![]()

![]()

contributor

Posted: November 30, 2024

AI cash have reached a file $42.19 billion in mixed marketplace cap, fueled via Nvidia’s “better-than-expected” file.

Alternatively, demanding situations loom, signaling a doubtlessly unstable yr forward for AI cash.

Nvidia’s spectacular third-quarter profits of $35.1 billion have made waves throughout each the tech and crypto sectors, sparking a surge in Synthetic Intelligence-related cryptocurrencies.

This stellar efficiency has pushed the AI crypto marketplace to new heights, with the mixed marketplace cap of AI tokens hitting a file $42.19 billion.

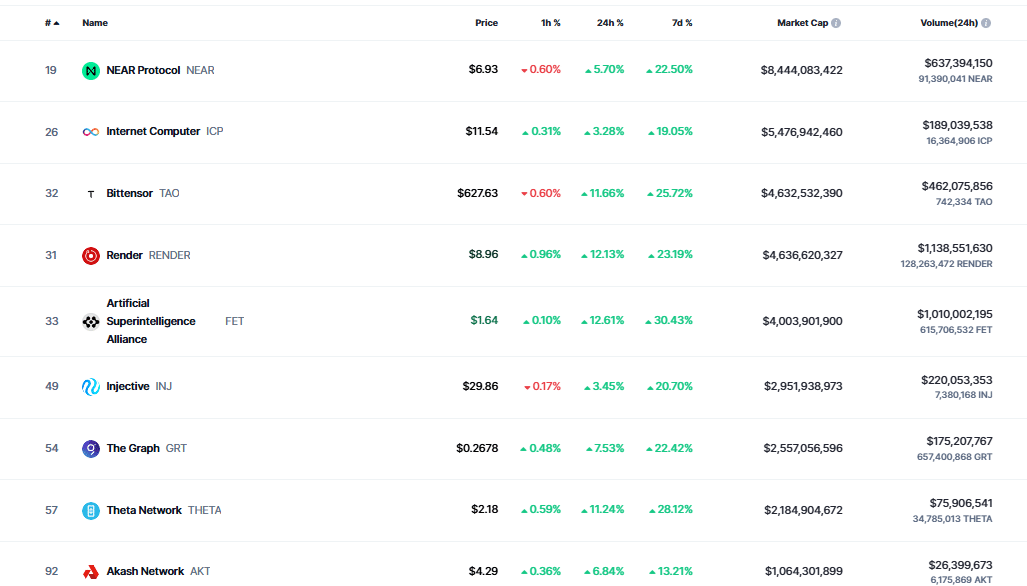

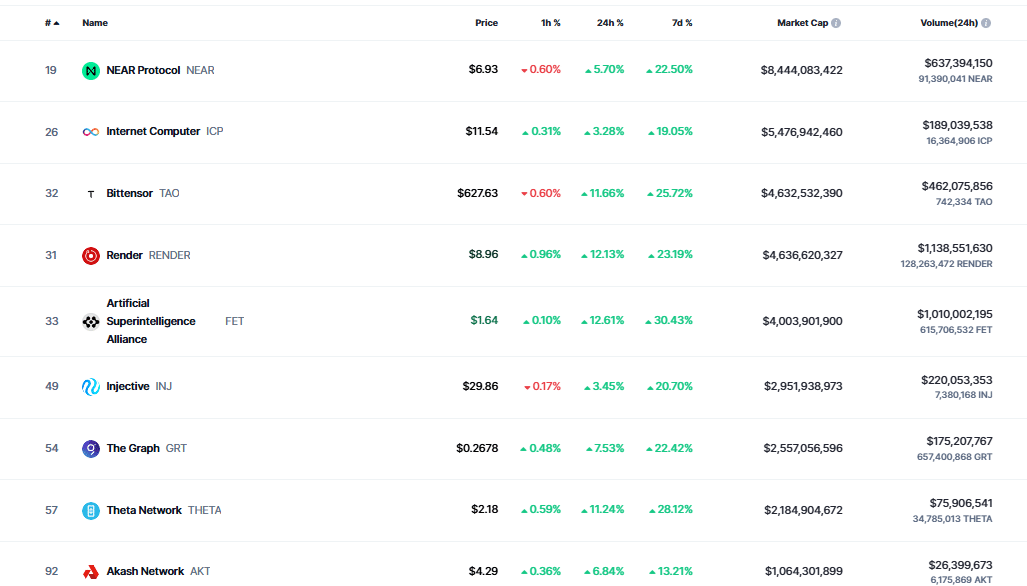

As Nvidia leads the AI revolution, tokens like NEAR Protocol, Web Laptop, and Bittensor are benefiting. Those tokens are posting really extensive double-digit positive factors.

AI cash poised for explosive enlargement

Supply: CoinMarketCap

Supply: CoinMarketCap

The timing aligns with an already bullish marketplace sentiment, as Bitcoin reclaims the $97K vary, pushing altcoins into the golf green.

AI cash have carved out a powerful area of interest, with the biggest AI-focused token nearing a $9 billion marketplace cap, outperforming many competition.

This momentum is anticipated to proceed. Nvidia CEO Jensen Huang highlighted surging call for for the Blackwell chip, signaling more potent efficiency forward.

With predictions of $7 billion in earnings for the following quarter, AI-driven tokens glance poised for vital enlargement.

A key merit for AI cash is their minimum reliance on Bitcoin’s value actions. This reduces their publicity to surprising marketplace swings, making them much less unstable and extra solid.

Alternatively, they aren’t resistant to broader financial demanding situations. Uncertainty surrounding regulatory insurance policies and Trump’s new groundwork for tariff charges may elevate intake prices.

Financial vulnerabilities stay the foremost impediment

The Non-public Intake Expenditures (PCE) value index for October larger via 0.2% month-over-month and a couple of.3% year-over-year, as reported via the U.S. Trade Division on Wednesday.

Following this, the U.S. inventory marketplace skilled a dip, with the S&P 500 finishing a week-long successful streak.

Alternatively, the crypto marketplace remained unfazed, with Bitcoin reclaiming its footing as buyers celebrated this yr’s rally all through Thanksgiving.

In the meantime, the Nasdaq composite dropped as buyers took income from giant tech shares. Nvidia, then again, bucked the fad, posting a 1.38% acquire in after-hours buying and selling.

In spite of this, the wider financial vulnerabilities impacting the inventory marketplace additionally impact the outlook for AI cash.

Those virtual property, intently related to macroeconomic prerequisites, face expanding dangers as the brand new management strikes ahead with addressing regulatory frameworks.

The marketplace could also be extra vulnerable to volatility within the yr forward, difficult AI cash’ skill to damage resistance and proceed their enlargement trajectory.

Subsequent: Pump.a laugh dumps 65K SOL tokens: How will this have an effect on Solana’s marketplace?