Kamala Harris had pals in high-tech puts, nevertheless it wasn’t just about sufficient to protected the presidency.Silicon Valley’s innovative leaders, like Reid Hoffman, Laurene Powell, and Vinod Khosla, raised hundreds of thousands for the Harris marketing campaign, hoping for a Democrat within the White Area for the following time period.Within the aftermath of Donald Trump’s transparent win, a few of tech’s denizens stewed on what is going to occur subsequent for his or her trade. Even of their unhappiness following Wednesday’s effects, strains of wary optimism began to appear.In conversations with over a dozen VCs and founders, there used to be a way that the regulatory local weather may melt, probably easing antitrust scrutiny and permitting a wave of mergers and acquisitions to continue unfettered. The election consequence, coupled with the inventory marketplace’s exuberant reaction, may just illuminate the go out marketplace just like the Fourth of July, signaling non-public firms to in spite of everything move public.Whilst many Silicon Valley VCs and founders are not large Trump enthusiasts, their trade prospers when startups are getting received or going public briefly. The Biden management clamped down closely on tech M&A, so Trump’s win generally is a monetary boon for the field. There may be additionally hope and early indicators of VC fund buyers being extra open to striking contemporary cash into the asset elegance.The result might be excellent for startups who’ve been sitting at the sidelines for the previous few years hoping to head public (and their buyers), mentioned Jordan Nof, a managing spouse of Tusk Mission Companions, an early-stage investor.Stephen Hays, the founder and managing spouse of What if Ventures, mentioned cash is already shifting back. He gained two emails from buyers on Wednesday morning about committing extra capital to offers his syndicate can get entry to. Each mentioned they’d waited for the election to go to start out writing larger exams.Trump’s go back to the White Area will ripple in the course of the generation sector in unpredictable and probably transformative techniques, regardless that tech coverage used to be in large part an afterthought this election cycle. In his marketing campaign, Trump centered at the financial system to win over swing citizens, whilst Harris solid herself because the candidate who would succeed in around the aisle on housing and immigration.Within the quick time period, the election result is excellent for enterprise, mentioned a Bay Space-based investor. Trump is allied with some well known tech folks like Elon Musk, there may be prone to be extra permissive M&A, and the cost of bitcoin is at report highs. However there may be longer-term uncertainty and questions closing about whether or not Trump will shake the principles of the United States’s financial system and society, he added.Large Tech returns to the tableAs president, Trump may just roll again one of the crucial antitrust insurance policies that his opponent would have endured. The Biden management used to be a miles harder antitrust enforcer, striking many generation mergers and acquisitions on grasp. That trickled right down to little tech within the type of fewer offers closed.

Similar tales

Federal Industry Fee Chair Lina Khan’s standing might be in jeopardy as soon as Trump takes over in January. She has been probably the most primary drivers of harder antitrust enforcement in tech offers. On Wednesday, Lulu Cheng Meservey, the communications whisperer to tech companies like Y Combinator, tweeted a photograph of Khan with LinkedIn’s #OpenToWork badge.Not anything is sure about how issues will shake out. Trump’s operating mate and previous VC JD Vance has publicly mentioned that Khan is “doing an attractive excellent activity,” relating to her antitrust enforcement for giant tech firms.

Lina Khan.

