Ethereum ETFs noticed a $515 million weekly listing influx.

In the meantime, ETH has declined over the last week, via 1.85%.

For the reason that approval of Ethereum [ETH] ETFs in July, the marketplace has struggled to listing a sustained influx. On the other hand, over the last two weeks, Ethereum ETFs have observed greater pastime.

A significant explanation why at the back of this was once the continuing inflow of institutional traders in anticipation of a bull run.

Spot Ethereum ETFs see inflows

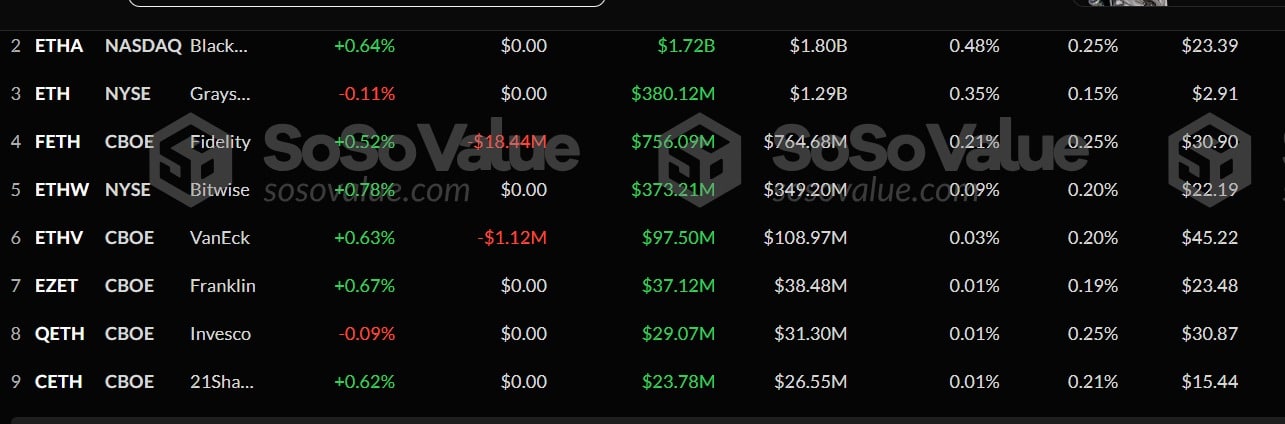

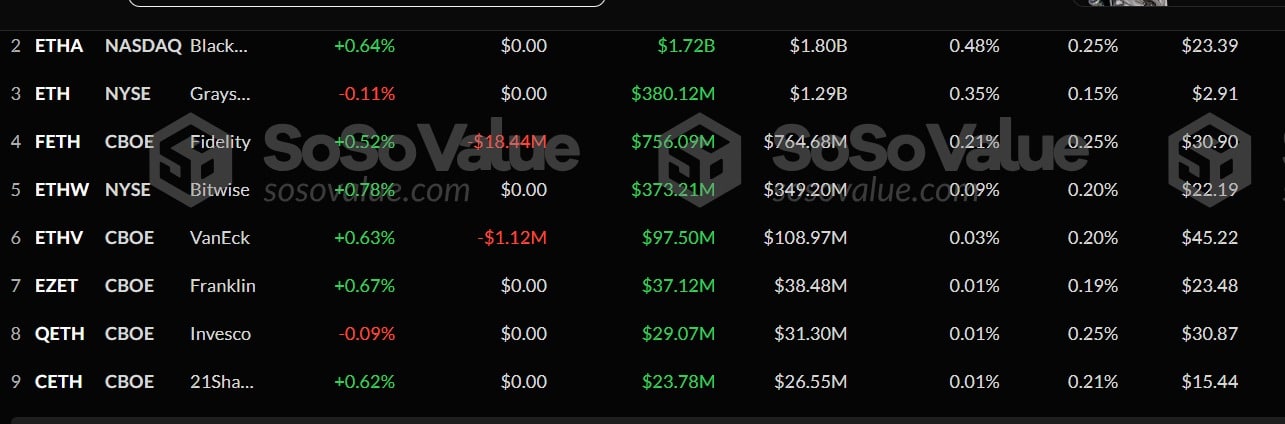

In line with AMBCrypto’s research of Sosovalue, Ethereum ETFs have observed a large influx between the ninth to the fifteenth of November. All over this era, ETH ETFs noticed a listing $515.17 million influx.

