Analysts imagine that BTC may well be at the verge of a significant rally, mentioning historical on-chain signs.

On the other hand, profit-taking continues to use downward drive, proscribing speedy positive factors.

Bitcoin [BTC] has delivered spectacular efficiency, accounting for a 46.59% per thirty days acquire and boosting its marketplace capitalization to $1.94 trillion.

Even so, momentum has slowed, with out a transparent marketplace path rising but. During the last 24 hours, BTC’s value has edged up by way of 0.80%, conserving it in a consolidation segment.

AMBCrypto’s research means that whilst BTC is range-bound, historical past presentations it has a tendency to wreck upper as soon as marketplace sentiment improves.

BTC nonetheless has room to rally

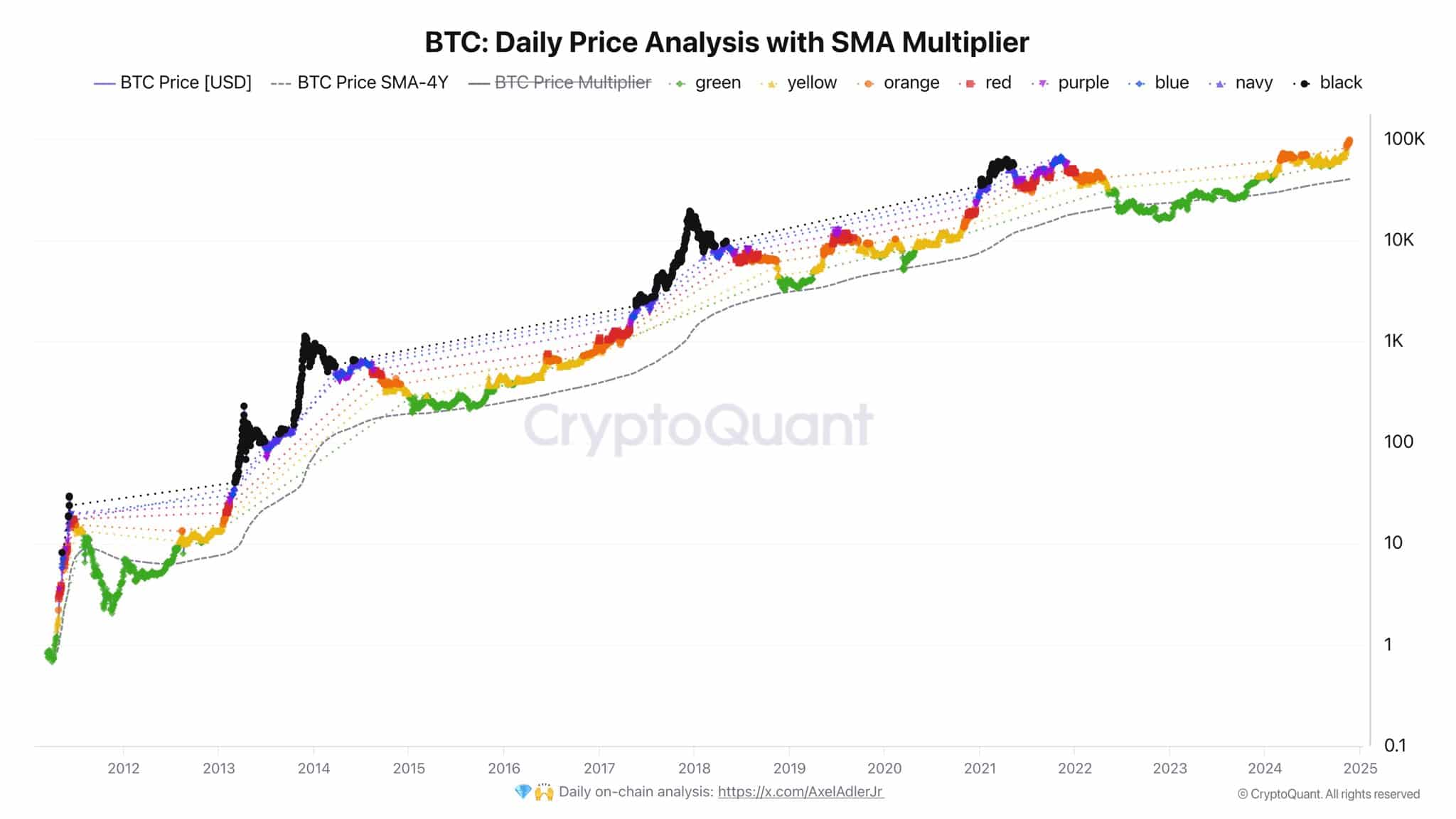

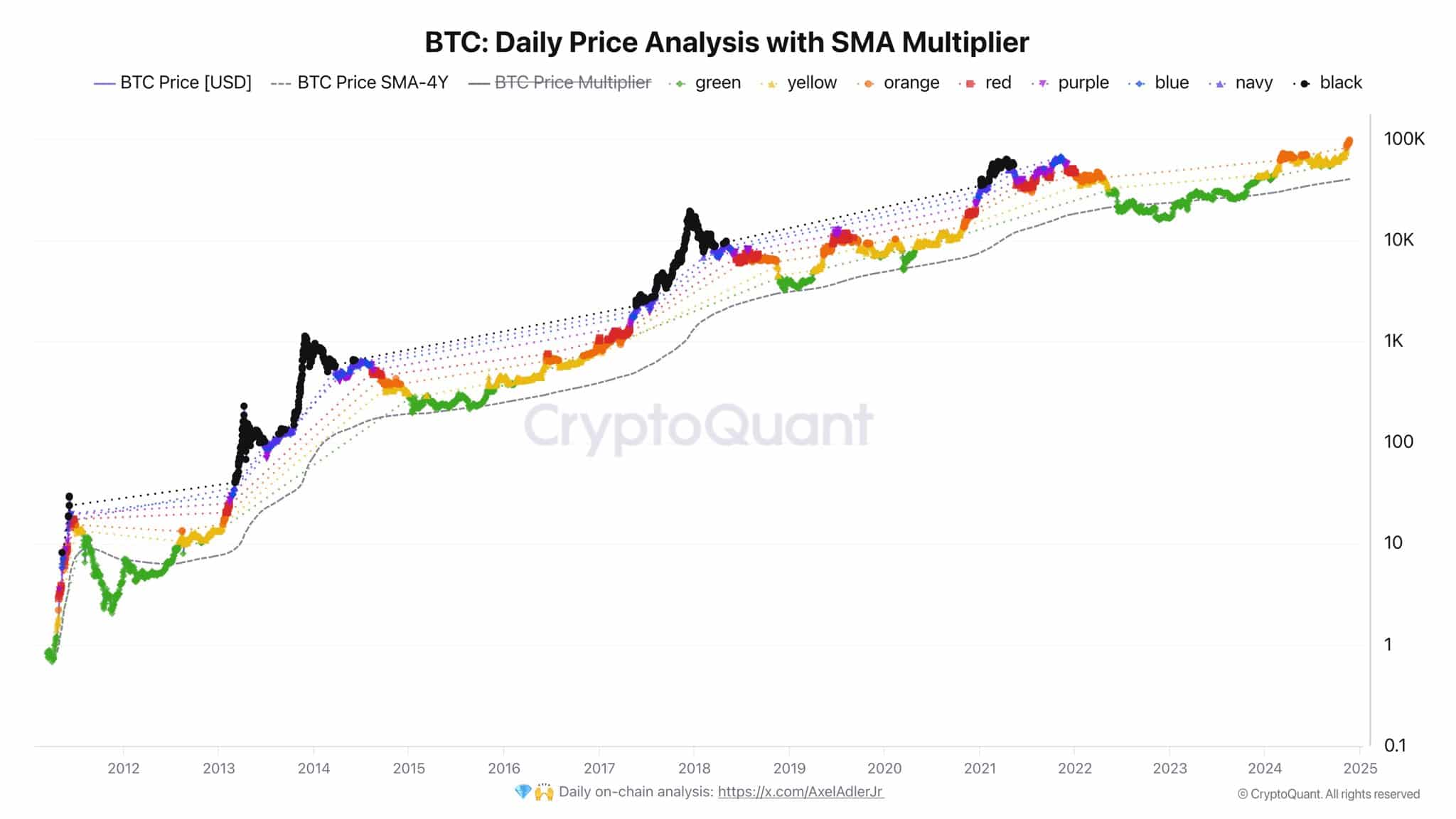

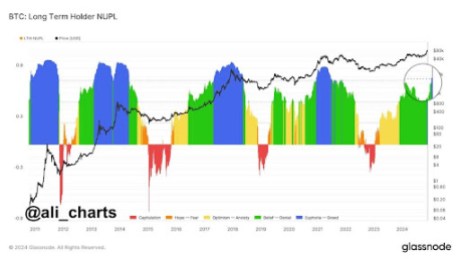

In step with a chart shared by way of Alex Adler Jr., Bitcoin has but to succeed in its cyclical height.

The chart examines BTC’s efficiency the usage of the Easy Transferring Reasonable (SMA) Multiplier, a device designed to trace value traits throughout marketplace cycles.

The research makes use of color-coded zones—starting from inexperienced (starting of cycle) to black (best of cycle)—to constitute Bitcoin’s marketplace sentiment all through other levels, from accumulation to height hypothesis.

In his put up, Adler said:

“The orange dot has arrived. Crimson, red, blue, military, and black—are coming.”

Supply: X

Supply: X

This implies BTC remains to be some distance from the height of its cycle, with 5 extra levels forward. Traditionally, those levels apply a predictable trend, with the overall “black” segment marking the onset of a decline.

If this trend holds, BTC may surpass the extremely expected $100,000 goal that has captured marketplace consideration.

AMBCrypto explored further insights into why Bitcoin, in spite of those promising metrics, has but to look its rally totally materialize.

