XYO has received via 17% in a single week inflicting a 20% spike in pockets profitability.

The MVRV ratio means that XYO is undervalued, giving it room for extra expansion.

XYO, at press time, had recorded a 67% upward push in buying and selling volumes in 24 hours in line with CoinMarketCap. All the way through this time, the cost higher via 6.9%, bringing its seven-day features to 17%.

The hot features have observed XYO’s marketplace capitalization upward push from $74 million in the beginning of the month to $123 million. On the other hand, a deep dive into technical signs and on-chain information displays combined alerts across the token.

XYO paperwork an asymmetrical triangle development

XYO had shaped an asymmetrical triangle development on its four-hour chart, indicating that the cost may just escape upper or go through a development reversal relying on purchasing or promoting force.

At press time, XYO used to be trying out resistance on the higher boundary of this triangle, however upper volumes are had to reinforce the uptrend.

In the meantime, the Superior Oscillator (AO) displays that the bullish momentum is gaining energy as depicted within the inexperienced histogram bars which might be expanding in dimension. If the rally continues, XYO may just goal for $0.0114.

Supply: Tradingview

Supply: Tradingview

On the other hand, a number of bearish alerts are obtrusive with the Chaikin Cash Float (CMF) having a unfavourable price of -0.11 suggesting that dealers have been extra lively than consumers.

This may result in a development reversal and a drop underneath the decrease boundary of the asymmetrical triangle to the reinforce stage at $0.007.