Supply: Sosovalue

Supply: Sosovalue

This stage arises for the time following a sustained certain influx over 3 weeks. Whilst the weekly influx was once a notable listing, the eleventh of November noticed the biggest day by day influx, hitting a top of $295.4 million.

Amidst this, Blackrock’s ETHA witnessed the best possible overall influx of $287 million, expanding its overall to $1.7 billion.

At 2nd position was once Constancy’s FETH, which noticed its marketplace develop to $755.9 million with a $197 million influx over this era.

In the meantime, Grayscale’s ETH’s influx touched $78 million, whilst Bitwise’s quantity stood at $54 million.

Those have been the highest gainers over this era, whilst others corresponding to ETHV, and 21 Stocks noticed average inflows. With those greater inflows, Ethereum’s ETFs sat at $9.15 billion.

Implication on ETH worth chart

Whilst such influx is anticipated to have certain affects on ETH’s worth chart, in this instance, they didn’t. All over this era, ETH declined from a top of $3446 to a low of $3012.

Even at the eleventh of November, when the influx was once the biggest on day by day charts, ETH declined.

This development has endured even on the time of this writing. In truth, at press time, Ethereum was once buying and selling at $3122, marking average declines on day by day and weekly charts, shedding via 1.22% and 1.85% respectively.

Supply: TradingView

Supply: TradingView

Those marketplace stipulations instructed that ETH was once suffering with bearish sentiment in a bull marketplace.

Such marketplace habits was once evidenced via the truth that ETH’s RVGI line made a bearish crossover to drop under its sign line. This means the upward momentum is weakening, signaling a possible development reversal.

