AIOZ breaks key resistance at $1.08, consolidating close to $1.20 with bullish momentum.

Emerging lively addresses and derivatives knowledge sign robust investor self assurance in AIOZ.

The AIOZ Community [AIOZ] token has proven spectacular resilience and energy, keeping up an upward pattern in spite of fluctuating marketplace prerequisites and extending pageant. At press time, AIOZ was once buying and selling at $1.09, reflecting a 1.38% build up during the last 24 hours.

This bullish worth motion aligns with rising investor pastime, as noticed in greater buying and selling quantity and derivatives task. With a upward push in each community engagement and investor self assurance, all eyes are on AIOZ’s subsequent transfer because it consolidates close to key resistance ranges.

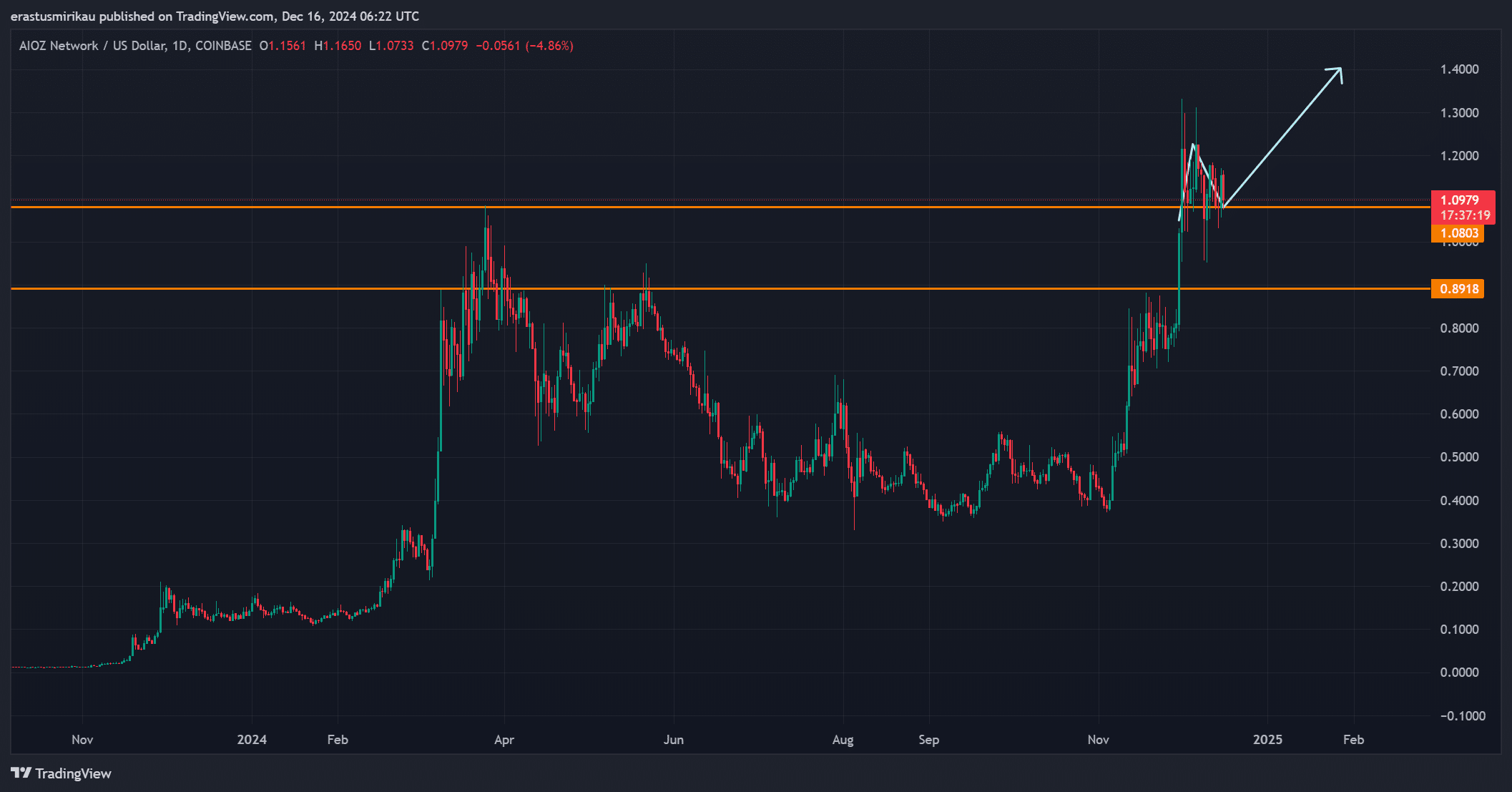

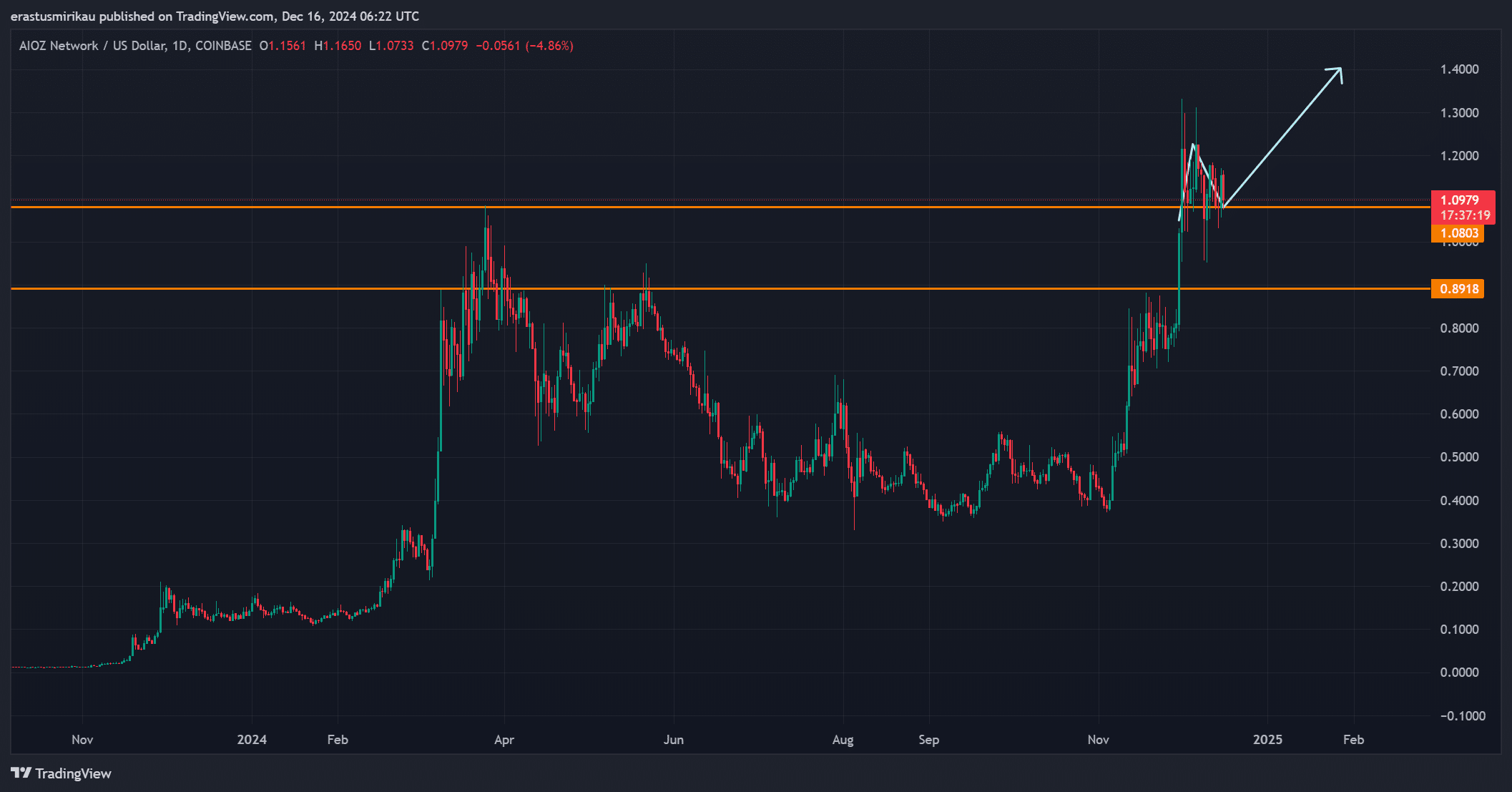

Worth research: Key ranges to look at and long run worth outlook

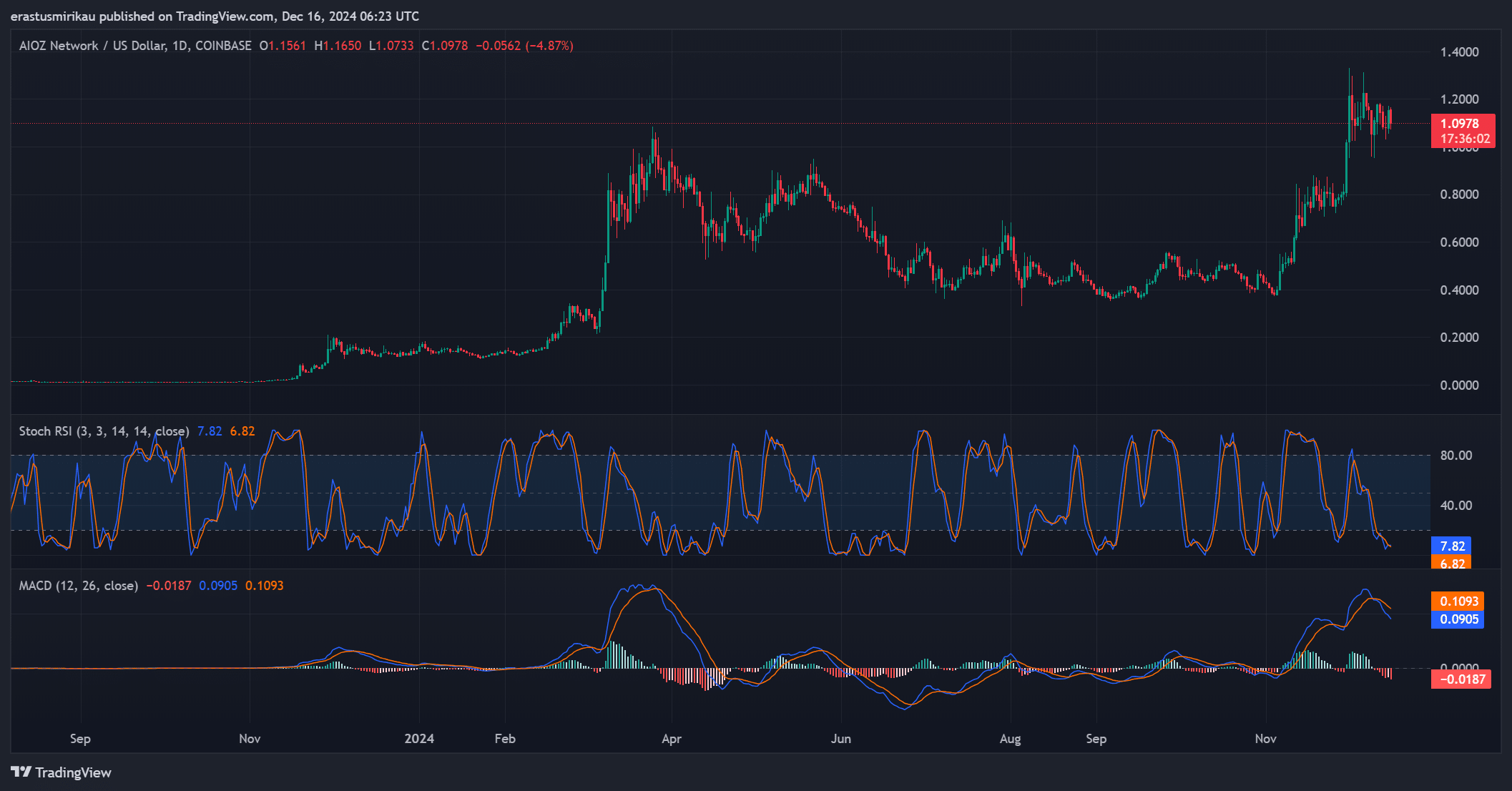

AIOZ has demonstrated spectacular worth motion, breaking above the vital resistance stage at $1.08. This breakout allowed the cost to surge towards $1.20, the place it now consolidates.

