Solana has noticed a favorable leap in the previous few days.

The sure capital glide signaled long-term bullish strikes.

Solana [SOL] endured to solidify its restoration segment with a robust resurgence in value and constant sure capital inflows. As of the twenty fourth of December, SOL traded round at $196, reflecting a three.53% building up.

Sponsored through favorable technical signs and powerful marketplace process, Solana has demonstrated resilience following a bearish length in 2022.

With sustained sure internet discovered earnings and extending marketplace self belief, Solana’s outlook for 2025 seems promising.

Solana value motion: Rebound from key beef up ranges

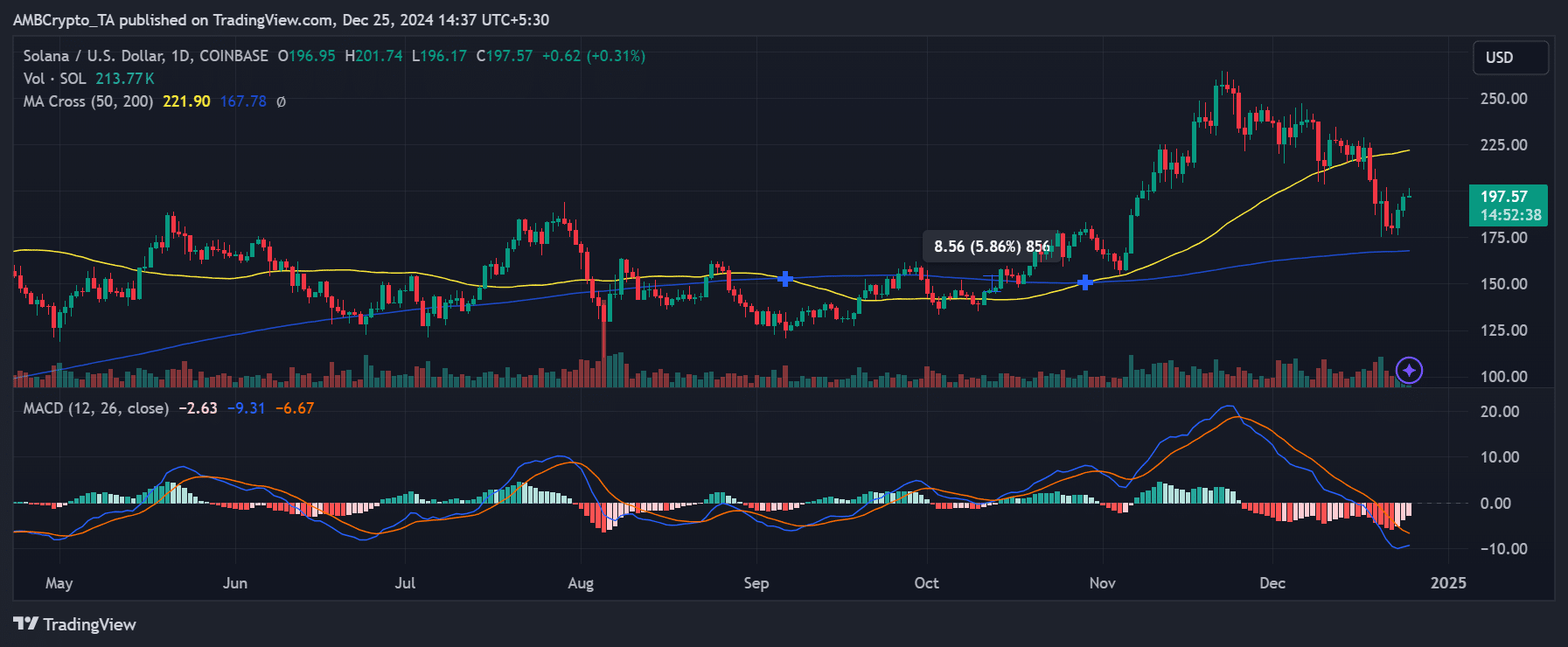

Solana’s fresh value efficiency showcased a rebound from crucial beef up close to $175, marking a turnaround from the pointy decline previous in December.

This value motion was once reinforced through the 50-day shifting moderate, which remained above the 200-day shifting moderate at press time.

This bullish indicator signaled doable long-term upward momentum and aligned with the wider restoration seen since September 2023.

Supply: TradingView

Supply: TradingView

In spite of the bullish backdrop, warning is warranted because of alerts from the MACD (Transferring Moderate Convergence Divergence) indicator.

The MACD line crossing underneath the sign line recommended bearish momentum within the quick time period. Alternatively, the knocking down of the MACD histogram signifies that promoting drive may weaken.

Traders will have to stay up for the MACD to opposite upward, which might validate a continuation of the present value rally.

Buying and selling volumes have remained increased, specifically all through fresh dips, suggesting energetic marketplace participation.

Those quantity spikes indicated that retail and institutional buyers were collecting SOL, even amid non permanent value volatility.

