Fairness Indexes Wrap: Airways Tumble on Delta’s Reduced Steering; Large Banks Diverge After Profits Misses

40 mins in the past

The Dow

Verizon (VZ) rose 1.7%, regaining one of the most flooring it misplaced the day gone by when it and competitor AT&T’s executives have been known as on to satisfy with federal officers over their use of lead-sheathed telephone cables.

Chevron (CVX) added 1.4% as oil costs edged greater amid escalated tensions within the Crimson Sea.

Microsoft (MSFT) rose 1%, bringing it nearer to overtaking Apple (AAPL) as essentially the most treasured U.S. corporate. Apple stocks inched up simply 0.2% after an appeals court docket upheld a patent tribunal resolution favoring Masimo in a dispute over blood oxygen sensors in Apple Watches.

UnitedHealth Crew (UNH) fell 3.3% after a 16% build up in clinical prices within the fourth quarter overshadowed its income beat.

Boeing (BA) misplaced 2.2% amid experiences it used to be being sued via Alaska Air passengers who have been aboard the 737 Max 9 jet that misplaced a part of its fuselage mid-flight ultimate week.

JPMorgan Chase (JPM) fell 0.7% after its web source of revenue and earnings got here in beneath expectancies following a $2.9 billion particular evaluation from the FDIC.

The S&P 500

Financial institution of New York Mellon (BK) rose 4% after its quarterly income crowned analyst estimates.

Protection corporations outperformed as tensions ratcheted up within the Crimson Sea following U.S. airstrikes on Houthi army installations in Yemen. Northrop Grumman (NOC) rose 3%, L3 Harris Applied sciences (LHX) climbed 2.4%, and Lockheed Martin (LMT) added 2.2%.

Citigroup (C) rose 1% after it mentioned quarterly income took successful from an FDIC evaluation and restructuring prices.

BlackRock (BLK) stocks rose 0.9% after the company reported better-than-expected income and introduced its $12.5 billion acquisition of World Infrastructure Companions.

Airline and cruise shares tumbled after Delta Airways (DAL) overshadowed its income beat with reduced full-year income steering. United Airways (UAL) misplaced 10.6%, whilst American Airways (AAL) and Delta misplaced 9.5% and 9%, respectively. Norwegian Cruise Line Holdings (NCLH) additionally sank amid Delta’s steering revision and emerging oil costs. It fell 4.3%, and peer Carnival Corp (CCL) misplaced 3.3%.

UnitedHealth’s income document despatched medical insurance shares decrease, together with Humana (HUM), down 3.6%, and CVS Well being (CVS), down 3%.

Financial institution of The united states (BAC) fell 1.1% after it reported income have been, like the opposite large backs, hit via an FDIC regulatory price within the fourth quarter.

The Nasdaq 100

MercadoLibre (MELI) led the index, gaining 4.2%.

Coca-Cola Europacific Companions (CCEP) rose 2.6% after BNP Paribus upgraded the inventory to “outperform” from “impartial.”

Regeneron (REGN) received 1.9% after RBC upgraded the inventory to “outperform” following its win over Viatris in a patent dispute associated with its best-selling eye drug Eylea.

Tesla (TSLA) tumbled 3.7% after it mentioned it might pause manufacturing at its biggest Eu manufacturing unit for 2 weeks after battle within the Crimson Sea disrupted its delivery chain.

BNY Mellon Leads S&P 500 Because of Upper Hobby Charges

1 hr 17 min in the past

Financial institution of New York Mellon Corp. (BK) used to be the best-performing inventory within the S&P 500 Friday afternoon because the financial institution posted better-than-expected effects on account of surging web passion earnings.

BNY Mellon reported fourth-quarter 2024 diluted income according to percentage (EPS) of 33 cents, down 47% in comparison to the similar duration the 12 months earlier than. However the financial institution took some large fees within the quarter. Adjusted EPS, which excludes the have an effect on of the ones bills, used to be $1.28. Income complicated 10% to $4.31 billion. Each exceeded analysts’ forecasts.

The ones changes come with $752 million in bills associated with a different evaluation from govt regulators after the cave in of Silicon Valley and Signature banks, severance, and litigation reserves.

Web passion earnings used to be up 4% to $1.10 billion. Belongings below control (AUM) rose 8% to $2 trillion, taking advantage of each shopper inflows and a inventory marketplace rally towards the tip of 2023.

BNY Mellon stocks have been up 4% past due within the consultation Friday to business at their best stage since ultimate February.