On the other hand, keeping up above $1.20 will likely be a very powerful for AIOZ to focus on its subsequent main resistance at $1.40. A failure to carry this stage may lead to a pullback, with $1.08 and $0.89 performing as robust give a boost to zones.

Moreover, the stable upward push in buying and selling quantity highlights rising marketplace participation, suggesting that consumers are nonetheless in keep an eye on. If AIOZ manages to near above $1.20 with vital quantity, it’s going to most likely ascertain the continuation of its bullish pattern, riding costs even upper.

Supply: TradingView

Supply: TradingView

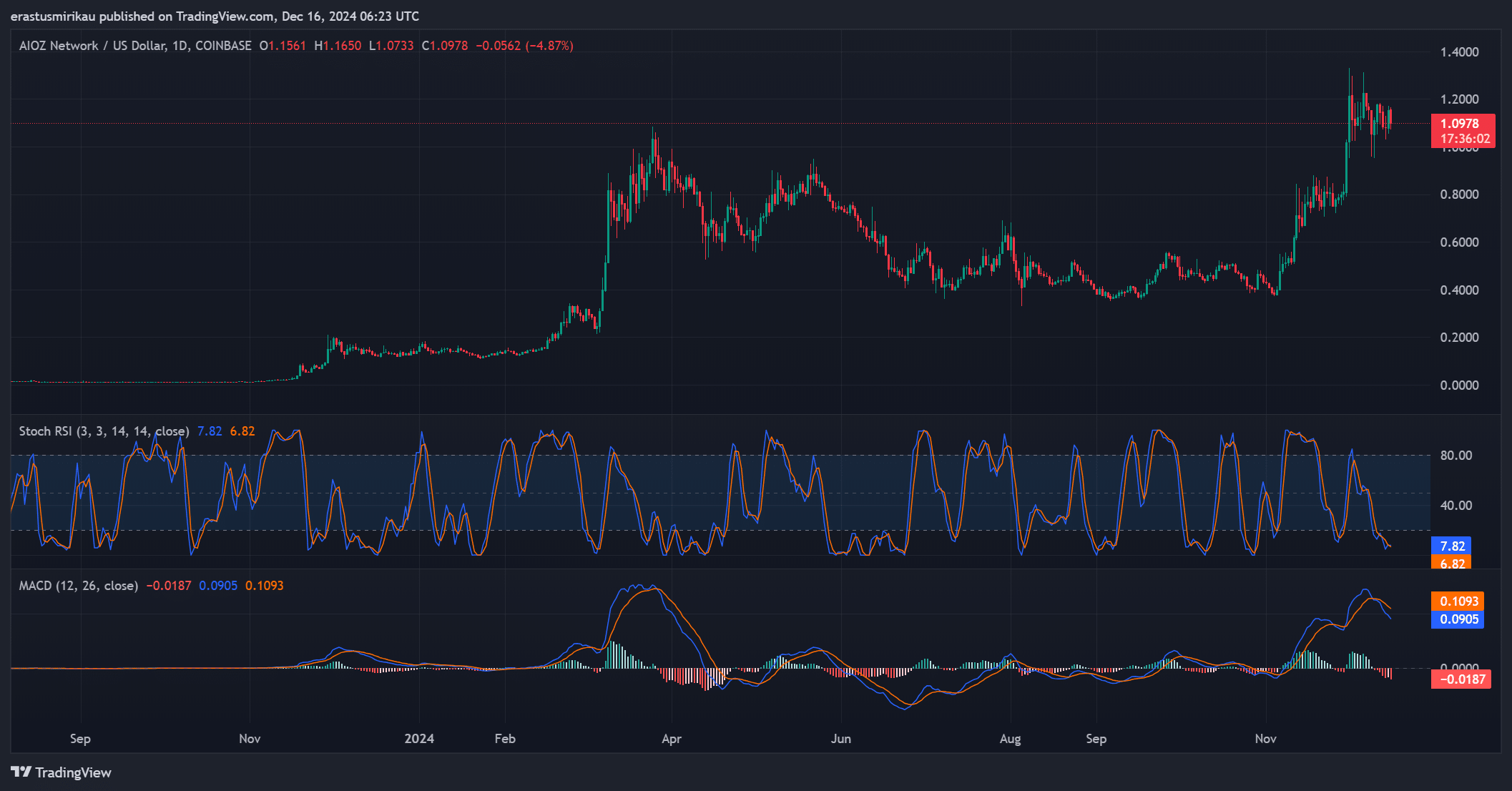

AIOZ technical signs: MACD and STOCH RSI

The technical signs also are offering a good outlook for AIOZ. The MACD stays above the sign line, signaling sustained upward momentum.

