Litecoin’s worth larger through 3% within the ultimate 24 hours.

Marketplace sentiment across the coin remained bullish.

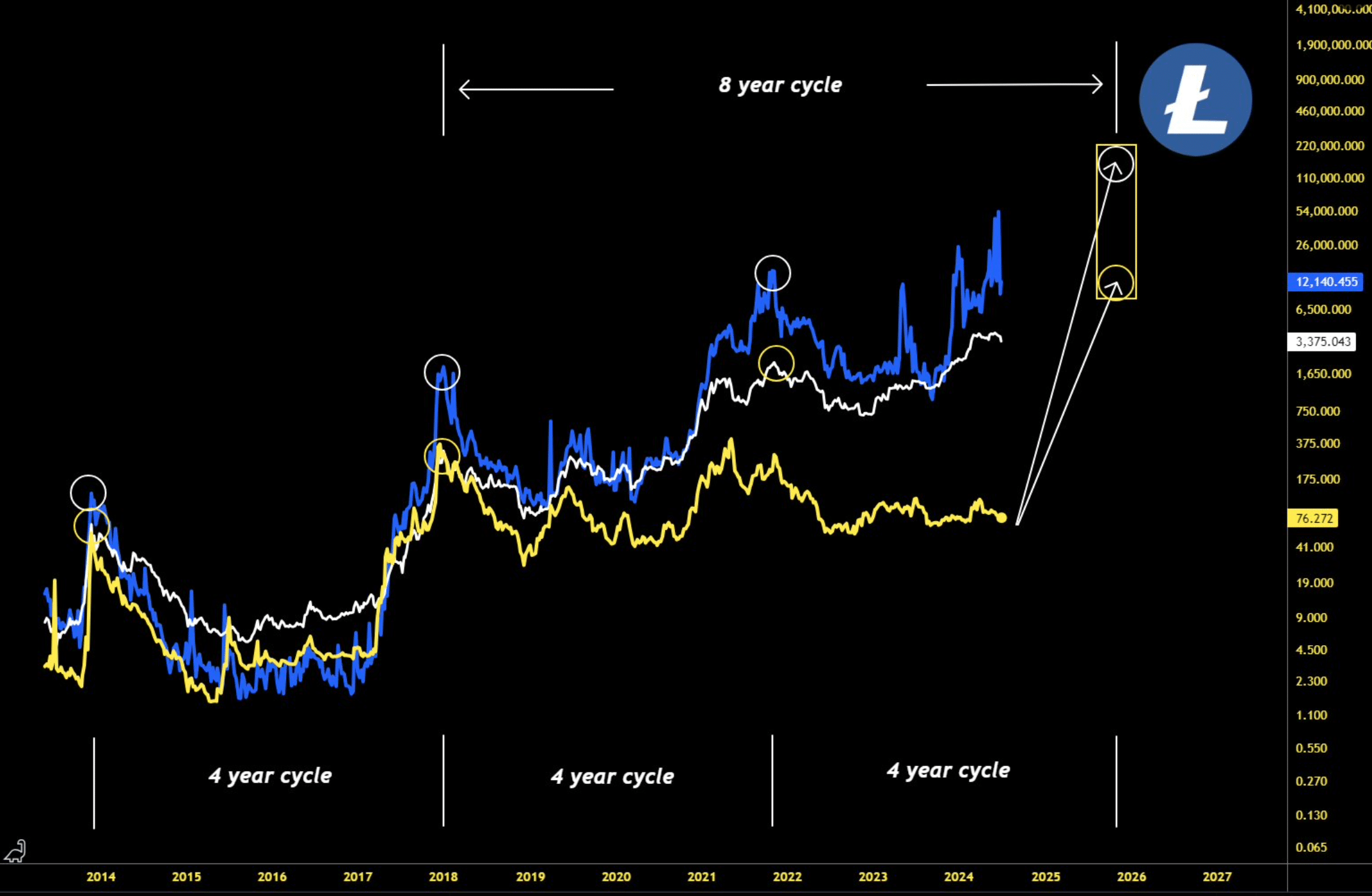

Litecoin [LTC], like maximum different cryptos, had a troublesome time ultimate month because it misplaced a great deal of its price. Actually, if the newest knowledge is to be thought to be, then LTC could be in an 8-year cycle, which to start with look seemed relating to.

