A paradoxical situation is rising because the crypto marketplace anticipates the prospective approval of spot Bitcoin ETFs (exchange-traded budget) in early 2024. Whilst such approval would possibly appear a harbinger of a bullish section for Bitcoin, a number of mavens recommend in a different way.

Their research signifies a possible downturn in Bitcoin’s value, with a forecasted decline to round $32,000 in January 2024.

Bitcoin ETFs and the “Promote-the-Information” Phenomenon

CryptoQuant, a famend analytics company, famous that the marketplace anticipates a 90% probability of spot Bitcoin ETF approvals by means of early January. This optimism, mirrored in 32 conferences between ETF issuers and the USA Securities and Change Fee (SEC), suggests optimistic discussion. Alternatively, it additionally units the degree for a vintage “sell-the-news” match.

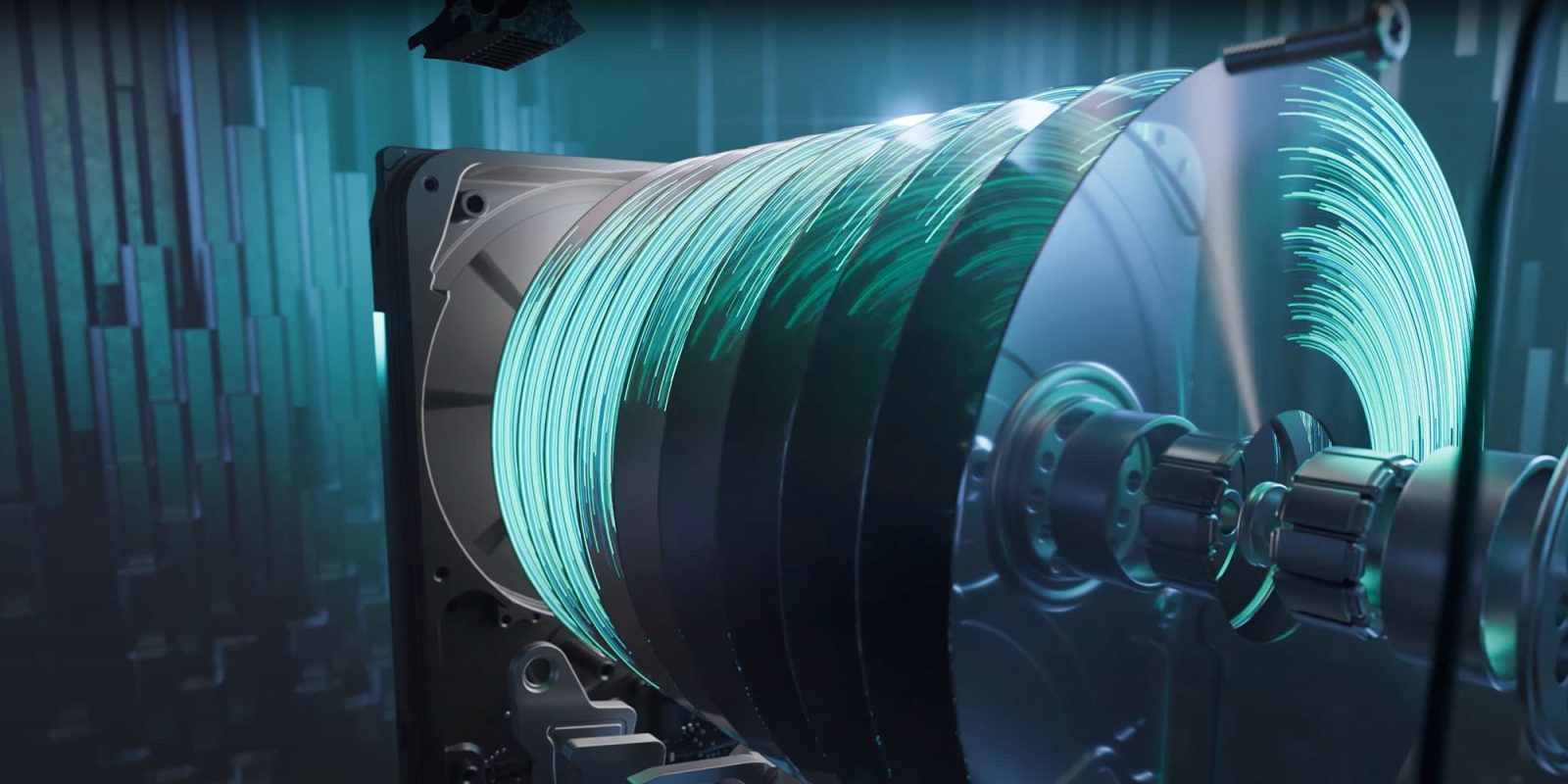

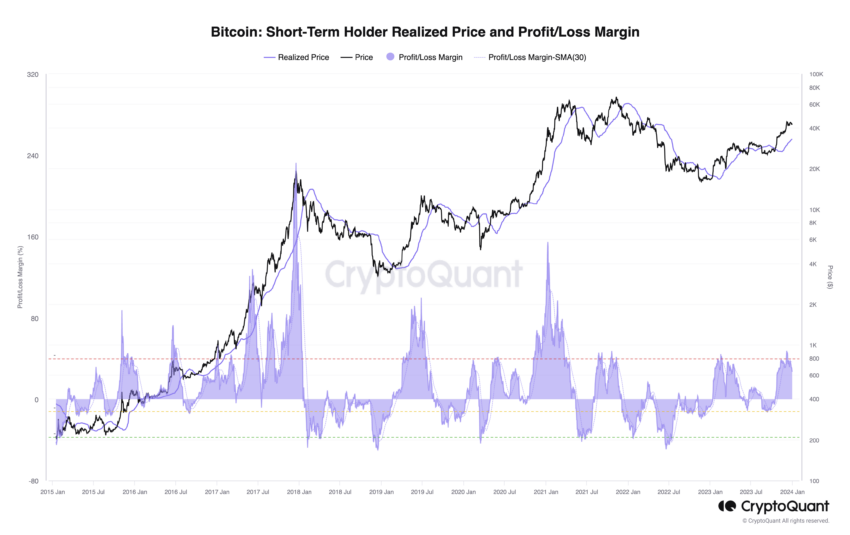

“There are expanding odds that the ETF approval will probably be a ‘Promote-the-Information’ match as Bitcoin marketplace members are sitting on top unrealized earnings. As an example, temporary Bitcoin holders are experiencing top unrealized cash in margins of 30%, which traditionally has preceded value corrections,” analysts at CryptoQuant argued.

Bitcoin Discovered Value. Supply: CryptoQuant

Bitcoin Discovered Value. Supply: CryptoQuant

The hot announcement from Blackrock about seeding its ETF with $10 million is a bullish signal. Nevertheless, CryptoQuant highlighted the affect of miner conduct. With the new surge in Bitcoin costs, miners are experiencing top unrealized earnings and feature began expanding their promoting actions, which might give a contribution to downward power.

Learn extra: How To Get ready for a Bitcoin ETF: A Step-by-Step Way

For those causes, CryptoQuant predicted that Bitcoin would possibly decline to as little as $32,000, which is the place the temporary holder discovered value sits.

Cathie Wooden and Nic Carter Be expecting BTC Value to Decline

Cathie Wooden, CEO and CIO of ARK Make investments, additionally equipped a extra nuanced viewpoint. She said the potential of a temporary sell-off however stays bullish on Bitcoin’s long-term potentialities.

“It wouldn’t be unexpected if we noticed a promote at the information. That’s an expression out there when you’ve got a large number of anticipation a worth strikes up, the development occurs after which, particularly rapid buying and selling organizations, promote at the information. However past that, I feel will probably be only a perhaps an overly temporary phenomenon,” Wooden concluded.

