companies using fewer folks.“It’s companies paying their taxes that pay for our public services and products and what we didn’t pay attention the day prior to this is a plan to develop the economic system and that’s what we’d like,” he mentioned.Liberal Democrats chief Ed Davey mentioned the chancellor used to be repeating the errors of her Conservative predecessors.“Elevating employer’s Nationwide Insurance coverage is a tax on jobs and Top Streets, and it’ll make the well being and care disaster worse by means of hitting hundreds of small care suppliers,” he mentioned.Talking to journalists on Thursday, the High Minister, Sir Keir Starmer, mentioned his govt had taken a “accountable” way as a way to “repair the principles” of the economic system.

Employees’ warned Funds tax rises will hit their pay