It’s secure to mention that inventory buyers are final out 2024 in a moderately upbeat temper. The markets posted considerable features, with the S&P 500 surging just about 27% year-to-date.Pick out the most efficient shares and maximize your portfolio:

The strengthen for the present bullish development is apparent. The chance of rate of interest cuts, coupled with stronger-than-expected company income, is using marketplace self belief. Including to the bullish outlook, remaining month’s election noticed former President Trump safe a non-consecutive 2nd time period, fueling hopes for a pro-business, pro-growth financial coverage.

Having a look forward, Oppenheimer’s leader funding strategist, John Stoltzfus, believes this rally is a ways from over.

“Investors and buyers of bullish persuasion (of which we’re phase) level to basics that recommend the present resilience of the economic system and the inventory marketplace seem poised to proceed into subsequent 12 months… In keeping with numerous elements together with present stateside financial coverage, the resilience in financial progress, enterprise task, the patron, and activity advent evidenced lately and the present 12 months, we begin a value goal for the S&P 500 through year-end 2025 of 7100,” Stoltzfus asserted.

With Stoltzfus’ goal in thoughts, we became our consideration to 2 shares that experience earned a spherical of applause from Oppenheimer. Consistent with the company’s analysts, each are not off course for enormous features, together with one that would leap through just about 580%.

After operating the tickers thru TipRanks’ database, it’s transparent the remainder of the Side road is in settlement, with every incomes a ‘Sturdy Purchase’ consensus score. Let’s take a better take a look at what’s using this broad-based enthusiasm.

Sagimet Biosciences (SGMT)

We’ll get started with Sagimet Biosciences, the primary inventory to earn Oppenheimer’s backing – and for just right reason why. This biotech company is pioneering a unique option to drug construction thru its fatty acid synthase (FASN) inhibitors, a unique elegance of therapeutics with huge medical doable.

A number of illnesses are connected to the overproduction of the fatty acid palmitate, and Sagimet’s medical pipeline targets to focus on the dysfunctional metabolic and fibrotic pathways related to those prerequisites. Leader amongst them is metabolic dysfunction-associated steatohepatitis (MASH), a extreme liver dysfunction. As a key regulator of lipid synthesis, FASN represents a possible healing goal for the remedy of this liver situation.

The FASN pathway is implicated in more than a few different prerequisites, starting from reasonably commonplace problems like zits to extra extreme illnesses similar to most cancers. Alternatively, the MASH trial observe stays the corporate’s maximum complex program.

In this entrance, Sagimet accomplished a milestone previous this 12 months through finishing the Segment 2b FASCINATE-2 trial. This learn about evaluated denifanstat, the corporate’s flagship product, as a remedy for F2/F3 MASH — a degree the place sufferers revel in average to complex liver fibrosis. Without a relating to protection or tolerability problems, denifanstat demonstrated a powerful efficacy profile.

Sagimet is getting ready to release a Segment 3 trial for denifanstat through the top of the 12 months and is making plans to enlarge the trial to incorporate sufferers with F4 MASH. The will for remedy on this house is immense, with round 22 million adults within the U.S. suffering from MASH and restricted choices to be had.

Past MASH, denifanstat may be being examined in China for zits remedy, in collaboration with Ascletis. Pimples gives every other vital alternative for Sagimet, because the FASN pathway performs a key position in sebum manufacturing, which contributes to the situation. The corporate anticipates freeing topline effects from a Segment 3 trial in the second one part of 2025.

Finally, Sagimet is exploring denifanstat as a remedy for the competitive mind most cancers glioblastoma, in particular recurrent glioblastoma multiforme (rGBM), together with bevacizumab. Segment 2 information of this mixture remedy met the principle endpoint of progression-free survival (PFS), with a 31.4% six-month PFS in comparison to 16% for bevacizumab monotherapy. The Segment 3 trial, just like the zits learn about, is being performed in China with Ascletis, with topline information anticipated within the first part of 2025.

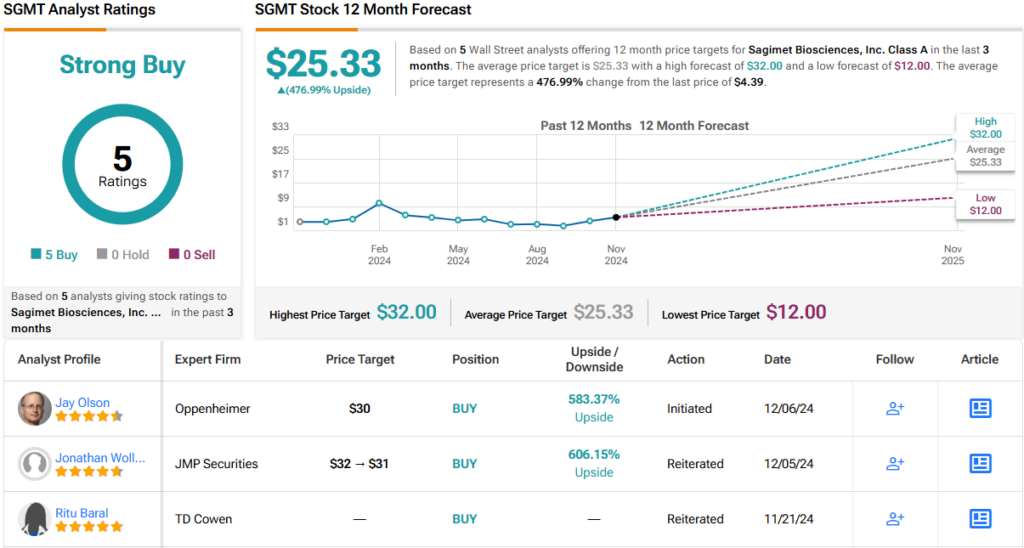

Given denifanstat’s doable and SGMT’s $4.39 percentage value, Oppenheimer analyst Jay Olson believes now could be the time to get in at the motion.

