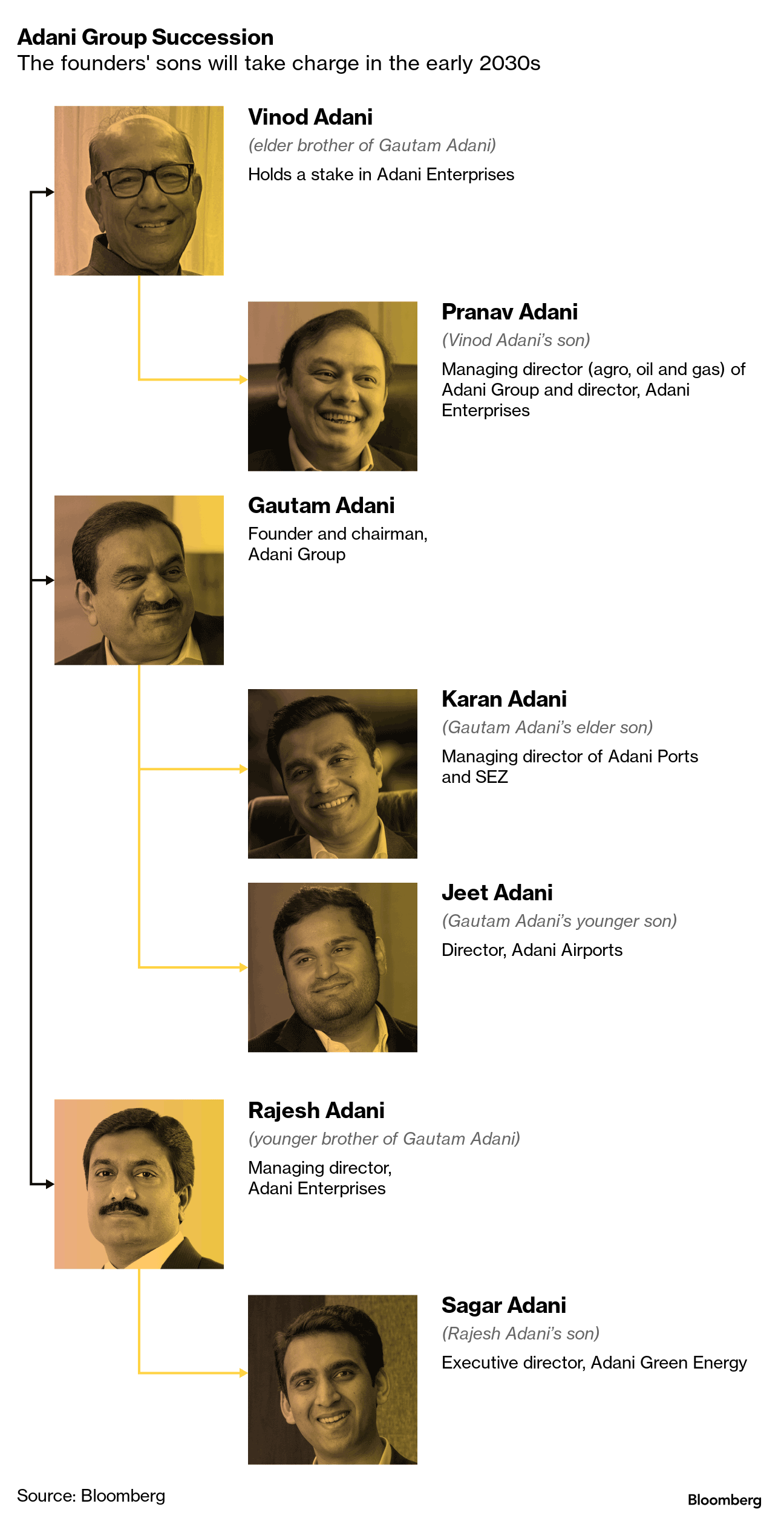

Sagar Adani, Jeet Adani, Pranav Adani and Karan Adani, at Adani Team headquarters in Ahmedabad in Would possibly. Supply: BloombergGautam Adani says he’ll shift keep an eye on to his scions within the early 2030s. Controversy over the Hindenburg short-seller assault and a DOJ bribery probe nonetheless looms.August 5, 2024, 9:00 AM UTCIn early 2018, Gautam Adani — Asia’s moment richest guy, with a fortune of greater than $100 billion — invited his sons and nephews to his house within the western Indian town of Ahmedabad. Over lunch, the patriarch requested the 4 more youthful males an sudden query: Did they need to carve up the Adani Team’s sprawling companies between themselves and section tactics? He gave them 3 months to make a decision.That circle of relatives confab kicked off what’s poised to transform some of the global’s biggest and maximum difficult transfers of wealth. The 62-year-old plans to step down at 70, he advised Bloomberg Tv’s Inside of Adani, a unique package deal in regards to the conglomerate. That may open the door to a management transition within the early 2030s that, if totally learned, is fraught with dangers for the billionaire extended family and could have main ramifications for India’s economic system and past. In an extraordinary interview, the multi-millionaire defined his retirement and succession plans for the 1st time. The interview, which was once restricted to his management transition preparations, didn’t cope with controversies swirling round his conglomerate, from investor considerations about trade and accounting practices to a US Division of Justice bribery investigation. His heirs mentioned problems together with the more than a few investigations and their imaginative and prescient for the gang.In a bold short-selling assault ultimate yr, New York-based Hindenburg Analysis accused the conglomerate of “the most important con in company historical past.” It alleged that the Adani Team had used a internet of businesses in tax havens to inflate its income and manipulate inventory costs, whilst debt piled up. For years, critics have raised equivalent questions. The crowd denied all claims however the damning document at one level sheared $153 billion off its price, losses it in the end recouped forward of India’s election this yr. “It was once a surprise to other people as a result of they weren’t anticipating it in how it was once offered,” mentioned Sagar Adani, one in all Gautam’s nephews. He added that the gang “gave an overly, very lengthy and complete reaction in simply 72 hours on each and every unmarried level.”

