Previous this yr, Tremendous Micro Laptop (SMCI -11.41%) reigned with Nvidia because the marketplace’s best-performing shares. Supermicro complicated 188% within the first part, whilst Nvidia climbed 149%.

Why did this 30-year-old corporate all at once soar into the limelight? The apparatus maker, offering parts like servers for synthetic intelligence (AI) information facilities, noticed its income bounce amid the AI growth.

However this expansion tale dimmed lately as troubles for the corporate began piling up, and all of this has ended in a greater than 60% drop within the inventory since overdue August. A brief file alleged issues at Supermicro, a newspaper article spoke of a imaginable Justice Division investigation, and only recently, Supermicro auditor Ernst & Younger resigned from the activity.

On the identical time, Supermicro has fallen at the back of in monetary reporting, and a number of other weeks in the past, it mentioned its 10-Ok annual file could be overdue. And simply this week, the corporate mentioned it might be not able to document its file for the quarter ended Sept. 30 on time. Did Supermicro’s troubles simply deepen?

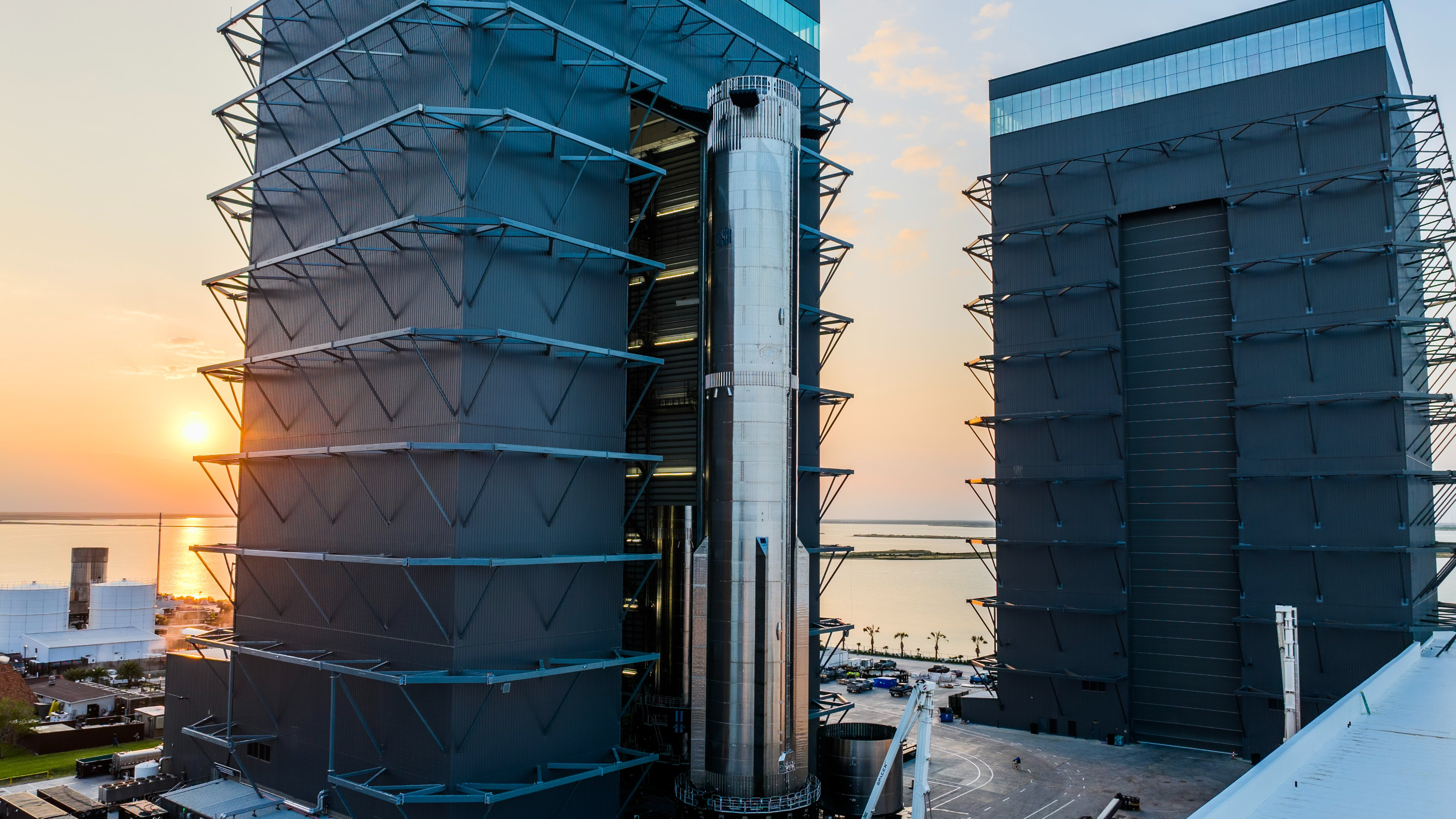

Symbol supply: Getty Pictures.

The Hindenburg file

First, a little bit of element at the quite a lot of headwinds, beginning with the fast file, launched in overdue August. Within the report, Hindenburg Analysis alleged a lot of troubles, together with “obvious accounting crimson flags.” You need to remember the fact that on the time of the file, Hindenburg held a brief place in Supermicro, so it would receive advantages if the inventory fell. This bias makes it tough for buyers to depend on Hindenburg as a supply of knowledge in regards to the apparatus maker.

The Wall Side road Magazine later reported of a probe into Supermicro introduced via the Justice Division. Each the U.S. legal professional’s administrative center and the corporate declined to remark.

In the end, auditor Ernst & Younger, after wondering the corporate’s inner controls again in July, not too long ago resigned, announcing it is “unwilling to be related to the monetary statements ready via control.” The Supermicro board appointed an unbiased particular committee to check the location, and only recently, the committee mentioned, “there is not any proof of fraud or misconduct at the a part of control or the Board of Administrators.” Despite the fact that the committee hasn’t formally finished its assessment, those phrases constitute some just right information for Supermicro and its shareholders.

