At the bullish aspect, the emergence of a head-and-shoulders trend issues to a possible upside.

Then again, warning prevails because of a notable imbalance in lengthy liquidations over the last 24 hours.

Regardless of a powerful 15.65% rally over the last week, marketplace process round Jupiter [JUP] has slowed. The asset slipped by way of 0.24% at the day by day chart, reflecting susceptible bearish force but additionally elevating considerations about waning momentum.

For now, uncertainty dominates, and not using a transparent indication of the place the asset is headed subsequent.

Bullish sentiment builds round JUP

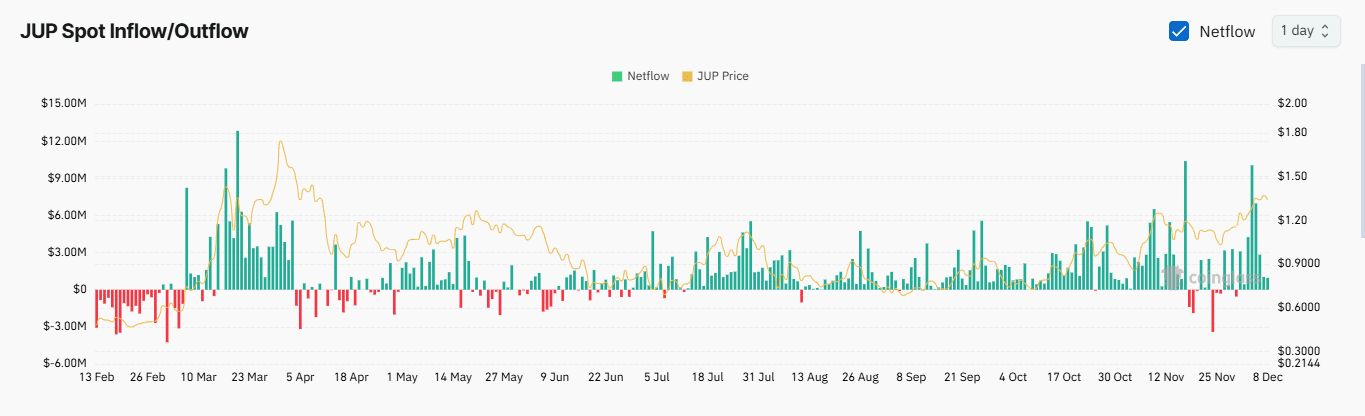

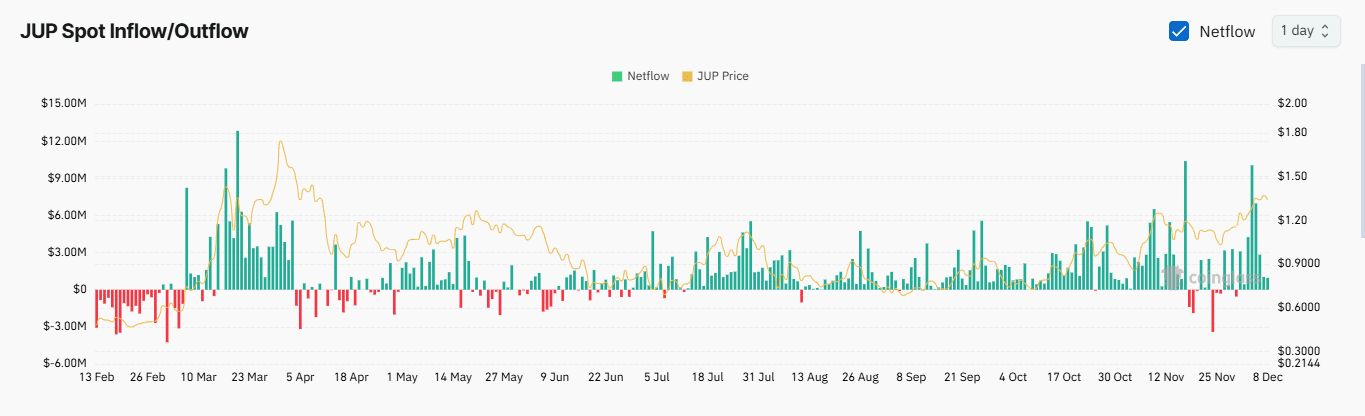

Bullish momentum seems to be forming round JUP, supported by way of declining Change Netflow and a steady upward push in Open Passion over contemporary days.

