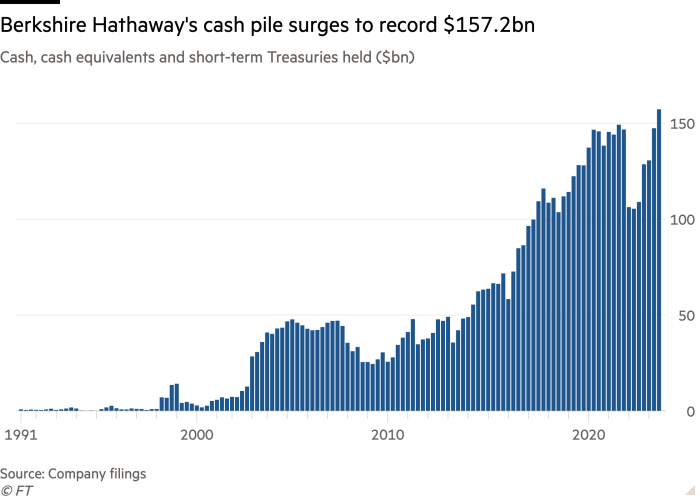

Unencumber the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.Warren Buffett’s Berkshire Hathaway slashed its positions in a variety of blue-chip US corporations within the 3rd quarter, because the billionaire investor transformed billions of bucks from the sprawling conglomerate’s inventory portfolio into money.The corporate disclosed it had bought off its closing place in carmaker Basic Motors right through the 3 months to the tip of September, an funding that was once value kind of $850mn within the earlier quarter.It exited a small stake of 59,400 stocks in logistics corporate UPS, trimmed its possession of laptop and printer maker HP by way of 15 in line with cent — with its stake falling in worth by way of greater than $1bn — and decreased its inventory holdings in oil primary Chevron by way of 10 in line with cent.Berkshire additionally bought out of small positions in Johnson & Johnson and Procter & Gamble, stakes that have been each and every value about $50mn on the finish of the second one quarter. A Berkshire-owned asset supervisor that invests independently of Buffett, referred to as New England Asset Control, persevered to carry stocks of each corporations on the finish of September, separate filings confirmed. The cuts didn’t prevent there. Berkshire bought stocks in Amazon, snack-food maker Mondelez Global and insurers Markel and Globe Existence. It additionally exited Activision Snowstorm, final out a merger arbitrage guess that the online game writer would effectively finalise its sale to Microsoft despite antitrust scrutiny. That deal closed in early October.The gross sales lifted Berkshire’s web divestments of publicly traded shares to almost $40bn over the last yr, as Buffett discovered better worth in temporary Treasury expenses now yielding greater than 5 in line with cent. Berkshire’s money place shot to a document $157bn on the finish of September, strengthened by way of upper pastime on its money and Treasury portfolio, in addition to robust working income from the masses of companies it owns.As a part of its disclosure, Berkshire famous it had neglected no less than one maintaining from the intently adopted file, writing that it had asked confidential remedy from the Securities and Alternate Fee.Berkshire has infrequently made the request when making an important funding.

The cuts didn’t prevent there. Berkshire bought stocks in Amazon, snack-food maker Mondelez Global and insurers Markel and Globe Existence. It additionally exited Activision Snowstorm, final out a merger arbitrage guess that the online game writer would effectively finalise its sale to Microsoft despite antitrust scrutiny. That deal closed in early October.The gross sales lifted Berkshire’s web divestments of publicly traded shares to almost $40bn over the last yr, as Buffett discovered better worth in temporary Treasury expenses now yielding greater than 5 in line with cent. Berkshire’s money place shot to a document $157bn on the finish of September, strengthened by way of upper pastime on its money and Treasury portfolio, in addition to robust working income from the masses of companies it owns.As a part of its disclosure, Berkshire famous it had neglected no less than one maintaining from the intently adopted file, writing that it had asked confidential remedy from the Securities and Alternate Fee.Berkshire has infrequently made the request when making an important funding.

Warren Buffett’s Berkshire Hathaway cashes in on blue-chip US shares

:max_bytes(150000):strip_icc()/Apple-News-Image---How-to-Invest-Like-Warren-Buffett-final-9c3f954d6d2d4677af76f5530292de13.jpg)

:max_bytes(150000):strip_icc()/SMCIChart-0600a4d228264d599d53c1d512767daf.jpg)