Gautam Adani, chairman of Adani Team, on the corporate’s headquarters on Would possibly 25. Photographer: Sumit Dayal/BloombergThe workforce has additionally confronted regulatory probes at house and in the USA. In March, Bloomberg reported that US prosecutors have been investigating whether or not an Adani entity, executives connected to the corporate, or billionaire founder Gautam himself have been desirous about paying bribes to Indian officers in go back for favorable remedy on a green-energy challenge. Azure Energy International Ltd., which competes with Adani for sun contracts and was once additionally a part of the investigation, mentioned ultimate yr it was once cooperating with the Justice Division following an inner probe. Azure didn’t reply to a request for remark.The Adani Team has mentioned none of its devices has been notified of the probe, and that it’s no longer conscious about its chairman being a part of the investigation. Sagar declined to supply additional remark. No Adani unit has been charged with wrongdoing through the USA Justice Division, and investigations don’t all the time result in prosecutions.WATCH: Bloomberg’s unique interview with Indian billionaire Gautam AdaniGiven this array of felony and reputational dangers, the conglomerate’s management switch takes on added importance for traders. On the similar time, Adani’s dominance in key sectors of India’s economic system makes it laborious for international budget to omit the gang.With a complete marketplace capitalization of $213 billion throughout 10 indexed devices by myself, the conglomerate controls huge swathes of the infrastructure that powers the country’s expansion and underpins the Asian enlargement of businesses from Apple Inc. to Amazon.com Inc. The Adani Team is India’s best importer of coal, its biggest proprietor of sun farms and its second-biggest producer of cement. Adani-owned ports elevate nearly part the rustic’s delivery bins, whilst greater than 90 million other people use its airports each and every yr. Adani Team SuccessionThe founders’ sons will take price within the early 2030s