Change Netflow, which tracks purchasing and promoting process by way of measuring property moved off and on exchanges, gives perception into marketplace sentiment.

Fresh information signifies a lower in JUP deposits on exchanges, suggesting that marketplace individuals are opting to carry slightly than promote. This habits strengthens JUP’s place by way of decreasing its to be had provide on exchanges.

Supply: Coinglass

Supply: Coinglass

In the meantime, Open Passion has higher by way of 2.62% up to now 24 hours, achieving $169.02 million. This upward push additional bolsters bullish sentiment, because it displays a rising choice of unsettled contracts, predominantly held by way of lengthy buyers.

In combination, those elements counsel optimism out there, even supposing broader tendencies might nonetheless form JUP’s trajectory.

JUP set to ascertain a brand new marketplace top

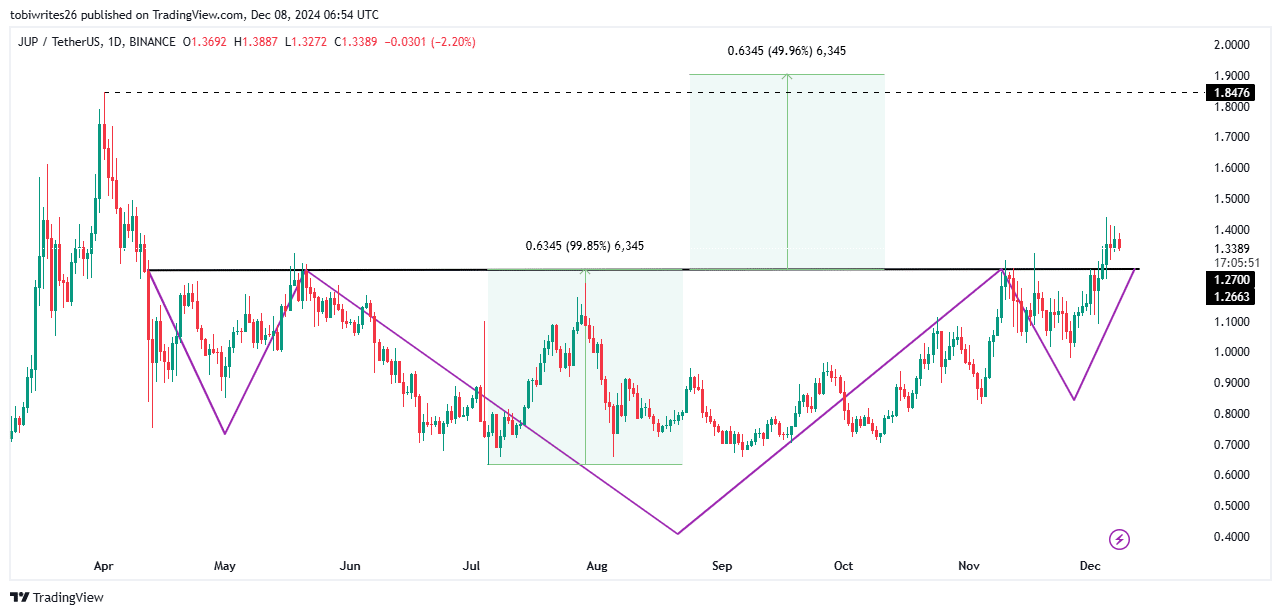

JUP has damaged in the course of the neckline of a vintage cup-and-shoulders trend at $1.2663, an important resistance degree that would sign the beginning of a full-fledged rally.

