AAVE remained in a bull development at press time.

The asset will see a golden move if the token maintains its worth development.

Aave [AAVE] ended the previous week undoubtedly, appearing robust efficiency. On the other hand, it has skilled a decline within the ultimate 24 hours.

In spite of this contemporary downturn, signs prompt that its worth might be poised for additional uptrend within the coming week.

AAVE presentations combined indicators

In keeping with AMBCrypto, AAVE used to be buying and selling at roughly $112.37, marking a day by day building up of over 1.30%.

The lengthy and brief transferring averages (blue and yellow traces) had been offering fortify at round $99.86 and $97.67, respectively, suggesting a forged base for its worth.

The Relative Power Index (RSI) is at 60.76, indicating that it’s in bullish territory however now not but overbought. This leaves room for additional upside sooner than the RSI reaches overbought stipulations (in most cases above 70).

The Shifting Moderate Convergence Divergence (MACD) line is at 1.32, with the sign line at 1.60, each in sure territory.

Supply: TradingView

Supply: TradingView

On the other hand, in spite of those bullish signs, information from CoinMarketCap confirmed that it used to be a few of the losers within the ultimate 24 hours, having misplaced over 1%.

This contemporary dip earned it a place a few of the most sensible losers, reflecting momentary volatility or profit-taking. Apparently, AAVE nonetheless stood out because the second-highest gainer during the last seven days, with a notable 18% building up.

Nearing a golden move

AAVE used to be situated for sure worth motion at press time, with the transferring averages suggesting {that a} golden move may shape if the fee continues to upward push.

A golden move, the place the momentary transferring moderate crosses above the long-term transferring moderate, is in most cases observed as a powerful bullish sign.

The following vital resistance for AAVE is across the $120 degree, a mental barrier prior to now performing as resistance.

If AAVE can effectively smash thru this degree, the following goal might be round $130, representing a prior prime. Additionally, it serves as the following logical resistance zone.

Whilst the symptoms are predominantly bullish, with the RSI and MACD supporting the case for additional upside, buyers must be wary of possible retracements.

Within the match of a pullback, AAVE may in finding fortify across the lengthy transferring moderate at $99.86 and the quick transferring moderate at $97.67.

On the other hand, if AAVE breaks beneath those transferring averages, it would sign a shift again to bearish sentiment. The cost may take a look at the $90 degree, the place earlier fortify used to be established.

