Nvidia (NASDAQ:NVDA) is the identify Wall Boulevard eagerly awaits because the Q3 profits season winds down. The chip large is scheduled to free up its October quarter (FQ3) profits this Wednesday (November 20), and all eyes are indisputably at the corporate’s efficiency to peer if it will possibly maintain its spectacular expansion trajectory.Do not Omit our Black Friday Provides:

Rick Schafer, a most sensible analyst at Oppenheimer and ranked eleventh amongst 1000’s of Wall Boulevard mavens, anticipates every other robust readout and steerage. “We see upside to F3Q (Oct) effects and F4Q (Jan) outlook led via sustained CSP/endeavor call for for AI accelerators,” Schafer commented.

With the H200 taking the lead, Information Middle – which accounts for 87% of revenues – must be up via 97% year-over-year and 9% sequentially. The Blackwell ramp takes to the air in F4Q and Schafer sees it contributing low-mid-single digit $billions within the quarter with a extra “tough ramp” anticipated in F1Q.

Networking (which makes up 14% of DC) is predicted to be up 9% quarter-over-quarter (+60% y/y) in F3Q. Spectrum-X Ethernet (Switches, DPUs) are “delivery in quantity,” and inside a 12 months are expected to give a contribution “multibillion-dollar” revenues.

Having a look forward to 2025, discussions with traders display the buyside is factoring 5-6 million GPUs for subsequent 12 months. The CY25 product combine is anticipated to lean towards “drop-in” HGX modules and air-cooled NVL36 GB200 racks, as those choices “perfect accommodate” present information middle infrastructure whilst demanding situations with liquid cooling are addressed.

For Gaming, no longer that way back Nvidia’s primary breadwinner, led via discrete PC GPU, Schafer sees y/y expansion of 6% and a sequential build up of 6%.

With sound possibilities forward, Schafer has now larger his CY24/25/26E EPS estimates from $2.80/$3.77/$4.51 to $2.85/$4.16/$5.04, respectively.

In spite of a staggering 183% year-to-date acquire, some distance outpacing the SOX index’s 17% upward push, Schafer contends Nvidia stocks stay attractively priced.

“NVDA trades at 29x our CY26E vs. 5-yr avg 37x,” the 5-star analyst stated. “One of the vital perfect GM/OM profiles within the team, NVDA is the purest scale play on AI proliferation. Sustained structural expansion led via DC/AI as accelerator connect will increase. NVDA’s entrenched DC/AI ecosystem core to GenAI. We’re long-term consumers.”

Accordingly, Schafer charges NVDA stocks as Outperform (i.e., Purchase), whilst his new $175 value goal (up from $150) makes room for 12-month returns of ~25%. (To look at Schafer’s monitor file, click on right here)

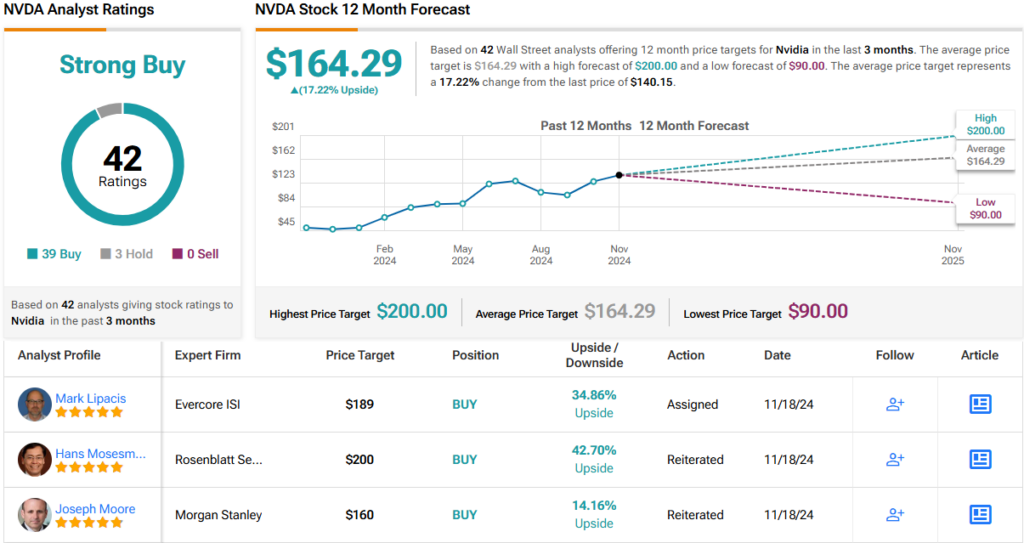

The remainder of the Boulevard likes NVDA too. The inventory claims a Sturdy Purchase consensus score in response to 39 Buys vs. 3 Holds. At $164.29, the typical value goal elements in one-year positive aspects of ~17%. (See NVDA inventory score)

To seek out excellent concepts for shares buying and selling at sexy valuations, seek advice from TipRanks’ Perfect Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions simplest. It is important to to do your individual research prior to making any funding.

:max_bytes(150000):strip_icc()/INV_UberHQ_GettyImages-1767540087-acf31fa021bf4dc99c93c0d264e00e06.jpg)