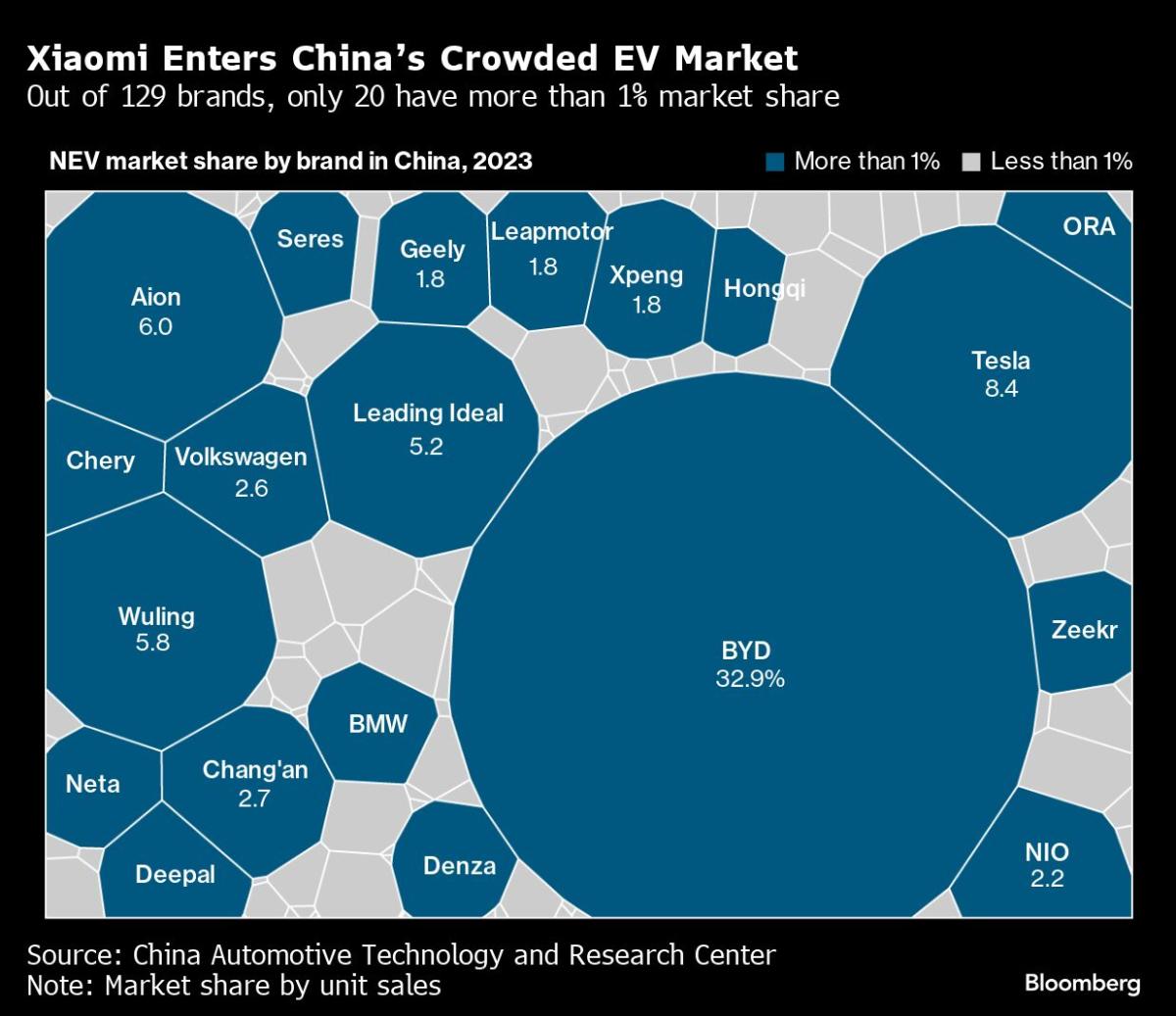

(Bloomberg) — Tesla Inc. stocks have proven indicators of existence in contemporary days after this yr’s excessive slide, however buyers lack the readability had to wager on any lasting restoration.Maximum Learn from BloombergThe electrical automobile maker is because of supply its first-quarter supply numbers early subsequent week and unexpectedly losing estimates during the last month recommend a lackluster document. Extra importantly, contemporary newsflow implies tepid call for for its vehicles in coming months.“Supply estimates had been reduce so much, and that has in reality killed investor self belief within the identify. It is going to be onerous to spin the first-quarter numbers definitely, even though they modestly beat expectancies,” mentioned Nicholas Colas, co-founder of DataTrek Analysis. “Valuations are continuously tied to an organization’s weakest hyperlink. In Tesla’s case, that’s the car trade.”Causes for the stocks’ dismal run this yr — down 28% in comparison to a ten% advance within the S&P 500 Index — are many. Alternatively, the largest cloud looming over the EV large is the slowdown within the call for for electrical cars, which is going on simply as pageant from legacy carmakers and Chinese language competitors is heating up.The soon-to-end first quarter will rank some of the inventory’s 3 worst ever. The EV maker is the largest share decliner at the S&P 500 thus far this yr. The inventory has given up all its positive aspects since mid-Might, and has erased over $350 billion from its marketplace capitalization since touching a 52-week excessive in July.Expectancies are low. Analysts had been unexpectedly dialing again their estimates for deliveries, income and benefit, whilst the proportion of bullish scores at the inventory has dropped to the bottom in about 3 years. However extra importantly, enthusiasm towards Tesla has eroded considerably, with buyers involved over a loss of new catalysts that may propel the inventory close to time period.Tale continuesSeveral analysts reduce estimates simply this week. Mizuho Securities’ Vijay Rakesh famous that EV gross sales expectancies have been decelerating sooner than anticipated. Rakesh estimates EV gross sales will develop about 15% over final yr in 2024, down from his prior expectation of 25%. And Sanford C. Bernstein’s Toni Sacconaghi mentioned that as enlargement expectancies decline, the inventory more and more seems to be dear in comparison to large-cap tech firms.“There’s reasonably just a little of pessimism already constructed into the inventory at those ranges,” mentioned Ivana Delevska, leader funding officer at SPEAR Make investments. “From right here, I feel it’ll be a binary result,” she added, pronouncing that the corporate will both display growth in its self-driving era, or will proceed to industry with the suffering EV marketplace.In contemporary weeks, buyers have begun to pay fairly extra for choices protective towards a selloff. The price of places that benefit on a ten% stoop in stocks inside the subsequent month has trended upper — signaling emerging skittishness towards the inventory.On the identical time, Tesla’s declare to turn out to be a significant synthetic intelligence