Chainlink’s trade provide ratio steadily rose to a one-month prime as pockets profitability climbed

Open pastime surged to its very best degree since April too

November delivered important features for many altcoins, together with Chainlink (LINK), with the crypto buying and selling at $18.63 at press time. In truth, after gaining via round 5% within the ultimate 24 hours by myself, LINK’s per 30 days features have now surpassed 52% at the charts.

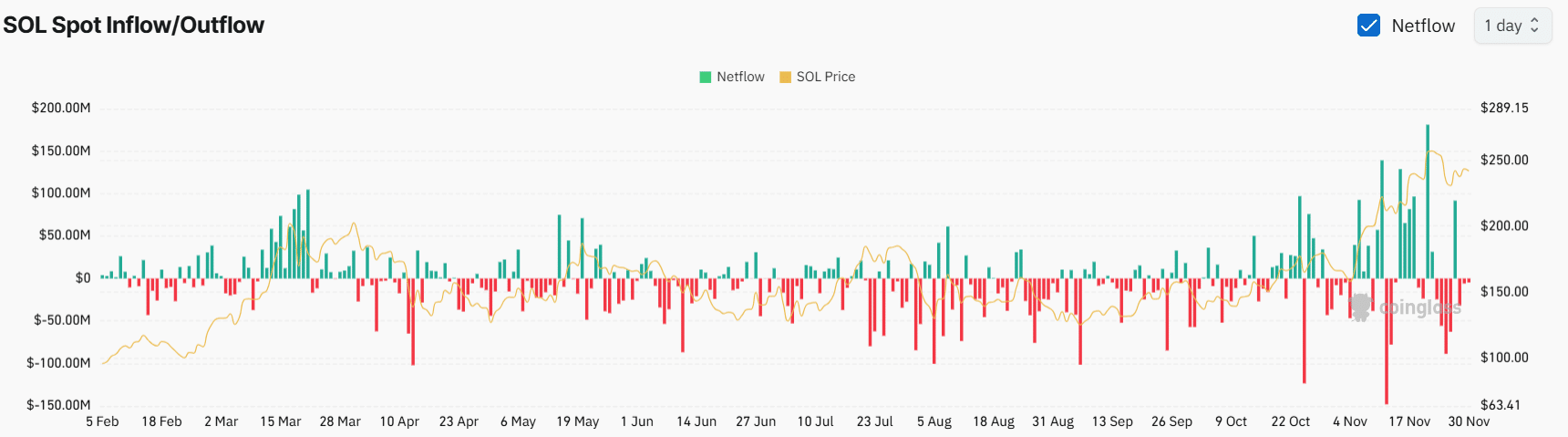

Those features appear to have stirred profit-taking actions, with the similar highlighted via the emerging trade provide ratio. Information from CryptoQuant printed a steady uptick on this metric to a per 30 days prime of 0.161.

(Supply: CryptoQuant)

(Supply: CryptoQuant)

When this ratio rises, it issues to an building up in LINK tokens being despatched to exchanges – An indication of emerging sell-side power. This is a bearish signal, particularly if there is not any uptick in purchasing process to soak up the offered cash.

