US shares popped on Wednesday, with techs vaulting again from a steep sell-off as buyers digested Federal Reserve Chair Jerome Powell’s stance that rate of interest cuts are nonetheless most probably this 12 months.The tech-heavy Nasdaq Composite (^IXIC) jumped about 0.8% after techs led a pointy slide in shares extra widely on Tuesday. The S&P 500 (^GSPC) additionally added 0.8%, whilst the Dow Jones Business Reasonable (^DJI) popped 0.6%, as each indexes got here off losses of greater than 1%.Powell’s testimony to Congress later would possibly supply a catalyst for shares, that have logged two days of losses as a battering for “Magnificent Seven” stalwarts Apple (AAPL) and Tesla (TSLA) fueled bubble fears.Traders will pay attention intently for any deviation through Powell from Fed policymakers’ much-repeated message that there is no rush to chop rates of interest. Powell informed lawmakers that charge cuts usually are warranted “someday” in 2024. Traders will search for extra readability in this factor as Powell fields questions from lawmakers over the following two days.”If the financial system evolves widely as anticipated, it’ll most probably be suitable to start dialing again coverage restraint someday this 12 months,” Powell mentioned to the Space Monetary Services and products Committee.In person shares, CrowdStrike (CRWD) stocks persisted their post-earnings rally, up over 12% after the cybersecurity corporate’s outlook signaled wholesome call for within the sector.Live8 updates Wed, March 6, 2024 at 10:38 AM PSTNew York Group Financial institution plunges amid file of tried capital raiseNew York Group Financial institution (NYCB) has tumbled once more on Wednesday and been halted from time to time right through the buying and selling consultation.Yahoo Finance’s David Hollerith experiences:The inventory of New York Group Financial institution plunged following a file that it is looking for to lift capital, highlighting the numerous demanding situations going through the economic actual property lender because it struggles to regain investor self belief.The cost of its inventory fell up to 45% after the Wall Side road Magazine reported that NYCB had dispatched bankers to search out buyers prepared to shop for inventory within the corporate. It’s now down greater than 80% since January.NYCB’s inventory first started falling on Jan. 31 when it shocked analysts through slashing its dividend and environment apart extra for mortgage losses.The turmoil intensified once more closing week after it disclosed the go out of CEO Thomas Cangemi, weaknesses in its inside controls, and a tenfold build up in its fourth quarter loss to $2.7 billion.The Hicksville, N.Y.-based lender now has 3 choices, consistent with Chris Marinac, an analyst for Janney who covers the financial institution.It may possibly promote property, elevate capital or proportion the chance of a few property with out of doors buyers by way of a monetary device referred to as a credit score chance switch.

Wed, March 6, 2024 at 10:38 AM PSTNew York Group Financial institution plunges amid file of tried capital raiseNew York Group Financial institution (NYCB) has tumbled once more on Wednesday and been halted from time to time right through the buying and selling consultation.Yahoo Finance’s David Hollerith experiences:The inventory of New York Group Financial institution plunged following a file that it is looking for to lift capital, highlighting the numerous demanding situations going through the economic actual property lender because it struggles to regain investor self belief.The cost of its inventory fell up to 45% after the Wall Side road Magazine reported that NYCB had dispatched bankers to search out buyers prepared to shop for inventory within the corporate. It’s now down greater than 80% since January.NYCB’s inventory first started falling on Jan. 31 when it shocked analysts through slashing its dividend and environment apart extra for mortgage losses.The turmoil intensified once more closing week after it disclosed the go out of CEO Thomas Cangemi, weaknesses in its inside controls, and a tenfold build up in its fourth quarter loss to $2.7 billion.The Hicksville, N.Y.-based lender now has 3 choices, consistent with Chris Marinac, an analyst for Janney who covers the financial institution.It may possibly promote property, elevate capital or proportion the chance of a few property with out of doors buyers by way of a monetary device referred to as a credit score chance switch. Wed, March 6, 2024 at 10:21 AM PSTAll 11 sectors are within the greenAfter a down day on Tuesday, tech is main Wednesday’s rebound.The Data Era (XLK) sector is up greater than 1.3% at the day main the sphere motion. Significantly, all 11 sectors are within the inexperienced with Utilities (XLU) additionally up greater than 1%.

Wed, March 6, 2024 at 10:21 AM PSTAll 11 sectors are within the greenAfter a down day on Tuesday, tech is main Wednesday’s rebound.The Data Era (XLK) sector is up greater than 1.3% at the day main the sphere motion. Significantly, all 11 sectors are within the inexperienced with Utilities (XLU) additionally up greater than 1%.

