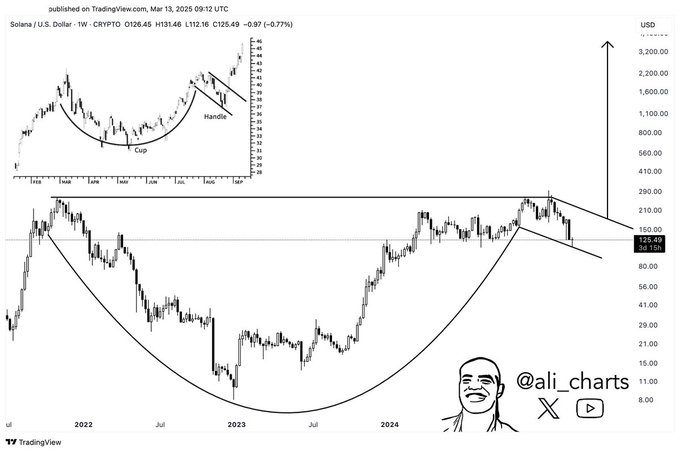

Bitcoin’s ancient bull cycle stays intact regardless of in style investor considerations over the present downturn, which analysts recommend is also only a transient “shakeout” ahead of the following upward transfer out there.Bitcoin’s (BTC) value is these days down 22% from its all-time top of over $109,000 recorded on Jan. 20, at the day of US President Donald Trump’s inauguration, Cointelegraph Markets Professional knowledge presentations.Regardless of investor sentiment shedding into “Excessive Concern” more than one occasions, ancient chart patterns recommend that this will simply be a value shakeout — a unexpected value drop brought about by means of more than one traders exiting their positions, preceded by means of a unexpected value restoration.“A number of key technical signs have became bearish, resulting in hypothesis that the bull cycle is also finishing upfront,” Bitfinex analysts advised Cointelegraph.BTC/USD, 1-year chart. Supply: Cointelegraph“Regardless of this, Bitcoin’s 4-year cycle stays a very powerful issue, traditionally shaping value actions,” stated the analysts, including:“Corrections inside bull cycles are standard, and previous developments recommend that this can be a shakeout fairly than the beginning of a protracted endure marketplace.”On the other hand, the release of the USA spot Bitcoin exchange-traded finances (ETFs), which quickly surpassed $125 billion in cumulative holdings, along side the rising institutional crypto investments, make it “transparent that the traditional cycle ceases to exist,” the analysts added.Similar: Bitcoin wishes weekly shut above $81K to steer clear of problem forward of FOMCIn an constructive signal for value motion, Bitcoin staged a day-to-day shut above $84,000 on March 15, for the primary time in over per week since March 8, TradingView knowledge presentations.

BTC/USD, 1-day chart. Supply: TradingView On the other hand, because of Bitcoin’s correlation with conventional monetary markets, BTC would possibly handiest discover a backside along side fairness markets, in particular the S&P 500, stated Bitfinex analysts, including:“Whilst $72,000–$73,000 stays a key reinforce vary, the wider marketplace narrative, particularly international treasury yields and fairness developments, will dictate Bitcoin’s subsequent primary transfer.”“Business wars have already been priced in, to a point, however extended financial pressure may just weigh on sentiment,” the analysts added.Similar: Emerging $219B stablecoin provide indicators mid-bull cycle, no longer marketplace topBitcoin halving and four-year cycle nonetheless the most important for value motion: Nexo analystDespite fears over a disrupted Bitcoin bull marketplace, the four-year cycle, along side the Bitcoin halving tournament, stay the most important for Bitcoin’s value motion, in step with Iliya Kalchev, dispatch analyst at Nexo virtual asset funding platform.“Bitcoin’s four-year compound annual enlargement price (CAGR) has declined to a report low of 8%, posing questions on whether or not its conventional four-year cycle stays legitimate,” Kalchev advised Cointelegraph, including:“Even though sturdy institutional adoption during the last yr has served as an important tailwind for Bitcoin, its halving occasions are nonetheless anticipated to exert long-term affect.”The 2024 Bitcoin halving diminished the Bitcoin community’s block praise to a few.125 BTC consistent with block.

BTC/USD, 1-day chart since 2024 halving. Supply: TradingView Bitcoin value is up over 31% for the reason that remaining halving befell on April 20, 2024, which used to be coined the “maximum bullish” setup for Bitcoin value, partially on account of the rising institutional hobby on the planet’s first cryptocurrency.Mag: SEC’s U-turn on crypto leaves key questions unanswered