Then again, there’s extra to the tale.

What’s happening with Litecoin?

CoinMarketCap’s knowledge printed that Litecoin’s worth witnessed greater than a 22% correction within the ultimate 30 days on my own. The declining development didn’t finish previously week, because it used to be down through 13%.

Although this used to be relating to, the newest research from Grasp, a well-liked crypto analyst, printed a special image. As in step with the tweet, Litecoin is in its 8-year cycle now.

If this is true, then traders will witness LTC achieving a top in October 2025. Traditionally, right through every 4-year cycle, LTC has reached a top. To be actual, right through the years 2014, 2018, and 2022.

If historical past repeats itself, then LTC would possibly vary from $65k to over $100k right through its subsequent top.

Supply: X

Supply: X

This will also be anticipated within the quick time period

Since having a look on the 2025 top is a little bit too early for now, AMBCrypto deliberate to test the coin’s present state to peer what will also be anticipated within the close to time period.

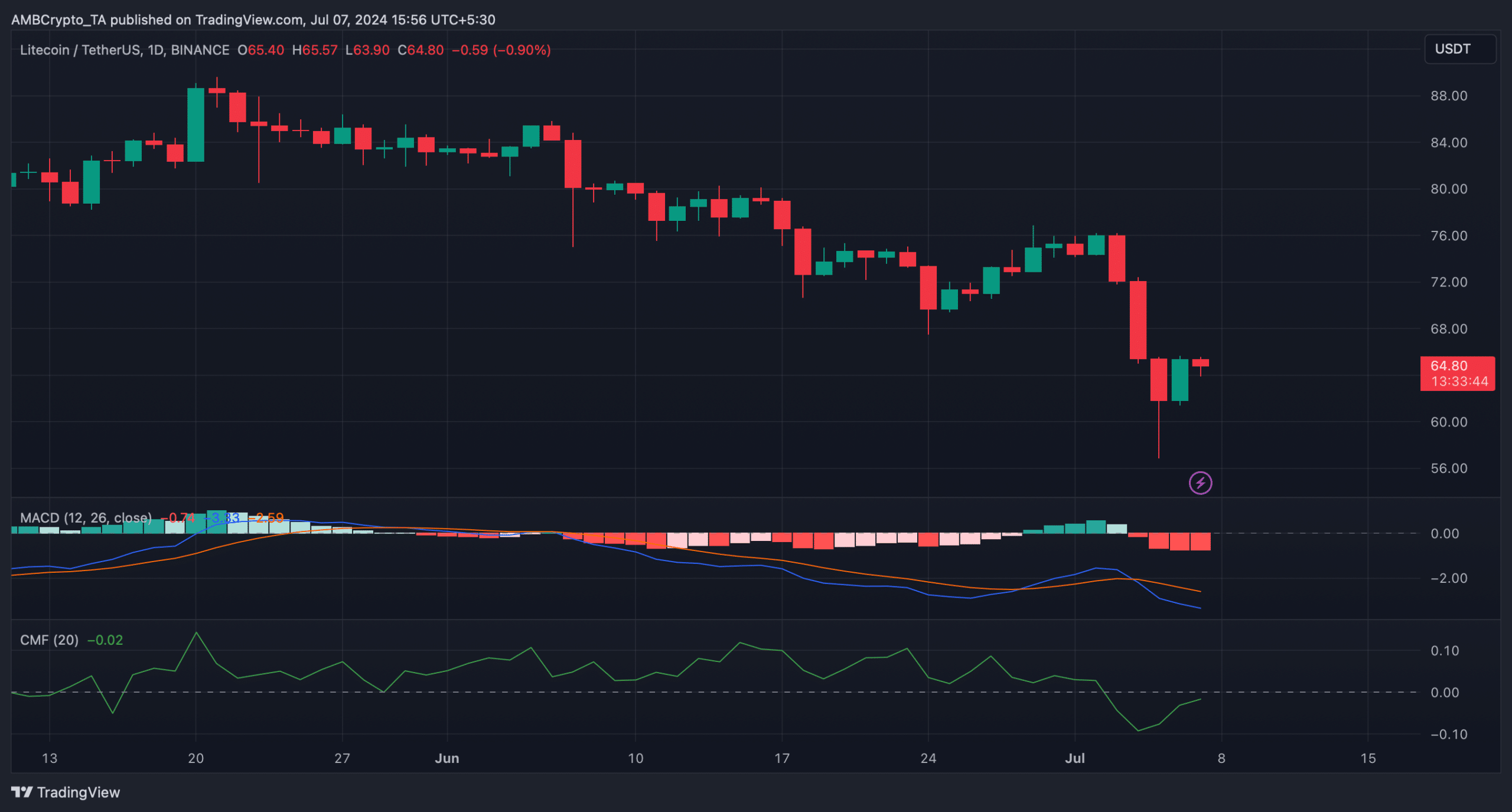

The excellent news used to be that, like every different cryptos, LTC additionally won bullish momentum within the ultimate 24 hours as its worth surged through greater than 3%.

On the time of writing, LTC used to be buying and selling at $64.73 with a marketplace capitalization of over $4.8 billion, making it the twenty first biggest crypto.

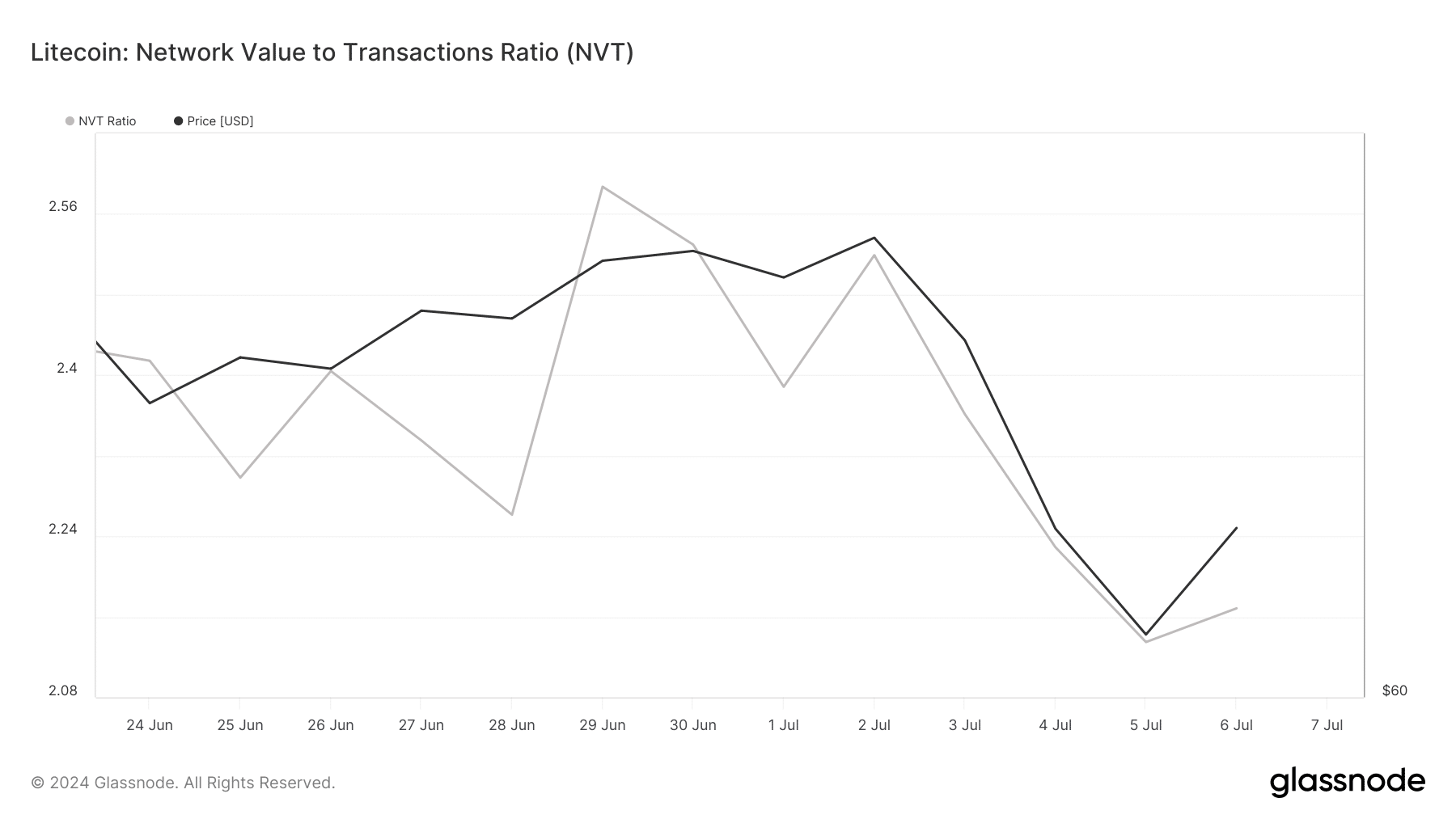

Issues can get even higher quickly, because the coin’s NVT ratio dropped ultimate week. A decline within the metric signifies that an asset is undervalued, hinting at a worth surge.