Supply: Yahoo Finance

Supply: Yahoo Finance Wed, March 6, 2024 at 9:30 AM PSTTrending tickers on WednesdayPalantir (PLTR) inventory led the Yahoo Finance trending tickers web page on Wednesday as stocks popped just about 9%. The corporate introduced on Wednesday it gained a brand new $178 million US Military contract for a battlefield device the use of synthetic intelligence.JD.com (JD) stocks rose greater than 16% after the corporate’s newest quarterly file. JD.Com crowned Wall Side road’s quarterly earnings estimates and introduced plans for a $3 billion inventory buyback program.Crowdstrike (CRWD) inventory rose about 12%, paring beneficial properties from a transfer of over 20% after hours on Tuesday evening. The cybersecurity corporate’s income in keeping with proportion of $0.95 mirrored 102% expansion in comparison to the similar length a 12 months prior and crowned Wall Side road’s estimates for $0.82.Foot Locker (FL) stocks sank just about 30%. The corporate introduced in its fourth quarter income name that the timeline for attaining its 8.5% to 9% running margin goal has been driven again two years to 2028.

Wed, March 6, 2024 at 9:30 AM PSTTrending tickers on WednesdayPalantir (PLTR) inventory led the Yahoo Finance trending tickers web page on Wednesday as stocks popped just about 9%. The corporate introduced on Wednesday it gained a brand new $178 million US Military contract for a battlefield device the use of synthetic intelligence.JD.com (JD) stocks rose greater than 16% after the corporate’s newest quarterly file. JD.Com crowned Wall Side road’s quarterly earnings estimates and introduced plans for a $3 billion inventory buyback program.Crowdstrike (CRWD) inventory rose about 12%, paring beneficial properties from a transfer of over 20% after hours on Tuesday evening. The cybersecurity corporate’s income in keeping with proportion of $0.95 mirrored 102% expansion in comparison to the similar length a 12 months prior and crowned Wall Side road’s estimates for $0.82.Foot Locker (FL) stocks sank just about 30%. The corporate introduced in its fourth quarter income name that the timeline for attaining its 8.5% to 9% running margin goal has been driven again two years to 2028. Wed, March 6, 2024 at 8:45 AM PSTNordstrom takes a poundingNordstrom (JWN) has been taking a beating all morning lengthy, down 15% after every other unsightly quarter.Maximum analysts at the Side road have remained wary after the consequences — deservedly so.Gross sales on the core Nordstrom logo have been vulnerable once more. Rack gross sales have been up double-digits. Margins beneath power. Convention name statement wasn’t inspiring.JP Morgan analyst Matt Boss completely sums up the vibe at the inventory:”We’re Underweight JWN. With the present backdrop doubtlessly “as excellent because it will get” for each JWN’s $100K+ core family source of revenue buyer (w/ MSD-HSD% private financial savings charge, debt carrier ratio at 40-year lows, and US family wealth advent of +$12 trillion in 2020) and at the pricing/promotional entrance (lean channel stock/ trade AUR enlargement) – JWN’s absolute and relative efficiency stay underwhelming with 2023 earnings ranges underneath 2019 with EBIT margins underneath 2019.”

Wed, March 6, 2024 at 8:45 AM PSTNordstrom takes a poundingNordstrom (JWN) has been taking a beating all morning lengthy, down 15% after every other unsightly quarter.Maximum analysts at the Side road have remained wary after the consequences — deservedly so.Gross sales on the core Nordstrom logo have been vulnerable once more. Rack gross sales have been up double-digits. Margins beneath power. Convention name statement wasn’t inspiring.JP Morgan analyst Matt Boss completely sums up the vibe at the inventory:”We’re Underweight JWN. With the present backdrop doubtlessly “as excellent because it will get” for each JWN’s $100K+ core family source of revenue buyer (w/ MSD-HSD% private financial savings charge, debt carrier ratio at 40-year lows, and US family wealth advent of +$12 trillion in 2020) and at the pricing/promotional entrance (lean channel stock/ trade AUR enlargement) – JWN’s absolute and relative efficiency stay underwhelming with 2023 earnings ranges underneath 2019 with EBIT margins underneath 2019.” Wed, March 6, 2024 at 8:13 AM PSTWage expansion for activity switchers will increase for first time since November 2022On Wednesday, ADP Analysis Institute’s per thirty days pay insights file confirmed salary beneficial properties for those that exchange jobs larger in February for the primary time since November 2022.ADP leader economist Nela Richardson informed Yahoo Finance that is noteworthy as a result of salary beneficial properties for activity changers are “maximum delicate to present hard work marketplace process.” Richardson added that the quantity displays the huge salary expansion observed all the way through the pandemic is “now not going to mattress quietly.”“[Wages] are in fact appearing that tightness when it comes to the hard work marketplace remains to be very prevalent,” Richardson mentioned.There have been, alternatively, different indicators on Wednesday that might point out slowing salary expansion is at the horizon, which many imagine can be a welcome signal for the combat towards inflation. SoFi’s head of funding technique Liz Younger famous on X that quits have a tendency to steer salary expansion through about 9 months. So the lower within the quits charge observed in January’s JOLTs file is pointing to “additional salary deceleration” within the pipeline.Any other replace on wages will include the February jobs file, which is slated for free up at 8:30 a.m. ET on Friday. Economists surveyed through Bloomberg be expecting wages grew at 4.3% all the way through February down from 4.5% in January.

