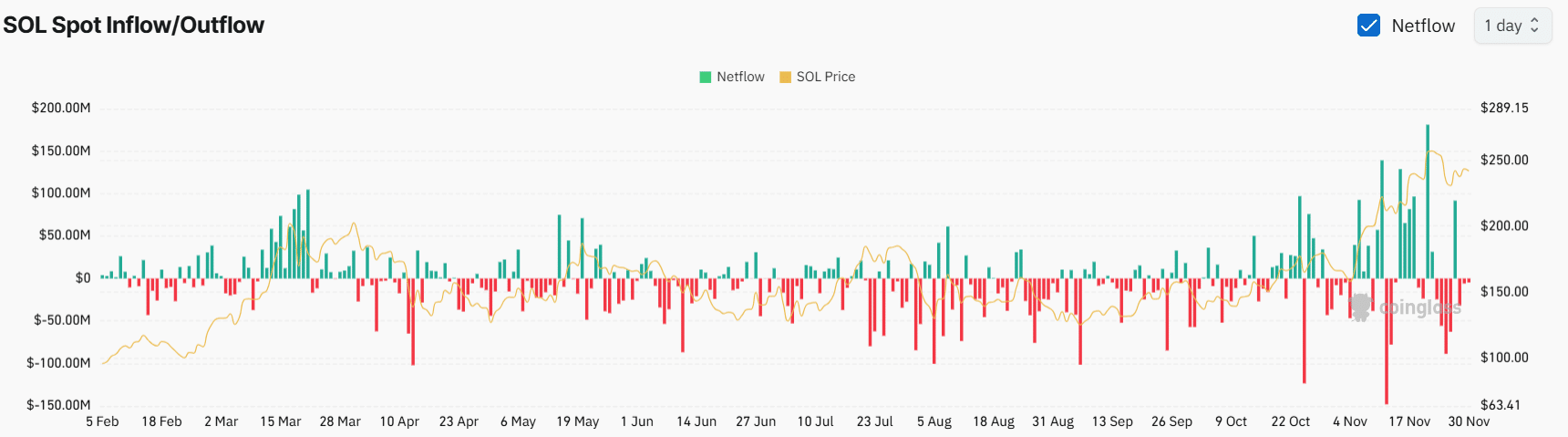

73.5% of most sensible Binance investors hang lengthy positions, whilst 26.5% hang brief positions.

If SOL doesn’t achieve momentum, it will lose its fourth spot to Ripple’s local token, XRP.

Solana [SOL], the sector’s fourth-largest cryptocurrency by way of marketplace cap, is consolidating inside a good vary and has shaped a bearish worth motion development.

In the meantime, altcoins like Ethereum [ETH] and Ripple [XRP] are appearing sturdy bullish momentum. This raises considerations amongst SOL holders about its talent to care for its place.

Consistent with CoinMarketCap, Solana’s marketplace cap has remained at $114.4 billion regardless of its sideways motion over the last two weeks. Against this, throughout the similar length, XRP skilled an 80% upward momentum, elevating its marketplace cap to $106.5 billion.

