![]()

![]()

contributor

Posted: December 16, 2024

Dormant XRP tokens reactivated, boosting liquidity and fueling renewed investor self belief.

Emerging taker purchase ratio displays rising bullish dominance in XRP’s derivatives marketplace.

At the tenth of December, Ripple’s [XRP] value in brief slipped beneath $2, fueling hypothesis that its prolonged uptrend could be working out of steam.

Alternatively, the swift 8% rebound during the last 24 hours has reignited optimism.

Past the outside, under-the-radar signs level to XRP’s rally having more space to develop, signaling that its bullish momentum is also some distance from over. Right here’s what may just force XRP upper.

Dormant XRP tokens are at the transfer

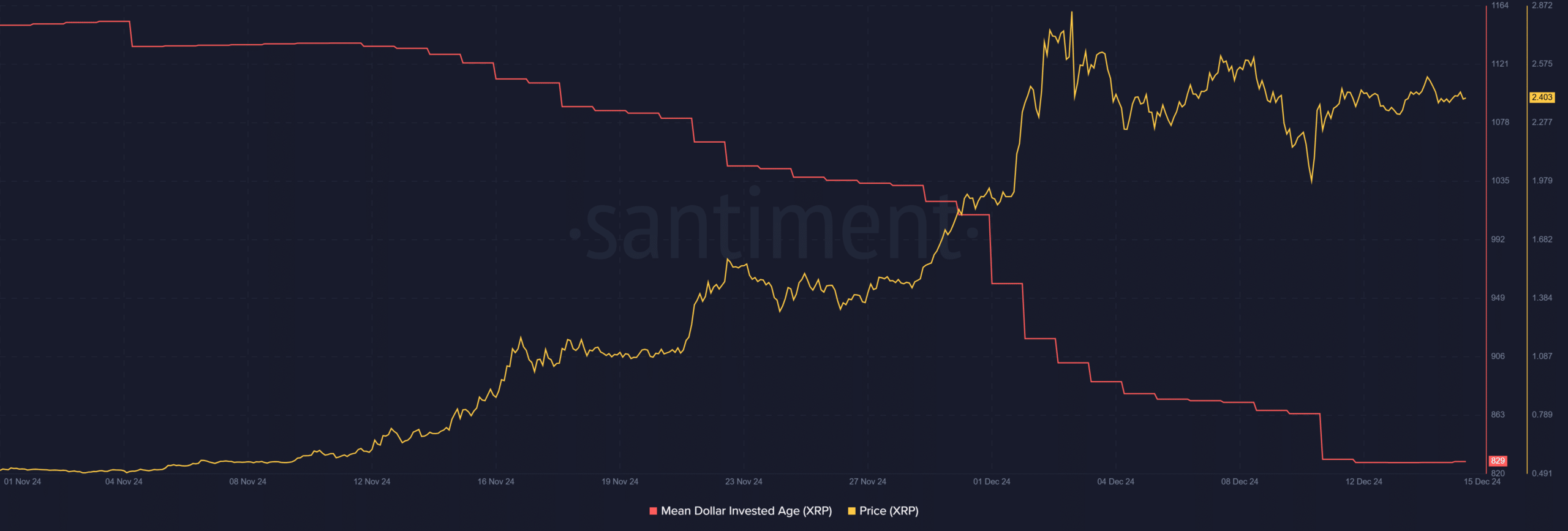

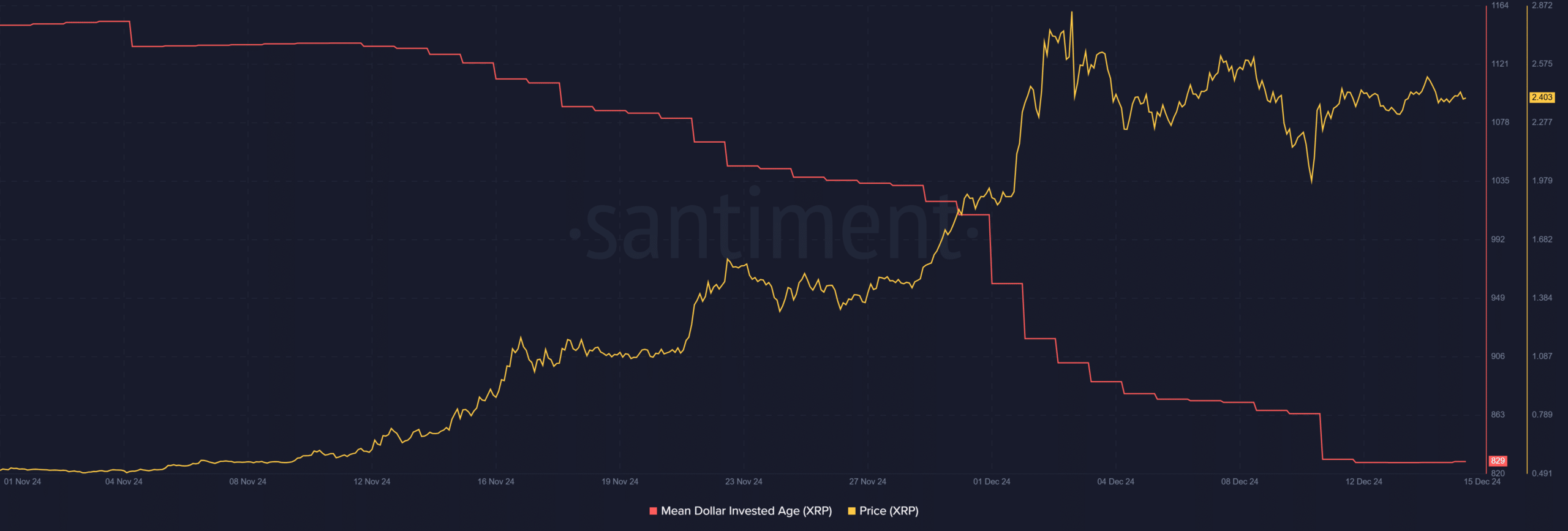

The Imply Greenback Invested Age (MDIA) for XRP has sharply declined, signaling vital on-chain process.

Traditionally, a low MDIA displays the reactivation of up to now dormant tokens, continuously suggesting renewed investor self belief.

By contrast, a emerging MDIA implies stagnation, as cash held by way of long-term stakeholders stay untouched, capping upside possible.

Supply: Santiment

Supply: Santiment

These days, XRP’s MDIA has dropped to its lowest degree since early November.

This downward shift signifies that long-inactive tokens are re-entering move, boosting liquidity and buying and selling volumes — each important drivers for sustained value momentum.

The recirculation of dormant property usually coincides with bullish stages, as recent buying and selling process means that each retail and bigger stakeholders are capitalizing on value actions.

Blended with XRP’s swift value rebound, the falling MDIA underscores rising marketplace participation and strengthens the case for XRP’s bullish outlook.

If this pattern persists, XRP may just deal with its upward trajectory.

