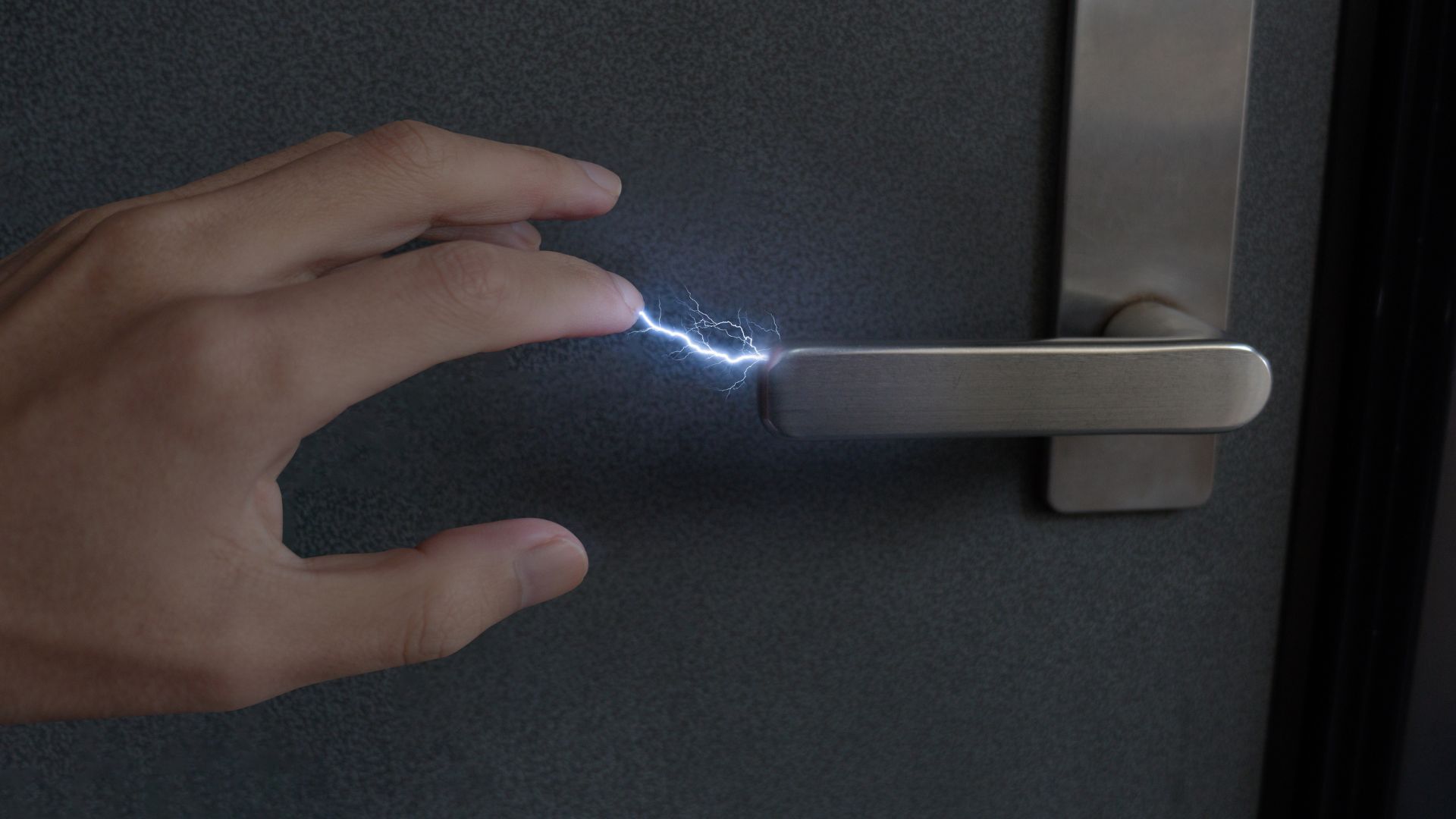

At other phases of the pandemic, the housing scene morphed from a patrons’ marketplace to a dealers’ marketplace—and infrequently again once more—with lightning pace. However as of a few yr now, it’s no longer a lot of a marketplace in any respect because the marketplace went right into a deep freeze with traditionally low ranges of houses converting fingers. Plus, loan charges hit their perfect stage for almost 40 years and are set to stick “upper for longer.” That’s all ended in what professionals have known as the “lock-in impact,” and it has ended in gridlock for months on finish.

However President Joe Biden desires to get issues transferring. “I do know the price of housing is so necessary to you,” Biden stated all through his State of the Union deal with final week. “If inflation helps to keep coming down, loan charges will come down as neatly. However I’m no longer ready.” And he’s taking motion, however will it’s sufficient?