Benefit-taking process slows BTC rally

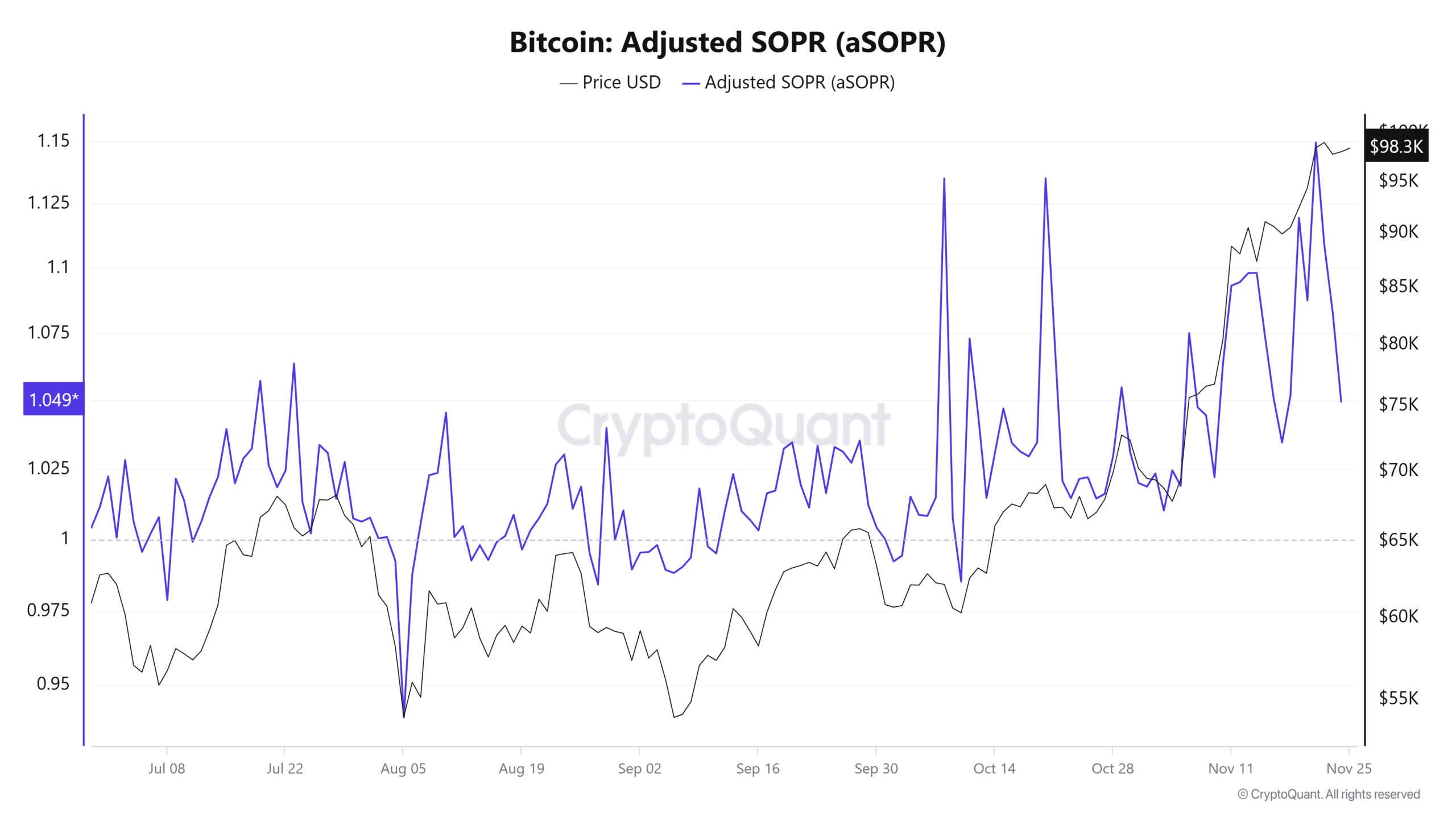

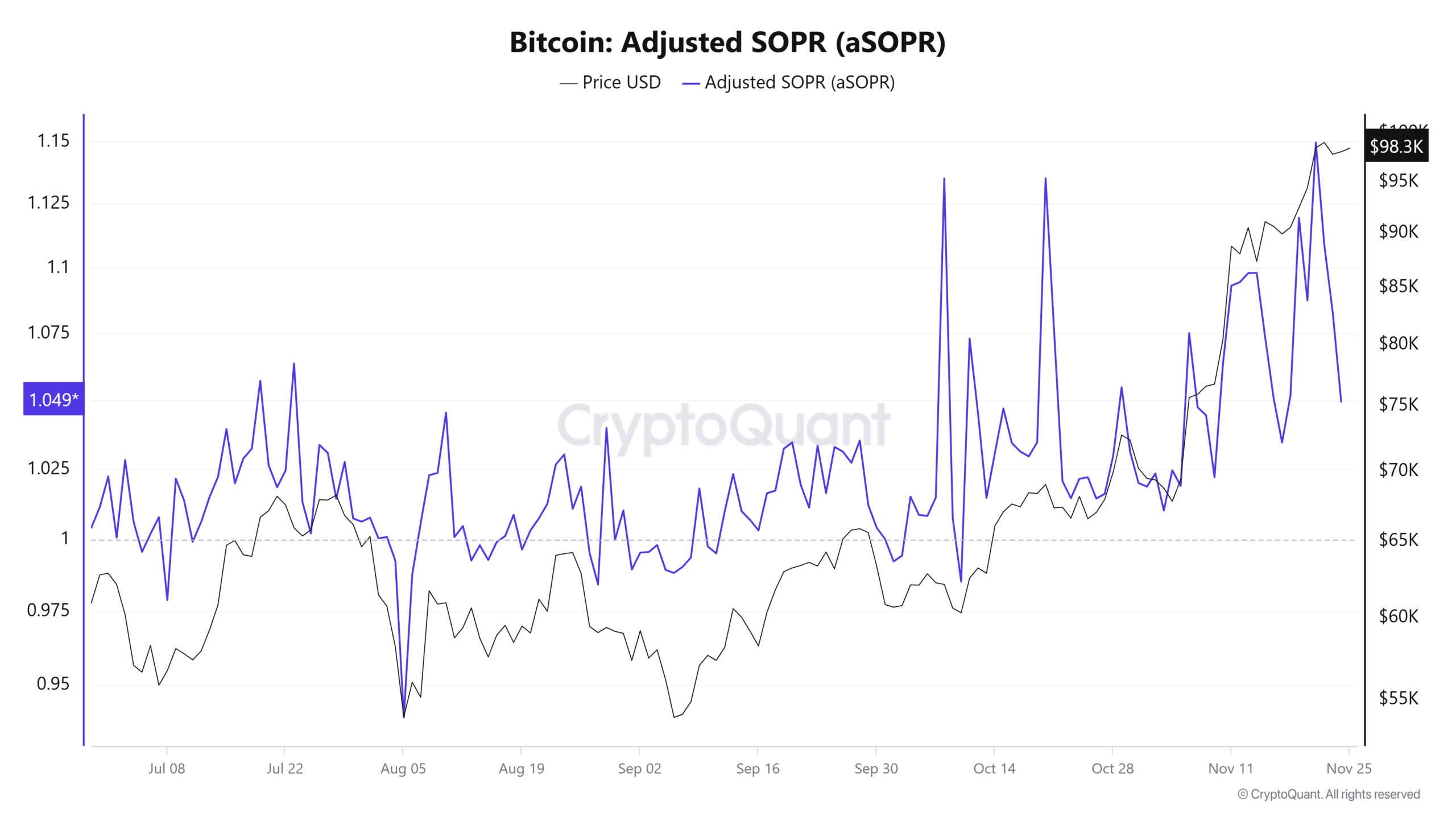

CryptoQuant’s newest perception finds that heightened profit-taking process is weighing on Bitcoin’s (BTC) value momentum, combating it from making important upward strikes.

The Adjusted Spent Output Benefit Ratio (aSOPR), which measures whether or not buyers are promoting their BTC holdings at a cash in or loss, sat at 1.049 at press time.

A studying above 1 signifies that buyers had been promoting at a cash in, and this has added drive on BTC’s value, slowing its rally.

Supply: Coinglass

Supply: Coinglass

Moreover, the Take Purchase/Promote Ratio, a trademark that presentations whether or not consumers or dealers dominate the marketplace, learn 0.963 on the time of writing.

This implies that promoting quantity outweighs purchasing quantity, giving bears the higher hand and extra delaying BTC’s upward motion.