Wed, March 6, 2024 at 8:13 AM PSTWage expansion for activity switchers will increase for first time since November 2022On Wednesday, ADP Analysis Institute’s per thirty days pay insights file confirmed salary beneficial properties for those that exchange jobs larger in February for the primary time since November 2022.ADP leader economist Nela Richardson informed Yahoo Finance that is noteworthy as a result of salary beneficial properties for activity changers are “maximum delicate to present hard work marketplace process.” Richardson added that the quantity displays the huge salary expansion observed all the way through the pandemic is “now not going to mattress quietly.”“[Wages] are in fact appearing that tightness when it comes to the hard work marketplace remains to be very prevalent,” Richardson mentioned.There have been, alternatively, different indicators on Wednesday that might point out slowing salary expansion is at the horizon, which many imagine can be a welcome signal for the combat towards inflation. SoFi’s head of funding technique Liz Younger famous on X that quits have a tendency to steer salary expansion through about 9 months. So the lower within the quits charge observed in January’s JOLTs file is pointing to “additional salary deceleration” within the pipeline.Any other replace on wages will include the February jobs file, which is slated for free up at 8:30 a.m. ET on Friday. Economists surveyed through Bloomberg be expecting wages grew at 4.3% all the way through February down from 4.5% in January. Wed, March 6, 2024 at 7:14 AM PSTJob openings hit lowest stage since March 2021Job openings hit their lowest stage since March 2021 in January, appearing additional indicators of rebalancing within the hard work marketplace.There have been 8.86 million jobs open on the finish of January, a slight lower from the 8.89 million activity openings in December, consistent with new knowledge from the Bureau of Exertions Statistics launched Wednesday. Economists surveyed through Bloomberg had anticipated there have been 8.85 million openings in January.The file additionally confirmed that the quits charge, which displays self belief amongst staff, slipped to two.1%. That is down from 2.2% within the earlier month and is its lowest stage since August 2020. Moreover, the JOLTS file confirmed that 5.7 million hires have been made within the month, a slight lower from the 5.8 million observed in December.The hiring charge sat at 3.6% in January.

Wed, March 6, 2024 at 7:14 AM PSTJob openings hit lowest stage since March 2021Job openings hit their lowest stage since March 2021 in January, appearing additional indicators of rebalancing within the hard work marketplace.There have been 8.86 million jobs open on the finish of January, a slight lower from the 8.89 million activity openings in December, consistent with new knowledge from the Bureau of Exertions Statistics launched Wednesday. Economists surveyed through Bloomberg had anticipated there have been 8.85 million openings in January.The file additionally confirmed that the quits charge, which displays self belief amongst staff, slipped to two.1%. That is down from 2.2% within the earlier month and is its lowest stage since August 2020. Moreover, the JOLTS file confirmed that 5.7 million hires have been made within the month, a slight lower from the 5.8 million observed in December.The hiring charge sat at 3.6% in January. Wed, March 6, 2024 at 6:34 AM PSTStocks pop on the openUS shares opened upper on Wednesday, with techs vaulting again from a steep sell-off as buyers digested Federal Reserve Chair Jerome Powell’s stance that rate of interest cuts are nonetheless most probably this 12 months.The Nasdaq Composite (^IXIC) jumped about 1% after techs led a pointy slide in shares extra widely on Tuesday. The S&P 500 (^GSPC) added greater than 0.6%, whilst the Dow Jones Business Reasonable (^DJI) popped 0.5%, as each indexes got here off losses of greater than 1%.Ready testimony revealed Wednesday morning published that Powell plans to inform lawmakers that charge cuts usually are warranted “someday” in 2024. Traders will search for extra readability in this factor as Powell fields questions from lawmakers over the following two days.”If the financial system evolves widely as anticipated, it’ll most probably be suitable to start dialing again coverage restraint someday this 12 months,” Powell will testify to the Space Monetary Services and products Committee.

