Bitcoin’s derivatives metrics regarded positive.

However promoting drive remained dominant out there.

Bitcoin [BTC] has been suffering with its worth motion because it has failed to meet traders of overdue. This has sparked worry in all of the neighborhood, as instructed by means of newest datasets.

Alternatively, this panic out there will have the possible to show issues round for the king coin.

Bitcoin traders are panicking!

Bitcoin’s worth witnessed an over 11% worth correction remaining week, pushing its worth below $95k. Actually, AMBCrypto reported previous that as we approached the Santa Claus rally, an match that traditionally has driven the crypto marketplace up, Bitcoin was once suffering.

On the time of writing, the king coin was once buying and selling at $94,078 with a marketplace capitalization of over $1.86 trillion.

It was once attention-grabbing to notice that regardless of the double-digit weekly correction, only one.98 million BTC addresses have been “out of the cash,” which accounted for lower than 4% of the entire collection of Bitcoin addresses, as in keeping with IntoTheBlock’s knowledge.

Amidst all this, Santiment, an information analytics platform, posted a tweet, highlighting a notable building. In step with the tweet, the crypto markets have opened the week retracing additional, instilling panic towards the retail crowd.

Specifically, Bitcoin and Ethereum [ETH] are seeing large FUD from more recent buyers who joined markets up to now 2–3 months.

The tweet discussed,

“Traditionally, when retail buyers start to promote in keeping with panic and emotion, whales and sharks have alternatives to scoop up extra cash with little resistance, growing bounces.”

Due to this fact, there’s a prime risk of a pattern reversal as we depend the rest days of this 12 months.

Will BTC sign in vegetables quickly?

As in keeping with our research of CryptoQuant’s knowledge, promoting sentiment remained dominant out there. This was once obvious from the expanding alternate reserve.

Alternatively, Santiment’s tweet discussed that if whales scoop up BTC, it may possibly cause a reversal. However that was once additionally now not going down.