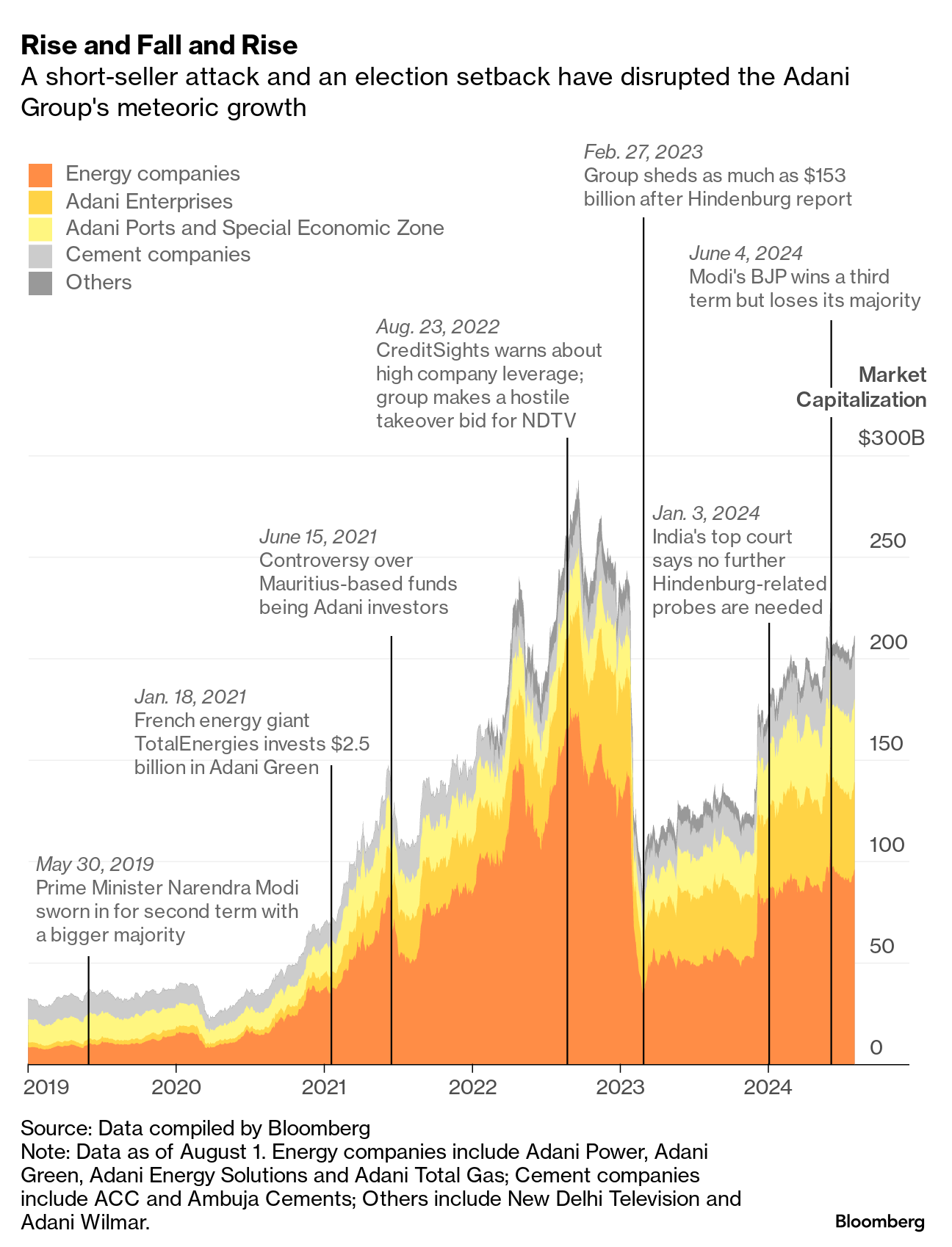

Gautam Adani, chairman of Adani Team, on the corporate’s headquarters on Would possibly 25. Photographer: Sumit Dayal/BloombergThe workforce has additionally confronted regulatory probes at house and in the USA. In March, Bloomberg reported that US prosecutors have been investigating whether or not an Adani entity, executives connected to the corporate, or billionaire founder Gautam himself have been desirous about paying bribes to Indian officers in go back for favorable remedy on a green-energy challenge. Azure Energy International Ltd., which competes with Adani for sun contracts and was once additionally a part of the investigation, mentioned ultimate yr it was once cooperating with the Justice Division following an inner probe. Azure didn’t reply to a request for remark.The Adani Team has mentioned none of its devices has been notified of the probe, and that it’s no longer conscious about its chairman being a part of the investigation. Sagar declined to supply additional remark. No Adani unit has been charged with wrongdoing through the USA Justice Division, and investigations don’t all the time result in prosecutions.WATCH: Bloomberg’s unique interview with Indian billionaire Gautam AdaniGiven this array of felony and reputational dangers, the conglomerate’s management switch takes on added importance for traders. On the similar time, Adani’s dominance in key sectors of India’s economic system makes it laborious for international budget to omit the gang.With a complete marketplace capitalization of $213 billion throughout 10 indexed devices by myself, the conglomerate controls huge swathes of the infrastructure that powers the country’s expansion and underpins the Asian enlargement of businesses from Apple Inc. to Amazon.com Inc. The Adani Team is India’s best importer of coal, its biggest proprietor of sun farms and its second-biggest producer of cement. Adani-owned ports elevate nearly part the rustic’s delivery bins, whilst greater than 90 million other people use its airports each and every yr. Adani Team SuccessionThe founders’ sons will take price within the early 2030s Within the wake of the short-seller assault, the conglomerate slashed debt, pared percentage pledges and gained new traders. Then got here an all of a sudden susceptible election win for High Minister Narendra Modi — who is thought of as to be with reference to Gautam — that after once more minimize nearly $45 billion from the conglomerate’s price. Whilst the gang has since rebounded, the outcome additionally re-energized opposition Indian Nationwide Congress chief Rahul Gandhi, who has alleged that Modi “passed over” the country’s assets and infrastructure to Adani. The billionaire has mentioned his companies don’t obtain preferential remedy, however the transferring political surroundings might build up scrutiny of the gang’s executive contracts. “Succession could be very, essential for the trade sustainability,” Gautam mentioned in his Sixteenth-floor place of business on the workforce’s Ahmedabad headquarters. “I left the selection to the second one technology because the transition should be natural, sluggish and really systematic.”That handover should take care of ongoing questions following Hindenburg, perceptions of key-man possibility round Gautam, the maze of entities and trusts that dangle the circle of relatives’s corporate shareholdings — and the complexities thrown up through the succession plan itself.When Gautam’s sons, Karan (37) and Jeet (26), and their cousins, Pranav (45) and Sagar (30), got here again to the patriarch, they advised him they sought after to run the conglomerate in combination as a circle of relatives, even after Gautam’s departure. That solution set in movement a sequence of strikes, a lot of that have escaped public consideration, such because the introduction of a four-way management construction that splits control of the companies however calls for the heirs to paintings in combination. Their spaces of duty don’t smartly align with particular devices or indexed entities. Even not unusual services and products around the workforce — equivalent to human assets, finance and IT toughen — were carved up a number of the 4.When the founder does step again, the joint decision-making will proceed, the Adani kids mentioned in separate interviews — even within the tournament of a disaster or a big strategic name. The scions disregarded questions in regards to the problem of collective decision-making. “Although each and every folks are having a look at other companies, we’re like one group,” Pranav mentioned. “The members of the family who’re in headquarters have lunch in combination on a daily basis, the place day by day problems are mentioned.”However with none formal hierarchy, trade control will nearly unquestionably be checking out and time-consuming. Managing a limiteless pool of dynastic wealth is an awfully tricky factor to do effectively, and few households have succeeded over more than one generations. The Waltons, house owners of US retail behemoth Walmart Inc., have succeeded through keeping board-level oversight. A Koch sibling feud ended in a failed boardroom coup within the Eighties and years of litigation. And India’s Ambani circle of relatives was once ripped aside through the succession struggle between Mukesh — now Asia’s richest guy — and his brother Anil. “Having no transparent chief a number of the 4 who can take key selections may just grow to be an obstacle,” mentioned Raphael Amit, Professor of Control on the Wharton College. “For this to paintings there want to be obviously laid-out processes for struggle solution and well-defined roles.”Upward push and Fall and RiseA short-seller assault and an election setback have disrupted the Adani Team’s meteoric expansion

