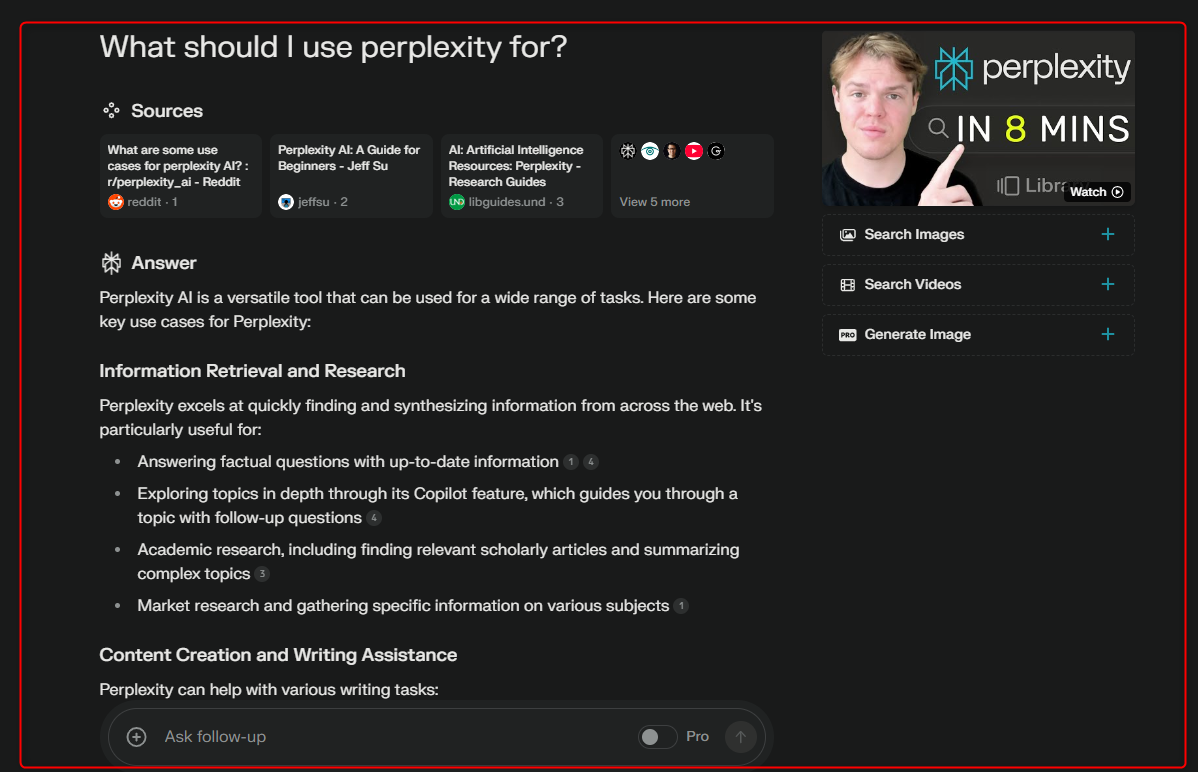

Two girls hang an umbrella whilst sitting at an out of doors desk of a restaurant on April 01, 2024 in Rome, Italy. Emanuele Cremaschi | Getty Photographs Information | Getty ImagesInflation within the 20-nation euro zone eased to two.4% in March, in step with flash figures printed on Wednesday, boosting expectancies for rate of interest cuts to start in the summertime.Economists polled by way of Reuters had forecast the velocity would hang secure in opposition to the former month at 2.6%.The core charge of inflation, apart from power, meals, alcohol and tobacco, cooled from 3.1% to two.9%, additionally coming in beneath expectancies.On the other hand, inflation in services and products — a key watcher for the Ecu Central Financial institution — remained caught at 4% for a 5th immediately month, pointing to persisted power from salary expansion. Every other indicator for the ECB launched Wednesday, the euro house unemployment charge, stood at 6.5% in February, strong in opposition to January however down from 6.6% in February 2023. Value rises in France and Spain got here in not up to forecast closing week. On Tuesday, headline inflation within the bloc’s greatest economic system, Germany, was once estimated at a three-year low of two.2%.Markets be expecting the euro zone’s central financial institution will start decreasing rates of interest in June — a place mirrored within the contemporary messaging of ECB decision-makers. They’re subsequent set to carry a financial coverage assembly on April 11.”The present narrative is obviously pointing to a primary charge lower in June as this would be the assembly with a complete batch of essential information to be had: a recent spherical of ECB workforce forecasts, GDP expansion and salary expansion information for the primary quarter of 2024 and result of the Financial institution Lending Survey, simply to say essentially the most related ones,” Carsten Brzeski, world head of macro at ING, mentioned in a notice on Wednesday.”We think the ECB to stick on hang subsequent week and to additional get ready markets for a primary charge lower in June.”

Euro zone inflation hastily slows to two.4% in March, with core print additionally beneath forecast