In the meantime, Supermicro knowledgeable the Securities and Alternate Fee (SEC) that it might be overdue submitting its 10-Ok annual file, a transfer that induced Nasdaq to ship the corporate a non-compliance letter. Supermicro now has till Nov. 16 to both document or provide a plan to regain compliance. Non-compliance in the end ends up in delisting, an consequence that indisputably could be dangerous information.

What occurs if Supermicro have been delisted?

If Supermicro have been delisted, the stocks would industry over-the-counter (OTC). Quantity is decrease at the OTC marketplace and transaction prices are upper, and this may weigh on call for for the inventory. On best of this, a delisting would additional shake buyers’ self assurance within the corporate’s control.

Now we come to the most recent information: This week, Supermicro mentioned it additionally would not be capable to document its 10-Q quarterly file on time. This is not essentially a marvel because the corporate does not have an auditor presently and it will have to rent one to check the monetary statements incorporated within the 10-Q. As Supermicro famous in its declaration to the SEC, the 10-Q cannot be filed sooner than the 10-Ok annual file.

Does this imply troubles have deepened for Supermicro? Now not essentially.

As discussed, it was once transparent that with out an auditor, Supermicro could be left at a standstill in the case of monetary reporting. So the corporate’s troubles lately are the similar as they have been when Ernst & Younger resigned a few weeks in the past.

What may lend a hand Supermicro

From right here, what may lend a hand Supermicro within the close to time period is to discover a new auditor in order that the corporate would possibly growth with its reporting. With out that, it’s going to be very tough for Supermicro to proceed to draw buyers. In spite of everything, buyers need to have a transparent image of an organization’s monetary state of affairs sooner than stepping into on a inventory. And with out an auditor and subsequently a submitting of economic studies, Supermicro is also at the street to a Nasdaq delisting — every other state of affairs that may harm call for for the inventory.

Despite the fact that Supermicro has turn into a pacesetter within the AI apparatus marketplace and can have a brilliant long run forward, all of those parts upload manner an excessive amount of uncertainty to the tale presently. As an investor, the most efficient factor you’ll be able to do is stay this participant in your watch listing — probably for a second at some point when the location improves — and observe this tale from the security of the sidelines.