Printed on

March 16, 2025

Expectancies had been that billionaires will be the giant winners in a Trump The us 2.0. As an alternative, their fortunes have plummeted within the first 8 weeks. Listed here are the largest losers.

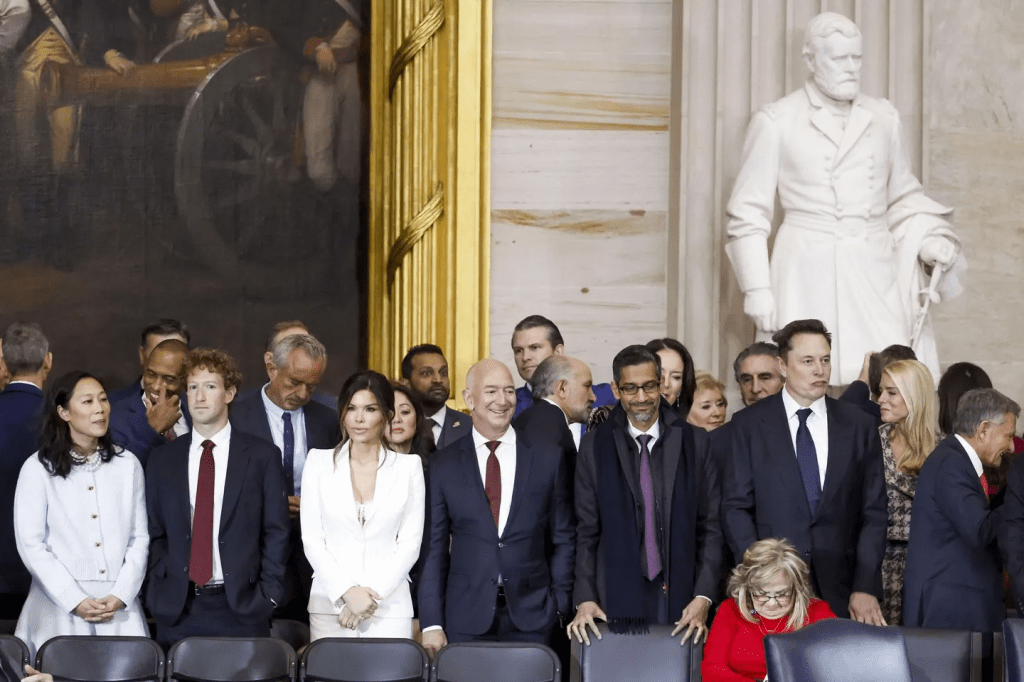

Tech billionaires at Trump’s inauguration, together with Mark Zuckerberg, Jeff Bezos and Elon Musk, were given top placement. However shares have tumbled beneath Trump 2.0 up to now.SHAWN THEW POOL/AFP/Getty mages

Tech billionaires at Trump’s inauguration, together with Mark Zuckerberg, Jeff Bezos and Elon Musk, were given top placement. However shares have tumbled beneath Trump 2.0 up to now.SHAWN THEW POOL/AFP/Getty mages

President Donald Trump has extra billionaires in his management than any earlier president, with no less than 9. He counts a number of billionaires as buddies or lovers: 16 visited him at Mar-a-Lago between the election and inauguration. Meta CEO Mark Zuckerberg reportedly simply went to the White Area on Wednesday following a Trump-Zuck White Area assembly in early February.

However having a pro-business, pro-capitalism president who could also be a billionaire hasn’t grew to become out rather well up to now for the participants of the three-comma-club. From January 20 thru Thursday March 13, the S&P 500 index fell 7.9%, whilst the tech-heavy Nasdaq index tumbled 11.8%. That downturn hit the rustic’s richest folks in a large means: jointly, American billionaires are actually $415 billion poorer, Forbes calculates.

Against this the S&P 500 inched up 2.4% and the Nasdaq down 1% in the similar duration following Joe Biden’s inauguration. Over that very same timespan, U.S. billionaires were given $153 billion richer–a three.6% build up.

A number of the components using shares decrease: Trump’s on-again, off-again selections on implementing price lists on Canada and Mexico. That has created uncertainty–one thing that company leaders abhor. Plus, the brand new 25% price lists that Trump put on all metal and aluminum imports previous this week glance to be environment off a industry warfare, with the E.U. making plans to release its personal price lists on U.S. items on April 1. Including to the troubles: in early March the Atlanta Fed predicted a 2.8% contraction in financial expansion for the primary quarter–in what’s being dubbed a “Trumpcession.”

