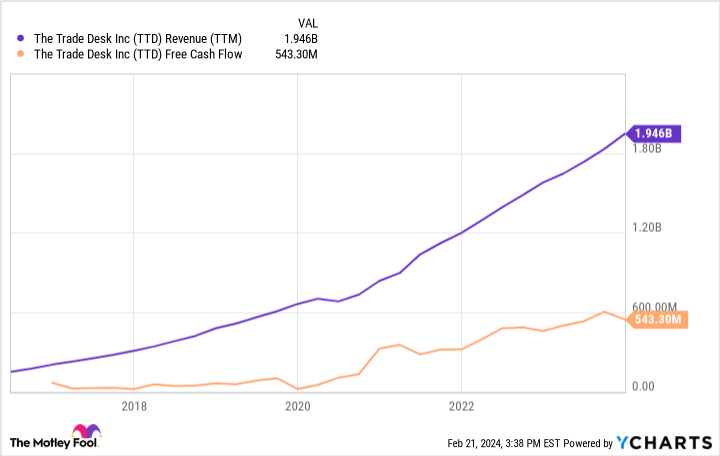

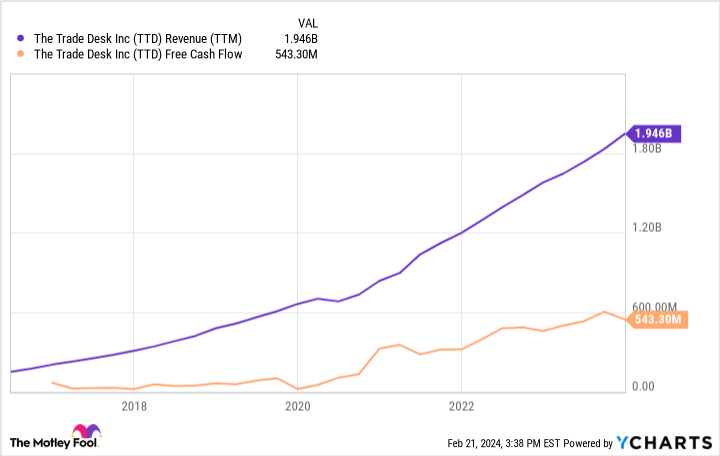

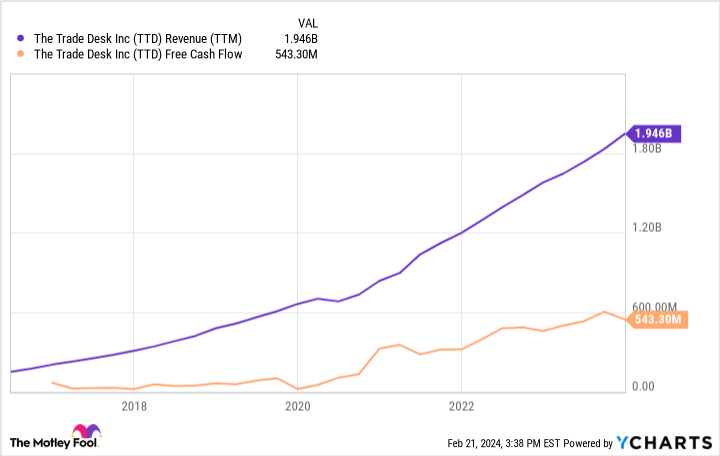

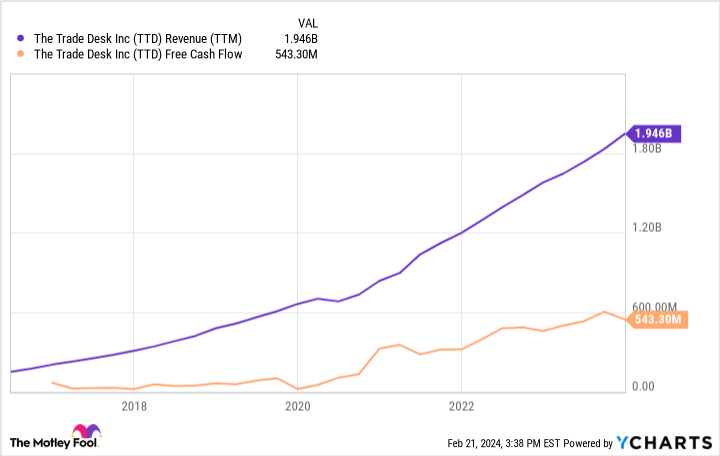

Undoubtedly, many manmade intelligence (AI) buyers are kicking themselves for lacking out on Nvidia’s large positive factors. With the replenish 280% within the final yr and over 1,800% in 5 years, it is without doubt one of the primary beneficiaries within the AI house.Nevertheless, Nvidia isn’t the one AI inventory within the chip trade, and AI is so a lot more than semiconductors. With the breadth of AI making an investment choices, the trade must proceed to carry alternative. 3 Idiot.com individuals have concepts on the place AI buyers can glance subsequent: Amazon (NASDAQ: AMZN), The Industry Table (NASDAQ: TTD), and Tesla (NASDAQ: TSLA).Amazon has some ways to win in the case of AIJake Lerch (Amazon): There are warmer AI shares available in the market, however Amazon stays one price gazing, and purchasing. This is why:First, the corporate is the most important cloud products and services supplier. Amazon Internet Products and services (AWS) is estimated to have about 31% of the global cloud products and services marketplace. That is necessary as a result of new generative AI gear and packages ceaselessly make the most of cloud products and services like AWS. Because the AI revolution rolls on, Amazon is poised to learn due to its lead within the cloud infrastructure marketplace.2nd, Amazon’s large e-commerce industry dovetails well with many alternative AI packages. As an example, the corporate has already presented Rufus, a brand new AI-powered buying groceries assistant designed to assist other folks by way of answering questions, making pricing comparisons, and producing product suggestions. As well as, Amazon is the use of AI in lots of different spaces of its operations, akin to:Streamlining prescription drug supply time and value thru Amazon Pharmacy.Reducing the corporate’s environmental affect thru AI-generated suggestions to scale back packaging use.Bettering buying groceries suggestions by the use of Amazon Model.Updating Alexa-enabled units to strengthen dialog and discussion between customers and Alexa.On best of all of that, Amazon stays some of the international’s best-run firms. Stocks are up 73% during the last three hundred and sixty five days, whilst income expansion has bounced again to a cast 13%.Tale continuesIn brief, Amazon stays a sensible selection for AI-focused buyers.The Industry Table advantages from AI and virtual promoting tailwindsJustin Pope (The Industry Table): Synthetic intelligence is a sizzling matter as of late, however it all started disrupting the promoting industry a number of years again when The Industry Table used to be in its infancy. Manufacturers and different firms should purchase promoting on The Industry Table’s platform, which makes use of AI and consumer information to compare advertisements to attainable consumers. That is way more efficient than conventional promoting, which might broadcast to huge audiences on tv, radio, or in print.The Industry Table has thrived, rising profitably since its 2016 preliminary public providing. The explanation? The Industry Table sits in an excellent spot within the trade. Promoting greenbacks are transferring to virtual mediums and whilst competition like Meta Platforms and Alphabet function with restricted transparency, The Industry Table gives additional information to its purchasers, and that’s successful over consumers.