Within the wake of the short-seller assault, the conglomerate slashed debt, pared percentage pledges and gained new traders. Then got here an all of a sudden susceptible election win for High Minister Narendra Modi — who is thought of as to be with reference to Gautam — that after once more minimize nearly $45 billion from the conglomerate’s price. Whilst the gang has since rebounded, the outcome additionally re-energized opposition Indian Nationwide Congress chief Rahul Gandhi, who has alleged that Modi “passed over” the country’s assets and infrastructure to Adani. The billionaire has mentioned his companies don’t obtain preferential remedy, however the transferring political surroundings might build up scrutiny of the gang’s executive contracts. “Succession could be very, essential for the trade sustainability,” Gautam mentioned in his Sixteenth-floor place of business on the workforce’s Ahmedabad headquarters. “I left the selection to the second one technology because the transition should be natural, sluggish and really systematic.”That handover should take care of ongoing questions following Hindenburg, perceptions of key-man possibility round Gautam, the maze of entities and trusts that dangle the circle of relatives’s corporate shareholdings — and the complexities thrown up through the succession plan itself.When Gautam’s sons, Karan (37) and Jeet (26), and their cousins, Pranav (45) and Sagar (30), got here again to the patriarch, they advised him they sought after to run the conglomerate in combination as a circle of relatives, even after Gautam’s departure. That solution set in movement a sequence of strikes, a lot of that have escaped public consideration, such because the introduction of a four-way management construction that splits control of the companies however calls for the heirs to paintings in combination. Their spaces of duty don’t smartly align with particular devices or indexed entities. Even not unusual services and products around the workforce — equivalent to human assets, finance and IT toughen — were carved up a number of the 4.When the founder does step again, the joint decision-making will proceed, the Adani kids mentioned in separate interviews — even within the tournament of a disaster or a big strategic name. The scions disregarded questions in regards to the problem of collective decision-making. “Although each and every folks are having a look at other companies, we’re like one group,” Pranav mentioned. “The members of the family who’re in headquarters have lunch in combination on a daily basis, the place day by day problems are mentioned.”However with none formal hierarchy, trade control will nearly unquestionably be checking out and time-consuming. Managing a limiteless pool of dynastic wealth is an awfully tricky factor to do effectively, and few households have succeeded over more than one generations. The Waltons, house owners of US retail behemoth Walmart Inc., have succeeded through keeping board-level oversight. A Koch sibling feud ended in a failed boardroom coup within the Eighties and years of litigation. And India’s Ambani circle of relatives was once ripped aside through the succession struggle between Mukesh — now Asia’s richest guy — and his brother Anil. “Having no transparent chief a number of the 4 who can take key selections may just grow to be an obstacle,” mentioned Raphael Amit, Professor of Control on the Wharton College. “For this to paintings there want to be obviously laid-out processes for struggle solution and well-defined roles.”Upward push and Fall and RiseA short-seller assault and an election setback have disrupted the Adani Team’s meteoric expansion Be aware: Knowledge as of August 1. Power firms come with Adani Energy, Adani Inexperienced, Adani Power Answers and Adani General Fuel; Cement firms come with ACC and Ambuja Cements; Others come with New Delhi Tv and Adani Wilmar. Supply: Knowledge compiled through BloombergFew outdoor the Adani circle of relatives totally perceive the empire’s underlying construction. Its flagship corporate, Adani Enterprises Ltd., is managed through the circle of relatives thru 8 out of the country entities, a circle of relatives consider and a locally included corporate. The wider workforce is a internet of particular goal cars, joint ventures with more than a few executive businesses and corporations during which companies are run.When Gautam retires, his 4 heirs will transform equivalent beneficiaries of the circle of relatives consider, consistent with the scions. Such constructions are ceaselessly utilized by the ultra-rich, and assist to stay trade main points non-public, to restrict tax liabilities, and to offer protection to property from judicial or executive crackdowns through hanging them in numerous jurisdictions. A confidential settlement will dictate the transition of stakes within the conglomerate’s companies to the heirs, other people accustomed to the subject mentioned. “Switch of control and wealth throughout generations for a bunch like Adani will likely be complicated and a time-drawn procedure,” mentioned Nirmalya Kumar, a professor at Singapore Control College’s Lee Kong Chian trade faculty. “How they’re conserving and controlling the wealth is a black field.”Alternatively, Karan says corporate constructions were simplified during the last 15 years to steer clear of the “criss-cross holdings” present in different Indian conglomerates. The adjustments were disclosed in public filings and the circle of relatives now holds its stakes in each and every trade immediately, he mentioned.

Be aware: Knowledge as of August 1. Power firms come with Adani Energy, Adani Inexperienced, Adani Power Answers and Adani General Fuel; Cement firms come with ACC and Ambuja Cements; Others come with New Delhi Tv and Adani Wilmar. Supply: Knowledge compiled through BloombergFew outdoor the Adani circle of relatives totally perceive the empire’s underlying construction. Its flagship corporate, Adani Enterprises Ltd., is managed through the circle of relatives thru 8 out of the country entities, a circle of relatives consider and a locally included corporate. The wider workforce is a internet of particular goal cars, joint ventures with more than a few executive businesses and corporations during which companies are run.When Gautam retires, his 4 heirs will transform equivalent beneficiaries of the circle of relatives consider, consistent with the scions. Such constructions are ceaselessly utilized by the ultra-rich, and assist to stay trade main points non-public, to restrict tax liabilities, and to offer protection to property from judicial or executive crackdowns through hanging them in numerous jurisdictions. A confidential settlement will dictate the transition of stakes within the conglomerate’s companies to the heirs, other people accustomed to the subject mentioned. “Switch of control and wealth throughout generations for a bunch like Adani will likely be complicated and a time-drawn procedure,” mentioned Nirmalya Kumar, a professor at Singapore Control College’s Lee Kong Chian trade faculty. “How they’re conserving and controlling the wealth is a black field.”Alternatively, Karan says corporate constructions were simplified during the last 15 years to steer clear of the “criss-cross holdings” present in different Indian conglomerates. The adjustments were disclosed in public filings and the circle of relatives now holds its stakes in each and every trade immediately, he mentioned.