Wooden additionally cited the numerous affect that even a modest institutional funding will have on the cost of Bitcoin. She argued that “there are trillions of greenbacks in property to be allotted” in Bitcoin, if those establishments transfer 0.1%, that may “transfer the needle.” Wooden’s view is grounded in Bitcoin’s shortage and the expected inflow of institutional budget post-ETF approval.

Learn extra: Famend Analysts Provide an explanation for Why BTC Value Will Hit $1 Million After Bitcoin ETF Approval

Likewise, Nic Carter, investment spouse at Fort Island Ventures, highlighted a dichotomy out there’s reaction to the spot Bitcoin ETF approval. Whilst agreeing with the temporary sell-off sentiment, he’s additionally constructive in regards to the medium-term results.

In step with Carter, the ETF would free up new capital categories, fostering structural flows that would receive advantages Bitcoin. He downplayed the affect of the halving match in comparison to the ETF’s doable to draw new funding.

“We can even see a news-selling match right here. Alternatively, over the medium time period, the ETF unlocks complete new categories of capital that in a different way wouldn’t have the ability to input the marketplace and haven’t been ready to allocate to Bitcoin. So, I feel you’ll see structural flows that will probably be sure for Bitcoin,” Carter emphasised.

Learn extra: BTC Value Prediction 2024: What Will Occur After Bitcoin ETFs Approval?

Bitcoin Per thirty days Returns. Supply: CoinGlass

Bitcoin Per thirty days Returns. Supply: CoinGlass

Ali Martinez, World Head of Information at BeInCrypto, presented a historic viewpoint on Bitcoin. He famous that sturdy BTC performances against the yr’s finish have frequently ended in bearish developments in January. This development means that January 2024 may see a spike in profit-taking. Therefore, it aligns with the opposite analysts’ predictions of a worth drop.

Disclaimer

In adherence to the Consider Challenge pointers, BeInCrypto is dedicated to independent, clear reporting. This information article targets to supply correct, well timed data. Alternatively, readers are suggested to ensure information independently and seek advice from a certified sooner than making any selections according to this content material. Please observe that our Phrases and Stipulations, Privateness Coverage, and Disclaimers had been up to date.