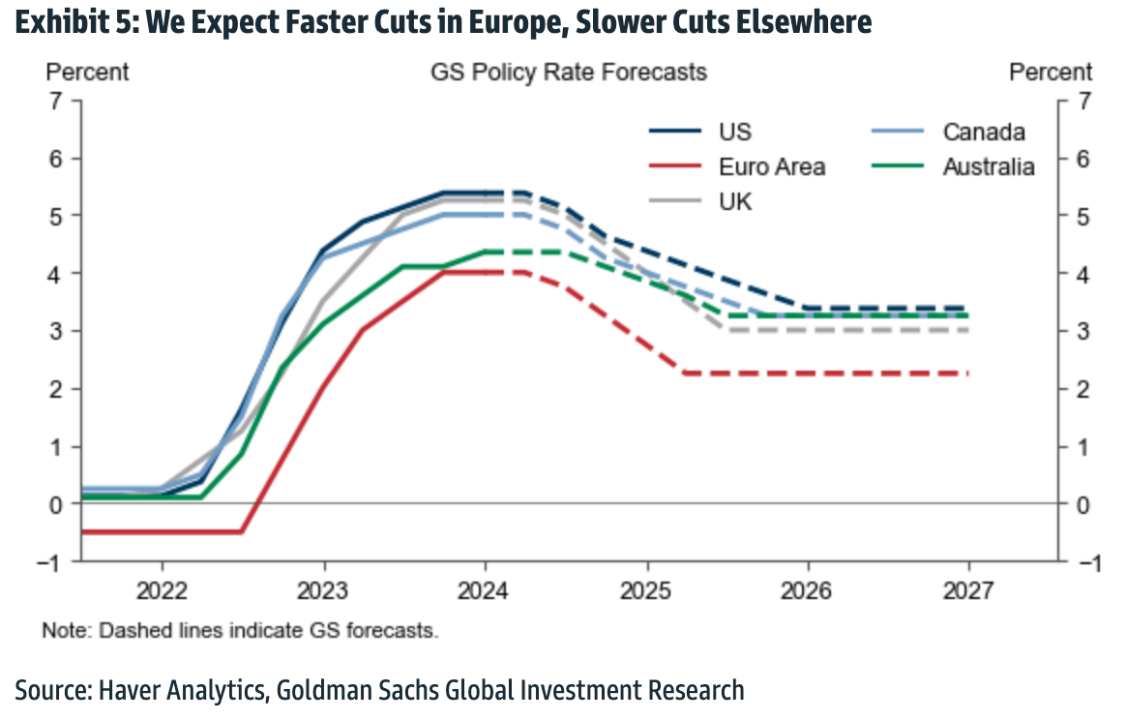

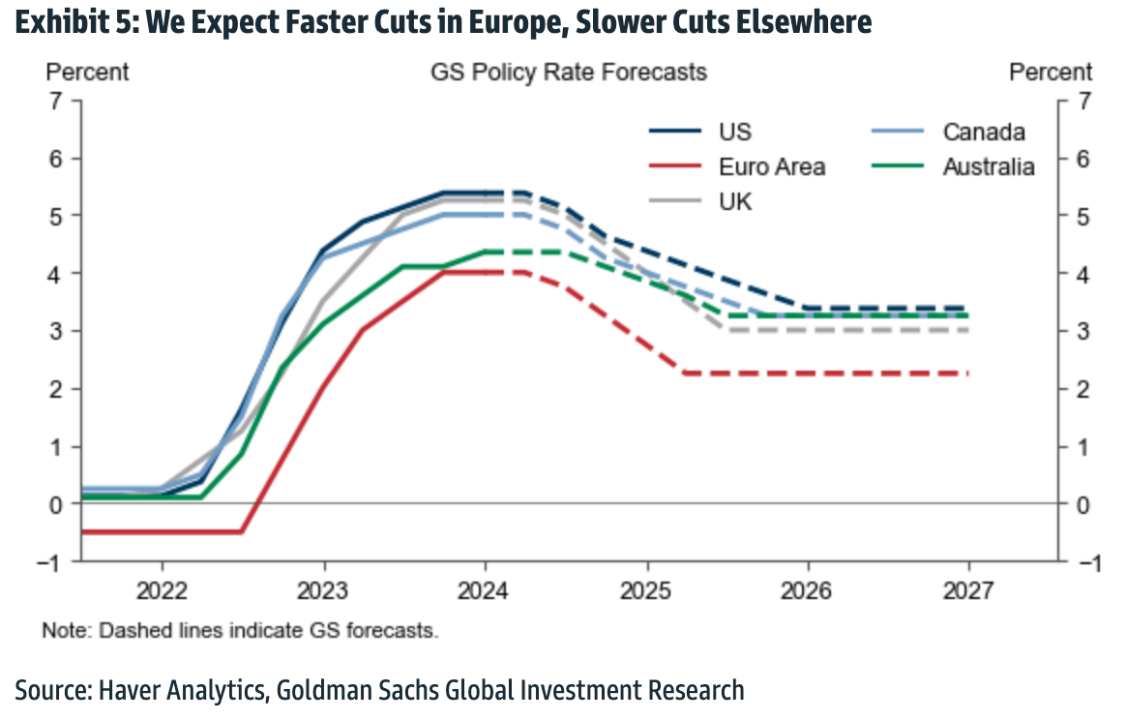

Wed, March 6, 2024 at 6:34 AM PSTStocks pop on the openUS shares opened upper on Wednesday, with techs vaulting again from a steep sell-off as buyers digested Federal Reserve Chair Jerome Powell’s stance that rate of interest cuts are nonetheless most probably this 12 months.The Nasdaq Composite (^IXIC) jumped about 1% after techs led a pointy slide in shares extra widely on Tuesday. The S&P 500 (^GSPC) added greater than 0.6%, whilst the Dow Jones Business Reasonable (^DJI) popped 0.5%, as each indexes got here off losses of greater than 1%.Ready testimony revealed Wednesday morning published that Powell plans to inform lawmakers that charge cuts usually are warranted “someday” in 2024. Traders will search for extra readability in this factor as Powell fields questions from lawmakers over the following two days.”If the financial system evolves widely as anticipated, it’ll most probably be suitable to start dialing again coverage restraint someday this 12 months,” Powell will testify to the Space Monetary Services and products Committee. Wed, March 6, 2024 at 4:30 AM PSTBring on Jerome PowellJust to stage set with you in case you have not gotten there already:The 12 months would possibly finish without a rate of interest cuts versus the six some at the Side road anticipated in early January. It’s attention-grabbing to peer markets nonetheless rocking as expectancies on charges have are available. Excellent to peer buyers embody excellent financial knowledge!It is most probably you are going to pay attention the Fed’s Jerome Powell proceed the drumbeat of latest Fedspeak on charges in his testimony to lawmakers lately.For Goldman Sachs economists, 2024 is now shaping as much as be the 12 months of charge cuts … in every single place else.”The main DM [developed market] central banks will minimize for no less than 3 consecutive