Bitcoin hit $95,000 for the primary time ever, following studies of a cryptocurrency-focused position within the incoming Donald Trump management.

CryptocurrencyGains +/-Value (Recorded at 7:45 p.m. ET)Bitcoin BTC/USD+2.73%$94,794.86Ethereum ETH/USD

-0.98%$3,083.96Dogecoin DOGE/USD -0.87%$0.3845

What Came about: The main cryptocurrency in brief surpassed the never-seen-before stage in a single day on Wednesday earlier than rebounding.

With the newest uptick, Bitcoin’s weekly good points jumped to just about 5%, whilst its marketplace dominance reached 60%. Its returns for November have shot previous 33% already, in opposition to the historic moderate of 45%.

To the contrary, Ethereum, the second-largest cryptocurrency through marketplace capitalization, slid under $3,100. It used to be down over 3.5% over the week.

Bitcoin’s rally {followed} studies of a devoted cryptocurrency position in Trump’s management that may act as a bridge between the White Space, Congress, and regulatory companies just like the SEC and CFTC.

Just about $350 million in leveraged positions had been liquidated from the cryptocurrency marketplace within the remaining 24 hours, with lengthy liquidations accounting for $241 million.

Bitcoin’s Open Passion (OI) surged 6.52% within the remaining 24 hours, implying heightened speculative passion amongst derivatives buyers.

Lots of the new bets appreciated Bitcoin’s value build up because the selection of lengthy positions larger vis-à-vis shorts, in step with the Lengthy/Shorts Ratio.

Marketplace sentiment remained within the “Excessive Greed” zone, as in keeping with the Cryptocurrency Concern and Greed Index.

Most sensible Gainers (24-Hours)

CryptocurrencyGains +/-Value (Recorded at 7:45 p.m. ET)Floki (FLOKI)+14.94%$0.0002822UNUS SED LEO (LEO)+6.46%$8.47Tezos (XTZ)+5.35%$1.08

The worldwide cryptocurrency marketplace capitalization stood at $3.12 trillion, following an build up of one.32% within the remaining 24 hours.

Shares traded combined on Wednesday. The S&P 500 ended the consultation flat, whilst the tech-heavy Nasdaq Composite slid 0.11% to near at 18,966.14. The Dow Jones Commercial Moderate

The Nasdaq Composite lifted 195.66 issues, or 1.04%, to finish at 18,987.47. The S&P 500 added 0.40% to near at 5,916.98. In the meantime, the Dow Jones Commercial Moderate used to be the outlier, surging 139.53 issues, or 0.32%, to finish at 43,408.47.

Nvidia Corp. NVDA stocks completed 0.76% decrease forward of third-quarter profits, which in the end grew to become out to be higher than anticipated.

.See Extra: Easiest Cryptocurrency Scanners

Analyst Notes: Famous cryptocurrency analyst Ali Martinez drew a parallel with Bitcoin’s Dec. 2020 trajectory, looking at a “just about equivalent” Relative Power Index (RSI).

“If true, BTC will move to $108,000, drop to $99,000, and soar to $135,000,” Martinez added.

Any other widely-followed analyst, Rekt Capital, mentioned that Bitcoin dips from the prior to now damaged resistance would imply a “post-breakout retest.”

“Those retests aren’t all the time essential however BTC’s most up-to-date problem wicking demonstrates that there’s a minimum of retesting intent in the cost motion,” the analyst remarked.

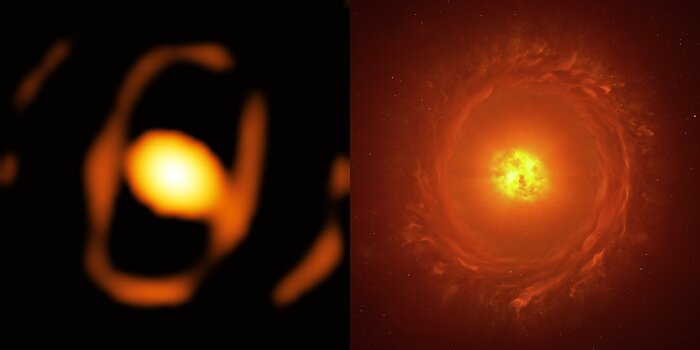

Picture through SvetlanaParnikova on Shutterstock

Learn Subsequent:

Marketplace Information and Knowledge dropped at you through Benzinga APIs© 2024 Benzinga.com. Benzinga does no longer supply funding recommendation. All rights reserved.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25596782/DSC08149.jpg)