Traders stay BTC from losing

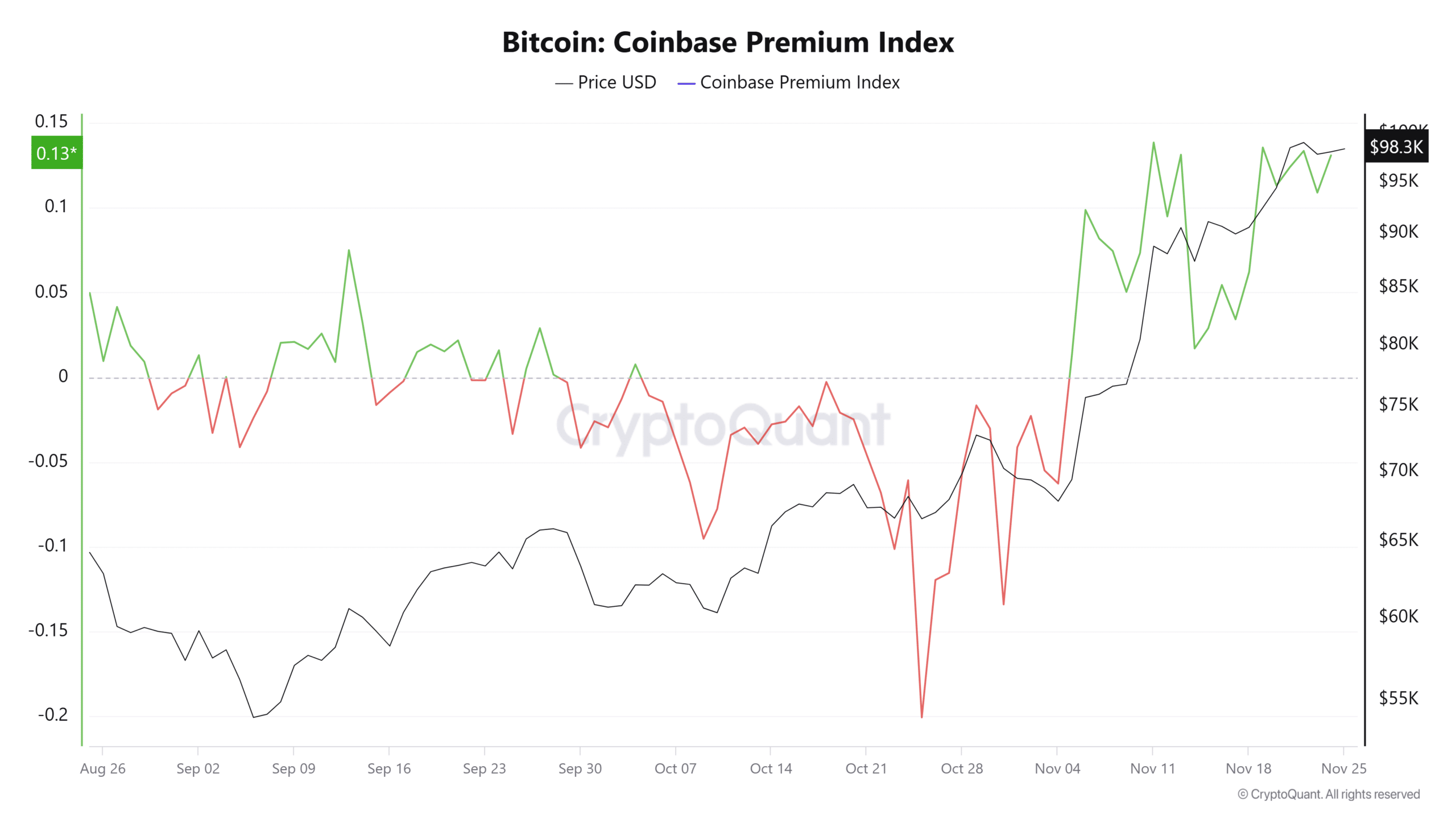

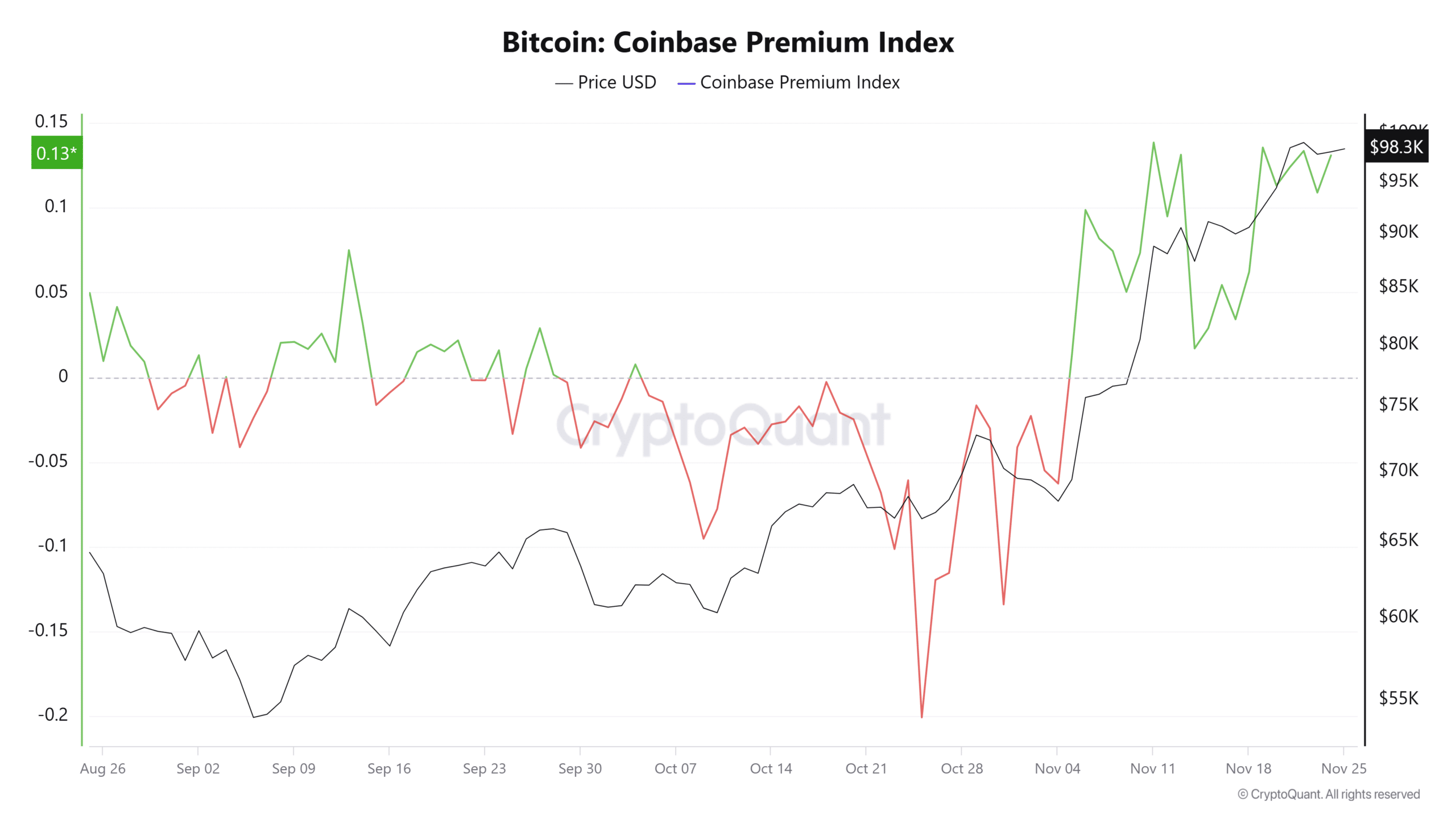

CryptoQuant studies that U.S. buyers had been actively purchasing Bitcoin (BTC) in contemporary days.

The Coinbase Top rate Index, which measures the cost distinction between BTC on Coinbase and Binance, has ticked upper, sitting at 0.1308. That is on the subject of its November top of 0.1384.

Supply: Coinglass

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

A good studying in this index—above 0—signifies more potent purchasing process from U.S. buyers in comparison to different markets.

This greater call for has helped stabilize BTC’s value, combating additional declines.

Earlier: Orchid crypto buying and selling quantity soars 2500% in 24 hours: Have an effect on on OXT?

Subsequent: Why Tron bulls will have to be wary prior to going lengthy

![Galaxy S25 Extremely ditches the Galaxy Observe design in first hands-on leak [Video] Galaxy S25 Extremely ditches the Galaxy Observe design in first hands-on leak [Video]](https://9to5google.com/wp-content/uploads/sites/4/2024/09/Galaxy-S23-Ultra-and-S24-Ultra-1.jpg?quality=82&strip=all&w=1600)