participant has additionally began to appear shaky. Whilst self-driving vehicles — which the corporate is attempting to broaden — could be a significant feat in AI, it stays an issue notoriously tough to unravel. Professionals and analysts don’t be expecting it to turn out to be a widely-adopted era any time quickly.All of this driven Tesla’s stocks into the so-called technical oversold territory final week, signaling that the inventory has fallen too some distance, too speedy.If the supply figures subsequent week are much better than what analysts recently be expecting, a aid rally within the stocks – then again transient — can’t be dominated out. The speculation is that with such a lot negativity already constructed into the stocks, there might not be a lot room left for extra.Additionally, as long-term Tesla bulls shall be fast to notice, the present weak point in EVs may end up to be only a blip for the corporate in the following couple of years, as adoption of those vehicles pick out up globally amid robust political push. That is helping to strengthen the inventory worth as neatly.However even then, the near-term issues about Tesla and its core EV trade will proceed to hang-out buyers, till there’s a transparent sense of the trajectory of EV gross sales this yr and the following.“The large center of attention for buyers on Tesla at this time goes to be supply quantity and gross margin – the route of the inventory shall be primarily based off of those numbers relative to whisper expectancies,” mentioned David Wagner, portfolio supervisor at Aptus Capital Advisors.“However for now, momentum has taken dangle of the inventory and there was some indiscriminate promoting as Tesla has been a investment mechanism for the narrative de jour – AI.”Tech Chart of the DayXiaomi Corp. is about to start out promoting its first electrical automobile in China, the arena’s greatest EV marketplace ruled through Tesla and BYD Co. The power of preliminary orders and shopper comments for its SU7 sedan shall be of prepared hobby to buyers, with China’s marketplace projected to sluggish for a 2d yr.Best Tech NewsAmazon.com Inc. says it’s making an investment an extra $2.75 billion in Anthropic, finishing a deal it made final yr to again the factitious intelligence startup and make bigger a partnership between the corporations.The pass judgement on presiding over Sam Bankman-Fried’s sentencing Thursday should make a decision whether or not the fallen crypto magnate is a run-of-the-mill monetary fraudster or a villain eclipsed most effective through Ponzi scheme mastermind Bernie Madoff.The White Space would require federal companies to check synthetic intelligence gear for attainable dangers and designate officials to verify oversight, movements meant to inspire accountable adoption of the rising era through the United States executive.Databricks Inc., a carefully held analytics instrument maker, says pageant from his corporate fueled a high-profile govt departure at rival Snowflake Inc.Profits Due Thursday—With the aid of Carly Wanna, Yasufumi Saito, Charlotte Yang, Jinshan Hong, Linda Lew and Chunying Zhang.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Tesla’s $350 Billion Inventory Hunch Shreds Investor Expectancies