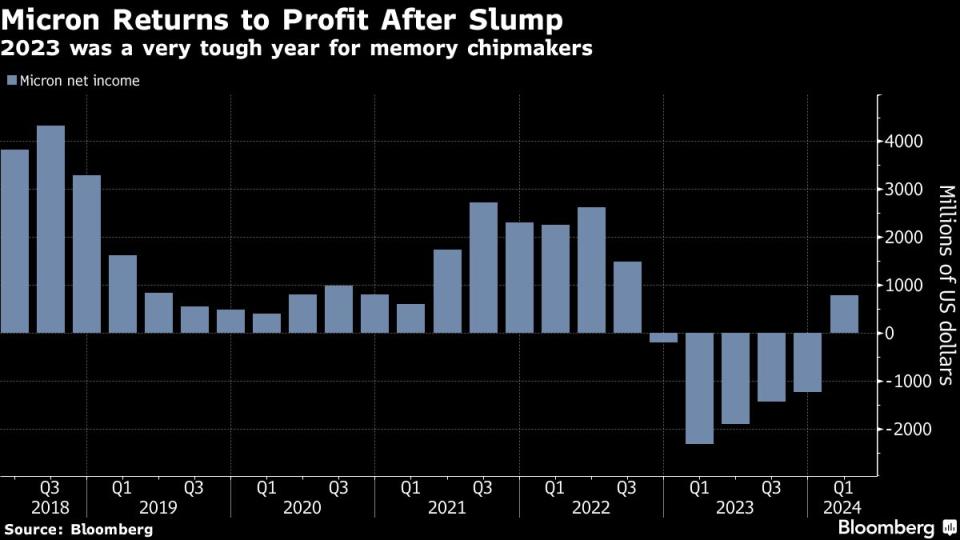

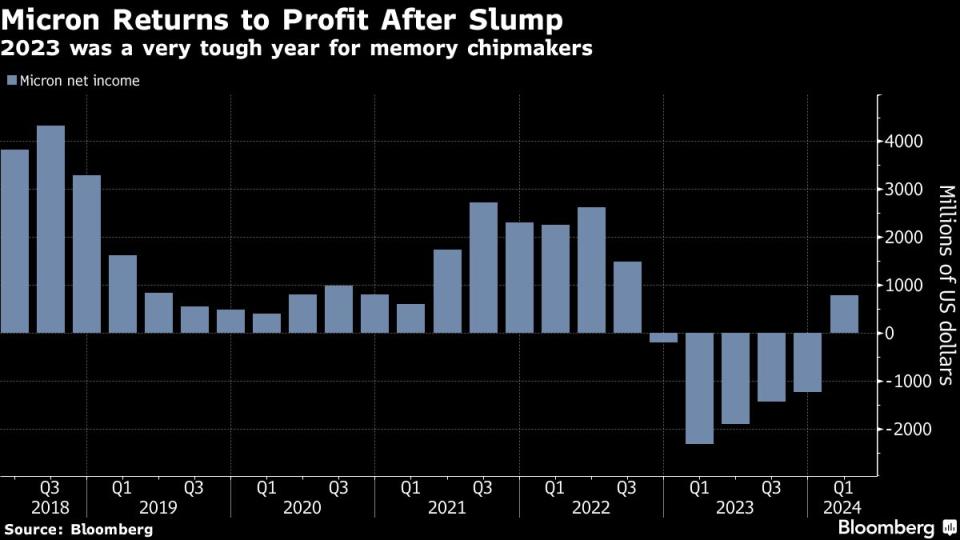

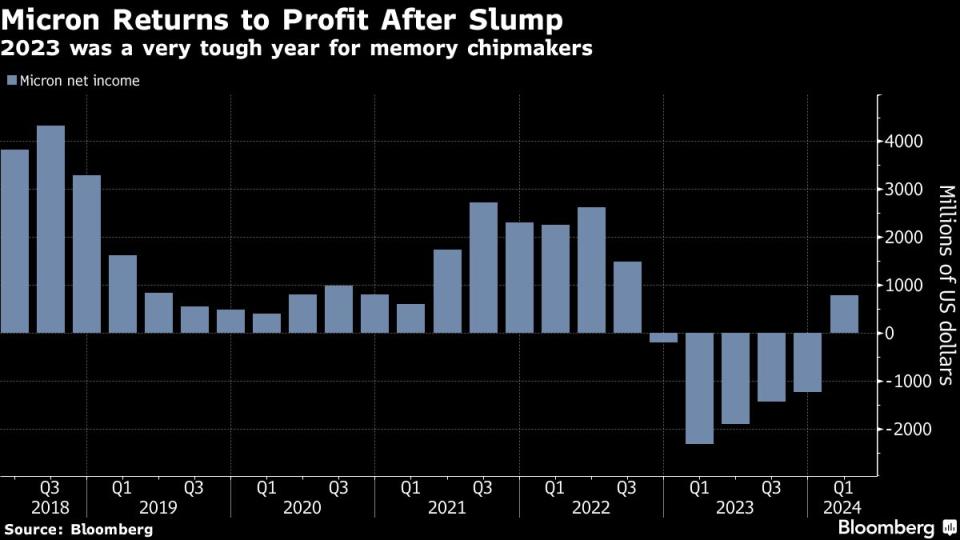

(Bloomberg) — Micron Generation Inc., the biggest US maker of laptop reminiscence chips, is on target for its largest acquire in additional than 12 years after giving a shockingly sturdy income forecast for the present quarter, buoyed via call for for synthetic intelligence {hardware}.Maximum Learn from BloombergFiscal third-quarter income will probably be $6.4 billion to $6.8 billion, the corporate mentioned in a commentary Wednesday. That compares with a median analyst estimate of $5.99 billion. Micron can have profits of about 45 cents a proportion, minus sure pieces. Analysts projected 24 cents.Micron and its opponents are rising from probably the most worst slumps the reminiscence chip business has suffered, caused via vulnerable call for for private computer systems and smartphones. However executives are constructive concerning the long term because the booming marketplace for AI equipment is helping chipmakers go back to enlargement and profitability.“We imagine Micron is without doubt one of the largest beneficiaries within the semiconductor business of the multiyear alternative enabled via AI,” Leader Govt Officer Sanjay Mehrotra mentioned within the commentary.

Micron Leader Govt Officer Sanjay Mehrotra. (Bloomberg)The stocks rose 18% to $113.30 in premarket buying and selling on Thursday. If the good points grasp, Micron will probably be set for its largest leap since Dec. 22, 2011 and hit its easiest degree on report. They’d climbed 13% to $96.25 this 12 months in the course of the shut on Wednesday.Mehrotra has promised traders that 2024 will mark a rebound for the business and 2025 will see report gross sales ranges. However Micron will want to make sufficient