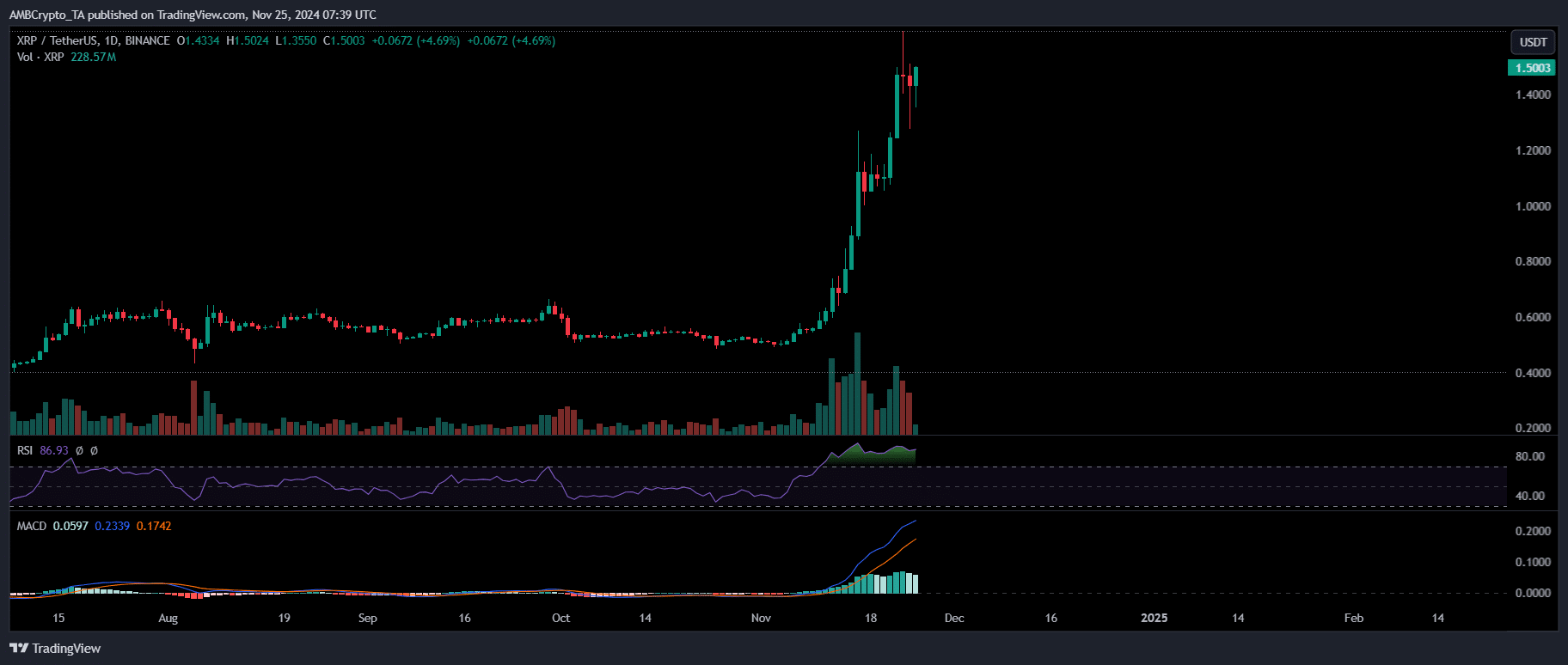

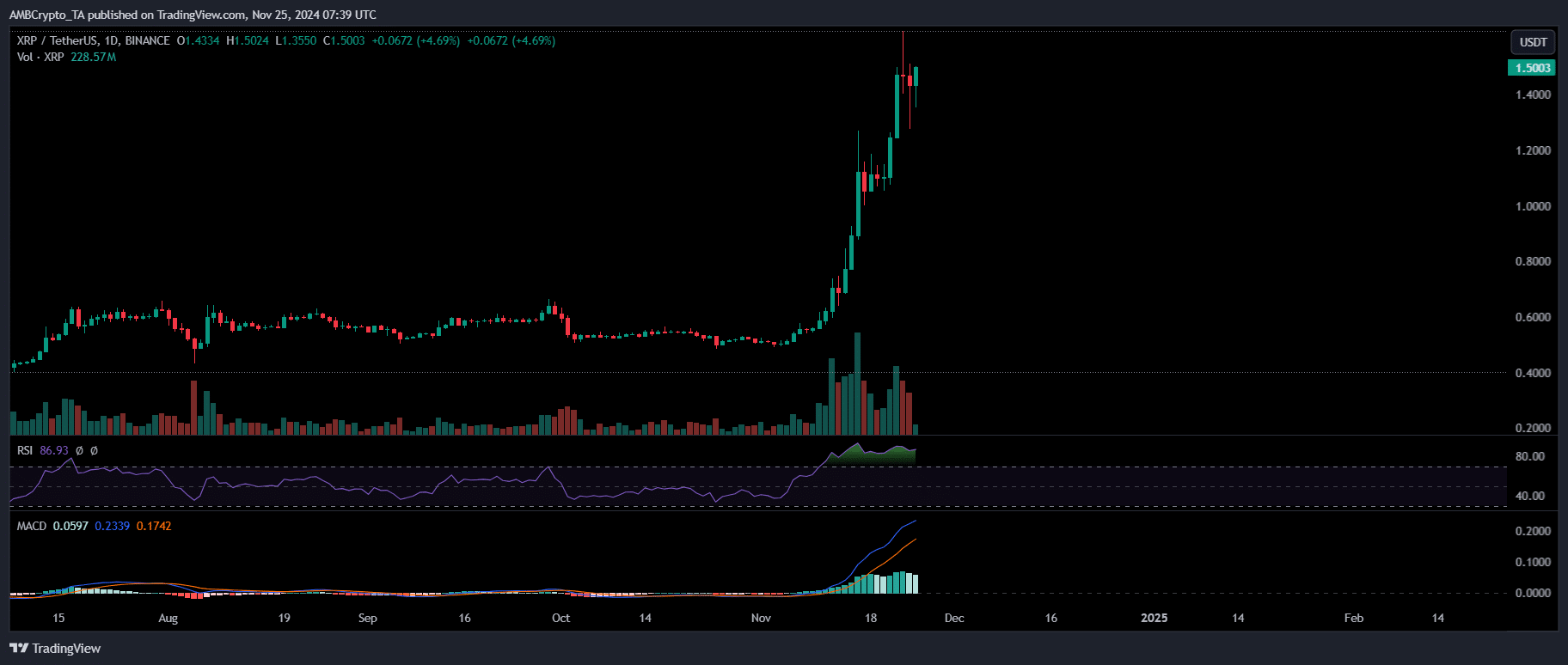

XRP holds stable at $1.50, unsure which method momentum will swing.

Extra volatility is predicted forward as marketplace forces struggle for dominance.

Following the election effects, this marketplace cycle noticed vital capital shifts. Bitcoin [BTC] led the rate, whilst Ethereum posted day-to-day beneficial properties of over 10% at its top.

However after every week of explosive enlargement, the rally began to chill, and maximum altcoins settled. That’s when Ripple [XRP] stole the highlight. A dramatic surge in investor sentiment driven XRP to reclaim the $1 milestone – a degree it hadn’t observed in 3 years.

But, the street again to its all-time top of $3.40 – ultimate observed just about seven years in the past – is anything else however easy. With erratic value motion shaking up the day-to-day chart, XRP has struggled to care for bullish momentum and smash previous the $2 mark.

Now, with a couple of metrics flashing indicators of overheating, the actual check starts. Bulls should protect the $1.40 degree with conviction.

If that degree fails to carry, a pullback to round $1 may be offering a extra horny access level, pushing again XRP’s advance towards its mental goal and a possible new all-time top.

XRP’s destiny hangs on the halfway level

Without a doubt, after 3 years of a gradual downtrend, XRP’s resurgence sparked renewed FOMO out there. At the day XRP hit $1, energetic accounts at the XRP ledger surged to a once a year top of round 48K. Alternatively, inside of only a week, that quantity has dropped to 30K, reflecting a 37.5% decline.

Those abrupt exits have disrupted the momentum had to smash the $2 barrier, resulting in a greater than 2% decline after it crossed the midway level two days in the past, with XRP lately priced at $1.46 (on the time of writing).

Most often, new pastime in a cycle emerges in two key situations: when a coin breaks thru key mental resistance or when it hits a neighborhood backside, offering a “dip” for buyers to go into and intention for oversized returns within the following classes.