Supply: Glassnode

Supply: Glassnode

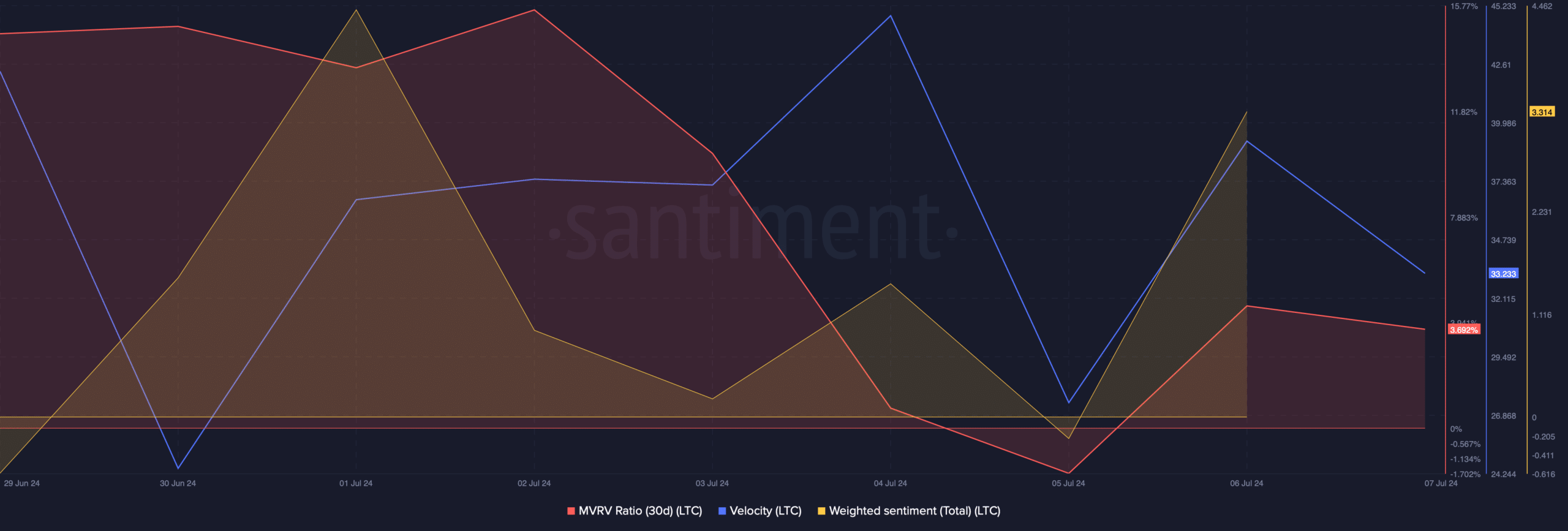

Buyers’ self belief within the coin additionally looked as if it would have progressed as its weighted sentiment went up. This obviously intended that bullish sentiment across the coin used to be dominant available in the market.

Nevertheless, now not each metric used to be positive. For example, the MVRV ratio registered a decline. Its speed additionally dipped in the previous few days, which means that LTC used to be used much less regularly in transactions inside of a suite time-frame.

Supply: Santiment

Supply: Santiment

Is your portfolio inexperienced? Take a look at the Litecoin Benefit Calculator

Our research of Coinglass’ knowledge printed that its lengthy/quick ratio additionally dipped, which means that there have been extra quick positions available in the market in comparison to lengthy positions.

The coin’s MACD displayed a bearish upperhand available in the market. Nevertheless, not anything will also be stated with utmost sure bet because the Chaikin Cash Go with the flow (CMF) registered an uptick, indicating a persisted worth upward thrust.

Supply: TradingView

Supply: TradingView