Cardano’s symmetrical triangle development may just result in a significant value surge or drawback possibility

Whale job and broader marketplace developments will form the altcoin’s subsequent value motion

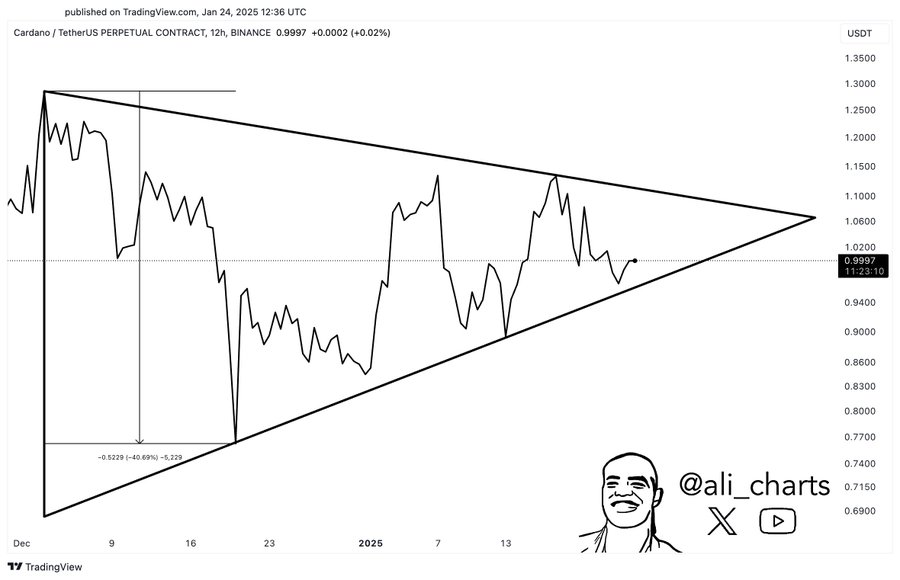

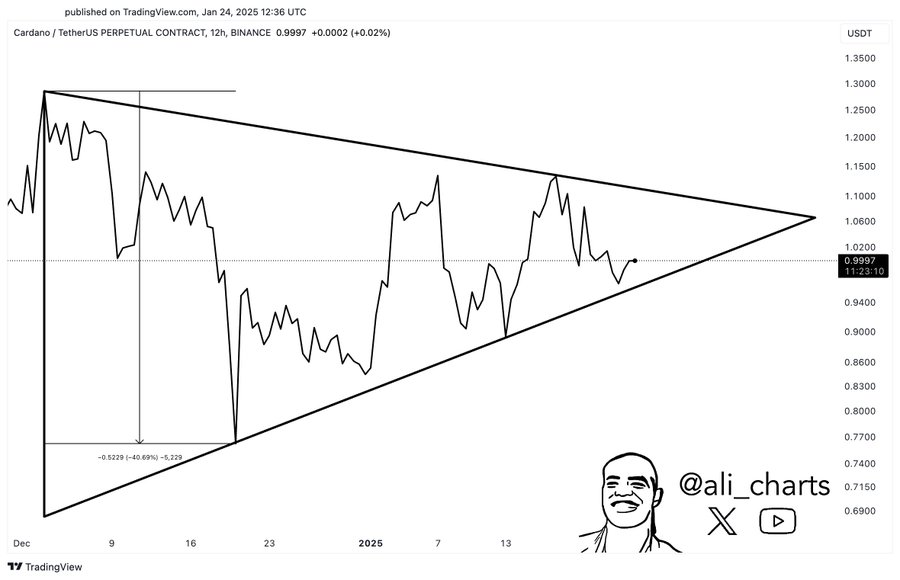

Cardano [ADA] reveals itself at a pivotal juncture, with its value motion narrowing right into a symmetrical triangle development – One who steadily precedes a vital breakout. This era of consolidation has stuck the eye of marketplace watchers, who forecast a possible 40% value surge if momentum shifts to the upside.

Whilst the development leaves room for each bullish and bearish situations, the tightening vary perceived to point out that heightened volatility is also approaching. With ADA’s subsequent transfer prone to set the tone for its brief to mid-term trajectory, the marketplace is carefully gazing for indicators of a decisive breakout.

Why symmetrical triangles steadily precede value breakouts

Symmetrical triangles shape when an asset’s value consolidates at the charts, growing decrease highs and better lows. This development displays a steadiness between patrons and dealers, steadily narrowing the variety till a breakout happens.

Symmetrical triangles don’t inherently sign course, however steadily precede sharp value actions because of the accumulation of marketplace power.

