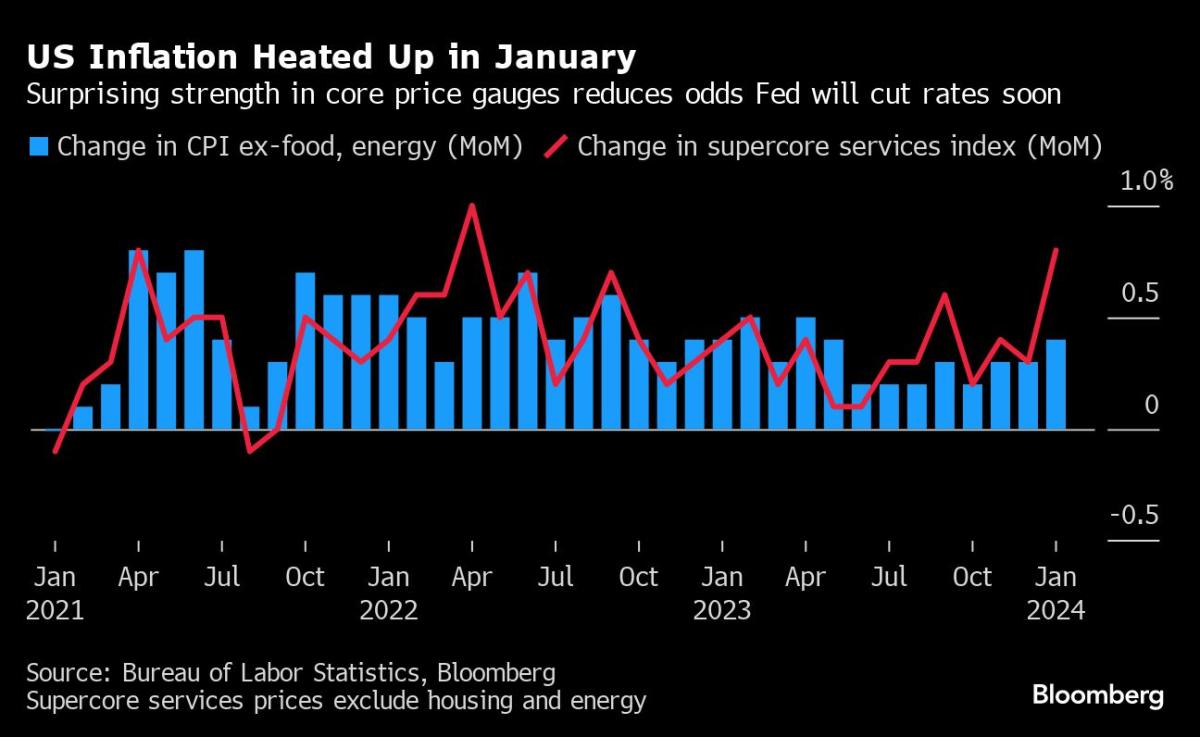

(Bloomberg) — US fairness futures signaled a rebound from Tuesday’s Wall Side road stoop precipitated via hotter-than-expected US inflation information that fueled bets the Federal Reserve would possibly not reduce rates of interest once anticipated.Maximum Learn from BloombergContracts at the S&P 500 climbed 0.5% after the worst inflation-day drop for the index since September 2022. Benchmark Treasury yields retraced a few of yesterday’s surge, however held close to the 4.3% mark, as investors trimmed bets for an early Fed price reduce.Coming quickly: Join Hong Kong Version to get an insider’s information to the cash and other people shaking up the Asian finance hub.The American CPI information got here as a sadness for traders pushing US shares to a document, and Eu friends to simply in need of one, on mounting hopes for coming near near price cuts. Fed swaps shifted complete pricing of a price reduce to July from June after the knowledge and international bonds erased the closing remnants of a rally that began in December.The setback did little to discourage traders driving bets on an eventual Fed pivot to more uncomplicated coverage. BlackRock Inc. portfolio supervisor Russ Koesterich sees the setback as transient, with possible for additional upside to US shares of 6-8% this yr and most likely 4 price cuts nonetheless within the offing.“In spite of the day before today’s motion within the inventory put it on the market’s most likely going to to be a good yr for US equities,” Koesterich stated in an interview with Bloomberg TV. “There’s explanation why to stick lengthy equities. I don’t suppose the narrative adjustments. We nonetheless suppose that the Fed will start chopping overdue this spring or in the summertime. We nonetheless suppose 3, possibly 4, cuts are most probably.”There used to be higher information Wednesday for UK investors taking a look ahead to coverage easing via the Financial institution of England. Inflation in Britain got here in not up to forecast in January, with underlying worth pressures now not emerging up to markets and the BOE feared. The pound reversed previous features after the knowledge, whilst UK bonds rallied. The inflation information precipitated a repricing in BOE price bets, with investors resuming wagers on 3 quarter-point discounts this yr.Tale continuesOil steadied after a combined US stock record, whilst OPEC and the IEA presented contrasting outlooks for the worldwide crude marketplace. Gold used to be locked in a slim vary after plunging beneath $2,000 an oz. for the primary time in two months whilst Bitcoin traded close to the $50,000 mark.Concentrate to the Giant Take podcast on iHeart , Apple Podcasts , Spotify and the Bloomberg Terminal. Learn the transcript right here.Company HighlightsLyft Inc. received in premarket buying and selling on Wednesday, even after the ride-sharing corporate corrected its outlook for profits