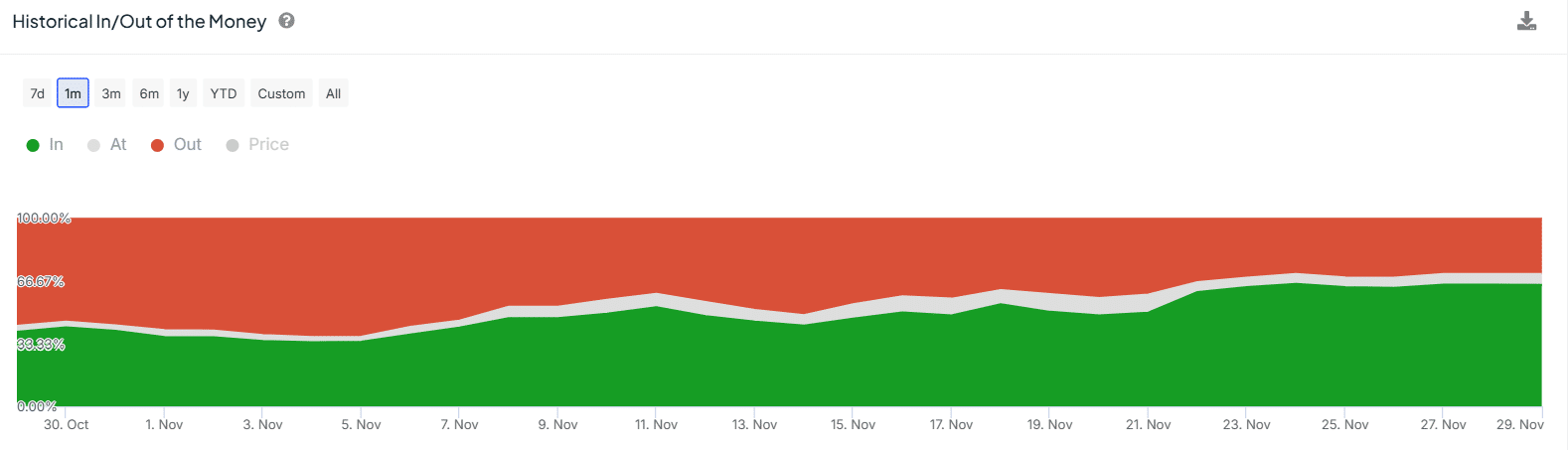

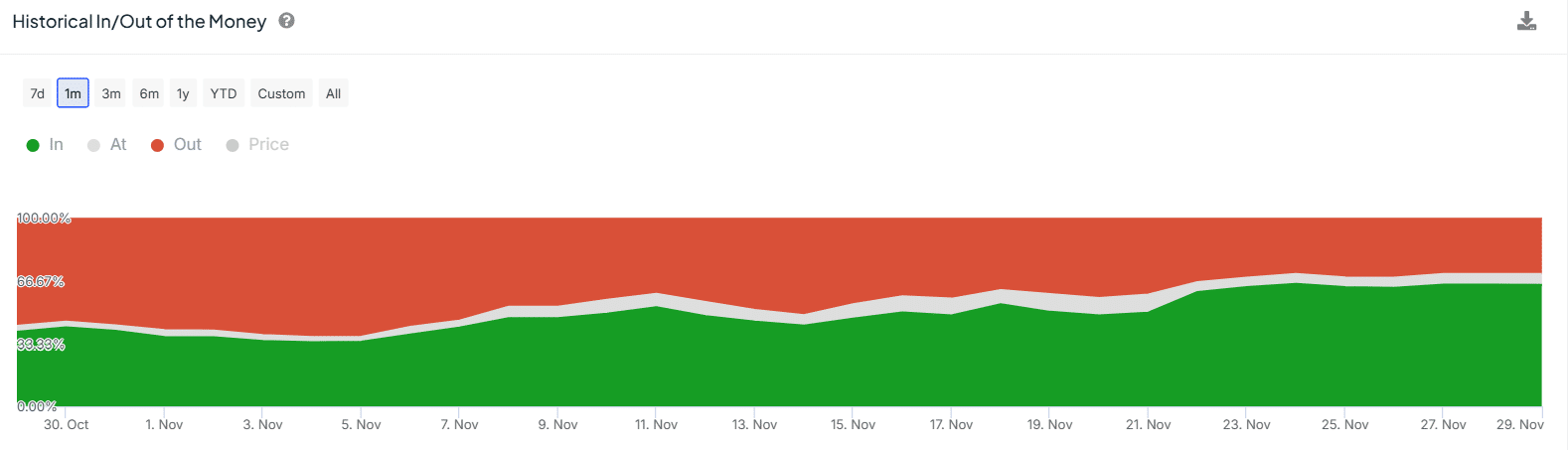

Right here, it’s price mentioning that the hike within the trade provide ratio coincided with emerging pockets profitability. In line with IntoTheBlock, 64% of LINK holders at the moment are in cash in – A vital bounce from 36% against the start of November.

On the identical time, wallets in losses dropped from 59% to 29%.

(Supply: IntoTheBlock)

(Supply: IntoTheBlock)

Emerging pockets profitability may also be just right for the cost because it can result in sure marketplace sentiment.

Then again, for LINK to proceed its uptrend, it wishes a surge in purchasing process.

Chainlink value research – Are patrons lively?