“SGMT’s present marketplace cap is ~$141M, which to us seems undervalued in line with the promising MASH program with validation from massive pharma, e.g. NVO and LLY’s medical efforts to enlarge incretin approval past weight problems into MASH and Boehringer Ingelheim’s contemporary $2B partnership with Suzhou Ribo Lifestyles Science Co. and Ribocure Prescription drugs to increase an siRNA-based MASH healing… Our SOTP research values denifanstat at $18/percentage in F2–F3 MASH, $2/percentage in F4 MASH, $1/percentage in recurrent glioblastoma, $5/percentage in moderate-to-severe zits, and estimated money through YE24 at $4/percentage,” Olson mentioned.

“Whilst we see doable for denifanstat to draw marketplace percentage thru its differentiated efficacy and protection as a monotherapy, its doable as a mixture remedy additional strengthens our conviction surrounding its business good fortune if authorized,” the analyst added.

To this finish, Olson charges SGMT an Outperform (i.e. Purchase), together with a $30 value goal. Must the objective be met, a twelve-month acquire within the form of a considerable 583% may well be in retailer. (To look at Olson’s observe document, click on right here)

Turning now to the remainder of the Side road, 5 Buys and no Holds or Sells were revealed within the remaining 3 months. Due to this fact, SGMT boasts a Sturdy Purchase consensus score. With the common value goal status at $25.33, the upside doable is available in at ~477%. (See SGMT inventory forecast)

Y-mAbs Therapeutics (YMAB)

The following inventory we’ll take a look at is Y-mAbs, an oncology-focused biotech corporate with one foot within the medical trial degree and one within the commercialization degree. Y-mAbs’ authorized drug, DANYELZA, is a monoclonal antibody utilized in aggregate with granulocyte-macrophage colony-stimulating issue (GM-CSF) to regard pediatric sufferers elderly 1 12 months and older, in addition to adults, with relapsed or refractory high-risk neuroblastoma within the bone or bone marrow. It won FDA approval to be used in the United States in November 2020.

Whilst DANYELZA has contributed to Y-mAbs’ earnings movement and is increasing its geographic succeed in, the corporate’s SADA platform generation has generated even higher enthusiasm. This cutting edge manner makes use of a pre-targeted payload supply machine, the place antibody constructs shape tetramers that exactly bind to tumor goals. Y-mAbs sees this generation as a transformative software in oncology, with the possible to focus on a wide selection of cancerous tumors with unequalled precision.

Y-mAbs is these days undertaking early-stage human medical trials on GD2-SADA, considered one of its medical merchandise related to this generation. The Segment 1 trial goals cast tumors expressing GD2, similar to SCLC, melanoma, and sarcomas, with drug management scheduled at various durations ahead of the usual 177Lu-DOTA remedy. Divided into 3 portions, the trial is predicted to ship Phase A effects early subsequent 12 months. This preliminary segment targets to spot the optimum protein dosage and determine the best timing between the management of the SADA protein and its next payload.

Any other key medical candidate from the SADA platform is CD38-SADA, which, because the title suggests, goals CD38 — a protein discovered at the floor of positive blood most cancers cells. Y-mAbs is advancing a Segment 1 dose-escalation learn about aimed toward comparing the security, tolerability, and optimum dosing of CD38-SADA PRIT, a two-step remedy involving CD38-SADA and Lu177-DOTA, in adults with relapsed or refractory Non-Hodgkin Lymphoma.

Some of the believers in Y-mAbs’ doable is Oppenheimer analyst Jeff Jones, who writes: “Our enthusiasm is focused on YMAB’s medical degree SADA platform, as probably the most complex pre-targeting platform these days in construction for supply of focused radiopharmaceutical treatments (TRT). The SADA platform has the possible to deal with a essential problem dealing with TRTs, off beam radiation publicity. YMAB’s number of goals for SADA will probably be key for his or her good fortune, with main points on long run plans expected in early 2025. Along with having two SADA founded applicants within the hospital through early 2025, YMAB is producing ~$90M once a year from DANYELZA gross sales in high-risk neuroblastoma (HRNB) which we view essentially with the intention to offset SADA R&D funding.”

Backing his enthusiasm, Jones charges YMAB as an Outperform (i.e. Purchase), and his $23 value goal issues towards a one-year upside doable that approaches 144%. (To look at Jones’ observe document, click on right here)

General, the inventory has picked up 5 analyst opinions – and the ones spoil all the way down to 4 Buys and 1 Cling, for a Sturdy Purchase consensus score. At $31.20, the common value goal is extra competitive than Oppenheimer’s and implies ~231% upside doable. (See YMAB inventory forecast)

To seek out just right concepts for shares buying and selling at sexy valuations, seek advice from TipRanks’ Best possible Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The reviews expressed on this article are only the ones of the featured analysts. The content material is meant for use for informational functions most effective. It is important to to do your individual research ahead of making any funding.