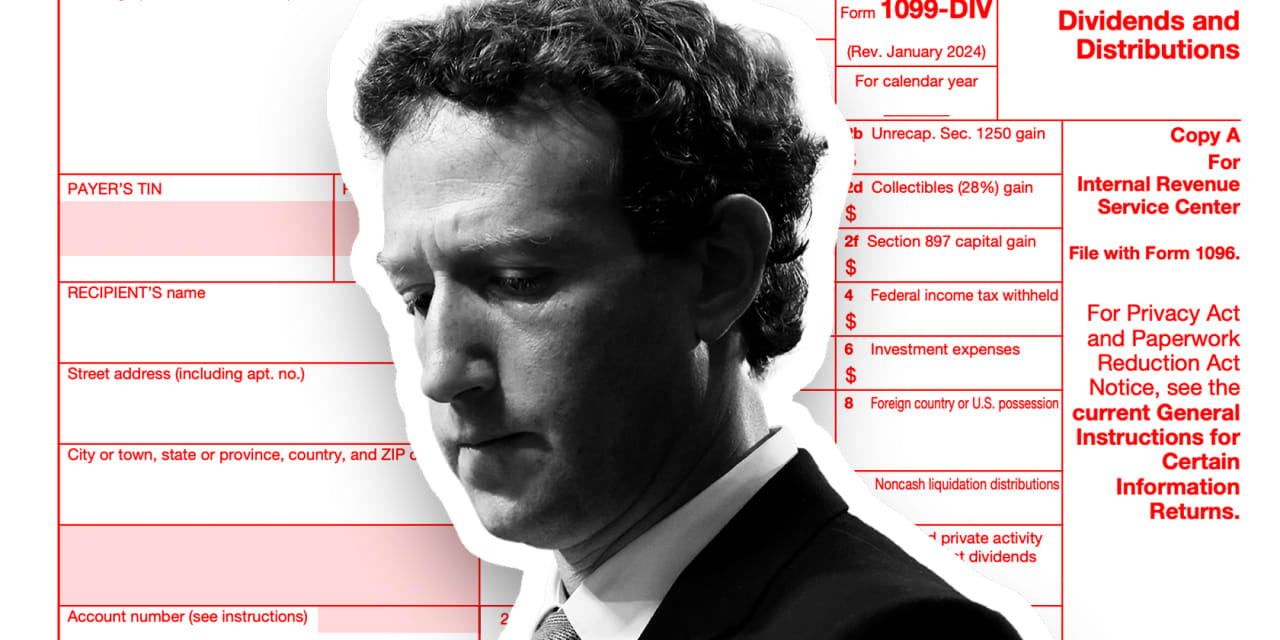

Mark Zuckerberg pleased Meta shareholders and Wall Street by announcing the social media giant’s first-ever dividend. The IRS may also benefit as it anticipates millions in taxes on the Meta stock dividends set for Zuckerberg’s portfolio. Zuckerberg, the CEO of Meta Platforms Inc, could potentially earn $700 million in dividends annually. According to FactSet, he owns nearly 350 million shares, and the company will start paying a quarterly dividend of 50 cents a share. This would result in nearly $167 million in federal taxes yearly, after a 20% qualified-dividend tax and an additional 3.8% tax on the investment returns of rich households, as stated by two accounting experts. In addition, California income taxes of 13.3% on the dividends could cost Zuckerberg another $93.1 million, estimated by Andrew Belnap, an accounting professor at the University of Texas at Austin’s McCombs School of Business. Altogether, the federal and state taxes on the Meta dividends could amount to $259.7 million annually.

