Ethereum’s change netflows on by-product exchanges fell beneath -400,000 ETH

CME ETH Futures Open Passion chart published a decline from $3,216.66M to $3,251.98M over 16 hours

Ethereum’s change netflows on by-product exchanges just lately fell beneath -400,000 ETH, coinciding with Bitcoin miner underpayment – An indication of marketplace pressure. Those traits, in combination, hinted at a vital ETH withdrawal from exchanges. This kind of construction is traditionally related to a fall in promoting force and a hike in bullish sentiment around the marketplace.

A conceivable restoration at the charts?

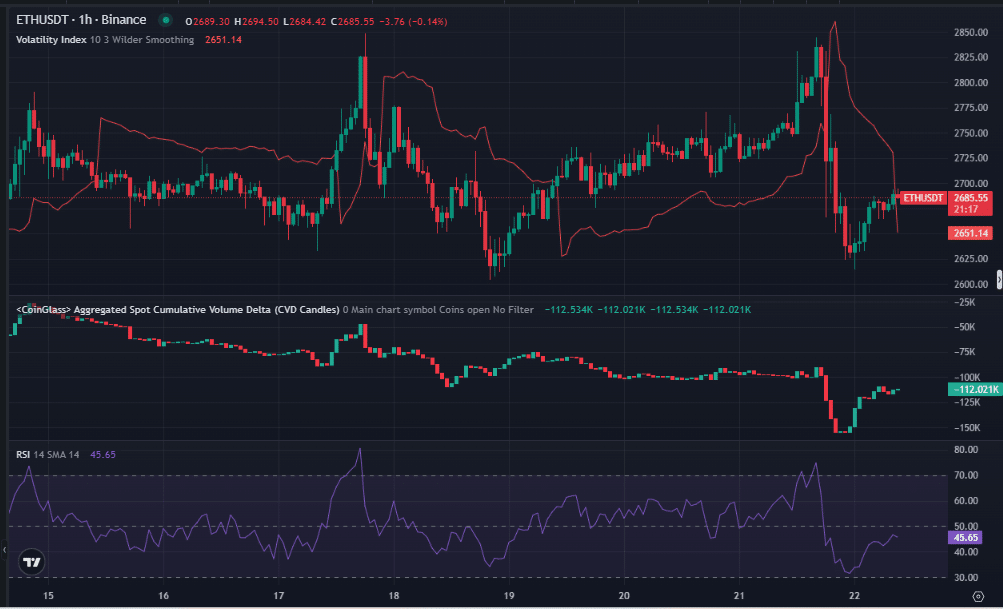

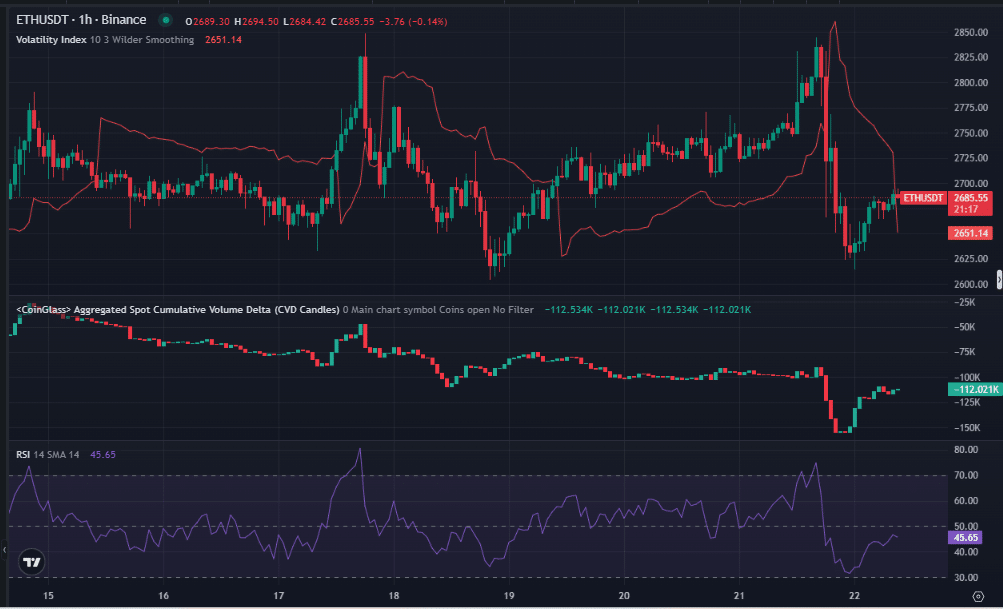

An research of the 1-hour ETH/USD chart on Binance noticed ETH buying and selling at round $2,685.55, following an even restoration over the past 72 hours. Price noting, alternatively, that the Bybit hack may nonetheless have some have an effect on at the altcoin’s worth.

Supply: CoinGlass

Supply: CoinGlass

The Relative Energy Index’s (RSI) place alluded to impartial to oversold stipulations around the marketplace – An indication of doable purchasing force. Traditionally, equivalent RSI ranges have preceded value rebounds, supporting diminished promoting force after primary outflows.

Additionally, the Aggregated Cumulative Quantity Delta (CVD) at -112.02k mirrored robust promoting dominance. Alternatively, as the fee bottomed, accumulation by way of strategic buyers used to be noticed too. Those alerts aligned with a bullish shift, reinforcing a conceivable transfer above $2,800 as buyers adjusted their positions.

A bullish accumulation sign

Ethereum’s three-month change netflows chart highlighted detrimental outflows of -191.96K ETH, with top outflows noticed very just lately.

Supply: IntoTheBlock

Supply: IntoTheBlock

In most cases, such primary outflows indicate a fall in promoting force, as traders shift property into chilly garage. The cost response close to $2,730, adopted by way of a decline to $2,529, mirrored an expected marketplace consolidation section.

Miner underpayment pressure additional indicated supply-side discounts, environment the root for a rebound as promoting job weakened.

Marketplace positioning for the next step

Moreover, an research of the CME ETH Futures Open Passion confirmed a decline from $3,216.66M to $3,251.98M over 16 hours.

Supply: CoinGlass

Supply: CoinGlass

It used to be buying and selling $2,736.79 at press time, with the drop in Open Passion signaling diminished speculative job. A equivalent trend in mid-2024 preceded value recoveries, aligning with the speculation of marketplace positioning prior to a possible transfer.

Decrease Open Passion is incessantly an indication of profit-taking or leverage discounts. This may additionally trace at marketplace stabilization, prior to a rebound pushed by way of bettering sentiment and diminished promoting force.

A prelude to a cost surge?

The 1-hour ETH/USD Volatility Index, smoothed over 10 sessions, stood at 26.61. During the last 16 hours, volatility spiked throughout the sell-off to $2,618.17, stabilizing afterwards.

This trend signaled marketplace uncertainty, however the diminished volatility gave the look to be consistent with historic post-outflow consolidations.

Holder self assurance stays robust amid marketplace pressure

In any case, the International In/Out of the Cash confirmed 107.13M ETH within the cash (75.06%), 24.24M ETH out of the cash (16.98%), and 11.35M ETH on the cash (7.95%), with ETH buying and selling at $2,686.24.

Supply: IntoTheBlock

Supply: IntoTheBlock

A dominant in-the-money Ethereum delivery is an indication of holder self assurance, decreasing sell-off dangers. The out-of-the-money demographic hinted at resistance zones, however total, the construction pointed in opposition to doable upside as miner underpayment force eased.

Those distributions resembled previous bullish recoveries, supporting the thesis of accumulation after huge outflows.

Subsequent: Cardano value prediction – A ten% hike could be incoming IF…