-Invoice McColl

TradingView

Delta Cuts Its 2024 Benefit Forecast on Financial, Provide-Chain Considerations

2 hr 6 min in the past

Delta Air Strains Inc. (DAL) stocks plummeted Friday after the air service reduced its 2024 income steering on issues in regards to the economic system and its delivery chain. The inventory value used to be additionally suffering from a bounce in oil costs as Center East tensions larger.

Delta mentioned it now anticipates 2024 income according to percentage (EPS) of $6 to $7, down from its previous steering of greater than $7. It made $6.25 a percentage ultimate 12 months.

The caution got here as Delta posted fourth-quarter fiscal 2023 benefit and gross sales that exceeded forecasts due to a persevered surge in post-pandemic trip call for. The corporate reported EPS of $1.28, with earnings up 11% to $13.66 billion. Each have been above analysts’ estimates.

Delta’s steering hit different airline shares as exhausting because it hit its personal. United Airways (UAL) used to be down greater than 10% Friday afternoon, whilst American Airways (AAL) misplaced greater than 8% and Southwest Airways (LUV) dropped greater than 4%.

-Invoice McColl

UnitedHealth Weighs on Dow, Well being Insurance coverage Shares

2 hr 48 min in the past

UnitedHealth Crew (UNH) used to be the worst-performing inventory within the Dow Jones Business Moderate Friday after it reported a 16% build up in clinical prices within the fourth quarter.

Hovering prices from clinical claims overshadowed an in a different way certain income document. Income grew 15% to $94.4 billion, whilst web source of revenue climbed just about 16% to $5.68 billion. Each exceeded Wall Side road’s forecasts.

Emerging healthcare prices this 12 months have outpaced UnitedHealth’s earnings from premiums, that are continuously set for a complete 12 months and require approval from regulators to be raised. UnitedHealth’s prices climbed to $62.23 billion within the quarter, contributing to a hospital treatment ratio of 85%. That exceeded the full-year ratio of 83.2%, which itself used to be greater than ultimate 12 months’s ratio of 82%.

UnitedHealth’s effects raised issues amongst traders about different insurance coverage corporations, sparking an industry-wide sell-off. UnitedHealth stocks fell 3.5% Friday, whilst competition Humana (HUM) and Aetna-owner CVS Well being (CVS) fell 3.3% and a pair of.4%, respectively. Elevance Well being (ELV) stocks fell 1.8%.

Wells Fargo Slides After Caution Hobby Source of revenue Most probably To Contract in 2024

3 hr 48 min in the past

Stocks of Wells Fargo & Co. (WFC) have been down nearly 4% Friday after the financial institution warned passion source of revenue may just fall considerably in 2024 as borrowing prices decline.

The corporate anticipates web passion source of revenue will probably be 7% to 9% not up to in 2023 on expectancies the Federal Reserve will reduce charges as inflation eases.

For its 2023 fourth quarter, the corporate reported web source of revenue of $3.45 billion, or 86 cents according to percentage. Except for one-time pieces, income have been $1.26 according to percentage, greater than forecasts, in line with London Inventory Change Crew estimates.

Regardless of Friday’s noon loss, stocks of Wells Fargo stay nearly 15% greater over the last 12 months.