Karan Adani on a website consult with to Mundra Port with one of the crucial port’s group of workers in Would possibly. Karan oversees companies together with cement, ports and logistics, and could also be in control of human assets.Photographer: Sumit Dayal/BloombergMundra Port. Adani-owned ports elevate nearly part the rustic’s delivery bins.Photographer: Sumit Dayal/BloombergOne of the nearest fashions for the Adani succession plan is that of luxurious massive LVMH Moet Hennessy Louis Vuitton SE. Each and every of billionaire Bernard Arnault’s 5 kids has an equivalent stake in a brand new conserving corporate. Arnault, like Adani, has no longer mentioned who will be successful him as chairman.The Adani wealth switch comprises a fair wider circle of circle of relatives — nephews in addition to sons. That’s in step with the gang’s origins. In 1988, Gautam arrange a commodity buying and selling corporate along with his brothers Vinod and Rajesh — the fathers of Pranav and Sagar, respectively — then expanded into ports, airports, coal and tool. Over the last couple of many years, the gang has grown the world over too, with pursuits that come with an Israeli hands production deal and a mining challenge in Australia, amongst others.“All 4 folks instinctively knew that we’d have to stick in combination as we grew up seeing our fathers operating in combination,” mentioned Jeet, who was once nonetheless in faculty on the time of the verdict.Alternatively, the first-generation Adanis have no longer introduced their daughters into the trade. It’s a notable absence: Many Indian tycoons — together with Mukesh Ambani — now appoint their daughters to senior company positions. “We aren’t some of the very best in gender variety, in part to do with the type of places that we’re in and in part because of the type of companies,” mentioned Karan, who’s in control of human assets. In Adani’s ports trade, for instance, handiest 3% of workers are ladies. “I’m no longer announcing it’s unattainable to carry extra ladies into our team of workers, but it surely has been difficult. We need to stay pushing on it.” His personal younger daughters can ceaselessly be noticed toddling across the place of business, and he expects them to sign up for the conglomerate at some point.

Karan Adani on a website consult with to Mundra Port with one of the crucial port’s group of workers in Would possibly. Karan oversees companies together with cement, ports and logistics, and could also be in control of human assets.Photographer: Sumit Dayal/BloombergMundra Port. Adani-owned ports elevate nearly part the rustic’s delivery bins.Photographer: Sumit Dayal/BloombergOne of the nearest fashions for the Adani succession plan is that of luxurious massive LVMH Moet Hennessy Louis Vuitton SE. Each and every of billionaire Bernard Arnault’s 5 kids has an equivalent stake in a brand new conserving corporate. Arnault, like Adani, has no longer mentioned who will be successful him as chairman.The Adani wealth switch comprises a fair wider circle of circle of relatives — nephews in addition to sons. That’s in step with the gang’s origins. In 1988, Gautam arrange a commodity buying and selling corporate along with his brothers Vinod and Rajesh — the fathers of Pranav and Sagar, respectively — then expanded into ports, airports, coal and tool. Over the last couple of many years, the gang has grown the world over too, with pursuits that come with an Israeli hands production deal and a mining challenge in Australia, amongst others.“All 4 folks instinctively knew that we’d have to stick in combination as we grew up seeing our fathers operating in combination,” mentioned Jeet, who was once nonetheless in faculty on the time of the verdict.Alternatively, the first-generation Adanis have no longer introduced their daughters into the trade. It’s a notable absence: Many Indian tycoons — together with Mukesh Ambani — now appoint their daughters to senior company positions. “We aren’t some of the very best in gender variety, in part to do with the type of places that we’re in and in part because of the type of companies,” mentioned Karan, who’s in control of human assets. In Adani’s ports trade, for instance, handiest 3% of workers are ladies. “I’m no longer announcing it’s unattainable to carry extra ladies into our team of workers, but it surely has been difficult. We need to stay pushing on it.” His personal younger daughters can ceaselessly be noticed toddling across the place of business, and he expects them to sign up for the conglomerate at some point.

Jeet Adani, at a gathering with senior executives within the airport trade unit on the workforce’s headquarters in Would possibly. Jeet oversees India’s best community of privately operated airports, in addition to the gang’s protection arm and virtual companies.Photographer: Sumit Dayal/BloombergThe Chhatrapati Shivaji Maharaj Global Airport in Mumbai. Greater than 90 million other people use Adani airports each and every yr.Photographer: Sumit Dayal/BloombergBy the factors of rich Indian scions, the US-educated Adani heirs stay a low profile. They’re hardly ever noticed at the cocktail circuits of Delhi or Mumbai, and often pull 100-hour weeks, consistent with officers they paintings with.Pranav, the eldest, joined the gang in 1999. He now oversees maximum of its client companies, together with client items, gasoline distribution, media and actual property. His obligations additionally come with communications, and of the scions, he did the heaviest lifting across the Hindenburg disaster. “We weren’t speaking the way in which we will have to have. So now we’re going out and speaking” to stakeholders and the media, Pranav mentioned. The 100-odd member communications group has been restructured and strengthened, in an try to higher set up the gang’s narrative.Pranav has an urge for food for possibility, consistent with other people accustomed to the subject. On a minimum of two events, he has changed senior executives who recommended him in opposition to bidding for enormous realty and gasoline distribution initiatives, they mentioned. It’ll be years earlier than returns demonstrate whether or not the ones bets have been proper. Of the 4 heirs, he delegates essentially the most to skilled leader government officials, consistent with senior officers he works with.He’s additionally operating some of the workforce’s trickiest and maximum high-profile initiatives: redeveloping Dharavi, Asia’s biggest slum. A number of different builders have failed to tug off the duty, which incorporates relocating about one million other people, and a political birthday party towards Modi has vowed to halt the challenge if it involves energy in state elections due this yr. If a hit, Pranav may just unencumber the potential for a limiteless tract of land sandwiched between an airport Adani already operates and town’s primary monetary district. If he fails, the gang dangers huge monetary losses and the in poor health will of tough politicians.