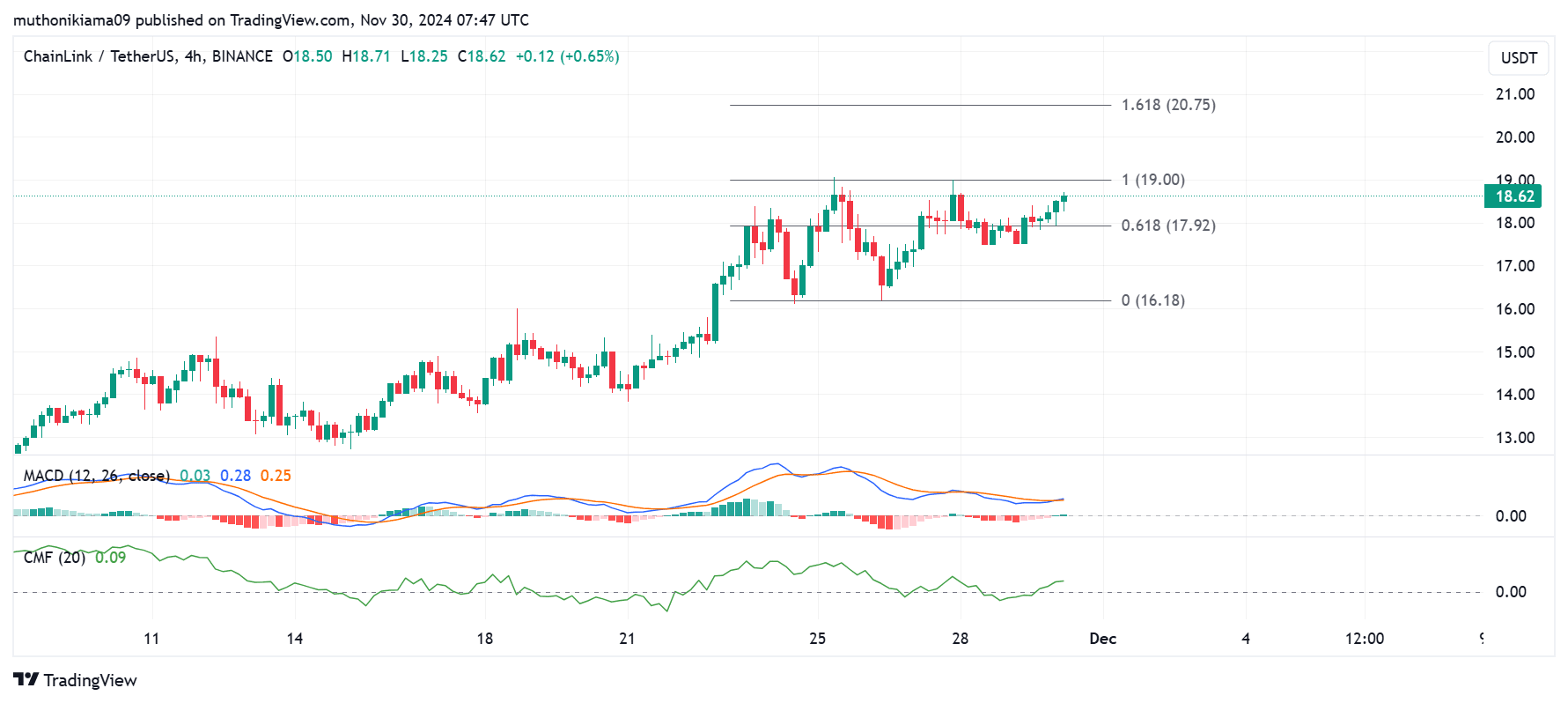

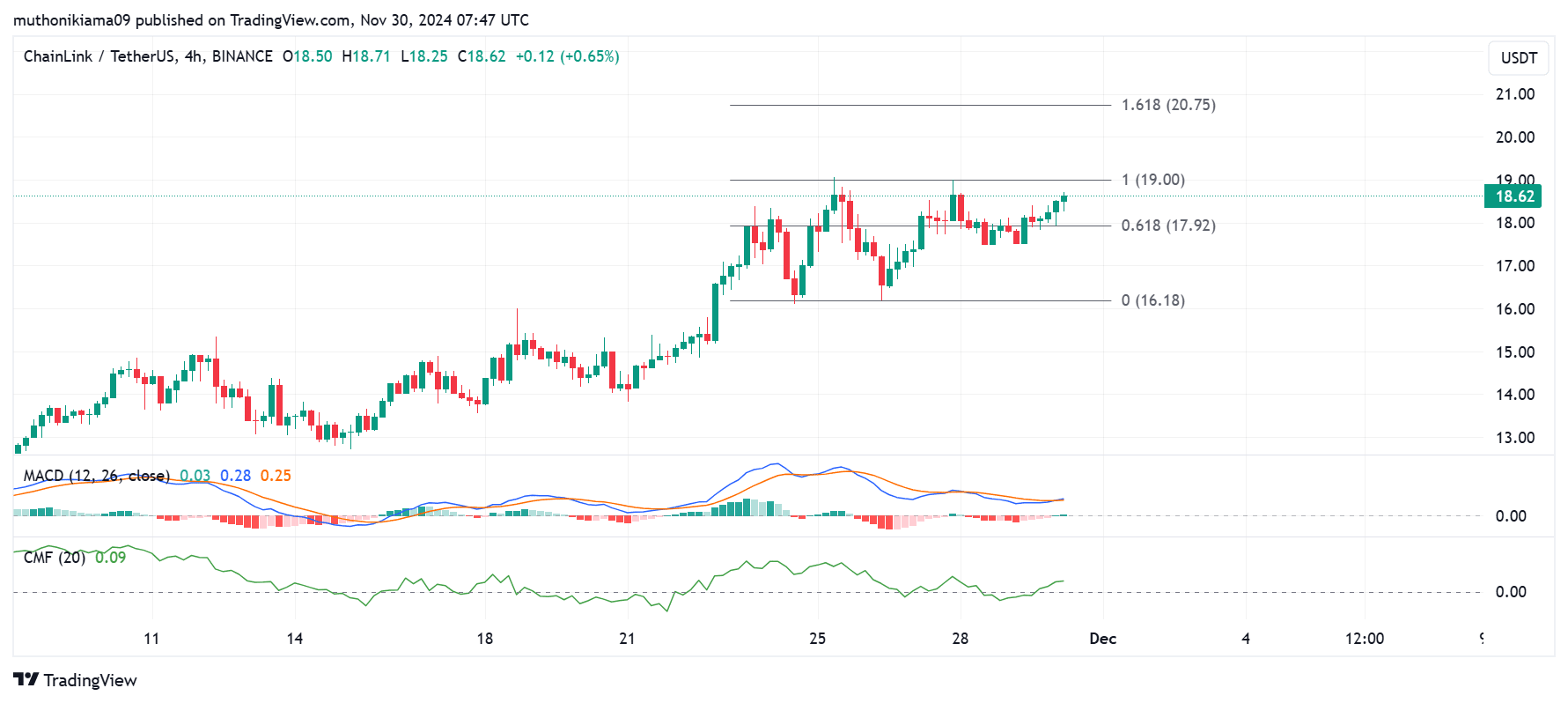

Chainlink’s four-hour chart printed that purchasing power has been more than the promoting power. This used to be evidenced via the Chaikin Cash Go with the flow (CMF) indicator which had a favorable worth of 0.02. The CMF used to be additionally tipping north, suggesting that extra patrons have entered the marketplace not too long ago.

The Shifting Reasonable Convergence Divergence (MACD) line additionally created a purchase sign after crossing above the Sign line. If the MACD line continues to development above the Sign line, it might beef up the altcoin’s bullish development.

(Supply: Tradingview)

(Supply: Tradingview)

If patrons organize to push LINK previous the resistance degree at $19, the token may just intention for $20.75. Then again, Chainlink has been rejected at this enhance degree a number of instances, with extra purchasing volumes had to enhance a breakout.

At press time, the collection of lively addresses recommended that purchasing volumes had been low. In line with IntoTheBlock, those addresses dropped via just about 50% in a single week from 7,420 to 4,210. New addresses additionally declined from 2,650 to at least one,530.

