Dow Jones futures had been little modified after hours, along side S&P 500 futures and Nasdaq futures, with the CPI inflation record on faucet. The SEC in spite of everything authorized the introduction of spot Bitcoin ETFs. KB House (KBH) reported profits.

X

The inventory marketplace rally noticed modest positive aspects Wednesday, with the key indexes transferring again towards 52-week highs.

Microsoft (MSFT), ServiceNow (NOW), Workday (WDAY), MercadoLibre (MELI) and Howmet Aerospace (HWM) all flashed purchase alerts on Wednesday.

MSFT inventory is last in on overtaking the marketplace cap of fellow Dow titan Apple (AAPL).

Microsoft and NOW inventory are at the IBD 50. Microsoft and MELI inventory are on SwingTrader. MSFT inventory is at the IBD Lengthy-Time period Leaders checklist. ServiceNow, Microsoft, MercadoLibre and WDAY inventory are at the IBD 50. Workday, ServiceNow and MELI inventory are at the IBD Large Cap 20. Microsoft was once Wednesday’s IBD Inventory Of The Day.

The video embedded within the article mentioned the marketplace motion and analyzed Microsoft, ServiceNow inventory and GigaCloud Era (GCT).

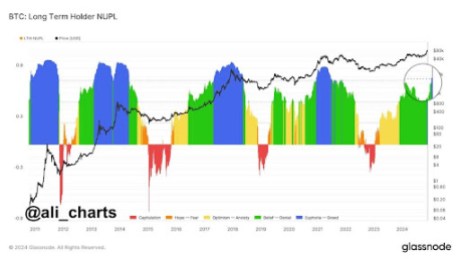

SEC OKs Spot Bitcoin ETFs

The Securities and Alternate Fee handed rule adjustments Wednesday afternoon allowing spot bitcoin exchange-traded price range.

In all, 11 spot bitcoin ETFs will start buying and selling Thursday.

All through Wednesday’s consultation, CBOE World Markets (CBOE) authorized six bitcoin ETFs to start out buying and selling Thursday. Particularly, the ETFs are the Invesco Galaxy Bitcoin ETF (BTCO), Franklin Bitcoin ETF (EZBC), ARK 21Shares Bitcoin ETF (ARKB), VanEck Bitcoin Consider (HODL), Constancy Smart Starting place Bitcoin Fund (FBTC), and WisdomTree Bitcoin Fund (BTCW).

The spot ETFs are noticed drawing in much more institutional improve for bitcoin.

The cost of bitcoin edged upper Wednesday to $45,954.49 as of five p.m. ET, however traded close to $47,000 in a single day, after in brief achieving $47,696.61.

Cryptocurrency replace Coinbase (COIN) and bitcoin miner Marathon Virtual (MARA) rose strongly after hours. Each misplaced a fragment in Wednesday’s consultation.

Dow Jones Futures Lately

Dow Jones futures edged decrease vs. truthful price. S&P 500 futures had been little modified. Nasdaq 100 futures rose 0.1%.

The Hard work Division will unlock the December shopper value index at 8:30 a.m. ET, along side weekly jobless claims. The CPI record is bound to transport Dow futures and Treasury yields.

Take into account that in a single day motion in Dow futures and somewhere else does not essentially translate into exact buying and selling within the subsequent common inventory marketplace consultation.

KB House Profits

KBH inventory fell modestly in past due industry after KB House profits and earnings modestly beat. Stocks rose 1.1% to 63.20 in Wednesday’s consultation, in brief hitting their best possible ranges in just about 17 years. Housing shares surged in past due 2023 as loan charges tumbled. A number of cleared brief consolidations Wednesday.

CPI Inflation File

Economists be expecting the December shopper value index to upward push 0.2% vs. November, with the once a year CPI inflation fee noticed ticking as much as 3.2%. Core CPI is forecast to upward push 0.2% at the month, with core inflation fee down to three.8% from 4%. That will be the lowest since Might 2021.

Sign up for IBD mavens as they analyze main shares and the marketplace on IBD Reside

Inventory Marketplace Rally

The inventory marketplace rally confirmed modest positive aspects at the main indexes, which closed close to consultation highs. The Dow Jones Business Reasonable climbed 0.45% in Wednesday’s inventory marketplace buying and selling. The S&P 500 index rose 0.6%. The Nasdaq composite complex 0.75%.

After a short lived pullback to begin 2024, the S&P 500 is slightly under contemporary peaks and nearly at its January 2022 file highs. The Nasdaq is last in at the 15,000 degree, with a two-year top simply above that. The Dow Jones is soaring slightly under its Jan. 2 all-time top.

The small-cap Russell 2000 edged up 0.1%, maintaining the 21-day line.

A lot of the key indexes’ positive aspects mirrored tech megacaps comparable to MSFT inventory, ServiceNow, Nvidia (NVDA) and Meta Platforms (META).

The Invesco S&P 500 Equivalent Weight ETF (RSP) and the First Consider Nasdaq 100 Equivalent Weighted Index ETF (QQEW) each rose 0.2%.

General, winners rather crowned losers Wednesday, however marketplace breadth has been quite missing in 2024. But traders have not had hassle this week discovering an important collection of main shares flashing purchase alerts from various sectors.