On the other hand, the histogram bars display slight weakening, suggesting that the token would possibly input a temporary consolidation section earlier than its subsequent transfer.

In the meantime, the stochastic RSI sits at 7.82 and six.82, striking AIOZ firmly within the oversold zone. This alerts a possible rebound, as patrons are prone to step in quickly. Subsequently, the mix of those signs issues to a powerful risk of persevered upward motion within the quick time period.

Supply: TradingView

Supply: TradingView

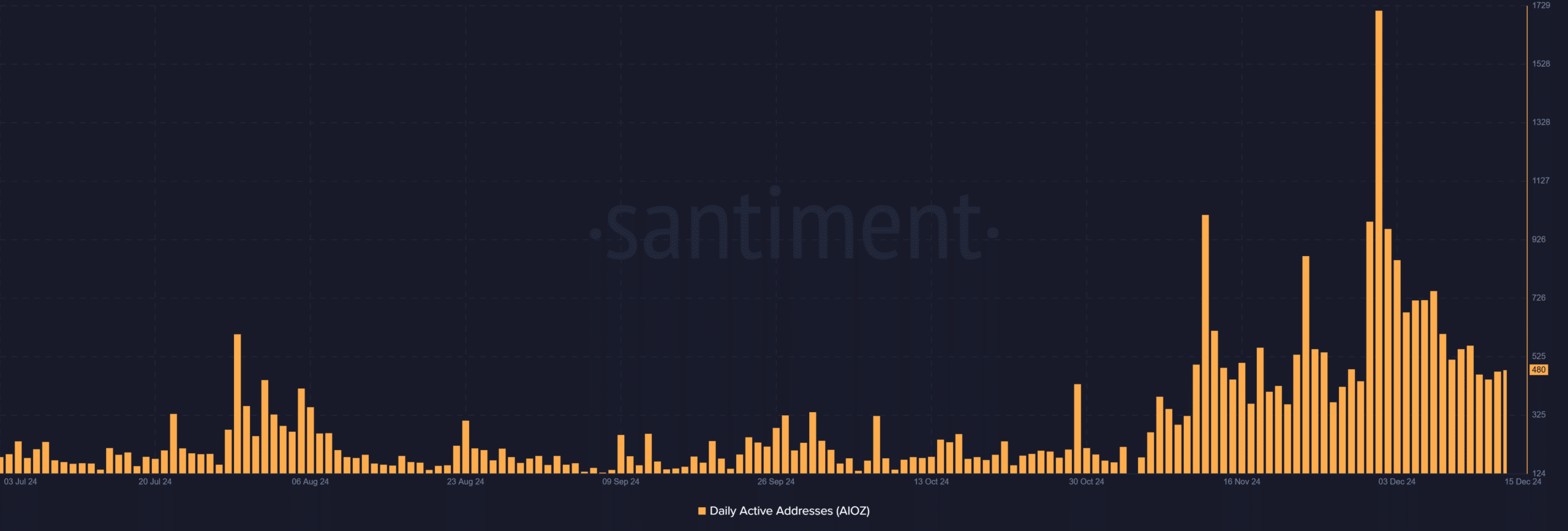

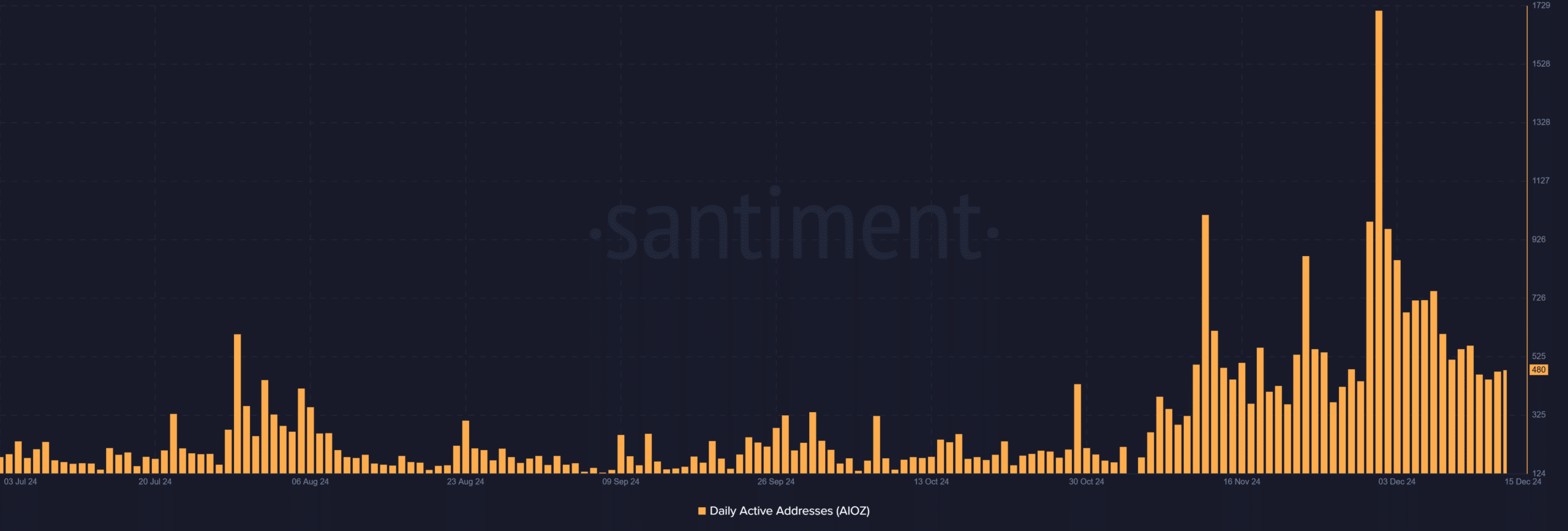

Day-to-day lively addresses: Expanding community task

On-chain task continues to turn energy, additional supporting the cost rally. Day-to-day lively addresses greater to 480, up somewhat from 475 the day before today.

This constant upward push in community utilization displays rising engagement inside the AIOZ ecosystem, crucial issue for long-term adoption.