-Invoice McColl

TradingView

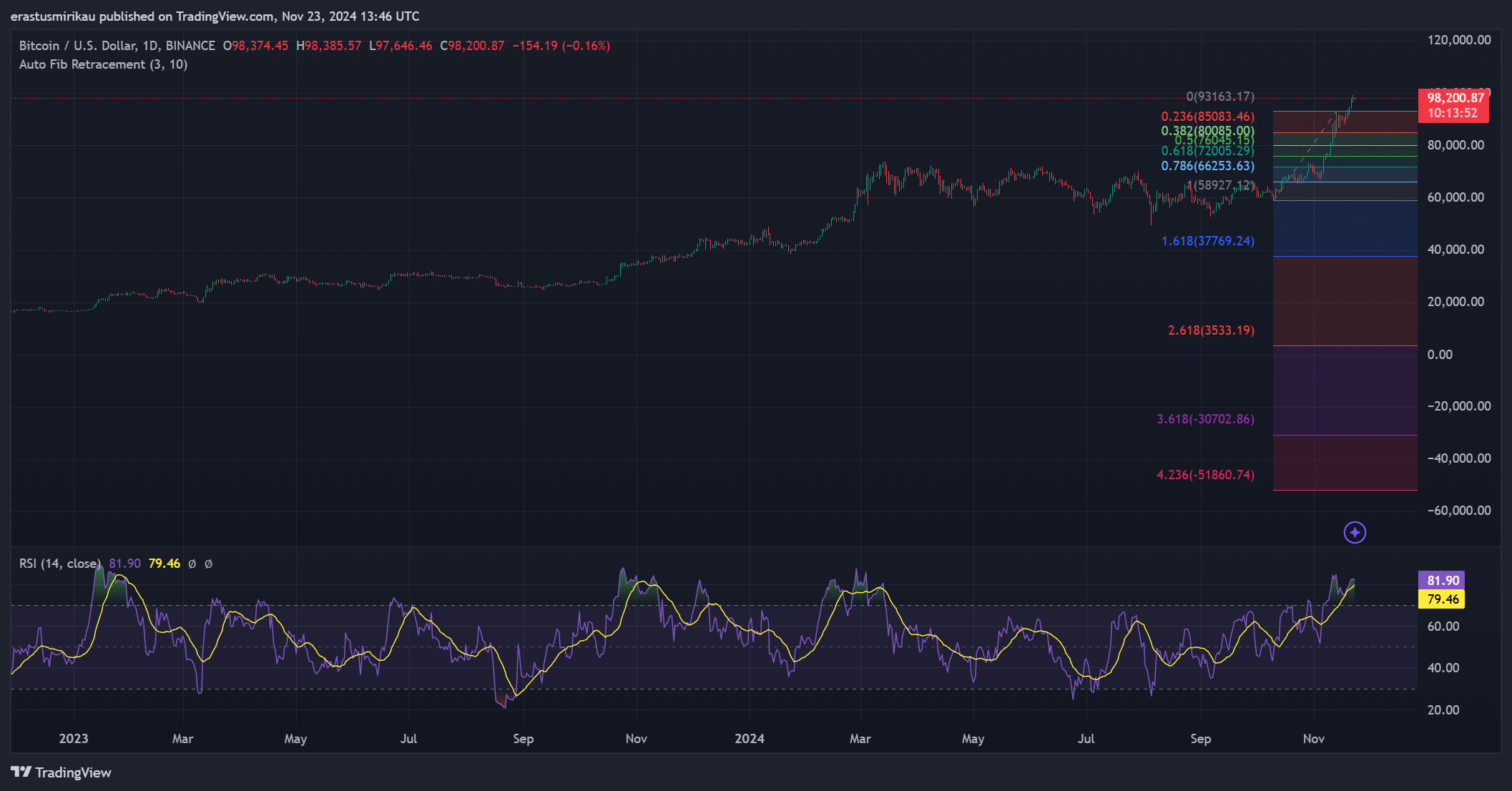

Bitcoin Slumps, Giving Up ETF Approval Good points

4 hr 34 min in the past

The cost of Bitcoin plummeted to lower than $44,000 Friday, hanging the arena’s most beneficial cryptocurrency about the place it used to be at the beginning of the week earlier than it surged within the days main as much as the day gone by’s debut of a number of spot Bitcoin ETFs.

Greater than $4.6 billion price of Bitcoin ETF stocks modified arms the day gone by, with Grayscale’s Bitcoin Consider (GBTC) accounting for greater than part of the process. BlackRock and Constancy’s choices noticed $1 billion and $700 million price of transactions, respectively.

Alternatively, no longer everybody who desires to shop for in can. Some brokerages—Leading edge, for instance—have selected not to be offering Bitcoin ETF buying and selling.

“Our point of view is that those merchandise don’t align with our be offering all for asset categories reminiscent of equities, bonds, and money, which Leading edge perspectives because the construction blocks of a well-balanced, long-term funding portfolio,” the brokerage instructed Investopedia.

In the meantime, Ethereum, the second one biggest cryptocurrency via marketplace cap, in short rose above $2,700 Friday morning after BlackRock CEO Larry Fink instructed CNBC he “sees price” in an ether ETF. That is regarded as via some to be the following large hurdle for crypto in its push to realize mainstream acceptance.

Tesla Stocks Sink as Crimson Sea Preventing Forces Manufacturing Pause in Germany

5 hr 28 min in the past

Stocks of Tesla (TSLA) fell greater than 2% after the electrical car maker mentioned it might pause manufacturing at its biggest Eu manufacturing unit for 2 weeks on account of delivery delays brought about via unrest within the Center East.