Consumers regain keep an eye on

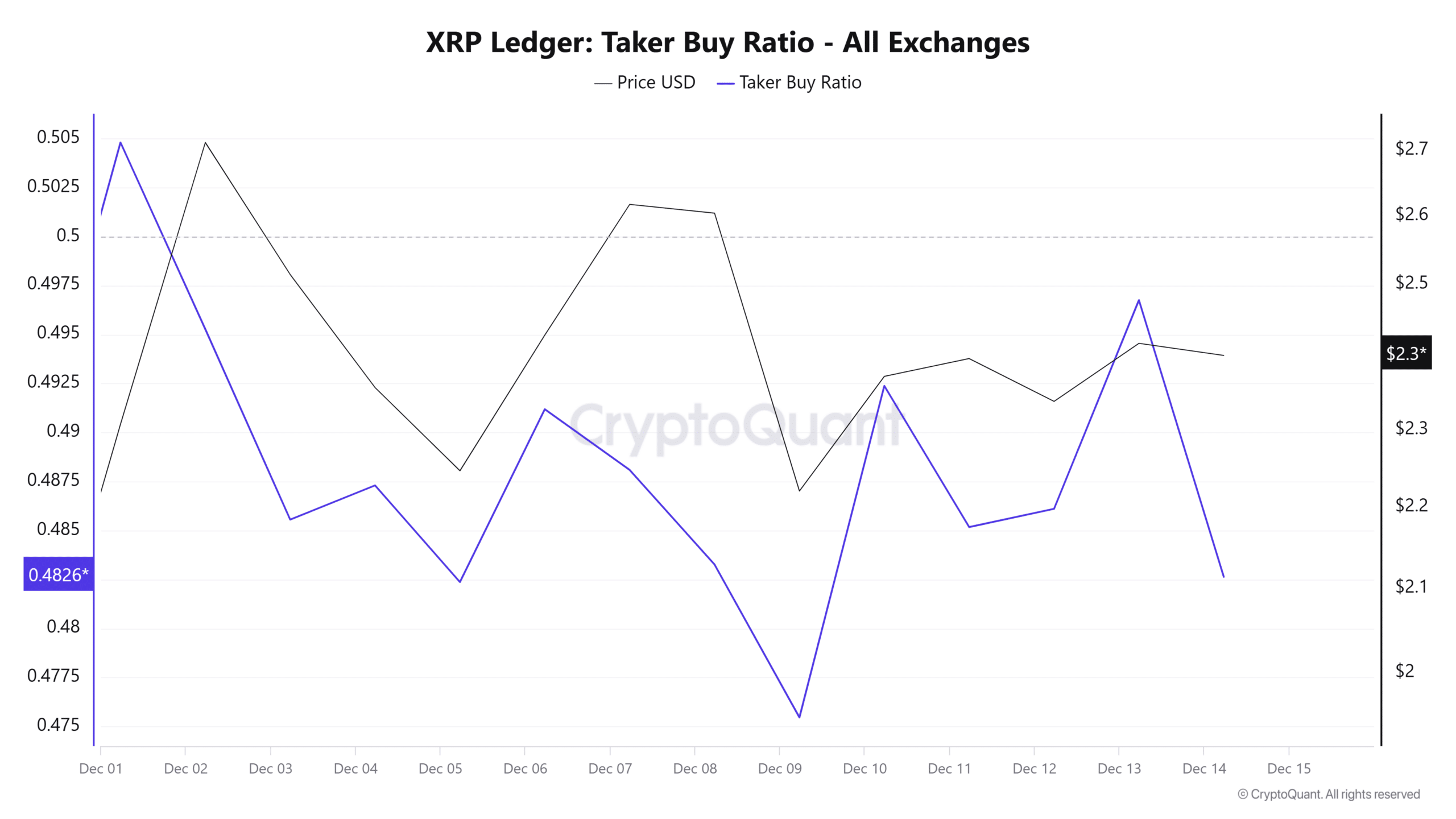

Supply: Cryptoquant

Supply: Cryptoquant

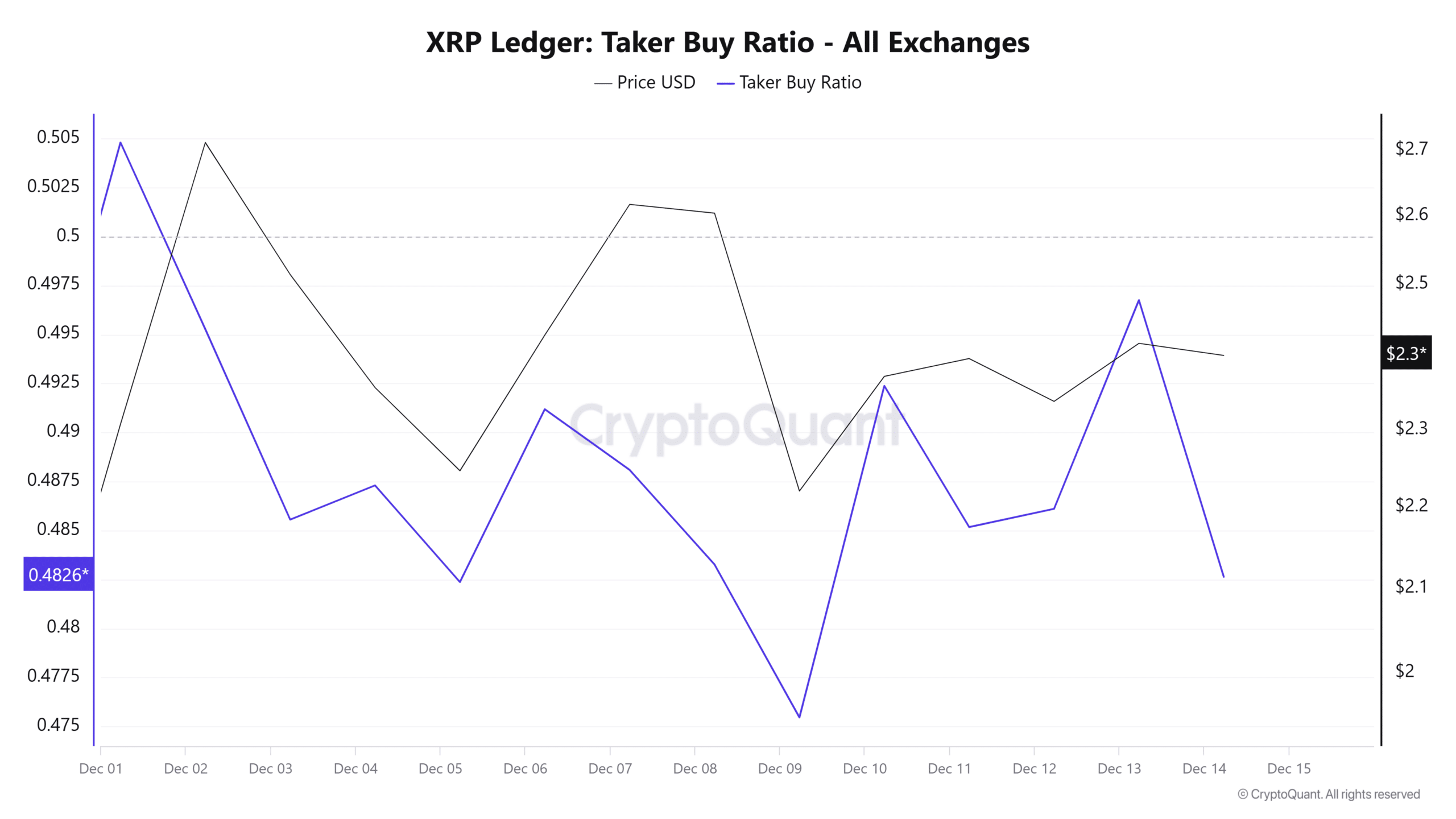

Past on-chain process, the taker purchase ratio in XRP’s derivatives marketplace additional reinforces its bullish outlook. This metric gauges the percentage of purchase orders relative to overall taker trades.

Every time the ratio surpasses 0.5, it signifies expanding bullish dominance, as patrons outpace dealers.

Fresh information from CryptoQuant confirmed that the taker purchase ratio had surged to 0.55, reflecting a pointy upward thrust in purchasing force.

Traditionally, such actions align with classes of sustained value positive factors, as buyers showcase heightened self belief in upward momentum.

Whilst the present studying signifies a good atmosphere, traders will have to observe this intently.

A sustained taker purchase ratio above 0.5 may just gasoline additional positive factors, while a drop beneath this threshold may sign waning optimism and suggested profit-taking.