TTD Earnings (TTM) ChartTotal international advert spending in 2023 used to be an estimated $830 billion, because of this that The Industry Table’s $9.6 billion in gross advert spending interprets to only over 1% of marketplace proportion. That leaves an amazing expansion runway for this corporate running outdoor the closed ecosystems of huge generation firms.The Industry Table’s long-term expansion alternatives and successful industry fashion make the inventory a no brainer AI funding you’ll grasp for the longer term.Tesla most likely has some AI-driven surprises below the hoodWill Healy (Tesla): Buyers would possibly generally tend to have a look at Tesla as an automaker, however it is if truth be told a various industry additionally growing battery generation, solar power answers, and AI breakthroughs.As a substitute of depending on chip firms like Nvidia for its generation, Tesla has evolved its personal semiconductor and robotics answers. Amongst those are the Dojo chip, designed to energy neural networks, and the FSD (complete self-driving) chip, which might energy absolutely self sufficient automobiles.CEO Elon Musk needs to release a robotaxi industry in line with Tesla generation. With robotaxis, analysts at Cathie Wooden’s Ark Make investments imagine Tesla’s income may succeed in no less than $600 billion by way of 2027, over seven occasions the 2023 stage of $82 billion.Wooden believes that expansion would take Tesla’s inventory worth to $2,000 in keeping with proportion, a greater than tenfold acquire from as of late’s ranges.Whilst that can appear outrageous, and Musk has a monitor document of being overly formidable in his guarantees, Wooden predicted a split-adjusted worth goal of $267 in keeping with Tesla proportion in 2018. Inside of lower than 3 years, Wooden’s prediction got here to go, so she might be proper once more.Tesla’s inventory worth has pulled again as Tesla has minimize costs on electrical automobiles (EVs) to spice up gross sales and keep aggressive with rising competitors. That pessimism has taken its P/E ratio all the way down to 45, a low valuation hardly noticed within the inventory’s historical past.Even if income are anticipated to fall 1% this yr, analysts are expecting a 36% building up in 2025. Those profits forecasts give some validation to Wooden’s thesis. A few of that optimism is also associated with the discharge of the lower-cost, compact Type 2 EV anticipated for 2025, and buyers also are prone to bounce in as the corporate improves its AI and self-driving features.Will have to you make investments $1,000 in Amazon presently?Before you purchase inventory in Amazon, believe this:The Motley Idiot Inventory Marketing consultant analyst staff simply known what they imagine are the 10 excellent shares for buyers to shop for now… and Amazon wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.Inventory Marketing consultant supplies buyers with an easy-to-follow blueprint for good fortune, together with steering on construction a portfolio, common updates from analysts, and two new inventory alternatives each and every month. The Inventory Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Marketing consultant returns as of February 20, 2024Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, Nvidia, and Tesla. Justin Pope has no place in any of the shares discussed. Will Healy has positions in The Industry Table. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, Tesla, and The Industry Table. The Motley Idiot has a disclosure coverage.Ignored Out on Nvidia? Purchase Those Synthetic Intelligence (AI) Shares As a substitute. used to be at first revealed by way of The Motley Idiot