margin in 2024, a typo that to start with helped ship the fill up up to 67% in after-market buying and selling on Tuesday.ASML Keeping NV stated the semiconductor marketplace has reached its nadir and there are actually are indicators of a rebound.Vizio slid in US premarket buying and selling, ceding a few of yesterday’s 25% surge precipitated via a Wall Side road Magazine record that Walmart is in talks to shop for the TV maker for greater than $2 billion.Heineken NV stocks slumped after the sector’s second-biggest brewer warned that chronic inflation and financial worries will weigh on beer call for in 2024.ABN Amro Financial institution NV rallied after it unveiled a contemporary percentage buyback with the Dutch state collaborating, as a part of its deliberate promote down within the lender.Robinhood stocks jumped in premarket buying and selling after the web brokerage company reported fourth-quarter internet income that beat estimates.Airbnb Inc. stocks declined after the home-rental corporate reported its fourth-quarter effects.Key Occasions this Week:BOE Governor Andrew Bailey testifies to Area of Lords financial affairs panel, WednesdayChicago Fed President Austan Goolsbee speaks, WednesdayFed Vice Chair for Supervision Michael Barr speaks, WednesdayJapan GDP, business manufacturing, ThursdayUS Empire production, preliminary jobless claims, business manufacturing, retail gross sales, trade inventories, ThursdayECB President Christine Lagarde speaks, ThursdayAtlanta Fed President Raphael Bostic speaks, ThursdayFed Governor Christopher Waller speaks, ThursdayECB leader economist Philip Lane speaks, ThursdayUS housing begins, PPI, College of Michigan client sentiment, FridaySan Francisco Fed President Mary Daly speaks, FridayFed Vice Chair for Supervision Michael Barr speaks, FridayECB government board member Isabel Schnabel speaks, FridaySome of the primary strikes in markets:StocksS&P 500 futures rose 0.5% as of 8 a.m. New York timeNasdaq 100 futures rose 0.6p.cFutures at the Dow Jones Business Moderate rose 0.2p.cThe Stoxx Europe 600 rose 0.5p.cThe MSCI Global index used to be little changedCurrenciesThe Bloomberg Buck Spot Index used to be little changedThe euro used to be little modified at $1.0708The British pound fell 0.3% to $1.2558The Eastern yen rose 0.1% to 150.60 in line with dollarCryptocurrenciesBitcoin rose 4% to $51,563.08Ether rose 4% to $2,739.28BondsThe yield on 10-year Treasuries declined one foundation level to 4.30p.cGermany’s 10-year yield declined two foundation issues to two.37p.cBritain’s 10-year yield declined seven foundation issues to 4.08p.cCommoditiesWest Texas Intermediate crude rose 0.1% to $77.98 a barrelSpot gold fell 0.1% to $1,990.29 an ounceThis tale used to be produced with the help of Bloomberg Automation.–With the aid of Winnie Hsu and Garfield Reynolds.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Shares, Bonds Reclaim Cast Floor After CPI Pass over: Markets Wrap