Jeet Adani, at a gathering with senior executives within the airport trade unit on the workforce’s headquarters in Would possibly. Jeet oversees India’s best community of privately operated airports, in addition to the gang’s protection arm and virtual companies.Photographer: Sumit Dayal/BloombergThe Chhatrapati Shivaji Maharaj Global Airport in Mumbai. Greater than 90 million other people use Adani airports each and every yr.Photographer: Sumit Dayal/BloombergBy the factors of rich Indian scions, the US-educated Adani heirs stay a low profile. They’re hardly ever noticed at the cocktail circuits of Delhi or Mumbai, and often pull 100-hour weeks, consistent with officers they paintings with.Pranav, the eldest, joined the gang in 1999. He now oversees maximum of its client companies, together with client items, gasoline distribution, media and actual property. His obligations additionally come with communications, and of the scions, he did the heaviest lifting across the Hindenburg disaster. “We weren’t speaking the way in which we will have to have. So now we’re going out and speaking” to stakeholders and the media, Pranav mentioned. The 100-odd member communications group has been restructured and strengthened, in an try to higher set up the gang’s narrative.Pranav has an urge for food for possibility, consistent with other people accustomed to the subject. On a minimum of two events, he has changed senior executives who recommended him in opposition to bidding for enormous realty and gasoline distribution initiatives, they mentioned. It’ll be years earlier than returns demonstrate whether or not the ones bets have been proper. Of the 4 heirs, he delegates essentially the most to skilled leader government officials, consistent with senior officers he works with.He’s additionally operating some of the workforce’s trickiest and maximum high-profile initiatives: redeveloping Dharavi, Asia’s biggest slum. A number of different builders have failed to tug off the duty, which incorporates relocating about one million other people, and a political birthday party towards Modi has vowed to halt the challenge if it involves energy in state elections due this yr. If a hit, Pranav may just unencumber the potential for a limiteless tract of land sandwiched between an airport Adani already operates and town’s primary monetary district. If he fails, the gang dangers huge monetary losses and the in poor health will of tough politicians.

Pranav Adani in Mumbai in Would possibly. Pranav oversees many of the workforce’s client companies, together with client items, gasoline distribution, media and actual property.Photographer: Sumit Dayal/BloombergA website consult with to Dharavi in Mumbai. Pranav is operating some of the workforce’s trickiest and maximum high-profile initiatives: redeveloping Asia’s biggest slum.Photographer: Sumit Dayal/BloombergKaran, Adani’s elder son, is overseeing companies together with cement, ports and logistics. They’re one of the crucial workforce’s maximum established devices, and amongst the ones with the steadiest money flows. The ports trade attracted complaint from Hindenburg for its excessive turnover of leader monetary officials, despite the fact that the position has now been solid since 2022. The unit is having a look to enlarge its community and is noticed as an extension of India’s strategic priorities, growing ports in Vietnam, Israel and a US-funded port in Sri Lanka that seeks to unseat China’s regional dominance. “The transparent precedence is that we stay increasing no longer simply inside of India, but in addition into our neighboring international locations,” Karan mentioned. “Through 2030, we need to be dealing with a minimum of a thousand million tonne of quantity.” He sees India as a possible choice to Dubai or Singapore, “the middle level of the entire provide chain from east to west.” Pranav and Karan are the obvious applicants to in the end take over as chairman. Alternatively, they are saying there aren’t any plans for both to take price.Sagar, Gautam’s more youthful nephew, oversees the gang’s calories trade, in addition to finance. He has a easy pitch for potential traders: “An infrastructure portfolio of our dimension, our type and expansion price doesn’t exist anyplace else on the earth.”Sagar could also be operating on bettering analyst protection, which is scant for many of the conglomerate’s companies. That’s extremely bizarre for such huge companies, and Hindenburg alleged brokerages had made a mindful selection to not quilt them.“Analysts haven’t noticed such scale and fast enlargement in infrastructure platforms anyplace else,” Sagar mentioned. As well as, “our goal traders are ones that take a look at a 10-year horizon, 20-year horizon” — time frames that analysts in India have no longer traditionally coated, he mentioned. “We’re enticing extra with them to assist them perceive this.”The Adani calories trade spans from coal to solar energy and can guzzle up a minimum of $100 billion in capital expenditure over the following 10 years. Hindenburg famous indicators of “momentary liquidity possibility” in one of the crucial workforce’s indexed calories devices. The crowd’s cashflows are sufficiently big to hide its expenditure if it comes to a decision to take action, Sagar mentioned. The circle of relatives will restrict additional funding in fossil fuels and take measures to segment out thermal energy technology consistent with the federal government’s objectives, Sagar mentioned.His plans to capitalize on India’s mounting call for for electrical energy come with development the arena’s biggest renewable calories park through 2030, filling a space 5 occasions the scale of Paris with sun panels and wind generators. Lots of the apparatus lately must be sourced from China, whose dating with India is ceaselessly rocky. “We’re putting in our production ecosystem in order that a majority of what we use in our crops is manufactured locally. In 18 to 24 months we can be utterly self-reliant,” Sagar mentioned.

