Hedge fund supervisor Cathie Wooden is capitalizing at the Nvidia (NASDAQ:NVDA) inventory rally. She continues to promote NVDA stocks, forward of This fall income, the Wall Boulevard Magazine reported. Particularly, Nvidia inventory has received just about 47% year-to-date. Additional, it’s up about 252% in twelve months. The chip large will announce its fourth quarter Fiscal 2024 monetary effects on February 21.

Chatting with the Magazine, Wooden mentioned Nvidia is the chief within the synthetic intelligence (AI) house. Then again, she believes NVDA is a cyclical inventory and expects larger pageant and stock correction to pose demanding situations. Wooden showed that she not too long ago bought Nvidia inventory price about $4.5 million.

Nvidia Inventory: Analysts’ Higher Value Objectives

Whilst Wooden sells NVDA stocks, analysts are upbeat about its possibilities, with a number of analysts expanding the cost goal and keeping up a bullish stance.

On February 16, analysts from Wedbush larger the cost goal to $800 from $600. Additional, Wells Fargo raised the cost goal to $840 from $675. On the identical time, Oppenheimer upped the cost goal to $850 from $650. Those analysts be expecting NVDA to ship cast income and be offering a promising outlook for the entire yr.

Nvidia – This fall Consensus Estimate

Analysts be expecting Nvidia to ship income of $20.37 billion, marking a considerable building up from the $6.05 billion reported within the prior-year quarter. The robust momentum within the Information Heart industry, led by way of call for for AI computing, will enhance the corporate’s top-line expansion.

The numerous building up in gross sales will most probably cushion its base line within the fourth quarter. Wall Boulevard expects NVDA to document income of $4.59 according to proportion in This fall, in comparison to $0.88 within the prior-year quarter.

Is Nvidia Inventory a Purchase, Promote, or Cling?

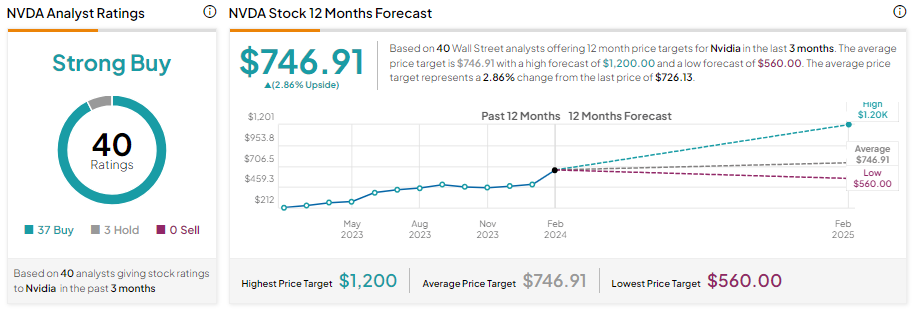

Nvidia inventory has a Robust Purchase consensus ranking in line with 37 Purchase and 3 Cling suggestions. Then again, because of the numerous rally in its stocks, analysts’ reasonable value goal of $746.91 implies 2.86% upside possible from present ranges.

Disclosure

/cdn.vox-cdn.com/uploads/chorus_asset/file/23954043/VRG_Illo_STK427_Podcasting_playbars.jpg)