Supply: Santiment

Supply: Santiment

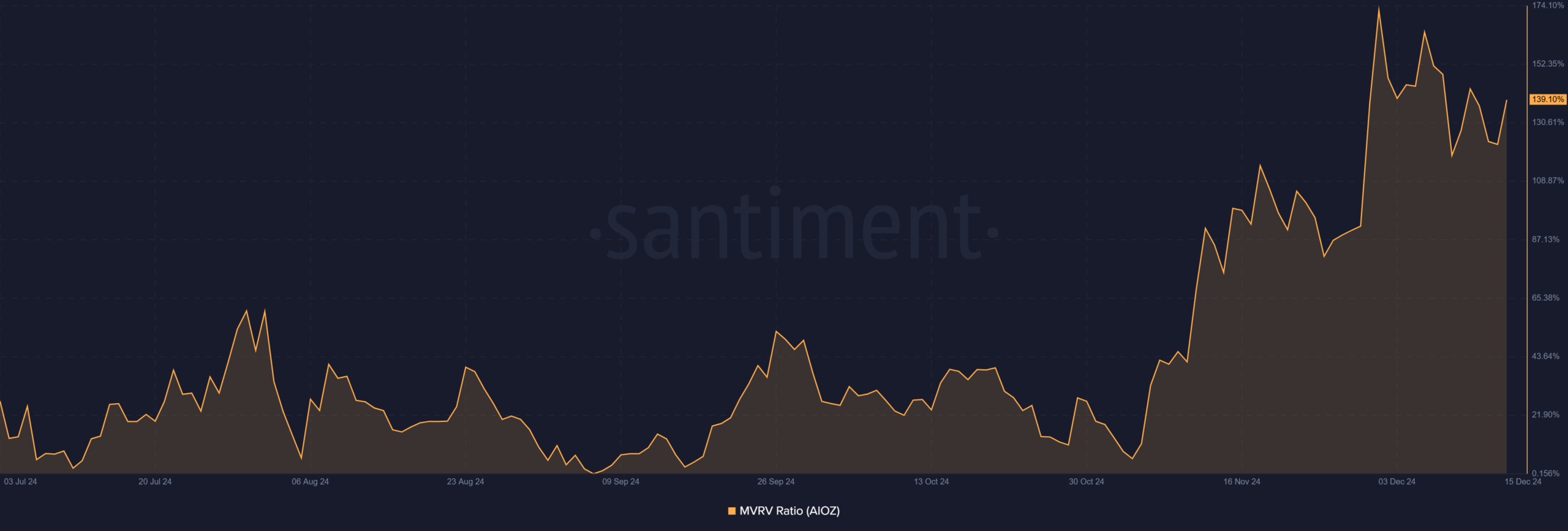

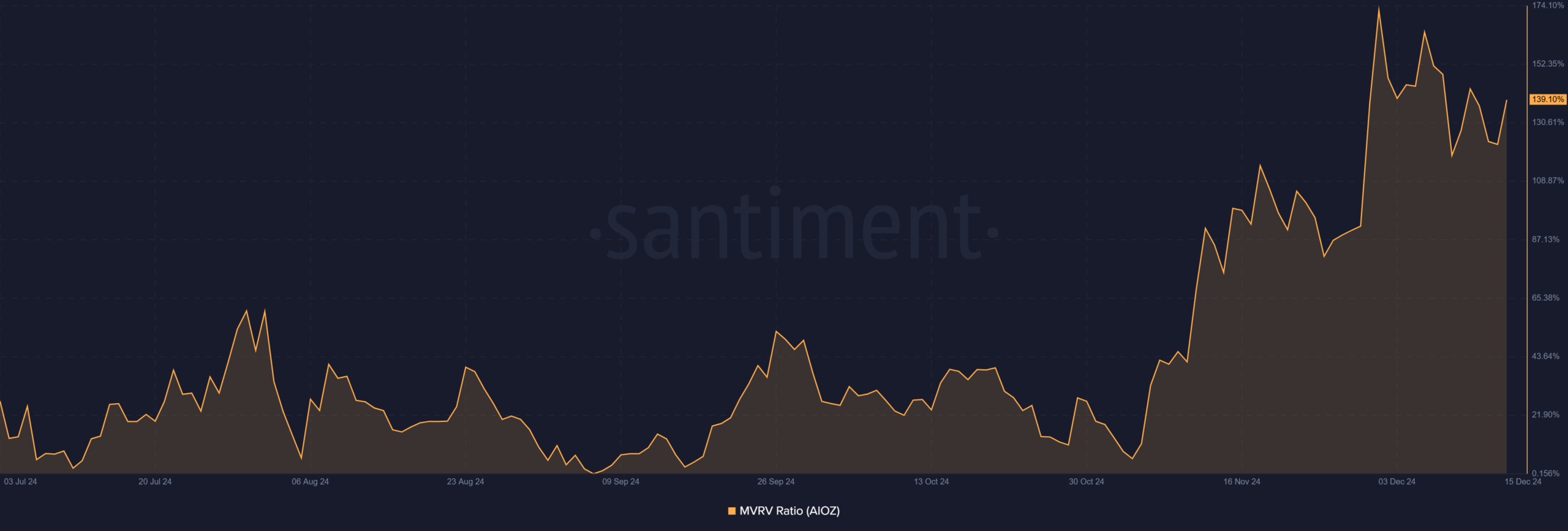

AIOZ MVRVratio: Are income sustainable?

The MVRV ratio climbed to 139.10%, emerging from 122.57% the day before today. This build up highlights that buyers are keeping considerable unrealized income.

On the other hand, such ranges additionally lift the opportunity of temporary profit-taking, which might result in minor corrections.