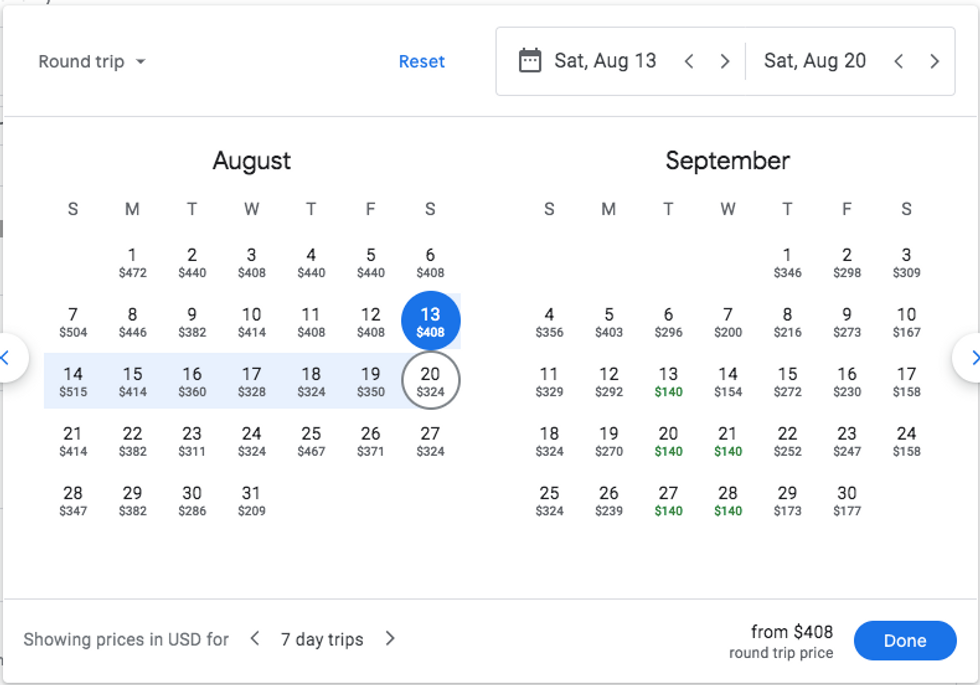

For context, U.S. taxpayers reported over $285 billion in qualified-dividend income to the IRS through mid-November 2023, with almost 30 million tax returns reporting qualified dividends during that time. Meta announced plans for a quarterly cash dividend going forward, with the first payment scheduled for March. On Friday, Meta shares soared 20.5%, closing at a record-high of $474.99. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all closed higher on Friday.

‘Zuck is getting a major break’ Meta’s announcement of the dividend payment coincided with the week when Americans began filing their income taxes. A glance at Zuckerberg’s dividends and their tax implications offers insight into the debate about the different ways wages and wealth are taxed. “Zuck is getting a major break,” remarked Andrew Schmidt, an accounting professor at North Carolina State University’s Poole School of Management. Schmidt estimated that if Zuckerberg received the $700 million as a straight salary, he would face a roughly $259 million tax bill at the top marginal rate of 37%.

Federal income tax brackets range from 10% to 37%, while the IRS taxes qualified dividends and capital gains at 0%, 15% and 20%, based on income and household status. The net investment income tax adds another 3.8% for individuals making at least $200,000 or married couples worth $250,000. For federal and state taxes on the Meta dividends, Zuckerberg would face a combined rate of 37.1%. “His tax rate on this is actually fairly high,” noted Belnap. The disparity in tax rates on income derived from wages and investments has been a significant criticism of U.S. tax policy, especially as lawmakers seek ways to generate more tax revenue.

Regular retail investors benefit from the same preferential rates on capital gains and dividends as the top 1% of taxpayers. However, the issue lies in the fact that those dividends and stock profits constitute a smaller part of their income while salaries, taxed at higher rates, represent a larger proportion. Belnap pointed out that California’s state tax rules don’t provide special treatment to dividends. Zuckerberg received a $1 base salary in 2022, a figure that has remained unchanged for several years. According to the Bloomberg Billionaires Index, he is currently worth $142 billion, making him the fifth-richest person in the world. Meta did not immediately respond to a request for comment. Taxes on the Meta dividends will not be a concern for Zuckerberg or any Meta shareholders, big or small, until next year’s tax season, as observed by Belnap and Schmidt.

As taxpayers gather their 1099-DIV forms on dividend income, IRS figures show that it’s mostly high-income taxpayers benefiting from the preferential rates for qualified dividends. Households worth at least $1 million accounted for 40% of the approximate $285.3 billion in qualified dividends reported through mid-November, according to agency figures. For less affluent investors, “it’s usually a nice supplement, but I’d say very few people are living off dividends,” said Belnap.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25752946/1183652392.jpg)