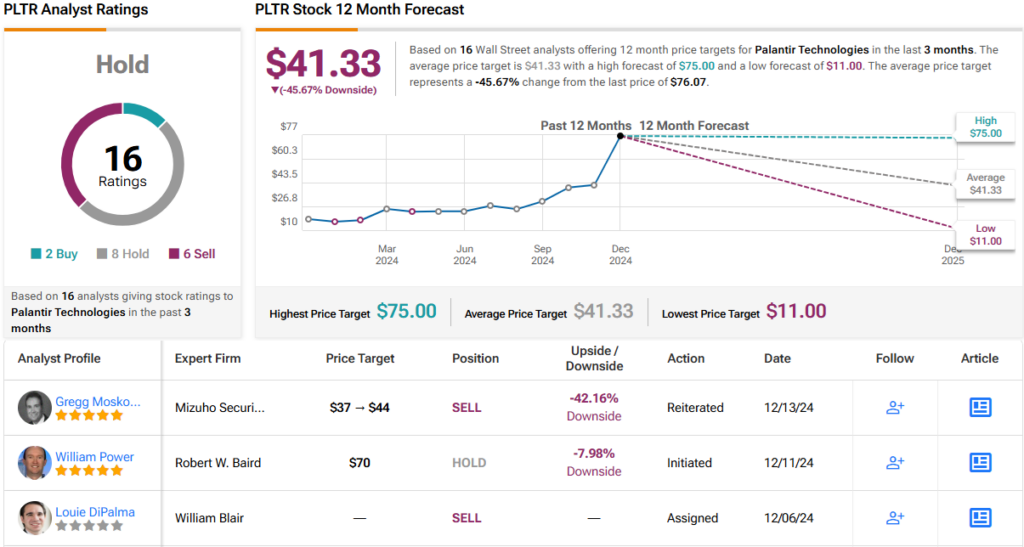

This is not the type of information we get each day for chip inventory Intel (INTC), so perhaps we must be satisfied it is right here. To not be outdone, the Battlemage graphics unit, often referred to as the Arc B580, is promoting at a fee described as “disruptive.” The scoop didn’t take a seat neatly with traders, who despatched stocks down just about 2% in Wednesday afternoon buying and selling. Pick out the most productive shares and develop your portfolio: “Sadness” will also be an excellent phrase. A record from The Verge says that Intel’s new card is on sale in lots of puts, and Intel is operating to send new playing cards each and every week. A number of critiques have already surfaced on Battlemage, and the record known as it “…common reward.” Reviews, on the other hand, recommend that Intel could have had the precise position/proper time mojo operating on its behalf right here. Each Nvidia ( NVDA ) and AMD ( AMD ) launched graphics playing cards this yr, and neither gained many lovers. And this was once after years of GPU costs that “larger greater than inflation on my own” as many customers bring to mind cryptocurrency mining. Now not All Peaches and Cream As is continuously the case, on the other hand, there’s a darkish cloud over each and every silver lining, and HPC Cord issues this out. In step with the “data-center product replace” interview, Intel is having issues at the moment. The lack of CEO Pat Gelsinger has left the Co-CEOs in the back of, looking to “be informed … Recently, Gaudi’s chips are regarded as “… the weakest AI access level.” The tale of Phoronix, on the other hand, gave extra hope. Adjustments to kernel graphics The motive force supplies a greater view on “engine busyness.” Up to now, there have been “race stipulations and insects” in it, however with the trade, higher metrics can be to be had Due to this fact, a greater figuring out of the engine’s efficiency, which is vital for the efficiency of the key tasks, is a Purchase, Cling or Promote? , 21 Holds and 5 Sells have been issued within the closing 3 months, as proven within the symbol underneath. After a 56.3% loss in its proportion worth closing yr, INTC’s moderate worth of $24.53 in step with proportion implies 23.08% upside attainable.

See extra of the INTC analyst scores Disclosure

![Right here’s the entirety new in Android 16 Developer Preview 2 [Gallery] Right here’s the entirety new in Android 16 Developer Preview 2 [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/12/Android-16-DP2-Note-taking-4.jpg?ssl=1)