conferences beginning in June, proceed to chop consecutively in economies just like the Euro House and UK the place expansion stays underneath pattern, however decelerate in economies like america the place process stays resilient,” mentioned Goldman’s leader economist Jan Hatzius.And that raises the query: is it time to rotate into Ecu shares from costlier US equities?

Wed, March 6, 2024 at 4:30 AM PSTBring on Jerome PowellJust to stage set with you in case you have not gotten there already:The 12 months would possibly finish without a rate of interest cuts versus the six some at the Side road anticipated in early January. It’s attention-grabbing to peer markets nonetheless rocking as expectancies on charges have are available. Excellent to peer buyers embody excellent financial knowledge!It is most probably you are going to pay attention the Fed’s Jerome Powell proceed the drumbeat of latest Fedspeak on charges in his testimony to lawmakers lately.For Goldman Sachs economists, 2024 is now shaping as much as be the 12 months of charge cuts … in every single place else.”The main DM [developed market] central banks will minimize for no less than 3 consecutive conferences beginning in June, proceed to chop consecutively in economies just like the Euro House and UK the place expansion stays underneath pattern, however decelerate in economies like america the place process stays resilient,” mentioned Goldman’s leader economist Jan Hatzius.And that raises the query: is it time to rotate into Ecu shares from costlier US equities?

Goldman sees a sooner tempo of charge cuts in markets out of doors america. (Goldman Sachs)

Goldman sees a sooner tempo of charge cuts in markets out of doors america. (Goldman Sachs)

Supply: Yahoo Finance

Goldman sees a sooner tempo of charge cuts in markets out of doors america. (Goldman Sachs)

:max_bytes(150000):strip_icc()/PLTRChart-71ec74b79d4442c2a8719bc71da59b23.gif)