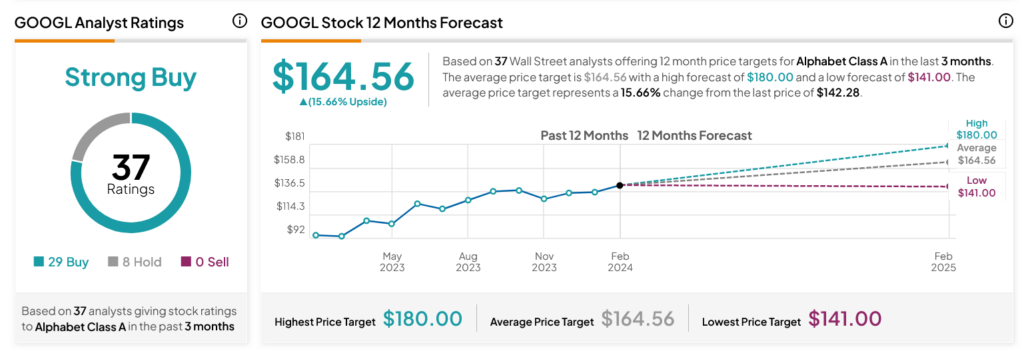

For a very long time, Alphabet's (NASDAQ:GOOG) (NASDAQ:GOOGL) subsidiary Google used to be the king of serps. Then again, that supremacy used to be challenged when phrase got here out that OpenAI used to be making plans to release its personal seek engine. The inventory, in the meantime, used to be down about 2.5% in Thursday afternoon buying and selling. Stories counsel that OpenAI's seek engine might be partly constructed round Microsoft's (NASDAQ:MSFT) Bing seek engine, which might give the underserved just a little additional lifestyles. Microsoft has already been including OpenAI merchandise to a number of of its merchandise, together with Bing, so it's no marvel that OpenAI's integration with Bing may just lengthen to the quest engine. OpenAI's seek engine may just lower Google's 90% proportion of the quest marketplace as it’s as of late. Don't Depend Google Out But Even if it is a problem, Google isn’t out of the battle. His paintings in AI has produced notable effects, beginning with the Gemini 1.5 improve to the present sequence of AI initiatives. Actually, Gemini 1.5 can analyze many stuff immediately; Only one instructed, document reviews, can analyze an hour of video, 11 hours of listening, or as much as 30,000 strains of code. Even if Google would possibly not be the highest canine on this box, it’ll unquestionably have pores and skin within the sport and ship effects. Is Alphabet Inventory a Purchase, Promote, or Grasp? Turning to Wall Boulevard, analysts have a Robust Purchase consensus on GOOGL inventory in keeping with 29 Buys and 8 Holds issued during the last 3 months, as proven within the chart beneath. After a 49.03% build up in proportion worth during the last 12 months, GOOGL's present proportion worth of $164.56 consistent with proportion implies a possible upside of 15.66%.

Disclosure