I am a large fan of making an investment in person shares and in point of fact consider {that a} well-crafted inventory portfolio can outperform the entire inventory marketplace. On the similar time, there is price in placing a few of your funding bucks on autopilot with top-quality index finances.

Index fund ETFs cannot best provide you with assorted publicity to a whole portfolio of shares in one funding car, however too can generate some lovely spectacular returns over lengthy classes of time. With that during thoughts, even if a few of my favourite shares (particularly high-yield dividend shares) appear to be very good values presently, I am making plans to regularly purchase stocks of 3 ETFs specifically during 2025.

The ETF each and every investor must personal

If I used to be best allowed to possess one funding, it will be the Forefront S&P 500 ETF (VOO 0.20%). That is Forefront’s flagship S&P 500 index fund. Because the identify suggests, this ETF tracks the S&P 500 (^GSPC 0.25%), which is extensively regarded as to be the most productive benchmark of the way the U.S. inventory marketplace is appearing.

^SPXTR knowledge through YCharts

This ETF has a rock-bottom 0.03% expense ratio, because of this that in case you have $10,000 invested within the fund, best $3 will move towards annual funding bills. Over lengthy classes of time, the S&P 500 has produced reasonable general returns of about 10% annualized. For context, which means that a $10,000 funding within the ETF may well be value about $175,000 in 30 years, and not using a repairs wanted alongside the best way.

My peak ETF for 2025

At first of 2024, small-cap shares have been buying and selling at their lowest price-to-book values relative to huge caps because the past due Nineteen Nineties. And during the yr, the valuation hole has widened even additional, due to the outperformance of large-cap tech shares and rates of interest now not falling up to mavens predicted.

Now, the common part of the Russell 2000 small-cap index trades for a price-to-book a couple of of one.9, when put next with 4.7 for the standard S&P 500 inventory. With rates of interest in the end beginning to fall and a doubtlessly pro-growth setting with the incoming Trump management, small caps may have some large tailwinds. That is why the Forefront Russell 2000 ETF (VTWO 0.38%) is my peak total ETF pick out for 2025.

AI publicity with out the company-specific chance

To be completely transparent, I believe synthetic intelligence (AI) is an enormous alternative and may finally end up being crucial technological pattern in my lifetime. Alternatively, I am just right at comparing financial institution shares, actual property firms, and e-commerce companies, to call a couple of. The most productive AI alternatives are, somewhat frankly, now not in my wheelhouse. Each and every just right investor must know their circle of competence, and AI shares are slightly out of doors of mine.

Because of this, I am making plans to begin construction a place within the Ark Self sufficient Generation and Robotics ETF (ARKQ 2.94%), which is administered through Cathie Picket’s Ark Make investments. The fund owns a hand-selected portfolio of shares that may be large winners of the AI revolution. Along with family names like Tesla and Nvidia, the fund additionally owns lesser-known firms like Kratos Protection & Safety in addition to less-obvious AI performs like Deere.

To make certain, that is through some distance the perfect value ETF in this record, with a zero.75% expense ratio. Alternatively, that is in keeping with different specialised, actively controlled finances.

How am I the use of those ETFs in my portfolio?

To be transparent, the majority of my portfolio remains to be made up of person shares, and I do not see that converting anytime quickly. Alternatively, at this level in my making an investment profession (I am in my mid-40s), I have began to shift my focal point slightly towards construction a cast “spine” to my portfolio with some top-quality index finances. For 2025, and for the foreseeable long term, I am making plans to allocate part of any new cash in my brokerage account to shares, and the opposite part to ETFs like those 3.

Matt Frankel has positions in Forefront Russell 2000 ETF and Forefront S&P 500 ETF. The Motley Idiot has positions in and recommends Deere & Corporate , Nvidia, Tesla, and Forefront S&P 500 ETF. The Motley Idiot has a disclosure coverage.

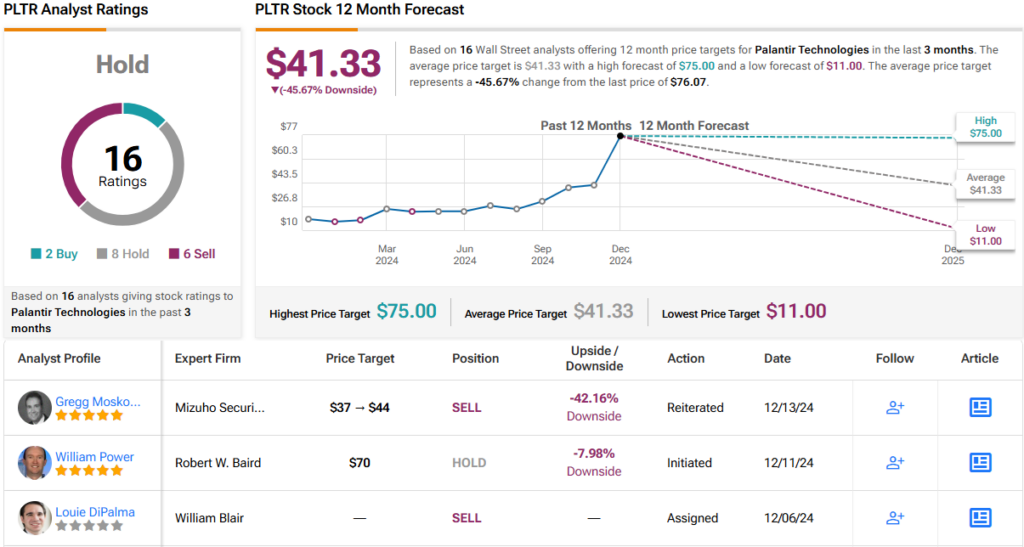

:max_bytes(150000):strip_icc()/PLTRChart-71ec74b79d4442c2a8719bc71da59b23.gif)