President-elect Donald Trump talking at a gathering with the Space GOP convention on Nov. 13.Allison Robbert/Pool by the use of AP

“I HAVE NO INTENTION OF SELLING!” Donald Trump posted on Nov. 8 on Fact Social, 3 days after he swept all seven swing states on his method to a well-liked vote victory and a 2d time period within the White Space. Calling for investigations into “faux, unfaithful, and almost definitely unlawful” ideas that he would possibly promote some or all of his 114,750,000 stocks of Trump Media and Era Workforce (which owns Fact Social), he expressed his self assurance within the platform, which reported shedding some $19 million ultimate quarter: “Fact is crucial a part of our ancient win, and I deeply consider in it.”

That method isn’t a wonder—it aligns with Trump’s refusal to divest from his companies all over his first time period. However which may be a large mistake, particularly given that there’s a transparent trail for him to sell off his stocks that may permit him to quiet ethics issues, diversify his internet value clear of one risky inventory and steer clear of an enormous capital features tax invoice, saving him loads of tens of millions of greenbacks. All he’d wish to do is safe a certificates of divestiture, a regimen file for incoming govt department officers.

When presidential appointees come into executive from the personal sector, they regularly have inventory holdings or different property that they’re legally required to promote to conform to conflict-of-interest rules. If an reputable obtains a certificates of divestiture, or CD, issued by way of the federal Place of business of Govt Ethics, and invests their sale proceeds right into a authorized asset—like different mutual finances or treasury bonds—they are able to defer any capital features taxes owed at the transaction till they promote the substitute assets.

“Up to now, it was once considered as a deterrent to cause them to divest after which incur capital features, and the theory was once that it’s essential to by no means get anyone to return into the federal government,” says Virginia Canter, who served as an ethics legal professional or marketing consultant in a couple of executive businesses sooner than changing into leader ethics suggest at Electorate for Duty and Ethics in Washington, a watchdog workforce.

A CD generally is a win-win for everybody concerned: “The principle receive advantages to the federal government is that you just’re resolving conflicts of curiosity,” Canter explains. “The prospective, debatable, advantages to the beneficiary is that they might be capable to diversify their portfolio.” When Goldman Sachs CEO Hank Paulson was once appointed to move the Treasury by way of George W. Bush in 2006, Richard Painter, then the White Space’s leader ethics legal professional, helped him conform to the requirement that Paulson unload round $600 million of Goldman Sachs inventory. “It’s glorious for Hank Paulson, having gotten out of Goldman Sachs in 2006,” Painter stated. “And I feel he must have known as me up and thanked me in 2008 when the ground fell out of the marketplace.”