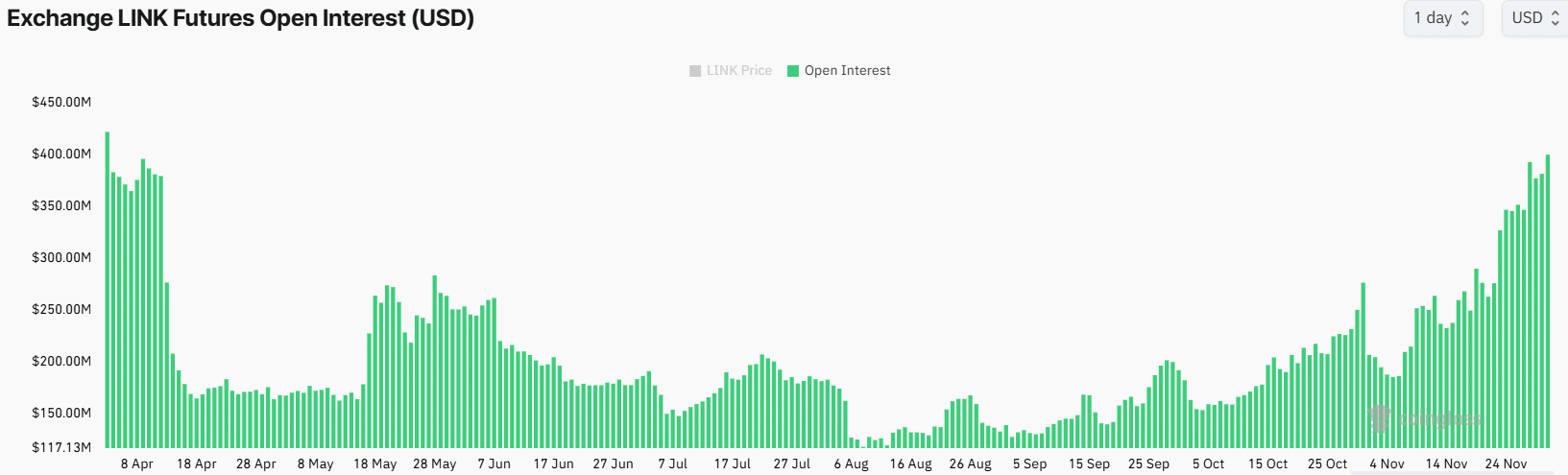

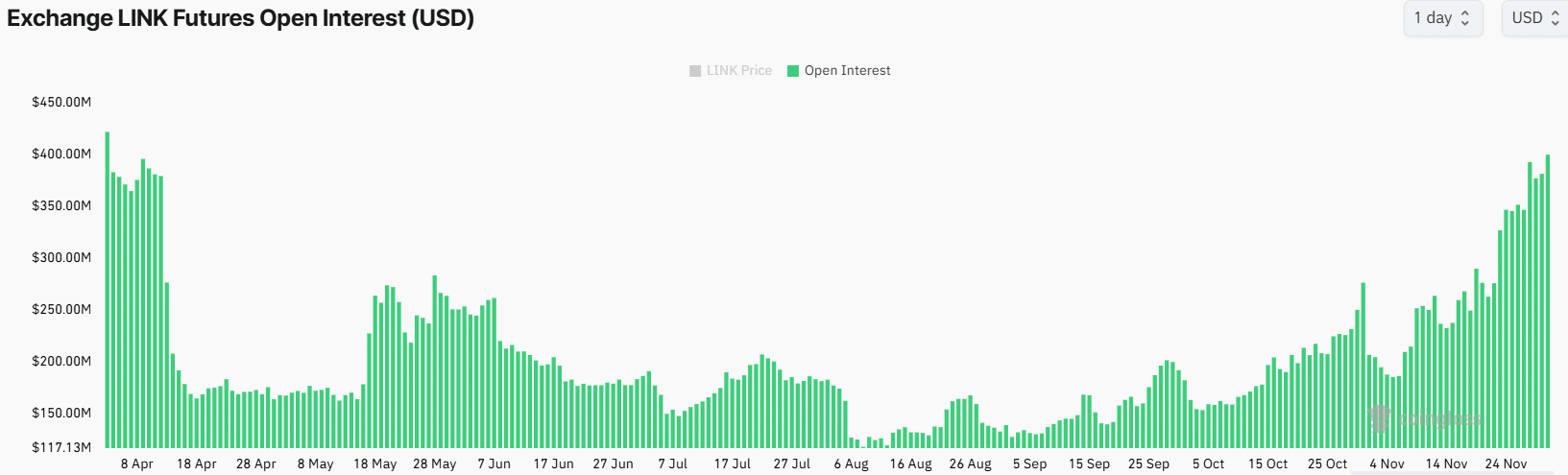

Open pastime approaches 8-month prime

At the derivatives marketplace entrance too, Chainlink has observed a surge in process. In. reality, Open Passion (OI) climbed to its very best degree in additional than seven months.

(Supply: Coinglass)

(Supply: Coinglass)

LINK’s OI, at press time, stood at $396M – A sign that spinoff buyers are opening new positions at the altcoin.

Chainlink’s investment charges additionally surged, highlighting that many of the newly opened positions had been via lengthy buyers making a bet on extra features.

Subsequent: PEPE’s subsequent rally depends upon THIS issue panning out!