A gradual movement of capital

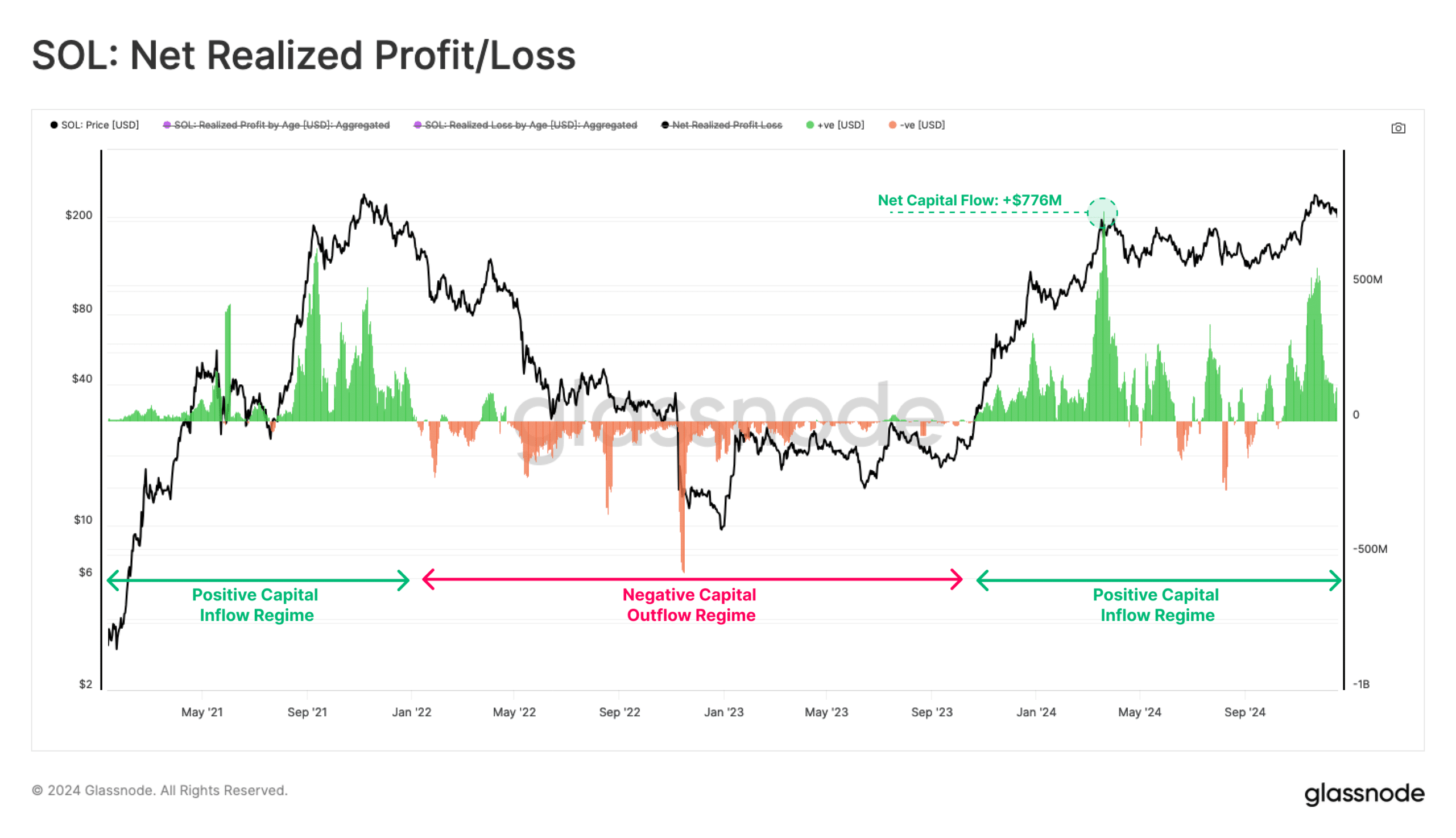

Complementing Solana’s value restoration is its constant sure internet discovered cash in/loss, as highlighted Glassnode.

Since September 2023, Solana has maintained a gradual inflow of capital, with discovered earnings considerably outweighing losses.

This sustained sure internet glide of liquidity has acted as a basis for Solana’s value appreciation, riding its price from sub-$20 ranges in early 2023 to its press time place close to $200.

Supply: Glassnode

Supply: Glassnode

The chart unearths a height influx of $776 million day-to-day, underscoring the size of liquidity getting into the ecosystem. This really extensive influx highlighted rising investor self belief.

The transition from a protracted detrimental capital outflow regime (2022–August 2023) to the present sure influx regime has been pivotal in reversing the bearish sentiment and environment the level for sustained enlargement.

Whilst minor outflows all through this era mirror herbal profit-taking, the overpowering dominance of inflows underscores a robust bullish sentiment.

This capital inflow has now not most effective supported value steadiness however has additionally enabled Solana to get better from marketplace downturns extra successfully than different property.

Key insights for Solana buyers

The combo of sure capital inflows and bullish value motion indicated Solana’s promising trajectory.

The “golden pass” and secure internet discovered earnings sign a robust basis for enlargement, whilst the MACD highlights non permanent demanding situations.

Solana’s talent to maintain inflows at present ranges will likely be the most important in keeping up its upward momentum, particularly because it approaches important resistance close to $225.

The capital inflows recommend higher adoption of Solana’s ecosystem, pushed through its velocity, scalability, and cost-effectiveness.

Learn Solana’s [SOL] Worth Prediction 2024-25

With institutional and retail buyers actively collaborating, Solana’s marketplace positioning continues to reinforce.

Alternatively, breaking via $225 may release additional upside doable because the asset approaches key resistance ranges. On the identical time, failure to take action may lead to non permanent consolidation.

Subsequent: Will Turbo crypto’s 25% surge lengthen past the vacation season?