ultrafast reminiscence, which matches with Nvidia Corp. chips to lend a hand knowledge middle operators increase AI instrument.AI-related methods use one thing known as high-bandwidth reminiscence, or HBM. That form of chip is new and not more of a commodity. That implies firms like Micron can fee a miles upper value for it.Tale continuesMicron were given its first income from a type of this reminiscence referred to as HBM3E in its most up-to-date quarter. The semiconductors are a part of Nvidia graphics chip-based AI accelerators, Micron mentioned. And Micron expects “a number of hundred million” greenbacks of income from HBM merchandise in fiscal 2024. Nearly all of its manufacturing of such chips is offered out for 2025, it mentioned.AI instrument is created via bombarding instrument with data. The method can contain trillions of parameters and is extremely reliant on reminiscence. So as to steer clear of bottlenecks and stay dear processors running flat-out, Micron and its competition have advanced chips that keep up a correspondence with different elements a lot sooner than conventional reminiscence chips.Nvidia CEO Jensen Huang mentioned previous this week that HBM used to be greater than only a reminiscence improve — it’s a technical wonder that’s important to AI methods. He discussed Micron as a pacesetter in bringing the brand new generation to marketplace.In the second one quarter, which ended Feb. 29, Micron’s income rose 58% to $5.82 billion. The Boise, Idaho-based corporate had profits of 42 cents a proportion, apart from sure pieces. That compares with estimated gross sales of $5.35 billion and a projected lack of 24 cents a proportion.“Micron has returned to profitability and delivered sure working margin 1 / 4 forward of expectation,” Mehrotra mentioned on a convention name with analysts.