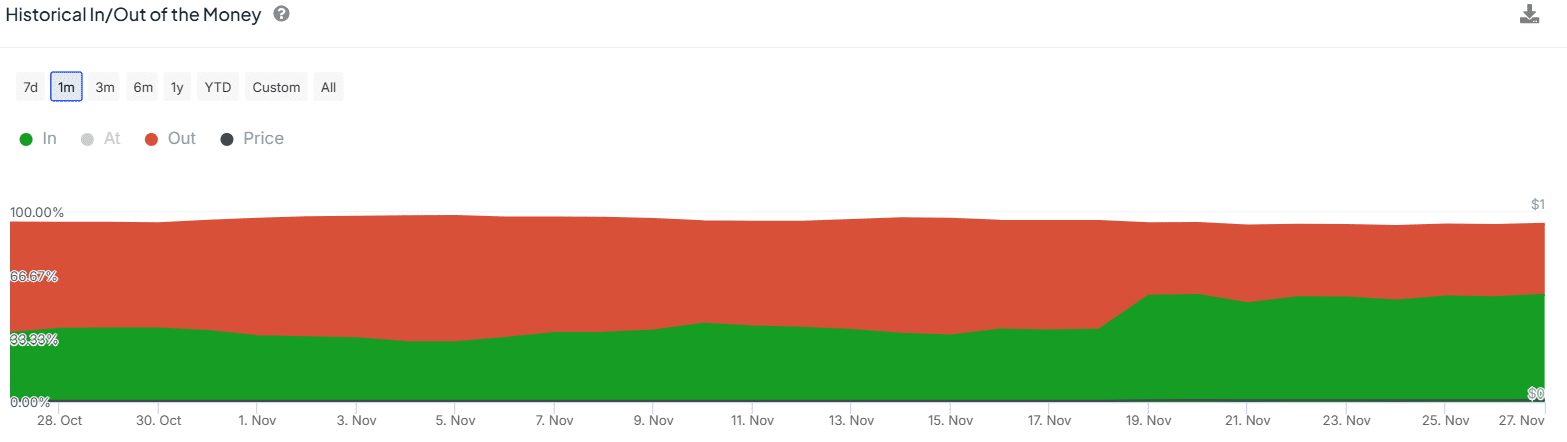

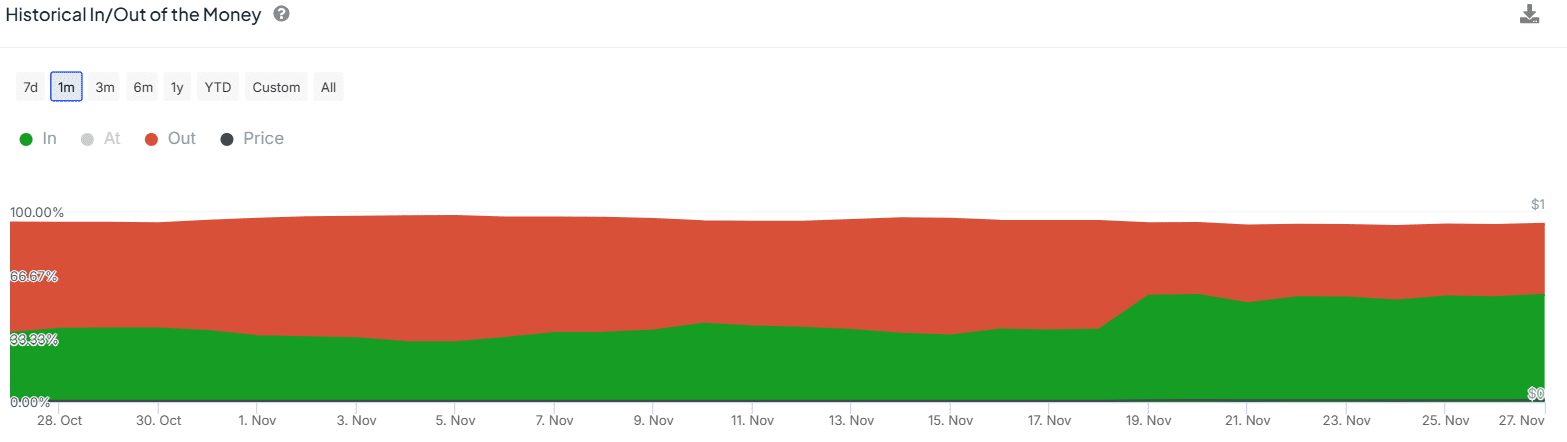

Wallets in income upward push 20%

The hot XYO features have observed the wallets which might be In The Cash (in income) build up via 20% in a single month from 36% to 56%. Then again, the wallets which might be in losses have declined from 58% to 37%.

Supply: IntoTheBlock

Supply: IntoTheBlock

A upward push in pockets profitability is bullish for a token as it could spice up the marketplace sentiment. On the other hand, it can be bearish if investors glance to take income. Subsequently, it will be significant to watch spikes in promoting process that might gasoline a downturn.

