Yields on 3-month

BX:TMUBMUSD03M

and 6-month

BX:TMUBMUSD06M

Treasury payments had been seeing yields north of five% since March when Silicon Valley Financial institution’s cave in ignited fears of a broader instability within the U.S. banking sector from rapid-fire Fed price hikes.

Six months later, the Fed, in its ultimate assembly of the yr, opted to stay its coverage price unchanged at 5.25% to five.5%, a 22-year prime, however Powell additionally in the end signaled that sufficient used to be most likely sufficient, and {that a} coverage pivot to rate of interest cuts used to be most likely subsequent yr. Importantly, the central financial institution chair additionally stated he doesn’t need to make the error of conserving borrowing prices too prime for too lengthy. Powell’s feedback helped carry the Dow Jones Business Reasonable

DJIA

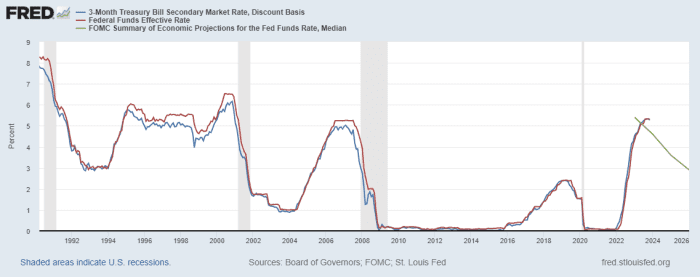

above 37,000 for the primary time ever on Wednesday, whilst the blue-chip index on Friday scored a 3rd report shut in a row. “Other people had been in point of fact surprised via Powell’s feedback,” stated Robert Tipp, leader funding strategist, at PGIM Mounted Source of revenue. Quite than hose down rate-cut exuberance development in markets, Powell as an alternative opened the door to price cuts via midyear, he stated. New York Fed President John Williams on Friday attempted to mood hypothesis about price cuts, however as Tipp argued, Williams additionally affirmed the central financial institution’s new “dot plot” reflecting a trail to decrease charges. “Sooner or later, you find yourself with a decrease fed-funds price,” Tipp stated in an interview. The danger is that cuts come all of sudden, and will erase 5% yields on T-bills, money-market finances and different “cash-like” investments within the blink of an eye fixed.Swift tempo of Fed cuts When the Fed lower charges prior to now 30 years it’s been swift about it, frequently bringing them down briefly. Fed rate-cutting cycles for the reason that ’90s hint the pointy pullback additionally observed in 3-month T-bill charges, as proven beneath. They fell to about 1% from 6.5% after the early 2000 dot-com inventory bust. In addition they dropped to nearly 0 from 5% within the enamel of the worldwide monetary disaster in 2008, and raced backpedal to a backside throughout the COVID disaster in 2020.

Charges on 3-month Treasury payments dropped all of sudden in previous Fed rate-cutting cycles

FRED information

“I don’t assume we’re shifting, whatsoever, again to a nil interest-rate global,” stated Tim Horan, leader funding officer mounted source of revenue at Chilton Consider. “We’re going to nonetheless be in an international the place actual rates of interest subject.” Burt Horan additionally stated the marketplace has reacted to Powell’s pivot sign via “partying on,” pointing to shares that had been again to report territory and benchmark 10-year Treasury yield’s

BX:TMUBMUSD10Y

that has dropped from a 5% height in October to a few.927% Friday, the bottom yield in about 5 months. “The query now, in my thoughts,” Horan stated, is how does the Fed orchestrate a pivot to price cuts if monetary stipulations proceed to loosen in the meantime. “After they start, the are going to proceed with price cuts,” stated Horan, a former Fed staffer. With that, he expects the Fed to stay very wary earlier than pulling the cause at the first lower of the cycle. “What we’re witnessing,” he stated, “is a repositioning for that.”Pivoting at the pivot The newest information for money-market finances presentations a shift, although transient, out of “cash-like” belongings. The frenzy into money-market finances, which persevered to draw report ranges of belongings this yr after the failure of Silicon Valley Financial institution, fell prior to now week via about $11.6 billion to kind of $5.9 trillion thru Dec. 13, in step with the Funding Corporate Institute. Buyers additionally pulled about $2.6 billion out of brief and intermediate executive and Treasury mounted source of revenue exchange-traded finances prior to now week, in step with the newest LSEG Lipper information. Tipp at PGIM Mounted Source of revenue stated he expects to peer any other “ping pong” yr in long-term yields, corresponding to the volatility of 2023, with the 10-year yield more likely to hinge on financial information, and what it manner for the Fed as it really works at the ultimate leg of having inflation right down to its 2% annual goal. “The large driving force in bonds goes to be the yield,” Tipp stated. “If you’re extending period in bonds, you’ve much more assurance of incomes an source of revenue move over individuals who keep in coins.” Molly McGown, U.S. charges strategist at TD Securities, stated that financial information will proceed to be a driver in signaling if the Fed’s first price lower of this cycle occurs one day. With that backdrop, she expects subsequent Friday’s studying of the personal-consumption expenditures value index, or PCE, for November to be a magnet for markets, particularly with Wall Boulevard more likely to be extra in moderation staffed within the ultimate week earlier than the Christmas vacation. The PCE is the Fed’s most well-liked inflation gauge, and it eased to a three% annual price in October from 3.4% a month earlier than, however nonetheless sits above the Fed’s 2% annual goal. “Our view is that the Fed will cling charges at those ranges in first part of 2024, earlier than beginning reducing charges in 2nd part and 2025,” stated Sid Vaidya, U.S. Wealth Leader Funding Strategist at TD Wealth. U.S. housing information due on Monday, Tuesday and Wednesday of subsequent week additionally will be a magnet for buyers, specifically with 30-year mounted loan price falling beneath 7% for the primary time since August. The foremost U.S. inventory indexes logged a 7th immediately week of positive factors. The Dow complicated 2.9% for the week, whilst the S&P 500

SPX

received 2.5%, finishing 1.6% clear of its Jan. 3, 2022 report shut, in step with Dow Jones Marketplace Information. The Nasdaq Composite Index

COMP

complicated 2.9% for the week and the small-cap Russell 2000 index

RUT

outperformed, gaining 5.6% for the week. Learn: Russell 2000 on tempo for easiest month as opposed to S&P 500 in just about 3 years Yr Forward: The VIX says shares are ‘reliably in a bull marketplace’ heading into 2024. Right here’s learn it.