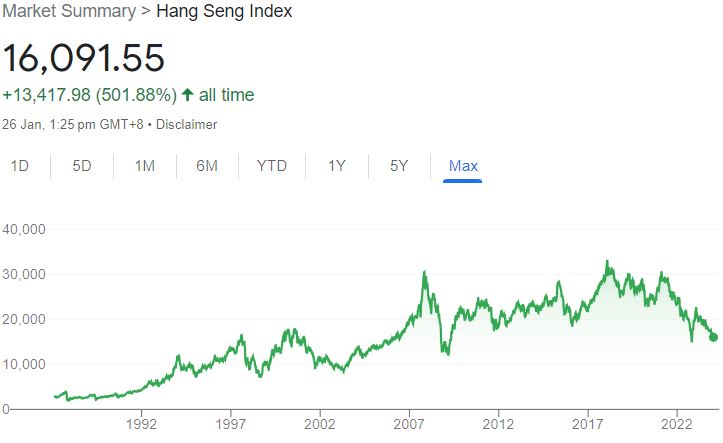

Taipei, Taiwan – Accountant Edelweiss Lam, like many in Hong Kong, witnessed the city’s stock market erase 14 months of gains as the Hang Seng Index dropped below 15,000 points.

This was not the first time Lam, who has been investing in Hong Kong stocks since the late 1990s, had witnessed such a decline. The index had also dipped during SARS in 2003, the Global Financial Crisis in 2008, and zero-COVID lockdowns in 2022.

However, Lam felt that this time, it was different. “It seems I cannot see the future,” Lam said.

According to Lam, this drastic change is due to China’s increased control over Hong Kong’s economy and the ongoing concerns about China’s post-pandemic recovery.

More than 25 years after Hong Kong’s return to China, the Hang Seng is back to its level during the final days as a British colony.

Meanwhile, US, Japanese, and other popular markets have flourished, with the S&P 500 growing nearly tenfold since 1997.

Hong Kong’s stock market has seen big losses over the last year [Al Jazeera]“If there’s any new announcement from the Chinese government about regulations or the control of some industry, then the market can fluctuate very seriously,” said Lam.

Hong Kong has observed China’s crackdowns, including the imposition of a national security law, tighter regulation of corporate giants, and raids on foreign companies on the Chinese mainland.

Furthermore, China’s economy is struggling to recover from the impact of COVID-19 and the government’s strict pandemic restrictions, while facing long-standing issues such as a shrinking population, high local government debt, and a slow-moving real estate crisis.

China’s CSI 300 Index has fallen over 40 percent in the past three years, and the Hang Seng has dropped by 50 percent over the same period.

Investors are turning to other markets like Japan and the US, where a positive outlook for 2024 is predicted.

Investor confidence in Hong Kong has taken a hit amid China’s crackdowns [File: Anthony Kwan/Getty Images]“[Hong Kong’s] economy may now be no more than a large rounding error on China’s GDP but it still plays an important role in finance and capital market transactions for and with the Mainland. So it’s self-evident that bearish sentiment and beaten up stock price valuations in China proper wash over into [Hong Kong] too,” said George Magnus, an associate at Oxford University’s China Centre and Research Associate at SOAS, London.

Additionally, the decline in rights and freedoms in Hong Kong since the passage of the national security law has fueled the crisis of confidence, resulting in a significant exodus of people and their investments from the city.

Analysts suggest that restoring both Hong Kong and China’s economy will require substantial reforms.

Beijing’s potential $278bn rescue plan for the stock market has received a lukewarm response, with many analysts arguing that broader structural reforms are needed to restore investor confidence.

The memories of a similar rescue plan deployed in 2015 and concerns about Beijing’s willingness to make necessary reforms have contributed to the cautious response to the current rescue plan.

Analysts have pointed out that Beijing has fewer options this time due to high levels of debt and limited scope of monetary easing.

In Hong Kong, Decades of Economic Growth Vanish Amid China’s Control