Nvidia (NASDAQ:NVDA) heads into its Q3 profits this week with hovering expectancies, leaving buyers questioning how for much longer its implausible streak of triple-digit year-over-year expansion can persist. Whilst the corporate has projected an outstanding $32.5 billion in income for Q3, this determine indicators a deceleration in quarter-over-quarter expansion.

Forward of the print, most sensible investor James Foord suggests it can be time to step clear of Nvidia, bringing up a mixture of macroeconomic elements and company-specific issues.

“NVDA faces festival, doable slowing AI call for, and bearish technical signs,” writes the 5-star investor, who sits within the most sensible 4% of TipRanks’ inventory execs.

The new re-election of Donald Trump provides some other wrinkle to believe. Trump introduces contemporary variables, with unresolved questions surrounding the prospective affect of his management on laws, industry, and effort prices.

Then again, Foord additionally sees doable upsides for Nvidia within the evolving political panorama. He highlights elements comparable to diminished regulatory pressures and the possibility of extra favorable financing prerequisites underneath the brand new management, which might bolster Nvidia’s potentialities.

“Lots of the massive investments in Information Middle build-outs are being financed via debt, so a extra favorable setting, i.e., decrease charges will have to permit this AI construct out to proceed, most likely even increase,” the investor opined.

Foord additionally dismisses issues that industry limitations will decrease margins, arguing that inelastic call for for Nvidia merchandise would successfully permit the corporate to go alongside any price will increase onto shoppers.

And but, the investor issues to a lot of different issues that give him pause. For starters, the marketplace expects good things from Nvidia, and pleasing those thirsty projections is rarely simple.

“At this level, it’s going to take a large wonder to delight buyers,” Foord argues, including that the “giant focal point” would be the Blackwell chips and their outlook for 2025.

As well as, the hot misses of different trade corporations comparable to ASML and Carried out Fabrics might be proof that call for is slowing down.

“I wouldn’t be stunned to look Nvidia move the similar means as the opposite chipmakers forward of profits subsequent week,” says Foord.

Every other signal that issues might be about to go downwards is the web outflows from insiders and institutional buyers in Q3.

“Have the establishments timed the highest smartly?” asks the investor. Obviously believing that they have got certainly, Foord charges NVDA stocks a Promote. (To look at Foord’s observe file, click on right here)

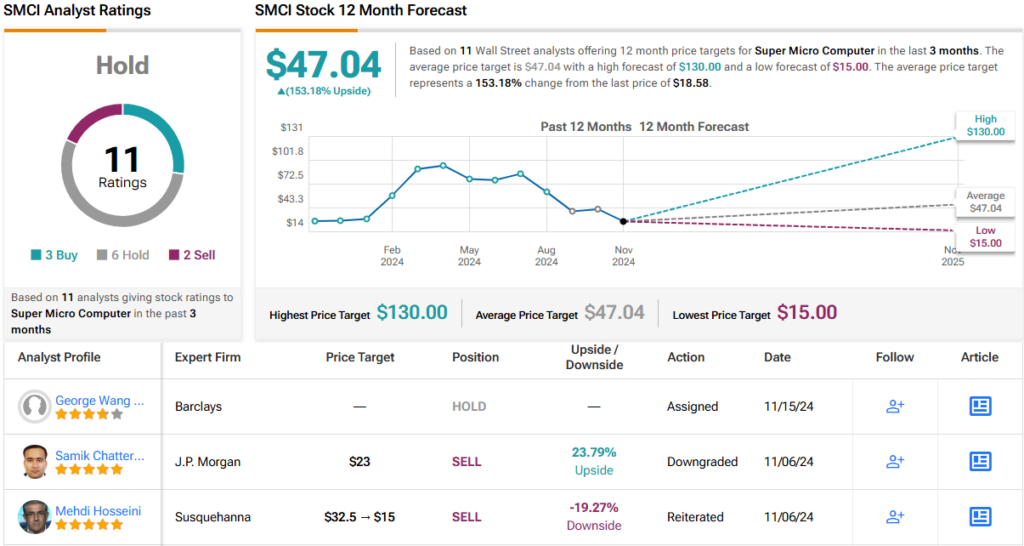

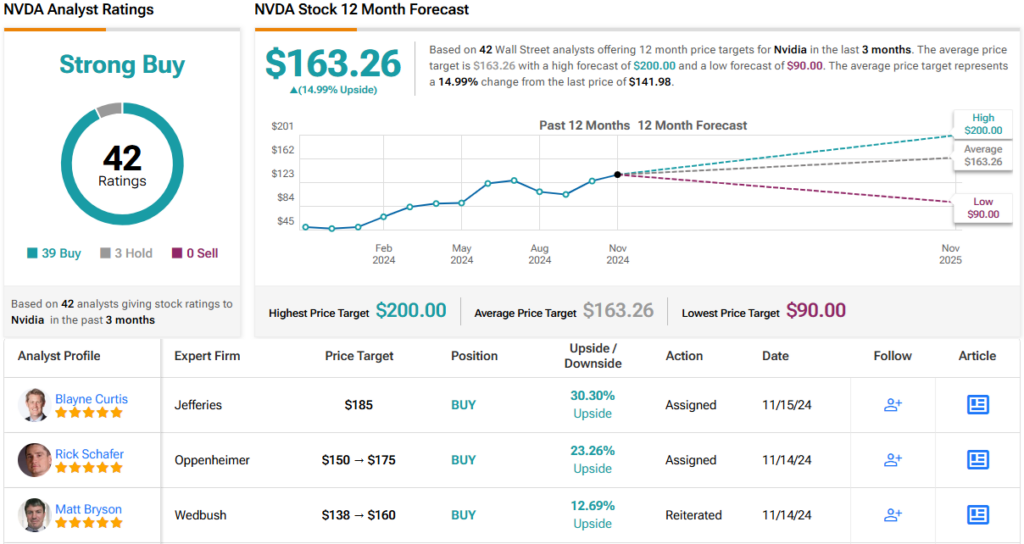

Foord’s pessimism appears to be slightly the outlier. With 39 Purchase and three Dangle scores, NVDA enjoys a consensus Robust Purchase score on Wall Side road. Its 12-month moderate worth goal of $163.26 suggests ~15% upside from present ranges. (See NVDA inventory forecast)

To search out excellent concepts for shares buying and selling at horny valuations, talk over with TipRanks’ Easiest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured investor. The content material is meant for use for informational functions most effective. It is important to to do your individual research earlier than making any funding.