New York

The Gentleman Report

—

For any individual having a look to shop for a brand new house, top loan charges, top house expenses and a shrunken housing provide have made the entire procedure difficult to mention the least.

Now a brand new research from Bankrate.com launched Monday unearths that during just about part of US states, consumers will want a six-figure family source of revenue simply to manage to pay for a median-priced house of their state in the event that they’re making plans to get a loan. (The median is the fee at which part of houses on the market in a space are costlier and part are more cost effective.)

Again in January 2020, a six-figure source of revenue used to be wanted in most effective six states and the District of Columbia.

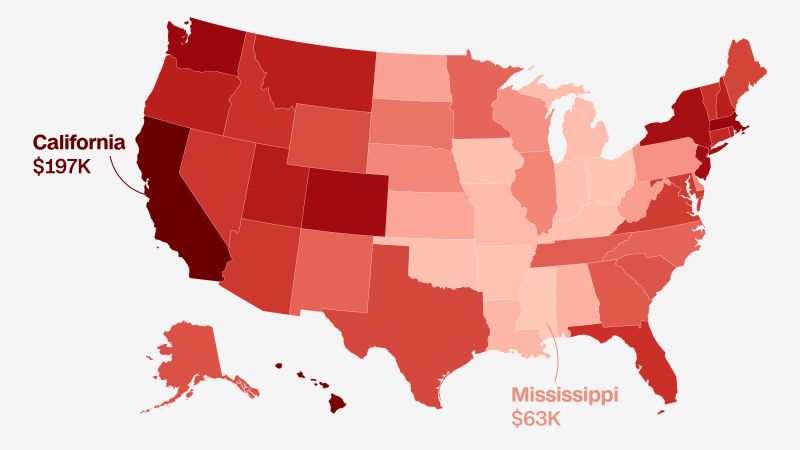

Assuming you’re making a 20% down cost and get a 30-year fixed-rate loan on the moderate 52-week fee, this map displays you ways a lot family source of revenue Bankrate’s research discovered you’ll wish to manage to pay for the median-priced house for your state.

Consider the learn about most effective regarded as the prices of securing a manageable loan cost (which contains main, hobby, assets taxes and assets insurance coverage). “Manageable” way it gained’t exceed 28% of your gross family source of revenue. The research didn’t consider ultimate prices or the prices one incurs as a house owner after you get the keys for your new area.

It’s value noting, too, that the median worth of a house in a given state gained’t essentially replicate the median worth within the a part of the state you’re in quest of to shop for.