No billionaire has been hit as onerous as Trump’s proper hand guy, Elon Musk. On January 20, the arena’s richest individual was once price $434 billion. Since then, studies have emerged of dramatic declines in Tesla automotive gross sales within the first two months of 2025 in Germany, China and Australia; analysts at JPMorgan minimize their forecast for first quarter 2025 deliveries of Tesla cars by means of 20% to 355,000, the bottom for the reason that 3rd quarter of 2022. In the meantime, protests in opposition to Tesla and Musk have erupted around the nation at Tesla dealerships; whilst some are non violent, others have incorporated incidents of vandalism.

Australia’s 50 Richest 2025

Amid all of it, stocks of Tesla have plunged 43% for the reason that inauguration. That during flip erased $104 billion from Musk’s fortune, which was once $330 billion after the inventory marketplace closed on Thursday, consistent with Forbes estimates. In spite of the 24% drop in his web price, he has held onto his spot as No. 1 wealthiest on the earth.

Ross Mayfield, an funding strategist at Baird Non-public Wealth Control, doesn’t consider this hit to Musk’s wealth is sudden, or has a lot to do with Musk’s more than one roles of overdue. “I don’t assume Musk’s position within the [Trump] management is most certainly serving to… however I don’t assume that’s the main motive force. If we’re heading against an financial slowdown, automobiles and cyclicals get hit the toughest, and automobiles also are truly uncovered to cross-border industry and price lists,” Mayfield mentioned.

The marketplace rout has additionally hit a number of further tech shares onerous. The as soon as high-flying Magnificent 7–Tesla, Nvidia, Alphabet, Amazon, Meta, Apple, and Microsoft–have jointly misplaced greater than $1.5 trillion in their marketplace worth since Jan. 20 amid issues about financial weak spot.

The leaders of a number of of the ones firms, together with Amazon’s Jeff Bezos, Google (now Alphabet) cofounder Sergey Brin, and Meta’s Zuckerberg, all attended Trump’s inauguration and got distinguished placement some of the attendees on the Capitol. Those tycoons are actually all amongst the ones whose fortunes have plunged probably the most since that party.

The highest 10 richest folks on the planet (March 2025)

Listed here are the 20 U.S. billionaires who misplaced probably the most since January 20, 2025: (Internet worths are as of marketplace shut on Thursday, March 13):

1. Elon Musk

Internet Value: $330 billion

Down: $104 billion

Supply of wealth: Tesla, SpaceX

2. Jeff Bezos

Internet Value: $210 billion

Down: $29 billion

Supply of wealth: Amazon

3. Larry Web page

Internet Value: $136 billion

Down: $26 billion

Supply: Alphabet (Google)

4. Sergey Brin

Internet Value: $130 billion

Down: $24 billion

Supply: Alphabet (Google)

5. Larry Ellison

Internet Value: $183 billion

Down: $22 billion

Supply: Oracle

6. Jensen Huang

Internet Value: $101 billion

Down: $19 billion

Supply: Nvidia

7. Michael Dell

Internet Value: $97 billion

Down: $18 billion

Supply: Dell computer systems

8. Steve Ballmer

Internet Value: $115 billion

Down: $11 billion

Supply: Microsoft

9. Stephen Schwarzman

Internet Value: $42.3 billion

Down: $10.2 billion

Supply: Non-public fairness

10. Thomas Peterffy

Internet Value: $48.8 billion

Down: $7.9 billion

Supply: Cut price brokerage

11. Mark Zuckerburg

Internet Value: $204 billion

Down: $7.6 billion

Supply: Fb/Meta

12. Rob Walton & circle of relatives

Internet Value: $103 billion

Down: $7 billion

Supply: Walmart

13. Jim Walton & circle of relatives

Internet Value: $102 billion

Down: $6.9 billion

Supply: Walmart

14. Alice Walton

Internet Value: $94.6 billion

Down: $6.8 billion

Supply: Walmart

15. Abigail Johnson

Internet Value: $31.3 billion

Down: $5.6 billion

Supply: Constancy Investments

16. Brian Armstrong

Internet Value: $7.6 billion

Down: $5.2 billion

Supply: Coinbase

17. Robert Pera

Internet Value: $14.9 billion

Down: $4.6 billion

Supply: Wi-fi networking

18. MacKenzie Scott

Internet Value: $27.4 billion

Down: $4.5 billion

Supply: Amazon

19. George Roberts

Internet Value: $14.2 billion

Down: $4.2 billion

Supply: Non-public fairness

20. Lyndal Stephens Greth & circle of relatives

Internet Value: $26.4 billion

Down: $4.2 billion

Supply of wealth: Oil & gasoline

This newsletter was once initially printed on forbes.com and all figures are in USD.

Glance again at the week that was once with hand-picked articles from Australia and world wide. Signal as much as the Forbes Australia e-newsletter right here or change into a member right here.