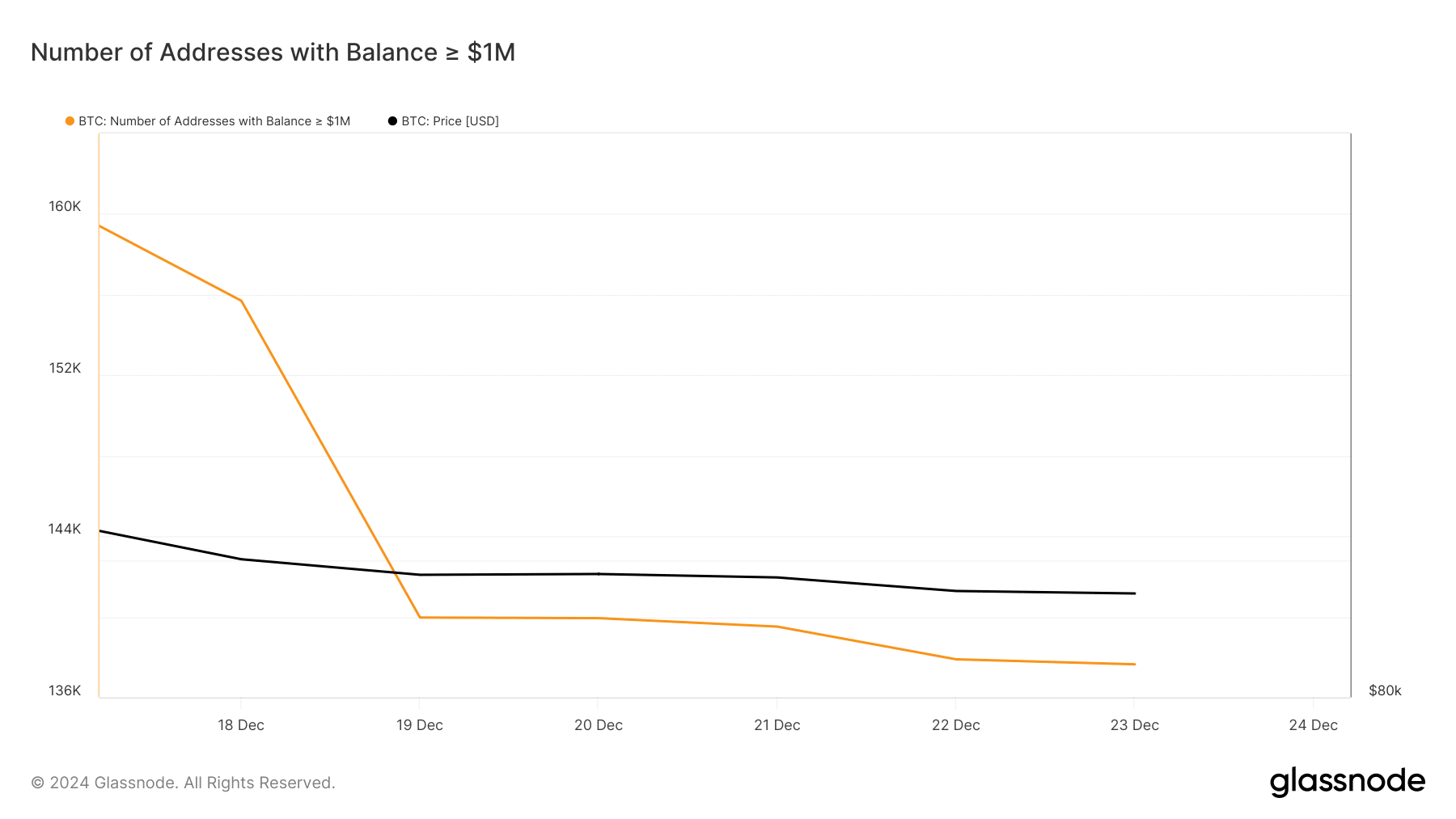

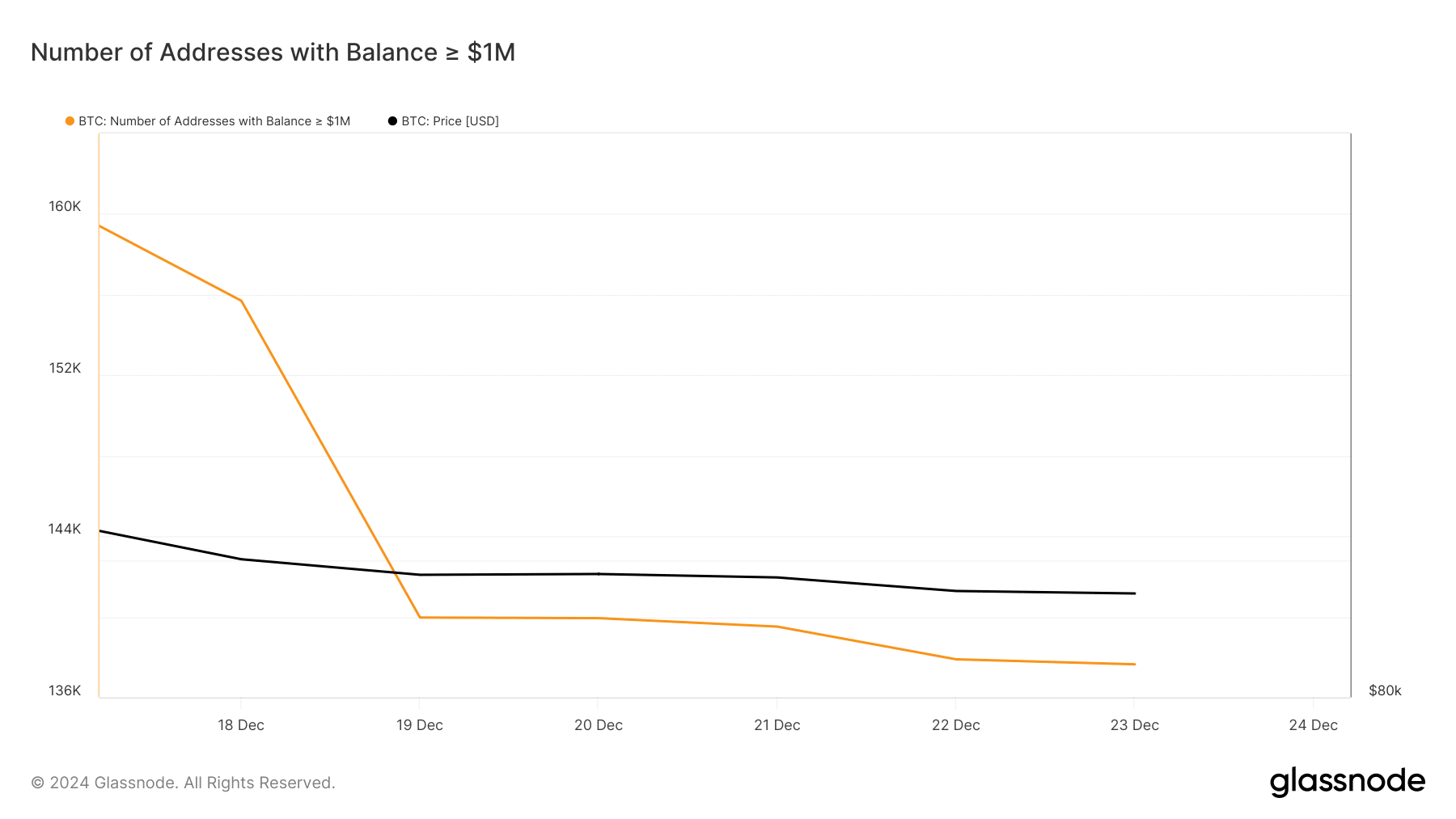

Bitcoin’s collection of addresses with balances of greater than $1million declined sharply remaining week, indicating that the big-pocketed gamers have been additionally promoting their holdings, which is able to purpose extra bother for BTC within the coming days.

Supply: Glassnode

Supply: Glassnode

However, issues within the derivatives marketplace regarded bullish as BTC’s investment price was once expanding.

Learn Bitcoin [BTC] Value Prediction 2024-25

A investment price building up within the crypto marketplace implies that the price of maintaining lengthy positions will increase—an indication of emerging bullish sentiment round an asset.

The taker purchase/promote ratio was once additionally inexperienced. This intended that purchasing sentiment was once dominant within the derivatives marketplace. If those metrics are to be believed, then anticipating a pattern reversal for BTC isn’t too bold.

Supply: CryptoQuant

Supply: CryptoQuant

Earlier: Ethereum leverage hits top ranges: Is a bullish breakout coming?

Subsequent: Metaplanet buys the dip: $61M Bitcoin acquisition amid marketplace volatility