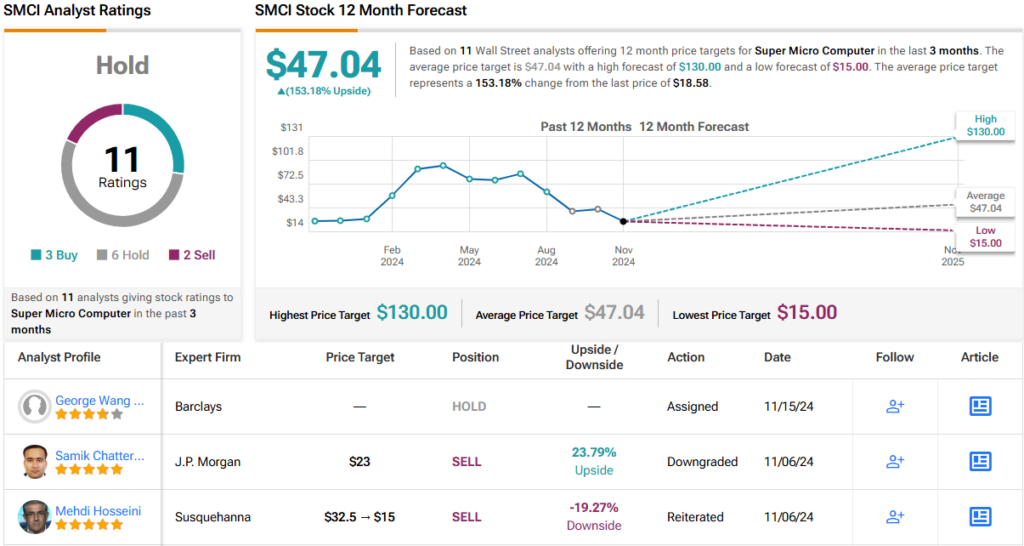

Diversification might be particularly treasured for Trump, too. His stocks of Trump Media have a tendency to oscillate wildly in worth: Since Sept. 1, they’ve hit a low of $12.15 (on Sept. 23) and a prime of $51.51 (on Oct. 29), with a couple of peaks and valleys in between. That implies that his internet value, at this level tied extra to this platform than his decades-old assets and lodge empire, additionally swings wildly; it doubled in October from $4 billion to $8 billion and now sits at $5.3 billion.

However despite the fact that shifting a risky funding into an index fund isn’t interesting sufficient, deferring the capital features generally is a primary providence. If Trump offered all his stocks at Friday’s remaining worth of $28.10 in line with percentage, he’d most likely need to pay some $770 million in taxes on his proceeds of $3.2 billion. (In fact, the inventory worth would most likely fall if his huge amount of stocks hit the marketplace, so each figures can be smaller general.) With a certificates of divestiture, he may just plow that $770 million proper again right into a different portfolio and concern in regards to the taxes later.

This is, if he can get one. The statute governing conflicts of curiosity doesn’t legally bind the president or vice chairman (despite the fact that traditionally, presidents—no longer together with Donald Trump in his first time period—have complied with its spirit by way of growing blind trusts or promoting off conflicting holdings). Walter Shaub, who headed OGE when Trump first got here into workplace, informed Forbes in 2020 that he would have issued one if Trump had requested and he anticipated that the IRS, which evaluations a CD when the recipient recordsdata their taxes, would have venerated it. (Shaub may just no longer be reached for remark for this newsletter.) Don Fox, Shaub’s predecessor who headed the company from 2011 to 2013, disagrees, noting that if the query of a presidential CD had come sooner than him when he led the company, he believes he would have needed to defer to Congress. “You’ll’t get one simply because you need one,” he says.

Canter stated that if OGE have been to resolve that it does no longer have the authority, it might search explanation from Congress—however may just additionally doubtlessly use an govt order issued by way of Biden or Trump. Painter agreed that there is also uncertainty, however felt that the president “must” be capable to get a CD. “If no longer,” he provides, “they must in no time amend the Place of business of Govt Ethics rules to be sure that a president may just get a certificates and experience the similar advantages as anyone else.” A spokesperson for OGE declined to remark.

The effects of Trump keeping onto his inventory might be severe—and stretch past simply his personal budget. Canter, Fox and Painter all expressed issues starting from the truth that Trump would appoint the heads of the businesses that keep watch over Fact Social to the potential for overseas governments and home particular pursuits purchasing commercials at the platform, placing cash proper into Trump’s pocket. “There’s no precedent in the US for this,” Fox says. “As soon as he’s inaugurated, does Fact Social turn out to be necessarily state-sponsored social media? How do you learn a put up by way of the sitting president of the US on a social media platform that he owns?” Trump’s newly minted cryptocurrency corporate items equivalent questions, to not point out his actual property empire that spawned proceedings and never-ending fights over conflicts of curiosity all over his first time period.

The president-elect turns out unconcerned, downplaying any attainable conflicts at a Fox Information the city corridor in January. “If I’ve a resort,” he stated, “and somebody is available in from China, that’s a small sum of money.”

With further reporting by way of Dan Alexander.

Editor’s word: In November 2023, Trump Media sued 20 media shops, together with Forbes, for reporting that incorporated calculations of its monetary effects whilst nonetheless a personal corporate. The defendants have moved to push aside the claims.