The corporate plans to halt manufacturing at its Gigafactory Berlin-Brandenburg between Jan. 29 and Feb. 12 after portions deliveries have been not on time via assaults on Crimson Sea delivery lanes via Yemen-based Houthi militants.

The pause amplifies issues that Israel’s struggle in Gaza and army responses via its Center East neighbors may just spark a Eu supply-chain disaster.

Iran-backed Houthis started attacking business ships within the Crimson Sea past due ultimate 12 months, main main delivery corporations to reroute Europe-bound site visitors round Africa. The U.S. and a coalition of allies have answered via intercepting Houthi drones and missiles and bombing army installations in Yemen.

JPMorgan Stocks Upward thrust on This autumn Profits Beat

6 hr 3 min in the past

JPMorgan Chase & Co.’s (JPM) stocks rose Friday morning after reporting report web passion source of revenue within the fourth quarter, taking the brink off an income leave out because of an FDIC particular evaluation.

JPMorgan income via the numbers:

Web earnings: $39.9 billion vs. $40.39 billion anticipated, in line with analyst estimates compiled via Visual AlphaEarnings according to percentage: $3.04 vs. $3.43 expectedNet source of revenue: $9.3 billion vs. $10.64 billion anticipated

A $2.9 billion particular evaluation from the Federal Deposit Insurance coverage Company (FDIC) shaved 74 cents according to percentage from the financial institution’s benefit.

The financial institution’s web passion source of revenue (NII) were given a spice up from the Federal Reserve’s anti-inflation rate of interest hike marketing campaign. Within the fourth quarter, JPMorgan posted NII of $24.1 billion, up 19% in comparison to the year-ago duration and above the $22.98 billion analysts anticipated.

-Mrinalini Krishna

UnitedHealth Stocks Tumble on Emerging Scientific Prices

6 hr 39 min in the past

UnitedHealth Crew’s (UNH) stocks dropped kind of 3% in early buying and selling in spite of reporting better-than-expected earnings and benefit within the fourth quarter as higher-than-expected claims prices spooked traders.

UnitedHealth income via the numbers:

Income: $94.4 billion vs. $92.1 billion anticipated, in line with analyst estimates compiled via Visual AlphaAdjusted income according to percentage: $6.16 vs. $5.78 anticipated

Scientific loss ratio, or the share of premiums the corporate can pay out to hide claims, is a key indicator of profitability for an organization like UnitedHealth. The upper the clinical loss ratio, the fewer room the corporate has to make a benefit.

Within the fourth quarter, the corporate’s clinical loss ratio larger to 85%, greater than analysts anticipated.

-Mrinalini Krishna

Shares Making the Greatest Strikes Premarket

7 hr 39 min in the past

Good points:

Oil tankers: Stocks of oil delivery corporations and oil futures jumped after the U.S. led airstrikes towards Yemen-based Houthi militants who’ve been focused on delivery lanes within the Crimson Sea for weeks in protest of Israel’s bombardment of Gaza.

JPMorgan Chase (JPM): The financial institution’s stocks rose about 2% after its quarterly income crowned estimates because it reported a 7th consecutive quarter of report web passion source of revenue.

Citigroup (C): Stocks of the financial institution additionally rose 1.5% after reporting a web lack of $1.8 billion because of a number of one-time fees. CEO Jane Fraser expressed self assurance that her restructuring plan will make 2024 a turning level for the financial institution.

Losses:

Delta Airways (DAL): Stocks fell greater than 5% after the corporate’s fourth-quarter income beat analyst estimates however its full-year benefit forecast fell in need of prior steering.

UnitedHealth Crew (UNH): Stocks fell greater than 4% after the well being insurer mentioned clinical prices jumped 16% year-over-year within the fourth quarter.

Tesla Inc. (TSLA): Stocks slid about 3% after the EV maker mentioned it might pause manufacturing at its Berlin manufacturing unit for 2 weeks as assaults on delivery within the Crimson Sea have not on time portions shipments.

Inventory Futures Dip Forward of PPI

8 hr 34 min in the past

Futures contracts hooked up to the Dow Jones Business Moderate have been down about 0.4% in early buying and selling Friday.

S&P 500 futures have been off about 0.3%.

Nasdaq 100 futures additionally slipped 0.3%.

:max_bytes(150000):strip_icc()/GettyImages-1918185892-7d97c661f9964d1fa890eb8181a6d6f9.jpg)