If this trend performs out, JUP may climb an extra 49.96%, achieving $1.90—surpassing its earlier all-time top of $1.85. This projected transfer aligns with the power of the trend displayed at the chart.

Supply: Buying and selling View

Supply: Buying and selling View

Then again, bearish sentiment persists out there and may prolong JUP’s upward momentum.

Imbalance in marketplace liquidations

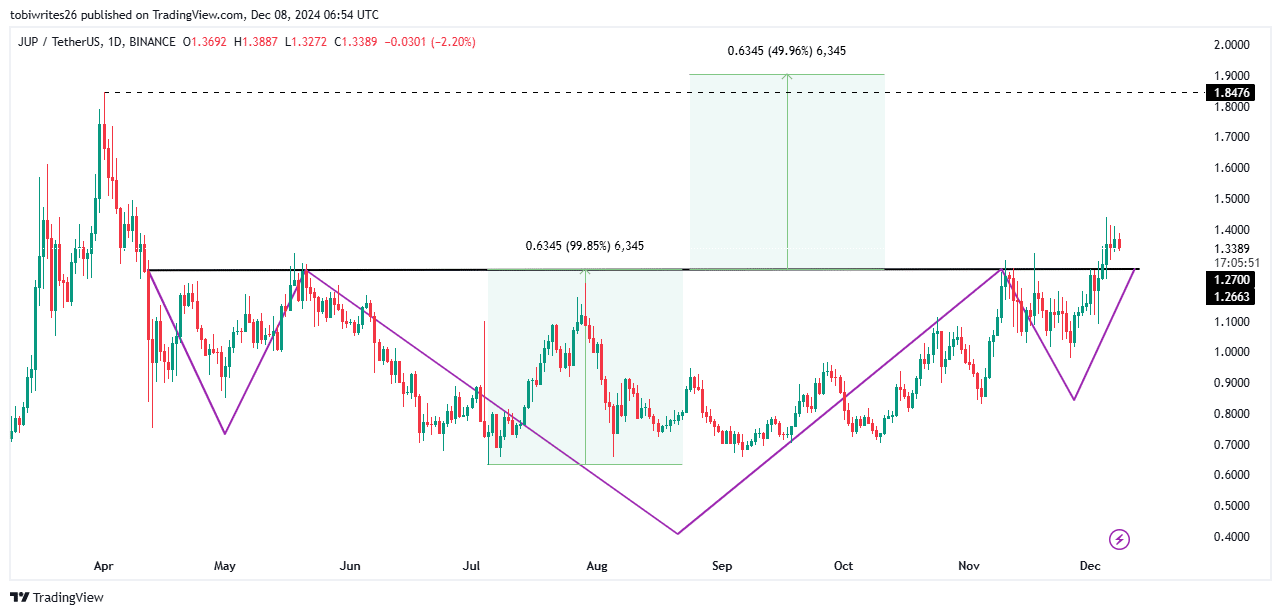

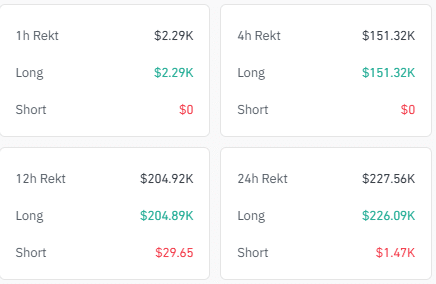

Over the last 24 hours, there was a notable imbalance in marketplace liquidations. On the time of writing, lengthy liquidations totaled $226,090, whilst quick liquidations have been considerably decrease, amounting to simply $1,470.

Supply: Coinglass

Supply: Coinglass

Learn Jupiter’s [JUP] Worth Prediction 2024–2025

Any such disparity, the place lengthy and quick liquidations display a large hole, signifies that marketplace sentiment is skewed towards one aspect. On this case, sentiment favors the bears.

If this development persists, the marketplace is prone to proceed shifting downward except more potent bullish forces emerge to counteract it.

Subsequent: Pepe reaches $0.000026948 ATH, marketplace cap reaches $11B: Extra features forward?