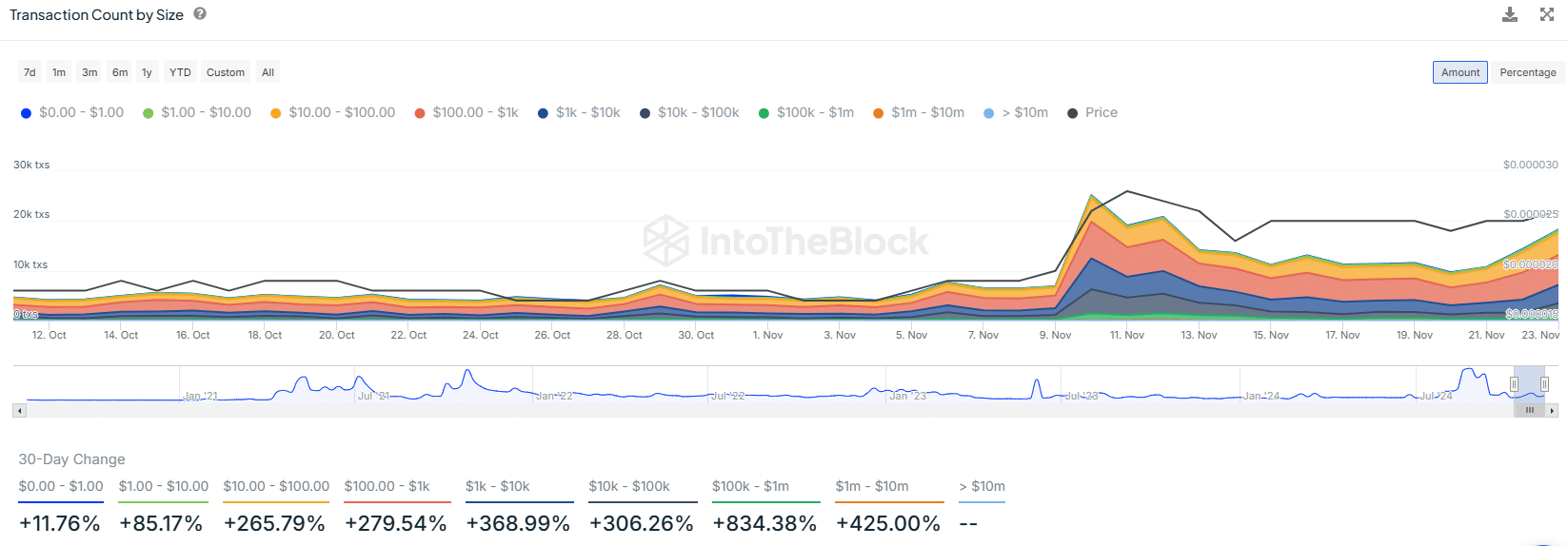

US DOLLAR FORECAST – EUR/USD, GBP/USD, AUD/USDThe U.S. greenback may just head decrease within the close to termThe pullback in U.S. Treasury yields will act as a headwind for the greenbackThis article explores the technical outlook for EUR/USD, GBP/USD and AUD/USD, specializing in value motion dynamics and key ranges in playMost Learn: Gold Worth Forecast – XAU/USD Breaks Out as Yields Sink, Fed Pivot Hopes BuildThe U.S. greenback, as measured by way of the DXY index, has fallen greater than 2.15% this month. Over the past couple of days, alternatively, the promoting force has eased, permitting the wider dollar to sit up modestly. In spite of the stabilization, it’s most likely that the downward correction that started a couple of weeks in the past has no longer but run its direction.One variable that might weigh at the U.S. foreign money is the new transfer in Treasuries as buyers attempt to front-run the “Fed pivot.” For context, yields have pulled again sharply this month, with the downturn accelerating following subdued October U.S. CPI and PPI knowledge. Either one of those experiences stunned to the drawback, sparking a dovish repricing of rate of interest expectancies.Yields may just proceed to retrench if financial weak spot, obviously displayed in the newest jobless claims numbers, intensifies heading into 2024. This situation is expected because the have an effect on of previous tightening measures feeds thru the actual financial system.Every other issue that might additional depress yields and the U.S. greenback is the large sell-off in oil, which has plunged just about 20% this quarter. If the trajectory of declining power prices persists, inflation will slow down sooner than forecast, decreasing the will for an excessively restrictive stance by way of the U.S. central financial institution.For an in depth research of the euro’s medium-term outlook, you’ll want to obtain our This fall technical and basic forecast

Advisable by way of Diego Colman

Get Your Loose EUR Forecast

EUR/USD FORECAST – TECHNICAL ANALYSISEUR/USD was once muted on Thursday following a reasonable pullback within the earlier consultation. In spite of marketplace indecision, the euro keeps a optimistic bias towards the U.S. greenback, with costs making upper highs and better lows not too long ago and buying and selling above key shifting averages.To reaffirm the bullish viewpoint, the pair wishes to carry above the 200 and 100-day SMA close to 1.0765. Effectively protecting this reinforce zone may just pave the best way for the change fee to wreck above the mental 1.0900 degree and advance against Fibonacci resistance at 1.0960, adopted by way of 1.1075.In case dealers regain power and push EUR/USD beneath 1.0765, the momentary bias may shift to a bearish outlook for the average foreign money. This possible building may result in a downward transfer against 1.0650, with endured weak spot heightening the danger of retesting trendline reinforce at 1.0570.EUR/USD TECHNICAL CHARTEUR/USD Chart Created The use of TradingViewUncover professional methods and helpful guidelines. Obtain the “The best way to industry GBP/USD” information to empower your buying and selling!

Advisable by way of Diego Colman

The best way to Business GBP/USD

GBP/USD FORECAST – TECHNICAL ANALYSISThursday noticed GBP/USD keeping up a subdued stance, suffering to assemble sure impetus, with slight consolidation beneath the 200-day easy shifting reasonable. Within the match of escalating losses, number one reinforce rests at 1.2320. Keeping this an important flooring is very important to restore hopes of a sustained uptrend; any failure to take action may result in a descent towards the 1.2200 threshold.Must the bulls reclaim regulate, preliminary resistance is predicted at 1.2450/1.2460. Upside clearance of this barrier may just invite contemporary purchasing pastime, laying the groundwork for a possible rally against the 100-day easy shifting reasonable. On additional power, shall we see a transfer against 1.2590, which represents the 50% Fibonacci retracement of the July/October decline.GBP/USD TECHNICAL CHARTGBP/USD Chart Created The use of TradingViewInterested in finding out how retail positioning can form the momentary trajectory of AUD/USD? Our sentiment information discusses the position of crowd mentality out there. Get the information now!

Trade in

Longs

Shorts

OI

Day-to-day

8%

-5%

3%

Weekly

-25%

41%

-12%

What does it imply for value motion?

Get My Information

AUD/USD FORECAST – TECHNICAL ANALYSISFollowing tough positive aspects previous within the week, AUD/USD fell on Thursday, with costs slipping underneath the 100-day SMA after being rejected on the 0.6500 care for. Must the retracement proceed, reinforce rests at 0.6460 and zero.6395 thereafter. On additional weak spot, a drop against 0.6350 is believable.Then again, if the pair resumes its advance, technical resistance is positioned across the 0.6500 mark. Overcoming this hurdle may provide a problem for the bullish camp, but a blank and transparent breakout may just catalyze a rally against the 200-day easy shifting reasonable, a tad beneath the 0.6600 degree/AUD/USD TECHNICAL CHARTAUD/USD Chart Created The use of TradingView