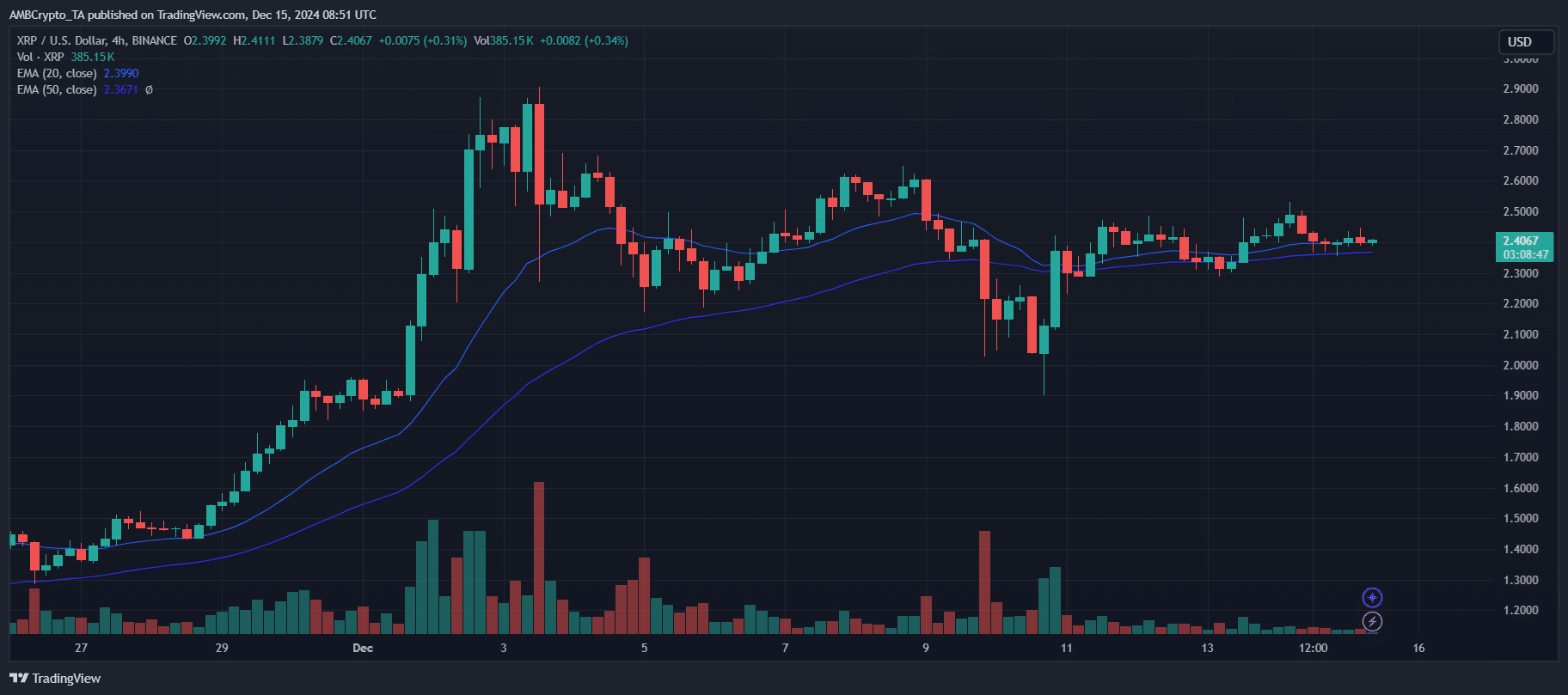

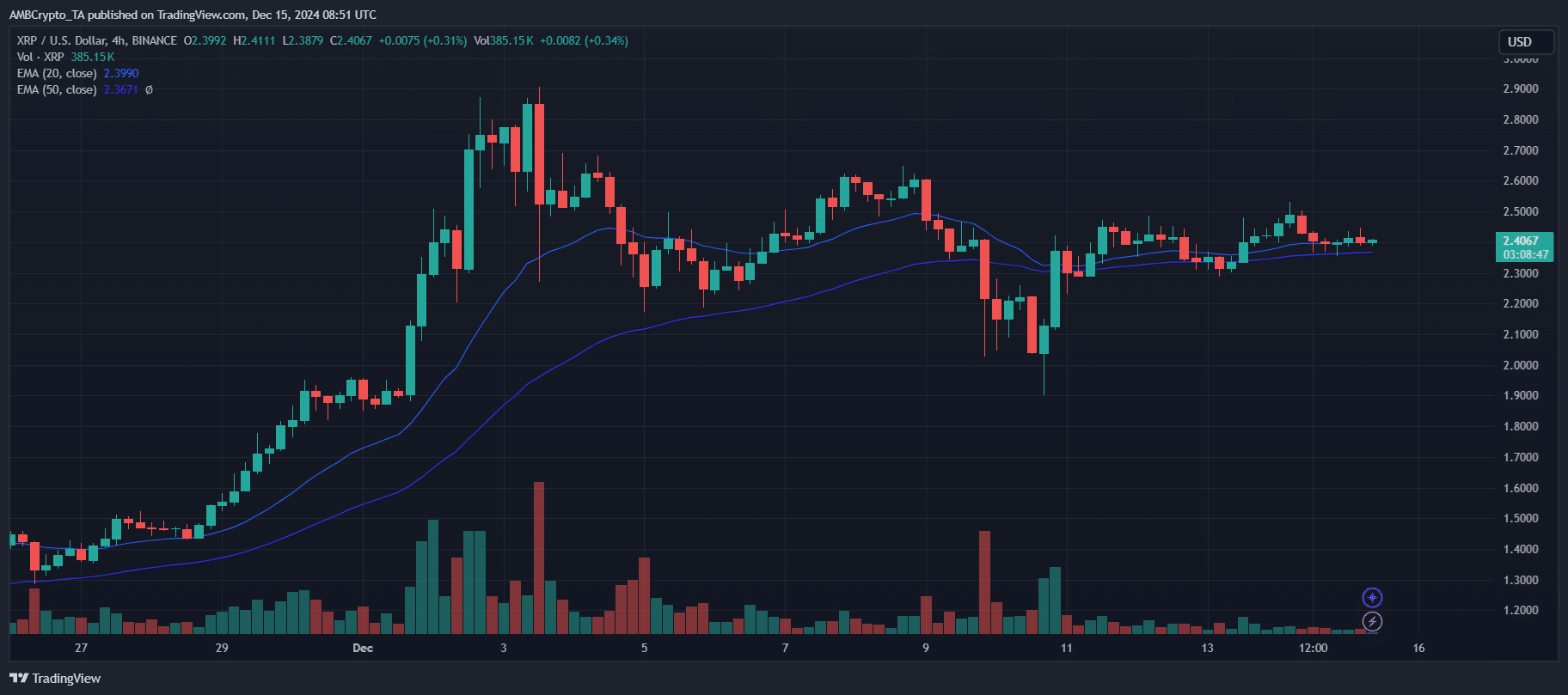

XRP value and quantity research

At the 4-hour chart, XRP’s value in brief slipped beneath the 20 and 50 EMAs at the twelfth of December, hinting at a possible correction. Alternatively, the swift restoration above those signs has restored bullish sentiment.

The EMAs now act as dynamic give a boost to, with XRP consolidating close to $2.40. Particularly, the low quantity accompanying contemporary value stabilization suggests diminished promoting force, favoring patrons within the brief time period.

Supply: TradingView

Supply: TradingView

Must buying and selling quantity spike along persevered value steadiness above the EMAs, XRP may just reclaim its bullish momentum and goal $2.90.

Learn Ripple’s [XRP] Worth Prediction 2024–2025

If quantity fails to construct, it dangers sideways motion or a retest of the $2.30 give a boost to.

The EMA alignment and present restoration underscore patrons’ keep an eye on, however sustained quantity expansion stays important for a push towards the $3.50 mark.

Subsequent: Ethena: Gauging ENA’s long term after International Liberty Financials’ $500K bid