Key Takeaways

Intel stocks will most likely stay on traders’ radar monitors Tuesday after a document over the weekend stated that Broadcom and Taiwan Semiconductor Production Co. are taking into account bids for portions of the corporate.Since gapping sharply decrease in early August remaining yr, the inventory has remained most commonly rangebound, probably carving out a rectangle bottoming trend.The relative power index sits slightly under the 70 threshold, confirming bullish momentum, surroundings the degree for certain value motion to proceed this week.Traders must watch key overhead spaces on Intel’s chart round $26, $32, $37, and $45, whilst additionally tracking a big give a boost to degree close to $19.

Intel (INTC) stocks will most likely stay on traders’ radar monitors Tuesday after The Wall Side road Magazine reported Saturday that Broadcom (AVGO) and Taiwan Semiconductor Production Co. (TSM) are taking into account bids for portions of the embattled chipmaker.

In line with the document, Broadcom has been having a look into Intel’s chip-design and advertising and marketing industry, whilst contract chipmaker TSMC has mulled taking up some or all of Intel’s chip crops as a part of an investor consortium or any other construction.

Intel stocks surged greater than 20% remaining week after Vice President JD Vance stated at a up to date AI convention in Paris that the Trump management would take steps to make sure AI chips are designed and manufactured within the U.S, a transfer that would get advantages Intel’s foundry industry that makes chips for 3rd events.

Sentiment surrounding the inventory gained an additional spice up remaining week on hypothesis that the corporate would possibly spouse with TSMC to manufacture chips within the U.S. In spite of remaining week’s features, Intel stocks have misplaced just about part their worth over the last yr amid considerations concerning the chipmaker’s unsure turnaround plan and lack of ability to seize extra of the profitable AI silicon marketplace.

Under, we take a more in-depth take a look at Intel’s chart and practice technical research to spot key value ranges that traders is also looking at out for.

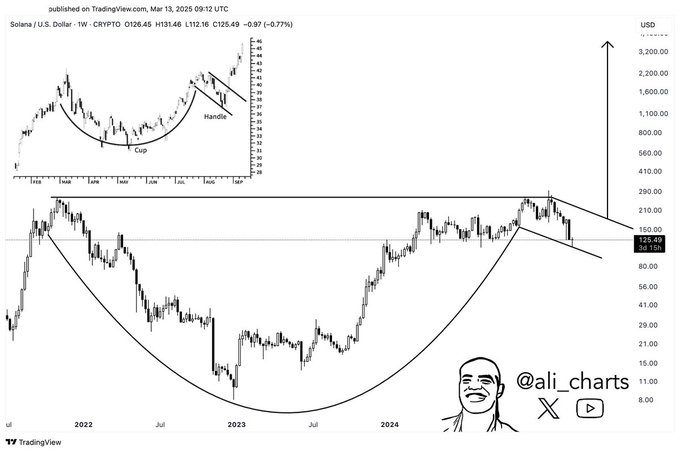

Possible Rectangle Trend Carving Chart Backside

Since gapping sharply decrease in early August remaining yr, Intel stocks have remained most commonly rangebound, probably carving out a rectangle bottoming trend.

This month, the inventory has rallied in opposition to the highest of the rangebound length on above-average quantity, even though the intently watched 200-day transferring common (MA) has equipped resistance in fresh buying and selling periods.

In the meantime, the relative power index (RSI) sits slightly under the 70 threshold, confirming bullish momentum, surroundings the degree for certain value motion to proceed this week.

Let’s determine 4 key overhead spaces on Intel’s chart the place the stocks may face promoting drive and in addition indicate a big give a boost to degree price tracking if the inventory reverses direction.

Key Overhead Spaces to Watch

At the beginning, it’s price maintaining a tally of the $26 space. This location, currenting sitting simply above the 200-day MA, would possibly supply overhead resistance close to the rectangle trend’s best trendline.

A decisive breakout above this degree may see the stocks climb to round $32. Traders who’ve purchased stocks at decrease costs would possibly search for go out issues on this area close to a trendline that connects a variety of similar buying and selling ranges at the chart between April 2023 and July remaining yr.

Purchasing above this degree would possibly cause a transfer as much as the $37 space. The stocks may stumble upon resistance on this location close to a horizontal line the hyperlinks more than one peaks at the chart from August 2023 and July remaining yr.

An extended-term uptrend opens the door for a transfer as much as round $45, a space the place traders would possibly glance to fasten in income close to a variety of peaks and troughs that shaped at the chart between November 2023 and March 2024.

Main Enhance Degree to Observe

If Intel’s proportion value reverses, traders must stay a detailed eye at the $19 degree. This space at the chart would most likely supply important give a boost to the place patrons would possibly search access issues close to the rectangle trend’s decrease trendline.

The feedback, critiques, and analyses expressed on Investopedia are for informational functions handiest. Learn our guaranty and legal responsibility disclaimer for more information.

As of the date this newsletter was once written, the writer does no longer personal any of the above securities.

:max_bytes(150000):strip_icc()/INTCChart-577805de95c644e9a5154484cfb6f3f2.gif)

:max_bytes(150000):strip_icc()/TAL-header-vancouver-canada-lunar-eclipse-LUNARECLIPSE0325-0bf2399d263c45078f2e2213b6923a34.jpg)