Subsequently, the duty now lies with the dominant bulls. In the event that they protect the present value degree and examine the hot pullback as a false sell off, a breakout above $2 may act as a mental catalyst, sparking renewed FOMO and using extra marketplace pastime, harking back to earlier cycles.

Alternatively, if the bulls lose self assurance in XRP’s long-term possible, a pullback to round $1 may shape a neighborhood backside, providing a phenomenal access level for brand spanking new buyers having a look to capitalize on a rebound.

This puts Ripple at a crossroads, the place your next step will outline whether or not the momentum will construct towards $2 or retrace to new access issues round $1.

Brace for extra volatility forward

On one hand, analysts recommend that XRP may go through a retracement prior to creating a transfer towards $2. With a 230% rally in lower than 20 days, the token seems overextended, making the $1.00–$1.20 vary an interesting access level for the ones anticipating a correction.

However, whales keeping between 1 million and 10 million XRP seem unfazed via those speculations, having amassed over $50 million value of XRP tokens over the weekend.

This accumulation has performed a the most important function in fighting XRP from losing under the $1.20 vary, a degree it in brief touched two days in the past, marking the bottom value of the day.

Supply : TradingView

Supply : TradingView

In the meantime, within the derivatives marketplace, sentiment is leaning against shorts, with buyers making a bet on XRP’s retracement. This makes the function of whales much more the most important in counteracting a possible long-squeeze.

Real looking or no longer, right here’s XRP marketplace cap in BTC’s phrases

The approaching days will most probably display which aspect takes regulate on this tug-of-war. Alternatively, the bulls’ force to stay XRP from falling after such a lot of demanding situations provides them a powerful mental edge.

With persevered self assurance, the possibility of breaking $2 grows, as bulls paintings to reignite FOMO out there.

Earlier: Weekend wipeout: Bitcoin stumbles, $500M in liquidations apply!

Subsequent: Michael Saylor hints at a $3B Bitcoin purchase – Will it push BTC above $100K?

/cdn.vox-cdn.com/uploads/chorus_asset/file/25755281/2181413178.jpg)