The White Home is proposing some aid for house owners: a one-year $10,000 tax credit score for middle-class, starter-home citizens who really feel locked in to their low loan charges to transport to a larger domestic. Through White Area estimates, this must open up 3 million starter properties for the ones desperately looking to spoil into the housing marketplace.

Along side the vendor tax credit score, Biden proposed a swath of housing-related techniques together with a first-generation down cost help program, housing voucher program enlargement, and apartment help for low-income families.

The White Area spoke to Fortune after Biden’s deal with, with Deputy Treasury Secretary Adewale Adeyemo pronouncing it bluntly: “We now have a provide problem within the economic system. Because the monetary disaster, we’ve constructed too little housing right here in the US.”

He used to be echoing the remarks of Fed chair Jerome Powell himself, who had not too long ago testified to Congress concerning the economic system and concluded, “The housing marketplace is in an overly difficult scenario at this time.”

So will Biden’s proposals transfer the needle?

No longer everyone seems to be satisfied that the brand new seller-focused tax incentive proposal could have the required results of creating housing possible for lower-income households and more youthful generations. Whilst $10,000 might be “not anything to sneeze at” for some households who might be compelled to transport this yr irrespective of domestic costs and loan charges, it most probably received’t be sufficient to meaningfully transfer the needle on transaction task, writes Bloomberg columnist Jonathan Levin.

“The so-called ‘loan lock-in’ impact for present house owners, who experience low and glued per thirty days bills, continues to be a ways too tough to undo given the dimensions of the proposed incentive,” Levin wrote.

How a lot does a starter domestic value within the U.S.?

Housing affordability within the U.S. has gotten so dangerous that first-time patrons must make 13% greater than they did in 2022, in step with a July 2023 Redfin document. That’s as a result of a standard starter domestic within the U.S. now prices a document $243,000—which is a whopping 45% greater than pre-pandemic starter domestic costs.

House costs like this have left first-time homebuyers “on a wild goose chase as a result of in lots of portions of the rustic, there’s no such factor as a starter domestic anymore,” Sheharyar Bokhari, Redfin senior economist, stated within the document. “Essentially the most inexpensive properties on the market are not inexpensive to other folks with decrease budgets because of the combo of emerging costs and emerging charges.”

The lock-in impact, due to this fact, has disproportionately affected more youthful generations like millennials and Gen Zers who would in most cases be scooping up starter properties by way of this time of their lifestyles. But those generations are nonetheless essentially the most housing-obsessed, in step with a December 2023 Financial institution of The us document that displays some 60% of Gen Z respondents, and just about 60% of millennials, stated they believe homeownership is extra necessary than it used to be all through their folks’ technology.

Whilst Biden’s tax credit score proposal for dealers can have the similar impact as a 1.5% loan fee aid, it would in fact aggravate one of the most different primary problems dealing with the housing marketplace as of late: low stock ranges.

“This proposal would building up call for for starter properties, that are already in brief provide, thereby using up costs,” Edward J. Pinto, a senior fellow and codirector of right-wing suppose tank AEI’s Housing Middle. “As well as, lots of the 3.5 million beneficiaries would were in a position to shop for a house with out the credit score. Then again, since cash is fungible, those households could have further buying energy to bid up the cost of properties.”

What’s extra is that the Biden tax credit score can have the unintentional result of opening up extra small properties for child boomers taking a look to downsize all through the following couple of years, because the similar starter properties that the household-forming fortysomethings need also are superb for downsizing grandparents.

“There’s a large overlap between choose child boomers and choose millennials,” Ali Wolf, leader economist at Zonda, a distributor of housing marketplace knowledge and consulting, up to now advised Fortune. “The important thing distinction here’s that the child boomer will most probably be capable of faucet domestic fairness by way of promoting their present domestic, permitting them to in all probability make a extra compelling be offering at the domestic in comparison to the millennials, particularly if the latter team are nonetheless renting.” In different phrases, child boomers are much more likely to win the housing marketplace with extra money available.

Whether or not Biden’s housing tax credit score for dealers is valuable would possibly finally end up being a moot level if it’s denied by way of Republican legislators—and it may well be not going we’ll see significant exchange all through an election yr.

“It stays unclear which of those insurance policies are possibly to reach Congress on this hotly contested election yr,” Nick Luettke, Moody’s Analytics affiliate economist, stated in a commentary. “Housing affordability has turn out to be a key factor for American citizens spanning all demographics and political divides, and housing coverage has most commonly remained secure in contemporary congressional budgets.”