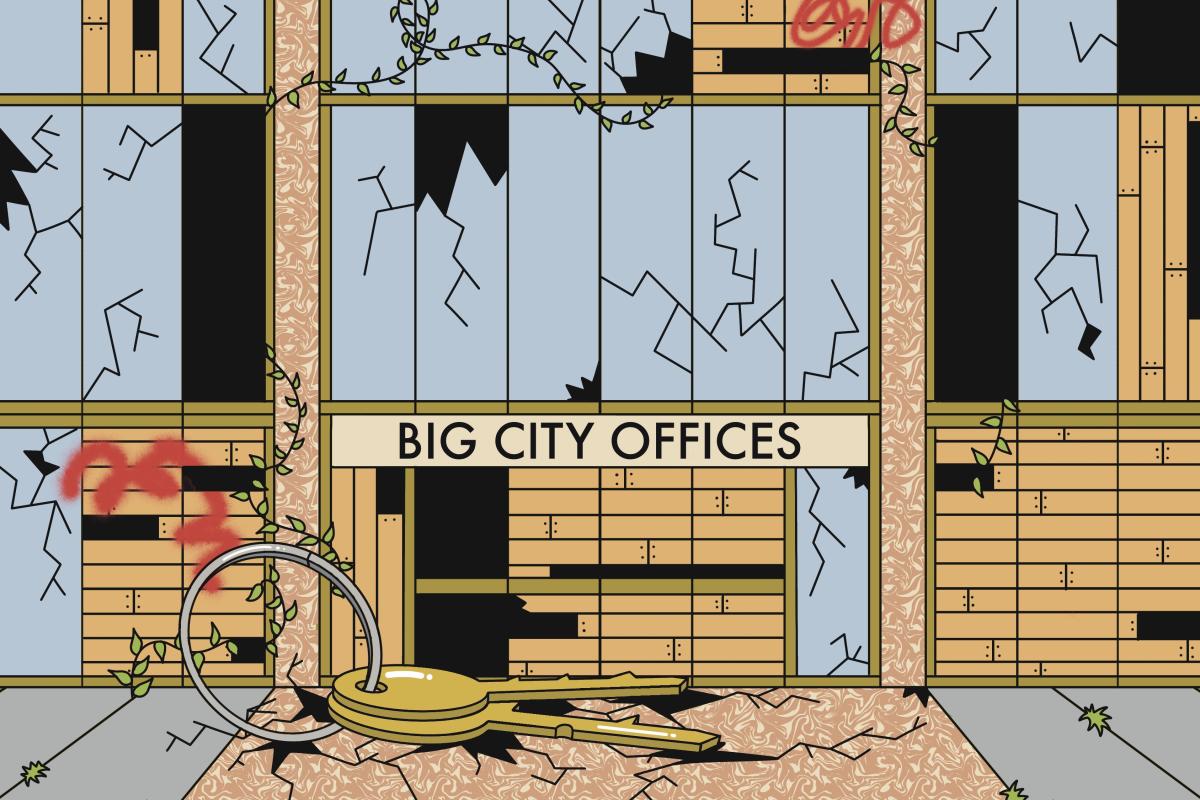

Workplace landlords, hit arduous via the work-from-home revolution, are resorting to a determined measure in the actual property global: “handing again the keys.”When this occurs, the owner stops paying the loan at the administrative center development or declines to refinance it. The financial institution or traders who made the mortgage then repossess the development.Join The Morning publication from the New York TimesSome of the most important names in industrial actual property, like Brookfield and Blackstone, have defaulted on mortgages and feature began or finished the method of handing again the keys on administrative center towers. The method unearths each the intensity of the issues within the administrative center marketplace and the facility of huge belongings corporations to push a lot of the monetary ache onto others — on this case, banks and different lenders.Because the pandemic started, administrative center staff confirmed they may get their jobs executed from domestic, and plenty of had been reluctant to return again. And corporations discovered they may save some huge cash via renting much less administrative center area, making many administrative center towers unprofitable for his or her house owners and turning many industry districts into ghost cities. About 23% of administrative center area in the US used to be vacant or to be had for sublet on the finish of November, in step with Avison Younger, an actual property products and services company, when compared with 16% prior to the pandemic.Handing again the keys is a drastic transfer, however it is smart as a result of it might probably restrict a landlord’s losses on a development.Take a belongings corporate that purchased an administrative center tower for $100 million simply prior to the pandemic, making an investment $25 million of its personal cash and borrowing $75 million. If the development is hemorrhaging tenants and now has a price of $45 million, the owner’s preliminary funding may well be value 0 — and the decrease hire source of revenue might not be sufficient to hide the development’s prices.Quite than proceed to pay passion and different bills, the owner can come to a decision to default at the mortgage, this means that the lenders get the beleaguered development. And in concept, the lenders may finally end up with a $30 million loss — the variation between the volume they lent ($75 million) and the resale worth of the development ($45 million).These days’s handing again the keys is paying homage to the time period “jingle mail,” which become infamous after the monetary disaster of 2008 when house owners deserted their houses — and supposedly despatched their keys again to their banks — as a result of their houses have been value a long way lower than what they owed at the loan.However there’s a distinction: Large belongings corporations can stay doing industry once they default and are even thought to be savvy for jettisoning distressed constructions. However house owners who stopped paying their mortgages suffered an enormous hit to their credit score scores and needed to in finding in other places to are living.c.2023 The New York Instances Corporate

With Places of work Sitting Empty, Landlords Are ‘Handing Again the Keys’