Supply: Santiment

Supply: Santiment

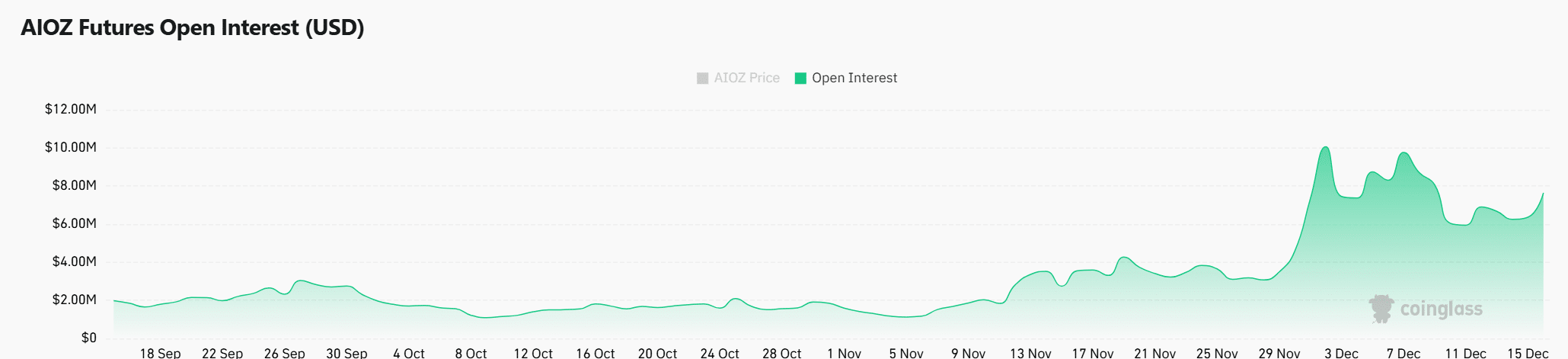

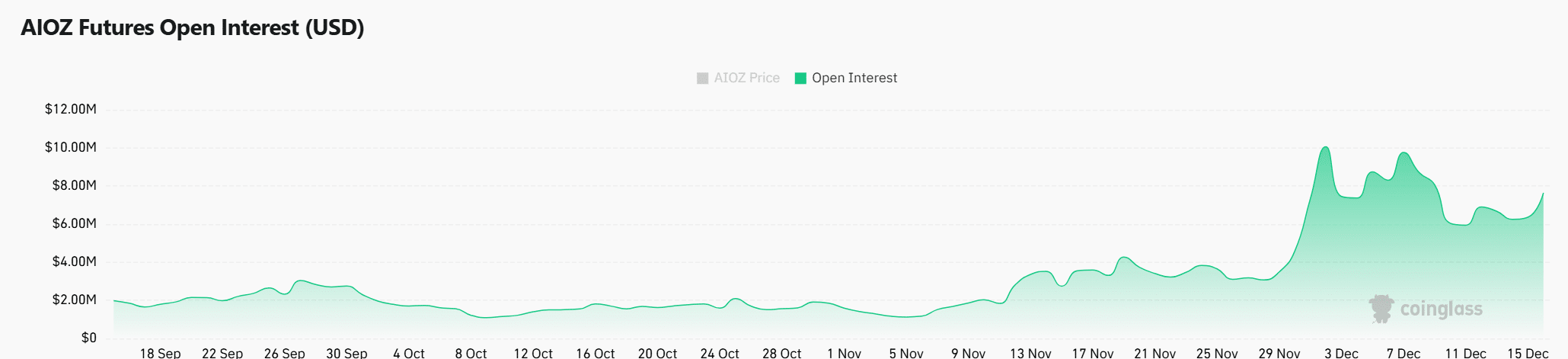

Derivatives knowledge research: Emerging dealer self assurance

The derivatives marketplace additionally displays rising optimism across the token. Open pastime surged by way of 13.30% to $7.41M, whilst buying and selling quantity noticed an outstanding build up of 46.62%. Those metrics spotlight a notable uptick in marketplace participation from each retail and institutional investors.

Subsequently, the expanding derivatives task suggests investors watch for additional upside for AIOZ.

Supply: Coinglass

Supply: Coinglass

AIOZ worth prediction 2025

AIOZ has robust momentum supported by way of bullish technical signs, expanding community task, and emerging derivatives self assurance. If the token effectively breaks and holds above $1.20, it’s prone to rally towards $1.40 within the close to time period.

Taking a look forward to 2025, sustained call for, stable on-chain enlargement, and investor optimism place AIOZ for additional upward beneficial properties, probably attaining new highs.

Subsequent: Stacks surges by way of 11% in 24 hours: Is $3 subsequent for STX?