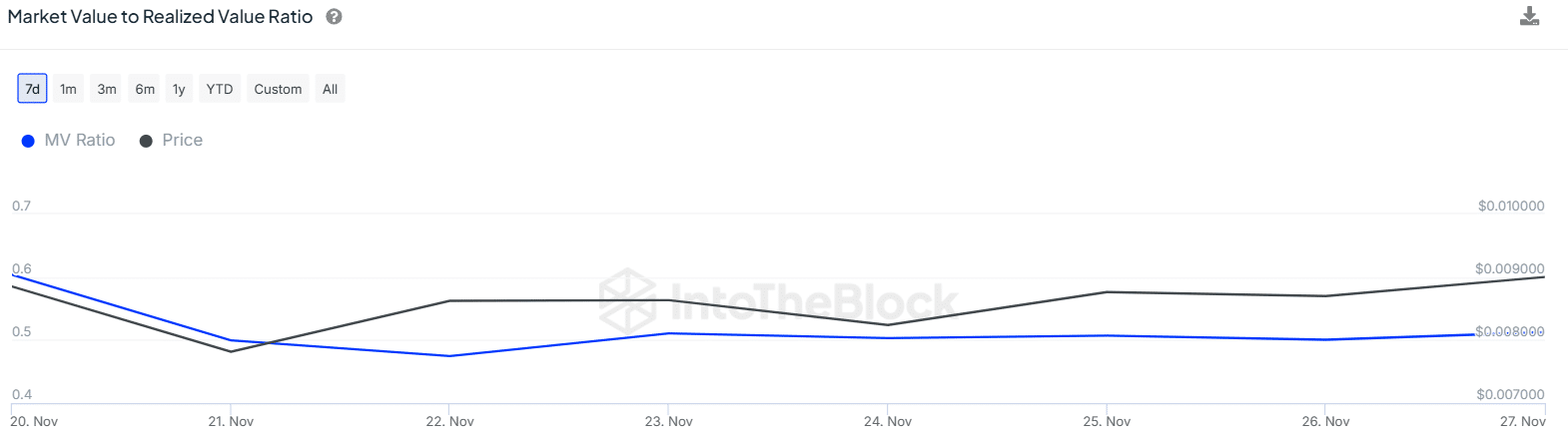

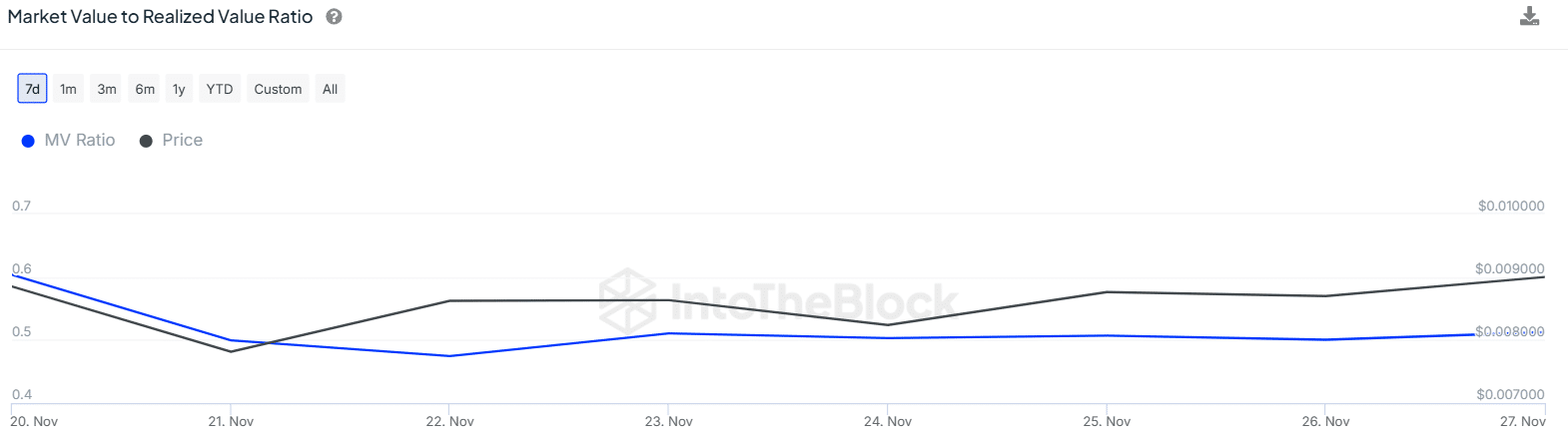

MVRV ratio displays imaginable undervaluation

The Marketplace Worth to Learned Worth (MVRV) ratio for XYO displays that the token may well be undervalued. At press time, this metric stood at 0.51, and not using a important adjustments within the ultimate seven days.

Supply: IntoTheBlock

Supply: IntoTheBlock

A low MVRV ratio gifts an accumulation zone for brand spanking new consumers. On the other hand, it additionally displays that traders are sitting on unrealized losses. As such, worth features may just draw in profit-taking, which might in flip purpose a downtrend.

Subsequent: Stellar [XLM] up 608% in 21 days – THIS is the following key temporary zone

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25514410/oceans.jpg)