Micron Leader Govt Officer Sanjay Mehrotra. (Bloomberg)The stocks rose 18% to $113.30 in premarket buying and selling on Thursday. If the good points grasp, Micron will probably be set for its largest leap since Dec. 22, 2011 and hit its easiest degree on report. They’d climbed 13% to $96.25 this 12 months in the course of the shut on Wednesday.Mehrotra has promised traders that 2024 will mark a rebound for the business and 2025 will see report gross sales ranges. However Micron will want to make sufficient ultrafast reminiscence, which matches with Nvidia Corp. chips to lend a hand knowledge middle operators increase AI instrument.AI-related methods use one thing known as high-bandwidth reminiscence, or HBM. That form of chip is new and not more of a commodity. That implies firms like Micron can fee a miles upper value for it.Tale continuesMicron were given its first income from a type of this reminiscence referred to as HBM3E in its most up-to-date quarter. The semiconductors are a part of Nvidia graphics chip-based AI accelerators, Micron mentioned. And Micron expects “a number of hundred million” greenbacks of income from HBM merchandise in fiscal 2024. Nearly all of its manufacturing of such chips is offered out for 2025, it mentioned.AI instrument is created via bombarding instrument with data. The method can contain trillions of parameters and is extremely reliant on reminiscence. So as to steer clear of bottlenecks and stay dear processors running flat-out, Micron and its competition have advanced chips that keep up a correspondence with different elements a lot sooner than conventional reminiscence chips.Nvidia CEO Jensen Huang mentioned previous this week that HBM used to be greater than only a reminiscence improve — it’s a technical wonder that’s important to AI methods. He discussed Micron as a pacesetter in bringing the brand new generation to marketplace.In the second one quarter, which ended Feb. 29, Micron’s income rose 58% to $5.82 billion. The Boise, Idaho-based corporate had profits of 42 cents a proportion, apart from sure pieces. That compares with estimated gross sales of $5.35 billion and a projected lack of 24 cents a proportion.“Micron has returned to profitability and delivered sure working margin 1 / 4 forward of expectation,” Mehrotra mentioned on a convention name with analysts.

Micron competes with South Korea’s Samsung Electronics Co. and SK Hynix Inc. in promoting chips that offer non permanent reminiscence in computer systems and telephones. Micron additionally makes flash reminiscence, which gives longer-term garage in the ones units.Each varieties of reminiscence observe business requirements, which means that portions from other firms are interchangeable and may also be traded like commodities. The disadvantage is that costs may also be risky, and shoppers can transfer from one provider to some other.Reminiscence-chipmakers were seeking to push into new markets, akin to knowledge facilities, vehicles and an expanding array of units — making them much less depending on telephones and PCs. However they haven’t turn into diverse sufficient to offset the swings in call for inside their core markets, as they skilled in 2023.Micron is taking a look to makers of private computer systems and smartphones to go back to stable ordering. Lots of them had scaled again call for to attract down the stock that they had readily available. Susceptible ordering from the ones shoppers driven chip costs down underneath the price of manufacturing closing 12 months.Previous Wednesday, the USA Division of Trade introduced it’s going to award Intel Corp. $8.5 billion in grants and up to $11 billion in loans to lend a hand fund a ramification of its semiconductor factories in the USA. The announcement used to be the largest disbursement thus far from the Biden management’s Chips and Science Act. No different giant chipmakers have thus far been publicly promised make stronger.Micron mentioned it’s keeping up its finances for brand new vegetation and kit for fiscal 2024 at $7.5 billion to $8 billion. It’ll continue with tasks in China, Japan and India. Proposed US expansions — in New York State and Boise — “require Micron to obtain the combo of enough Chips grants, funding tax credit, and native incentives to handle the associated fee distinction in comparison to out of the country enlargement,” Mehrotra mentioned.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Micron competes with South Korea’s Samsung Electronics Co. and SK Hynix Inc. in promoting chips that offer non permanent reminiscence in computer systems and telephones. Micron additionally makes flash reminiscence, which gives longer-term garage in the ones units.Each varieties of reminiscence observe business requirements, which means that portions from other firms are interchangeable and may also be traded like commodities. The disadvantage is that costs may also be risky, and shoppers can transfer from one provider to some other.Reminiscence-chipmakers were seeking to push into new markets, akin to knowledge facilities, vehicles and an expanding array of units — making them much less depending on telephones and PCs. However they haven’t turn into diverse sufficient to offset the swings in call for inside their core markets, as they skilled in 2023.Micron is taking a look to makers of private computer systems and smartphones to go back to stable ordering. Lots of them had scaled again call for to attract down the stock that they had readily available. Susceptible ordering from the ones shoppers driven chip costs down underneath the price of manufacturing closing 12 months.Previous Wednesday, the USA Division of Trade introduced it’s going to award Intel Corp. $8.5 billion in grants and up to $11 billion in loans to lend a hand fund a ramification of its semiconductor factories in the USA. The announcement used to be the largest disbursement thus far from the Biden management’s Chips and Science Act. No different giant chipmakers have thus far been publicly promised make stronger.Micron mentioned it’s keeping up its finances for brand new vegetation and kit for fiscal 2024 at $7.5 billion to $8 billion. It’ll continue with tasks in China, Japan and India. Proposed US expansions — in New York State and Boise — “require Micron to obtain the combo of enough Chips grants, funding tax credit, and native incentives to handle the associated fee distinction in comparison to out of the country enlargement,” Mehrotra mentioned.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.