U.S. crude oil costs fell 1.2% to $71.37 a barrel.

The ten-year Treasury yield rose 1 foundation level to 4.03%.

ETFs

Amongst enlargement ETFs, the iShares Expanded Tech-Instrument Sector ETF (IGV) won 1.4%. Microsoft inventory is a large IGV part, with ServiceNow and Workday additionally notable holdings. The VanEck Vectors Semiconductor ETF (SMH) edged up 0.1%

Reflecting more-speculative tale shares, ARK Innovation ETF (ARKK) dipped 0.3% and ARK Genomics ETF (ARKG) slipped 0.6%. COIN inventory is the No. 1 maintaining throughout Ark Make investments’s ETFs.

SPDR S&P Metals & Mining ETF (XME) declined 0.9% and the World X U.S. Infrastructure Construction ETF (PAVE) rose 0.5%. U.S. World Jets ETF (JETS) edged up 0.3%. SPDR S&P Homebuilders ETF (XHB) stepped up 1%. The Power Choose SPDR ETF (XLE) retreated 1% whilst the Well being Care Choose Sector SPDR Fund (XLV) climbed 0.5%.

The Business Choose Sector SPDR Fund (XLI) rose 0.5% and the Monetary Choose SPDR ETF (XLF) inched up 0.2%.

Time The Marketplace With IBD’s ETF Marketplace Technique

Microsoft Flashes Purchase Sign

Microsoft inventory rose 1.9% to 382.77, transferring towards a 384.30 purchase level from a flat base, base-on-base development. However stocks gave 3 causes to take an early access. MSFT inventory cleared a downward-sloping trendline decisively. It moved above a number of weeks of tight buying and selling resistance close to 377. And it is prolonged its rebound from the 50-day and 10-week traces, whilst nonetheless being shut.

Microsoft is true at the heels of Apple for the identify of most dear corporate. It now has a marketplace valuation of $2.845 trillion. That is slightly under Apple inventory’s $2.895 trillion.

Up to now in 2024, MSFT inventory is up 1.8%. Apple is down 3.3%, with stocks up 0.6% on Wednesday. 3 analysts have downgraded AAPL inventory this yr, most commonly on iPhone considerations.

Apple gross sales have fallen for 4 instantly quarters. Microsoft profits and gross sales enlargement have slowly sped up for the previous 3 quarters. And Wall Boulevard expects Microsoft enlargement to outpace Apple’s, buoyed via its AI management.

Different Shares In Purchase Zones

NOW inventory rose 2.2% to 714.30, proceeding to rebound from the 10-week line. Stocks flirted with a downward-sloping trendline. ServiceNow inventory has a four-weeks-tight development with a 720.68 access, solid slightly under a 20%-25% profit-taking zone. However NOW inventory is on the right track to forge a flat base with that purchase level after this week. Traders must be aware that ServiceNow profits are due Jan. 24.

WDAY inventory edged up 0.4% to 276.81, simply breaking a trendline in a brief consolidation, providing an early access. This week Workday has rebounded from simply above its 10-week line, albeit in mild quantity. Stocks have a 279.83 access from a four-weeks-tight development that will be a flat base after Friday if WDAY remains in its vary.

MELI inventory complex 1.6% to one,598.16, transferring off the 21-day line after rebounding from the 50-day line closing Friday. MercadoLibre has a flat base that is a part of a base-on-base formation, with a 1,660 purchase level. Traders can have used Monday’s transfer above the 21-day as an access, with Wednesday providing a good trendline access.

Howmet Aerospace inventory popped 3.5% to 55.57, clearing a 54.53 access and proceeding this week’s leap from the 10-week line. The 54.53 purchase level is from a shelf — technically a four-weeks-tight — solid across the most sensible of a previous purchase zone.

Why This IBD Device Simplifies The Seek For Most sensible Shares

What To Do Now

The entire image is bullish and traders must be in search of tactics so as to add publicity steadily. A couple of extra shares flashed purchase alerts Wednesday, together with Microsoft, however a bunch are getting prolonged already. So do not chase the ones names.

Additionally, imagine diversifying your portfolio.

Learn The Large Image on a daily basis to stick in sync with the marketplace path and main shares and sectors.

Please observe Ed Carson on Threads at @edcarson1971, X/Twitter at @IBD_ECarson and Bluesky at @edcarson.bsky.social for inventory marketplace updates and extra.

YOU MAY ALSO LIKE:

Catch The Subsequent Large Profitable Inventory With MarketSmith

Best possible Enlargement Shares To Purchase And Watch

IBD Virtual: Liberate IBD’s Top rate Inventory Lists, Equipment And Research Lately

Tesla Vs. BYD: EV Giants Vie For Crown, However Which Is The Higher Purchase?

![Galaxy S25 Extremely ditches the Galaxy Observe design in first hands-on leak [Video] Galaxy S25 Extremely ditches the Galaxy Observe design in first hands-on leak [Video]](https://9to5google.com/wp-content/uploads/sites/4/2024/09/Galaxy-S23-Ultra-and-S24-Ultra-1.jpg?quality=82&strip=all&w=1600)