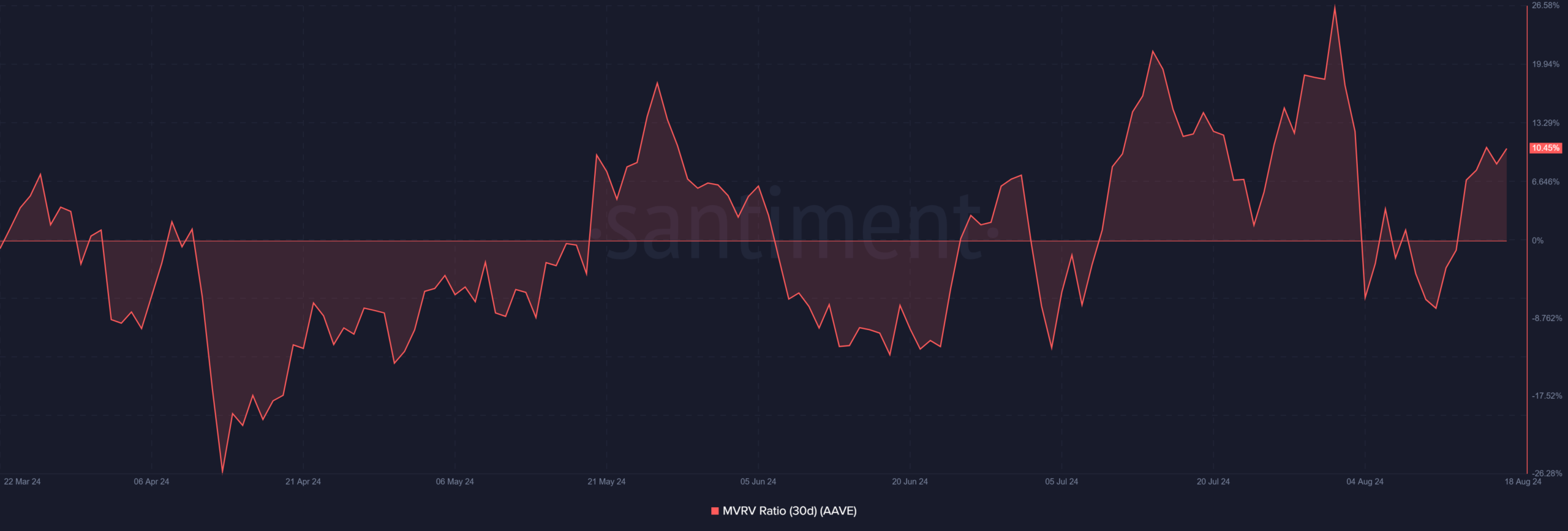

Holders revel in earnings

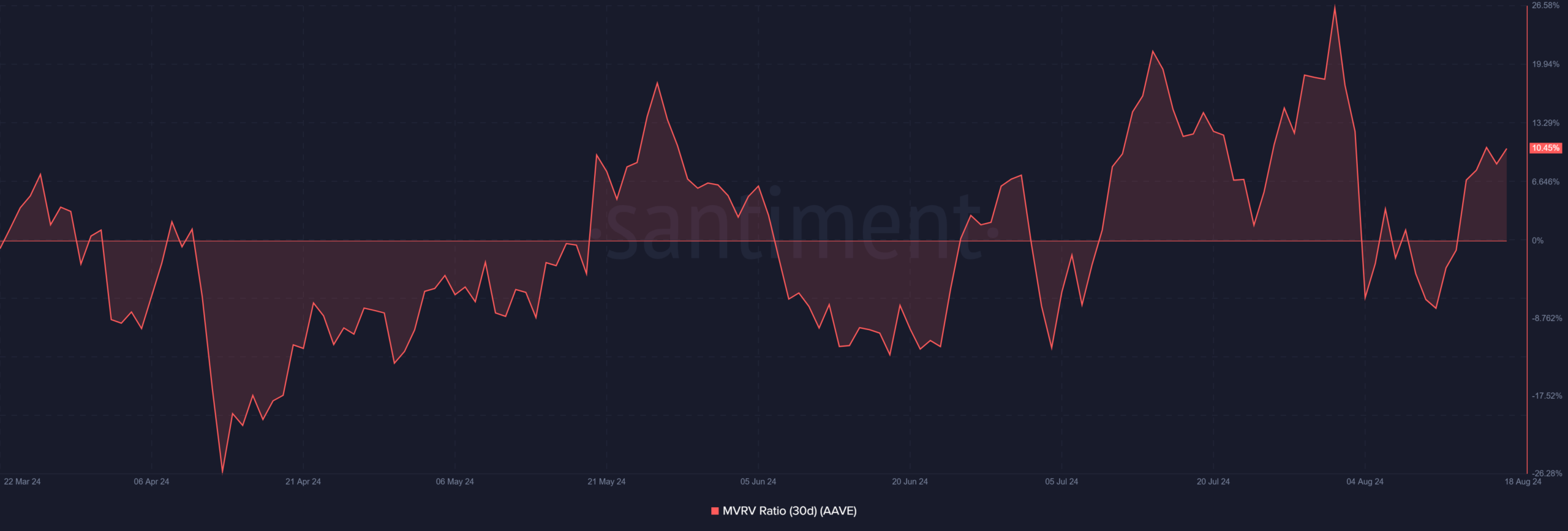

An research of AAVE’s 30-day Marketplace Worth to Learned Worth (MVRV) published that holders had been winning at press time.

The MVRV climbed above 0 at the thirteenth of August and has remained in sure territory since then. As of this writing, the MVRV stood at roughly 10.45%, in line with Santiment information.

Supply: Santiment

Supply: Santiment

Lifelike or now not, right here’s AAVE’s marketplace cap in BTC’s phrases

This development indicated that holders who bought AAVE throughout the ultimate 30 days grasp a median cash in of over 10%.

A favorable MVRV ratio in most cases displays robust marketplace sentiment. It means that the present holders aren’t best in cash in but in addition assured within the asset’s price.

Subsequent: XRP: Assessing the percentages of the altcoin attaining $0.94

:max_bytes(150000):strip_icc()/GettyImages-2215621025-34731005cd10466889af0a17a36a9a6b.jpg)