Pranav Adani in Mumbai in Would possibly. Pranav oversees many of the workforce’s client companies, together with client items, gasoline distribution, media and actual property.Photographer: Sumit Dayal/BloombergA website consult with to Dharavi in Mumbai. Pranav is operating some of the workforce’s trickiest and maximum high-profile initiatives: redeveloping Asia’s biggest slum.Photographer: Sumit Dayal/BloombergKaran, Adani’s elder son, is overseeing companies together with cement, ports and logistics. They’re one of the crucial workforce’s maximum established devices, and amongst the ones with the steadiest money flows. The ports trade attracted complaint from Hindenburg for its excessive turnover of leader monetary officials, despite the fact that the position has now been solid since 2022. The unit is having a look to enlarge its community and is noticed as an extension of India’s strategic priorities, growing ports in Vietnam, Israel and a US-funded port in Sri Lanka that seeks to unseat China’s regional dominance. “The transparent precedence is that we stay increasing no longer simply inside of India, but in addition into our neighboring international locations,” Karan mentioned. “Through 2030, we need to be dealing with a minimum of a thousand million tonne of quantity.” He sees India as a possible choice to Dubai or Singapore, “the middle level of the entire provide chain from east to west.” Pranav and Karan are the obvious applicants to in the end take over as chairman. Alternatively, they are saying there aren’t any plans for both to take price.Sagar, Gautam’s more youthful nephew, oversees the gang’s calories trade, in addition to finance. He has a easy pitch for potential traders: “An infrastructure portfolio of our dimension, our type and expansion price doesn’t exist anyplace else on the earth.”Sagar could also be operating on bettering analyst protection, which is scant for many of the conglomerate’s companies. That’s extremely bizarre for such huge companies, and Hindenburg alleged brokerages had made a mindful selection to not quilt them.“Analysts haven’t noticed such scale and fast enlargement in infrastructure platforms anyplace else,” Sagar mentioned. As well as, “our goal traders are ones that take a look at a 10-year horizon, 20-year horizon” — time frames that analysts in India have no longer traditionally coated, he mentioned. “We’re enticing extra with them to assist them perceive this.”The Adani calories trade spans from coal to solar energy and can guzzle up a minimum of $100 billion in capital expenditure over the following 10 years. Hindenburg famous indicators of “momentary liquidity possibility” in one of the crucial workforce’s indexed calories devices. The crowd’s cashflows are sufficiently big to hide its expenditure if it comes to a decision to take action, Sagar mentioned. The circle of relatives will restrict additional funding in fossil fuels and take measures to segment out thermal energy technology consistent with the federal government’s objectives, Sagar mentioned.His plans to capitalize on India’s mounting call for for electrical energy come with development the arena’s biggest renewable calories park through 2030, filling a space 5 occasions the scale of Paris with sun panels and wind generators. Lots of the apparatus lately must be sourced from China, whose dating with India is ceaselessly rocky. “We’re putting in our production ecosystem in order that a majority of what we use in our crops is manufactured locally. In 18 to 24 months we can be utterly self-reliant,” Sagar mentioned.

Sagar Adani in his place of business in Ahmedabad in Would possibly. Sagar oversees the gang’s calories trade, in addition to finance.Photographer: Sumit Dayal/BloombergSagar’s plans to capitalize on India’s mounting call for for electrical energy come with development the arena’s biggest renewable calories park through 2030, filling a space 5 occasions the scale of Paris with sun panels and wind generators.Photographer: Sumit Dayal/BloombergGautam’s more youthful son Jeet, the circle of relatives’s handiest skilled engineer, is having a look after India’s best community of privately operated airports. He’s additionally in control of the gang’s virtual companies and its protection arm, which makes apparatus starting from small hands to missiles. “Protection has an enormous scope for total building and virtual is also a key house for us,” Jeet mentioned.Interviews with Gautam and the opposite Adanis, in addition to body of workers throughout the conglomerate and trade friends — a few of whom requested to stick nameless to talk freely in regards to the tough circle of relatives — disclose an old-school Indian father, mentor and boss, who’s ceaselessly nonetheless at paintings at 2 a.m. His place of business incorporates 3 telephones, however maximum communique is available in on four-inch slips of white paper that he tears up after studying. The billionaire is as tough of his proteges as every other workforce CEO, consistent with other people accustomed to the subject. In 2022, Gautam took Karan to job in entrance of different executives over an sudden $11 million quarterly loss at ACC Ltd. and demanded that he spend extra time at the cement trade, officers who have been provide mentioned. Previous this yr he pulled up Jeet in a gathering for the gradual tempo of the gang’s virtual plans, consistent with the officers. Following the comments, Karan began to delegate extra of his ports obligations in an effort to oversee the cement devices extra carefully. Jeet tweaked the gang’s virtual methods and remodeled the marketing strategy for its superapp, Adani One.“Every time a mistake is noticed it will get corrected in actual time,” Gautam mentioned.Regardless of the gang’s blockbuster ambitions, the hazards highlighted through Hindenburg and the USA bribery probe nonetheless grasp over the Adanis. India’s markets regulator, Sebi, has issued a minimum of six Adani firms with show-cause notices — formal paperwork outlining allegations of non-compliance.In January, India’s Excellent Court docket concluded not more investigations have been wanted and gave the regulator 3 months to wrap up its current probes. In June, Sebi issued Hindenburg with its personal show-cause realize, announcing the quick vendor had didn’t abide through Indian laws and had “offered sure inferences within the Hindenburg Record in keeping with deceptive statements, making a sensational document with a extra sure destructive affect than would were conceivable with an easy narration of info.” Hindenburg posted an competitive rebuttal on its web site, describing the attention as “an try to silence and intimidate those that divulge corruption and fraud perpetrated through essentially the most tough folks in India.” Sebi didn’t reply to a request for remark.The questions raised within the Hindenburg document have prior to now been addressed in public disclosures, “if it is in our annual document, if it is in our bond issuance or if it is in any of our IPOs,” mentioned Karan. “The place the problem would come is that if, as a bunch, we had no longer disclosed.”