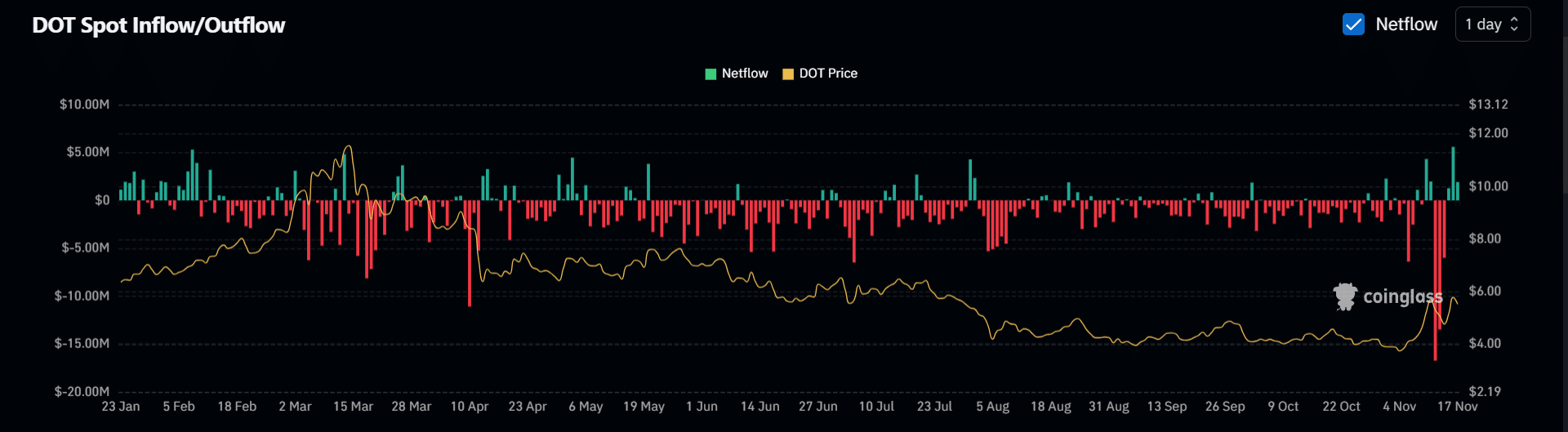

Supply: CryptoQuant

Supply: CryptoQuant

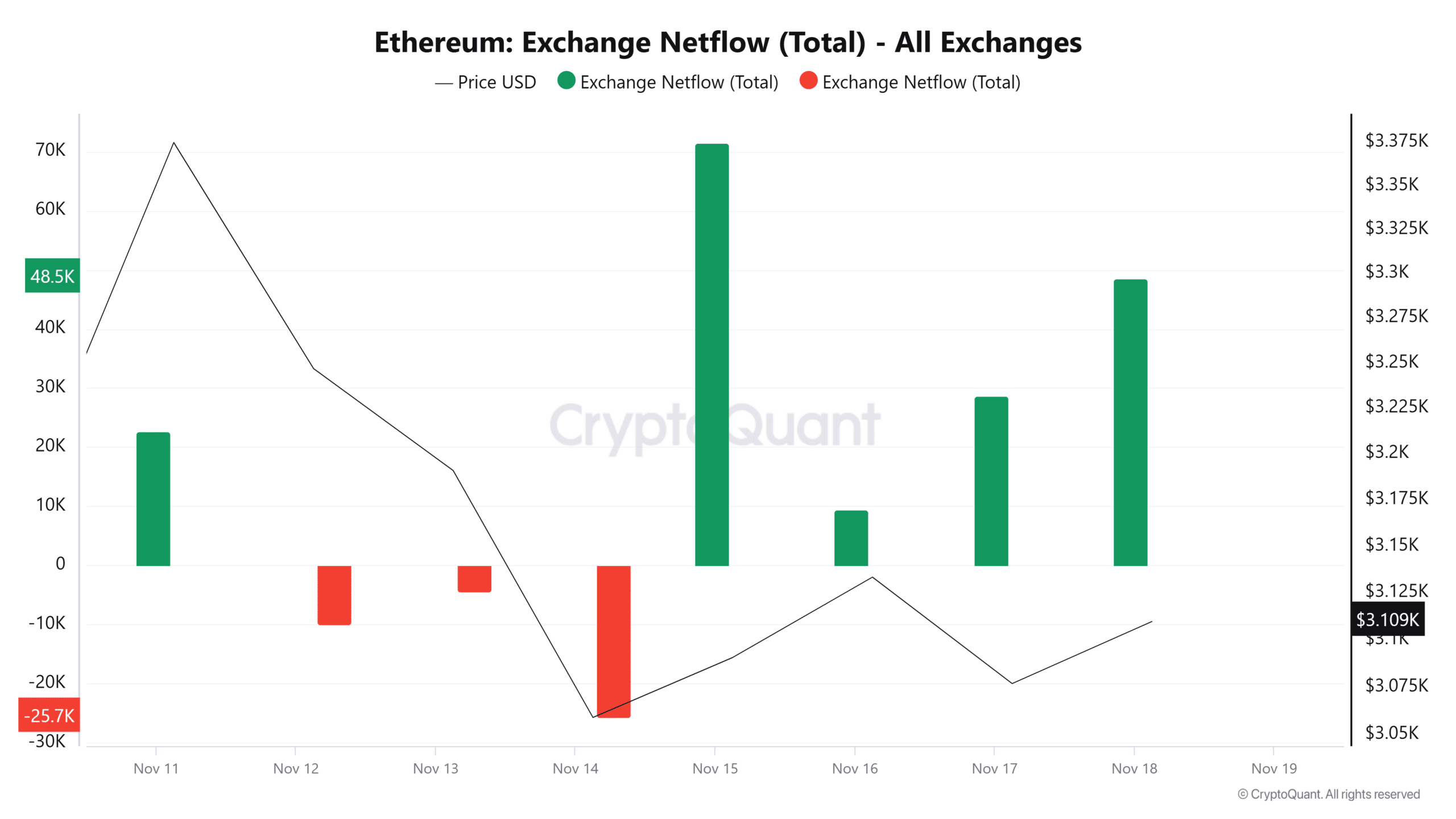

Moreover, Ethereum’s netflow has remained certain over the last 4 days, implying that there was once extra influx into exchanges than outflow. Episodes like those counsel that traders lacked self belief.

Even if Ethereum ETFs have skilled record-breaking influx, it has but to have certain affects on ETH worth charts. To the contrary, the altcoin has declined right through this era.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

Prevailing marketplace stipulations instructed a possible pullback. If it occurs, ETH will to find enhance round $3000.

On the other hand, for the reason that crypto marketplace continues to be in an uptrend if bulls regain keep an eye on, ETH will reclaim the $3200 resistance within the quick time period.

Earlier: Bitcoin Dominance drops to 60%: DOGE, XRP to guide the altcoin rally?

Subsequent: ‘Financial freedom’ or unsuitable plan? D.O.G.E debate escalates amongst mavens