Robust participation of whales

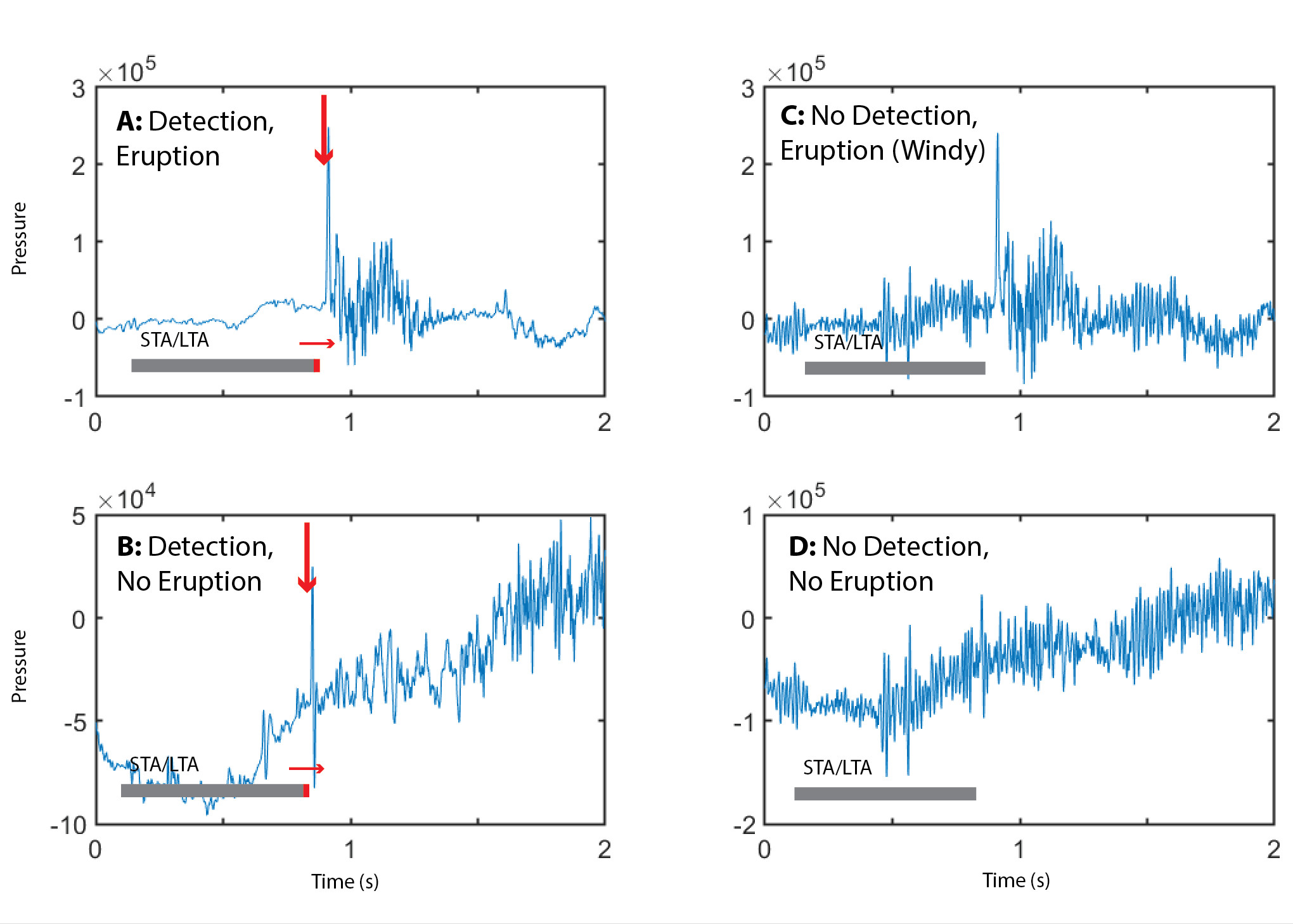

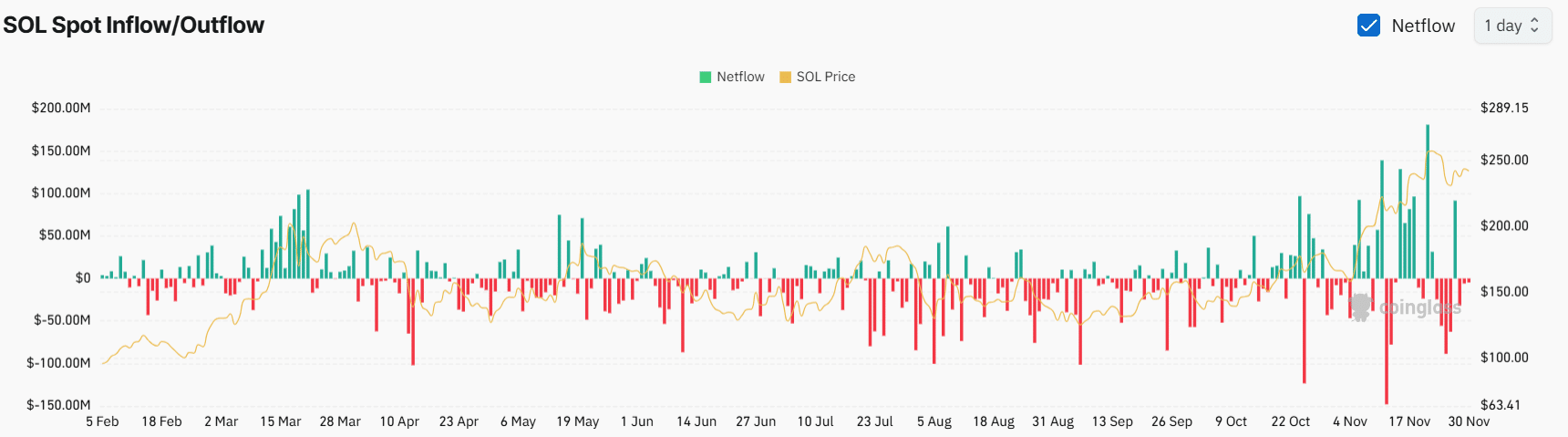

Knowledge from the on-chain analytics company Coinglass signifies that, regardless of SOL’s worth final in a consolidation zone, long-term holders have proven sturdy pastime within the asset.

Coinglass’s SOL Spot Influx/Outflow metrics point out that SOL has noticed important outflows of $182.5 million from exchanges because the twenty third of November 2024.

This really extensive outflow means that whales and long-term holders have withdrawn those tokens from exchanges to their wallets, indicating accumulation.

Supply: Coinglass

Supply: Coinglass

The crypto neighborhood steadily perspectives alternate outflows as a good signal, signaling a possible purchasing alternative and upward momentum.

Investors’ fresh process

Along with long-term holders, investors have additionally proven sturdy pastime and self belief within the token, as reported by way of Coinglass. On the time of writing, the Binance SOLUSDT Lengthy/Quick ratio stood at 2.77, indicating sturdy bullish sentiment amongst investors.

Supply: Coinglass

Supply: Coinglass

Lately, 73.5% of most sensible Binance investors hang lengthy positions, whilst 26.5% hang brief positions.

The combo of those on-chain metrics with technical research means that bulls are lately dominating the asset and is also making an attempt to stay SOL in its fourth place.

Solana’s technical research and key ranges

Consistent with AMBCrypto’s technical research, Solana appears to be forming a bearish head-and-shoulder development on a four-hour chart. Lately, this development is incomplete as the second one shoulder remains to be growing.

If SOL completes this development and breaks its neckline at $230, it will probably fall to the $200 degree.

Supply: TradingView

Supply: TradingView

Conversely, if SOL closes 4 consecutive candles above the $245 degree, this bearish outlook would possibly finish, and lets see a brand new prime.

At the certain aspect, Solana’s Relative Energy Index (RSI) indicated a possible for an upside rally within the coming days. With an RSI of 51, it remained underneath the overbought space, suggesting there’s nonetheless room for enlargement.

Learn Solana’s [SOL] Value Prediction 2024–2025

At press time, SOL was once buying and selling close to $242 and has skilled a value decline of over 1.25% previously 24 hours.

All over the similar length, its quantity jumped by way of 14.56%, indicating heightened participation from investors and buyers in comparison to earlier days.

Subsequent: Filecoin worth prediction – Why FIL hitting $10 quickly is NOT unimaginable