Sagar Adani in his place of business in Ahmedabad in Would possibly. Sagar oversees the gang’s calories trade, in addition to finance.Photographer: Sumit Dayal/BloombergSagar’s plans to capitalize on India’s mounting call for for electrical energy come with development the arena’s biggest renewable calories park through 2030, filling a space 5 occasions the scale of Paris with sun panels and wind generators.Photographer: Sumit Dayal/BloombergGautam’s more youthful son Jeet, the circle of relatives’s handiest skilled engineer, is having a look after India’s best community of privately operated airports. He’s additionally in control of the gang’s virtual companies and its protection arm, which makes apparatus starting from small hands to missiles. “Protection has an enormous scope for total building and virtual is also a key house for us,” Jeet mentioned.Interviews with Gautam and the opposite Adanis, in addition to body of workers throughout the conglomerate and trade friends — a few of whom requested to stick nameless to talk freely in regards to the tough circle of relatives — disclose an old-school Indian father, mentor and boss, who’s ceaselessly nonetheless at paintings at 2 a.m. His place of business incorporates 3 telephones, however maximum communique is available in on four-inch slips of white paper that he tears up after studying. The billionaire is as tough of his proteges as every other workforce CEO, consistent with other people accustomed to the subject. In 2022, Gautam took Karan to job in entrance of different executives over an sudden $11 million quarterly loss at ACC Ltd. and demanded that he spend extra time at the cement trade, officers who have been provide mentioned. Previous this yr he pulled up Jeet in a gathering for the gradual tempo of the gang’s virtual plans, consistent with the officers. Following the comments, Karan began to delegate extra of his ports obligations in an effort to oversee the cement devices extra carefully. Jeet tweaked the gang’s virtual methods and remodeled the marketing strategy for its superapp, Adani One.“Every time a mistake is noticed it will get corrected in actual time,” Gautam mentioned.Regardless of the gang’s blockbuster ambitions, the hazards highlighted through Hindenburg and the USA bribery probe nonetheless grasp over the Adanis. India’s markets regulator, Sebi, has issued a minimum of six Adani firms with show-cause notices — formal paperwork outlining allegations of non-compliance.In January, India’s Excellent Court docket concluded not more investigations have been wanted and gave the regulator 3 months to wrap up its current probes. In June, Sebi issued Hindenburg with its personal show-cause realize, announcing the quick vendor had didn’t abide through Indian laws and had “offered sure inferences within the Hindenburg Record in keeping with deceptive statements, making a sensational document with a extra sure destructive affect than would were conceivable with an easy narration of info.” Hindenburg posted an competitive rebuttal on its web site, describing the attention as “an try to silence and intimidate those that divulge corruption and fraud perpetrated through essentially the most tough folks in India.” Sebi didn’t reply to a request for remark.The questions raised within the Hindenburg document have prior to now been addressed in public disclosures, “if it is in our annual document, if it is in our bond issuance or if it is in any of our IPOs,” mentioned Karan. “The place the problem would come is that if, as a bunch, we had no longer disclosed.”

Sagar, Jeet, Pranav and Karan at Adani Team headquarters in Would possibly. Photographer: Sumit Dayal/BloombergAll 4 heirs say possibility containment has been a larger focal point following the Hindenburg allegations, and recognize that expansion will likely be extra calibrated after they take over.“If we proceed to run the companies in the similar way and in the similar taste that Gautam Adani did, with the similar roughly possibility urge for food, we can almost certainly fail,” mentioned Jeet. “We’re that specialize in getting the proper skilled skill, managing them effectively and bettering possibility control.” Whilst the infrastructure alternatives in India are monumental — Morgan Stanley predicts that the rustic will pressure a 5th of the arena’s financial enlargement this decade — the heirs are more likely to want all of the trade acuity they are able to muster. Gautam Adani says his 4 heirs will ship. “I’m satisfied that every one of them are hungry for expansion, which isn’t not unusual in the second one technology,” he mentioned. “They’ve to paintings in combination to construct a legacy.”Extra On Bloomberg

Sagar, Jeet, Pranav and Karan at Adani Team headquarters in Would possibly. Photographer: Sumit Dayal/BloombergAll 4 heirs say possibility containment has been a larger focal point following the Hindenburg allegations, and recognize that expansion will likely be extra calibrated after they take over.“If we proceed to run the companies in the similar way and in the similar taste that Gautam Adani did, with the similar roughly possibility urge for food, we can almost certainly fail,” mentioned Jeet. “We’re that specialize in getting the proper skilled skill, managing them effectively and bettering possibility control.” Whilst the infrastructure alternatives in India are monumental — Morgan Stanley predicts that the rustic will pressure a 5th of the arena’s financial enlargement this decade — the heirs are more likely to want all of the trade acuity they are able to muster. Gautam Adani says his 4 heirs will ship. “I’m satisfied that every one of them are hungry for expansion, which isn’t not unusual in the second one technology,” he mentioned. “They’ve to paintings in combination to construct a legacy.”Extra On Bloomberg

Adani Unveils $212 Billion Succession Plan as Scrutiny Persists