TTD Earnings (TTM) ChartTotal international advert spending in 2023 used to be an estimated $830 billion, because of this that The Industry Table’s $9.6 billion in gross advert spending interprets to only over 1% of marketplace proportion. That leaves an amazing expansion runway for this corporate running outdoor the closed ecosystems of huge generation firms.The Industry Table’s long-term expansion alternatives and successful industry fashion make the inventory a no brainer AI funding you’ll grasp for the longer term.Tesla most likely has some AI-driven surprises below the hoodWill Healy (Tesla): Buyers would possibly generally tend to have a look at Tesla as an automaker, however it is if truth be told a various industry additionally growing battery generation, solar power answers, and AI breakthroughs.As a substitute of depending on chip firms like Nvidia for its generation, Tesla has evolved its personal semiconductor and robotics answers. Amongst those are the Dojo chip, designed to energy neural networks, and the FSD (complete self-driving) chip, which might energy absolutely self sufficient automobiles.CEO Elon Musk needs to release a robotaxi industry in line with Tesla generation. With robotaxis, analysts at Cathie Wooden’s Ark Make investments imagine Tesla’s income may succeed in no less than $600 billion by way of 2027, over seven occasions the 2023 stage of $82 billion.Wooden believes that expansion would take Tesla’s inventory worth to $2,000 in keeping with proportion, a greater than tenfold acquire from as of late’s ranges.Whilst that can appear outrageous, and Musk has a monitor document of being overly formidable in his guarantees, Wooden predicted a split-adjusted worth goal of $267 in keeping with Tesla proportion in 2018. Inside of lower than 3 years, Wooden’s prediction got here to go, so she might be proper once more.Tesla’s inventory worth has pulled again as Tesla has minimize costs on electrical automobiles (EVs) to spice up gross sales and keep aggressive with rising competitors. That pessimism has taken its P/E ratio all the way down to 45, a low valuation hardly noticed within the inventory’s historical past.Even if income are anticipated to fall 1% this yr, analysts are expecting a 36% building up in 2025. Those profits forecasts give some validation to Wooden’s thesis. A few of that optimism is also associated with the discharge of the lower-cost, compact Type 2 EV anticipated for 2025, and buyers also are prone to bounce in as the corporate improves its AI and self-driving features.Will have to you make investments $1,000 in Amazon presently?Before you purchase inventory in Amazon, believe this:The Motley Idiot Inventory Marketing consultant analyst staff simply known what they imagine are the 10 excellent shares for buyers to shop for now… and Amazon wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.Inventory Marketing consultant supplies buyers with an easy-to-follow blueprint for good fortune, together with steering on construction a portfolio, common updates from analysts, and two new inventory alternatives each and every month. The Inventory Marketing consultant provider has greater than tripled the go back of S&P 500 since 2002*.See the ten shares*Inventory Marketing consultant returns as of February 20, 2024Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Jake Lerch has positions in Alphabet, Amazon, Nvidia, and Tesla. Justin Pope has no place in any of the shares discussed. Will Healy has positions in The Industry Table. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Nvidia, Tesla, and The Industry Table. The Motley Idiot has a disclosure coverage.Ignored Out on Nvidia? Purchase Those Synthetic Intelligence (AI) Shares As a substitute. used to be at first revealed by way of The Motley Idiot