Supply: X

Supply: X

In style analyst Ali Martinez highlighted ADA’s value motion inside of this sort of triangle, with the beef up close to $0.83 and resistance round $1.06.

The extended consolidation perceived to align with ancient precedents, one the place the breakout course in most cases fits the existing development. Given ADA’s setup, the marketplace is now looking forward to a breach of both boundary. This might cause a 40% transfer within the breakout’s course.

Worth research and whale job’s have an effect on

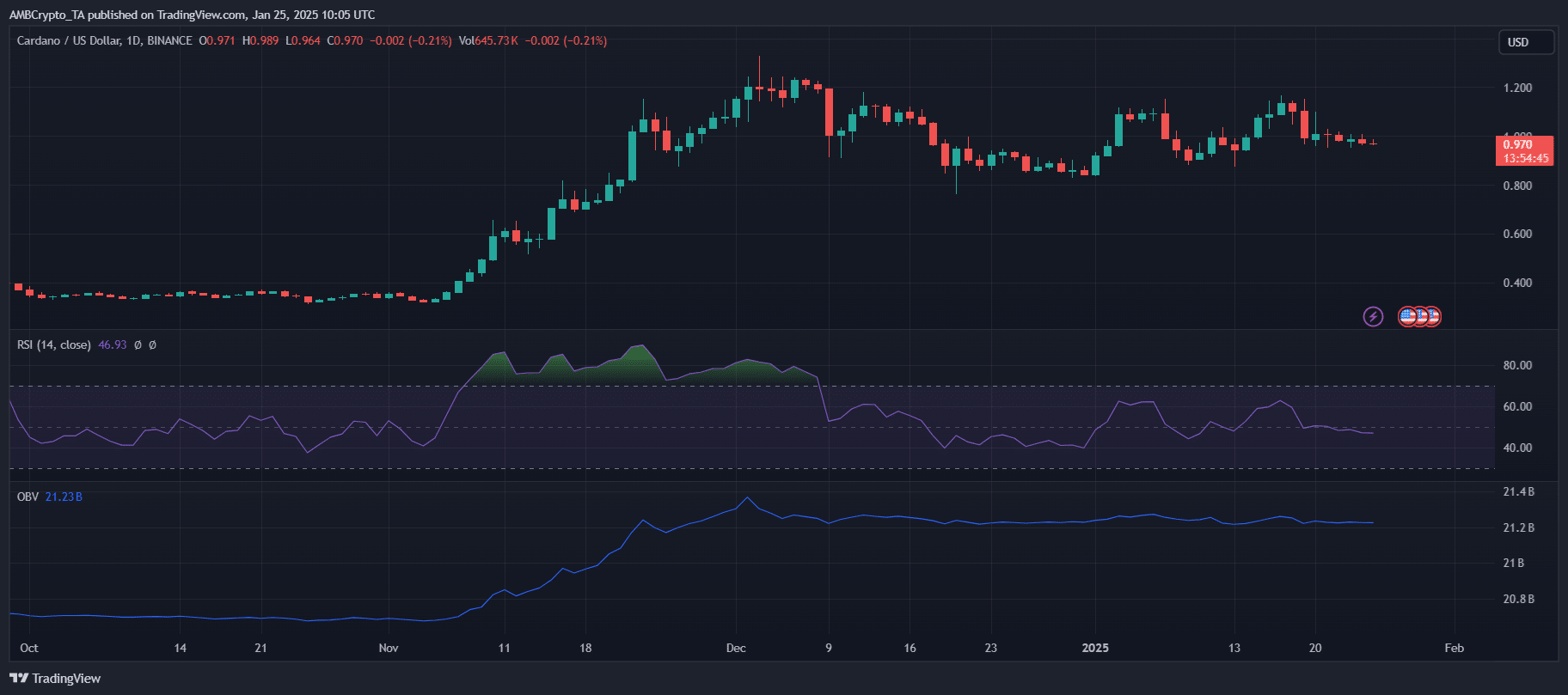

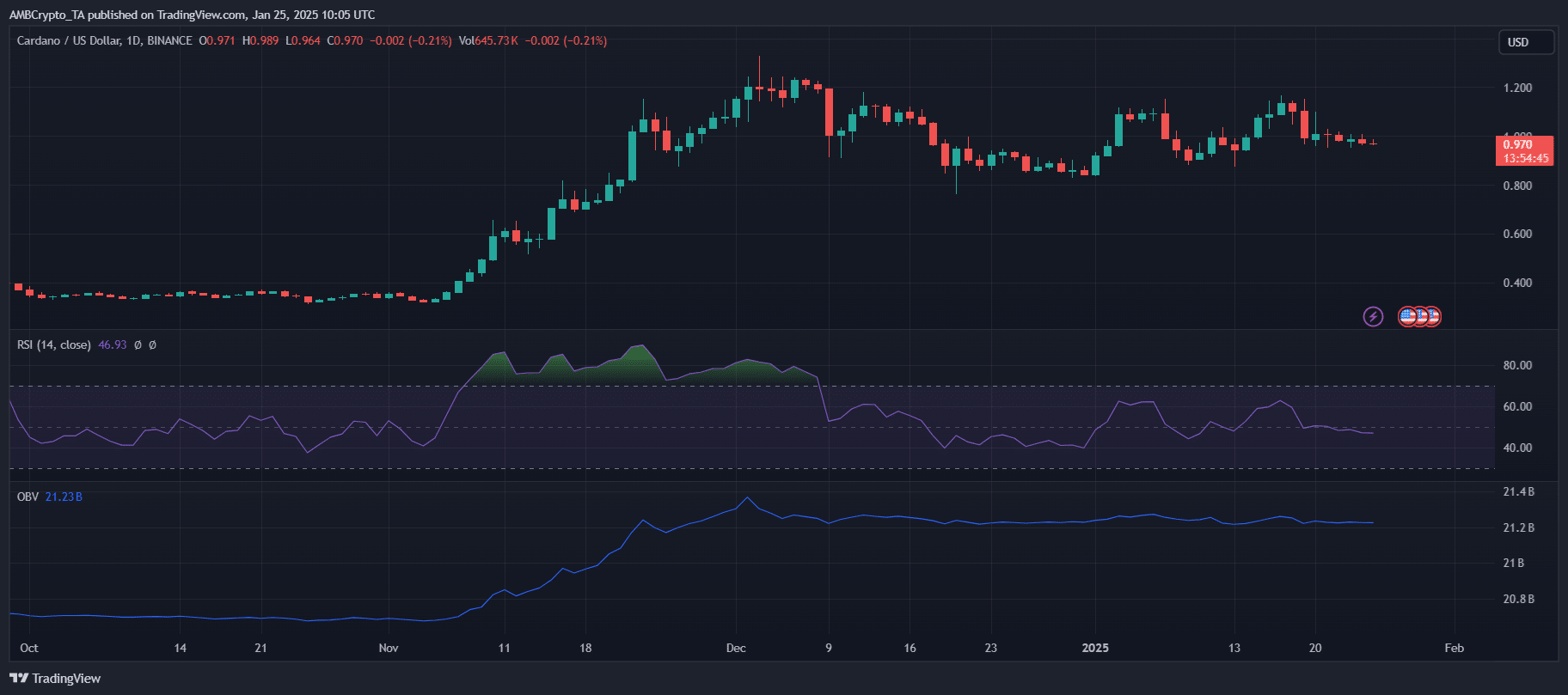

Supply: TradingView

Supply: TradingView

ADA’s press time value motion gave the look to be soaring round $0.97 – Keeping up a gentle steadiness between its $0.83 beef up and $1.06 resistance ranges. The symmetrical triangle development underlined indecision, with the volatility prone to surge upon breakout.

Supply: Santiment

Supply: Santiment

Whale job has been pivotal, with on-chain information appearing that over 180 million ADA was once bought via primary holders over the last week. This sell-off will have exerted downward power on ADA, stalling its upward momentum close to $1.06. Constant outflows from wallets retaining over $1 million hinted at waning self assurance amongst massive traders too.

If this development persists, it might cause a bearish breakdown under the $0.83 beef up. Conversely, a halt in sell-offs may just repair bullish sentiment and fortify a push above $1.06.

Learn Cardano’s [ADA] Worth Prediction 2025–2026

What may just impact ADA’s value within the following weeks?

Cardano’s value trajectory hinges at the answer of its symmetrical triangle development. A bullish breakout above $1.06 may just pave the way in which for a 40% hike, doubtlessly drawing renewed hobby from retail and institutional traders.

Key drivers for this state of affairs come with diminished whale sell-offs, better on-chain job, and broader marketplace optimism.

At the turn aspect, a breach under $0.83 beef up would possibly result in vital drawback dangers. Chronic whale outflows and susceptible marketplace sentiment may just magnify promoting power, pushing ADA in opposition to decrease ranges. Moreover, exterior elements like a normal macroeconomic uncertainty and Bitcoin’s value motion will most probably play a pivotal function in figuring out ADA’s trail.

Subsequent: Is Dogecoin’s newest 40% ‘hike’ the primary signal in opposition to restoration?