Kevin Dietsch/Getty Pictures

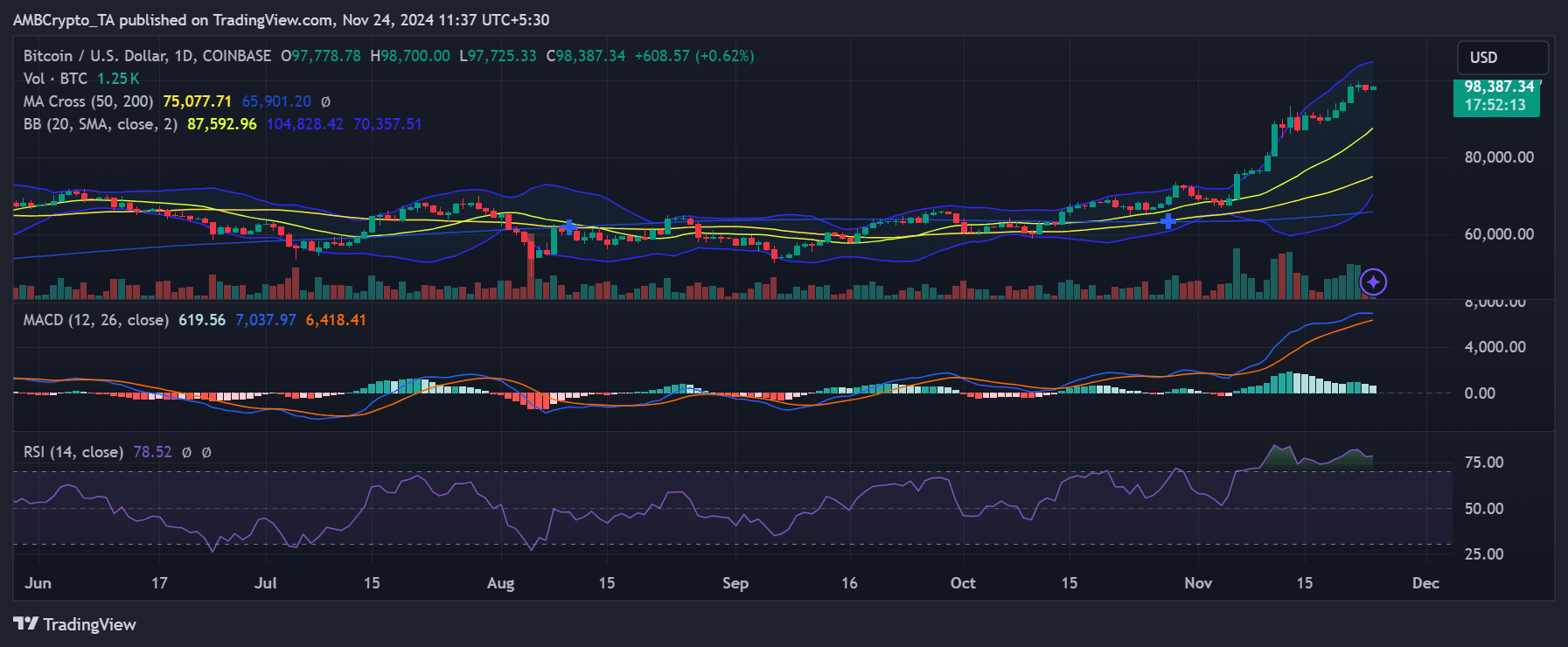

“I imagine we will see the markets open again up for M&A, a extra business-first means,” mentioned Brandon Brooks, a spouse on the tech funding company Lost sight of Ventures. He added that having a former project capitalist within the White Area — Vance — may just convey “a extra non-public marketplace center of attention” to the presidency.Traders similar to SignalFire founder Chris Farmer and Mason Angel of Industrious Ventures mentioned a extra comfortable technique to antitrust enforcement may just release billion-dollar exits for a restricted set of founders and project capitalists who’ve a vested passion in acquisitions choosing again up. That is how they go back earnings to buyers.Louis Lehot, a spouse at Foley & Lardner, expects a respite from the antitrust crackdown to “allow Large Tech patrons to go back the desk.” He mentioned, “They have got been frozen out for almost 4 years, necessarily warned to not even attempt to achieve new firms, and in some instances, to arrange for his or her looming defenestration.”The query of ways a 2nd Trump time period impacts the inventory marketplace additionally has far-reaching penalties for tech. Fewer bucks are flowing into the project capital finances that stay tech companies flush with money. Restricted companions similar to pensions and endowments that fund project companies had been choosier over months of upper rates of interest and a scarcity of personal corporate exits to the general public marketplace.Markets rallied on Wednesday as Trump’s victory ended probably the most contentious presidential elections in fashionable historical past. It is unclear how lengthy the “Trump industry” growth will final and whether or not prerequisites for project companies looking for funding will beef up anytime quickly.”I feel the troubles round price lists and the emerging price of capital make our asset elegance much less sexy if folks can earn higher charges of go back in other places,” mentioned Michael Greeley, a basic spouse at Flare Capital Companions.Crypto wins, uncertainty for climateThis election marked the primary with synthetic intelligence in play, and as president, Trump must cope with how you can keep watch over it. Even though he hasn’t launched an in depth coverage schedule, analysts be expecting Trump will ease up-regulation. His marketing campaign pledged to repeal a Biden-era government order that set guardrails at the generation and that some conservatives in tech argued went too a ways.Trump could also be noticed as bullish for crypto.The blockchain sector, together with many VCs who spend money on the field, poured $100 million into elections this 12 months. Trump situated himself because the pro-crypto candidate, promising to make the United States “the crypto capital of the sector,” and pledging he would fireplace Biden-appointed SEC chairman Gary Gensler, who has cracked down at the crypto law. Trump has additionally publicly mentioned he would “stay the entire bitcoin the United States executive recently holds or acquires into the longer term.” Bitcoin surged to a report excessive of $75,000 after Trump’s victory used to be showed.Traders in local weather tech had been extra worried about what a 2nd Trump time period method for clear power. Trump’s on-again, off-again fortify for nuclear power may just lead to new regulation to “amplify choice power resources, specifically by way of accelerating the deployment of complex nuclear micro-reactors,” mentioned Brian Garrett, managing director at Crosscut Ventures.Meta, Google, Microsoft and Amazon are all exploring the use of nuclear power to energy their knowledge facilities.Garrett shared tech investor Jenny Fielding’s issues that the brand new management may just repeal the Inflation Relief Act, a invoice that fueled funding within the clean-tech sector by way of green-lighting $369 billion in subsidies to private and non-private actors. He mentioned Trump may just retract the unspent finances a very powerful to upgrading power infrastructure within the nation.”Whilst laws had been at all times extra innovative in puts like Europe, if the local weather [regulation] beneath Biden and the Inflation Relief Act are rolled again, this generally is a important setback for local weather tech firms running (hoping to promote) in the United States,” mentioned Fielding, a managing spouse at In all places Ventures, which invests globally.In different wallet of the Valley, buyers rolled up their sleeves for a brand new day of dealmaking. “Persons are holding to themselves and simply getting on with their enterprise,” mentioned Conrad Burke, a managing spouse of MetaVC Companions.Leslie Feinzaig, a project capitalist who turned into one in all tech’s bundlers for Harris, despatched an e-mail to individuals of the VCs for Kamala team on Wednesday morning. “It hurts, after all, however it is a harm we’re conversant in,” she wrote. “I have been right here sufficient occasions that I do know what I am intended to do: Get again up, be informed the lesson, and get again to paintings.”