There’s a little bit of AI spending one-upmanship occurring some of the hyperscalers and cloud developers – and now the root type developers who’re partnering with their new sugar daddies so to have enough money to construct huge AI accelerator estates to push the state-of-the-art in type functions and intelligence.

It looks as if Amazon, thru its Amazon Internet Products and services cloud, is successful the AI funds bonanza sport. On a convention name with Wall Side road analysts going over the fourth quarter 2024 monetary effects for the Amazon conglomerate, leader monetary officer Brian Olsavsky stated this:

“Capital investments had been $26.3 billion within the fourth quarter, and we expect that run charge shall be somewhat consultant of our 2025 capital funding charge. Very similar to 2024, nearly all of the spend shall be to give a boost to the rising want for generation infrastructure. This basically pertains to AWS, together with to give a boost to call for for our AI products and services in addition to tech infrastructure to give a boost to our North The usa and Global segments.”

Later within the name, Olsavsky reiterated that the capital expenditure charge for Amazon in This fall 2024 could be sustained during 2025, and simply should you didn’t listen that proper, that signifies that Amazon will spend north of $100 billion in belongings and kit in 2025. Our highest wager – and we need to wager as a result of Amazon does now not reveal this – is that greater than 90 % of that capital spending will opt for AWS datacenters, and 90 % of that spending shall be for AI methods and the datacenters that wrap round them. In case you do this math on that, it really works out to $86 billion in AI datacenter spending in 2025, roughly.

As highest we will be able to determine from our personal type, knowledge generation has been an expanding portion of the Amazon capital funds since AWS used to be based in 2006. It used to be tens of thousands and thousands of greenbacks in step with quarter long ago then, and briefly busted thru masses of thousands and thousands of greenbacks because the AWS cloud grew. Because the first quarter of 2008, Amazon has invested $469.7 billion in belongings and kit, which is a staggering amount of cash till you imagine that that is the ballpark of what Amazon, Microsoft, Google, and Meta Platforms say they will spend on capital bills within the present calendar 12 months. (That’s $80 billion for Microsoft, $75 billion for Google, $65 billion for Meta Platforms, and $100 billion for Amazon.)

We predict that Amazon shelled out $38.4 billion in IT infrastructure spending in 2023, and $30.1 billion of that used to be for AI servers and the datacenters that space them. The opposite $8.2 billion used to be for generic datacenters and the servers, garage, and switches within them. In 2024, we expect this generic datacenter spending at Amazon (because of this AWS) used to be up 13.2 % to $9.3 billion, and AI datacenter spending at Amazon (once more allotted to AWS) doubled to only underneath $60 billion. Amazon spent any other $14.6 billion for success facilities, transportation methods, and administrative center house, which used to be down 4.7 %.

This type has a number of witchcraft in it, we concede, and we made some assumptions about easy methods to apportion this. If we ran the Securities and Alternate Fee, such disclosures could be performed as a question after all as a result of you wish to have such granularity in financials to make funding selections.

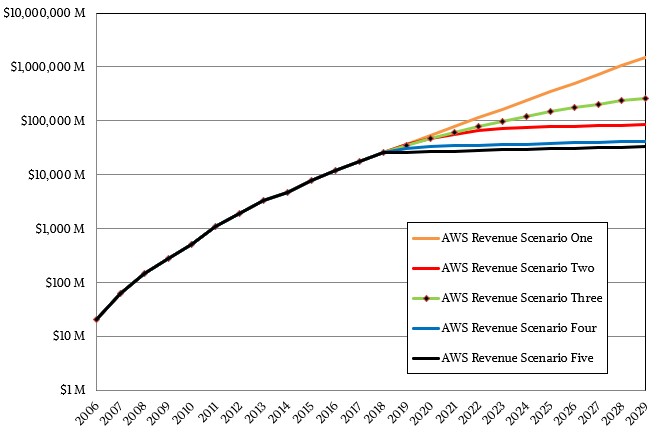

The fantastic factor in regards to the measurement of the 2025 capital expense funds for Amazon is that it at the similar order of magnitude as the corporate’s AWS cloud revenues in 2023, which got here in at $90.76 billion. In 2024, annual revenues at AWS rose through 18.5 % to $107.6 billion. Long ago in February 2019, we had been stated that AWS would no doubt wreck $100 billion in annual gross sales in 2026, which might had been the twentieth anniversary of the release of the bookseller’s cloud department, and due to the AI revolution and a powerful push to transport enterprises to the cloud, Amazon has beat that projection through two years.

By means of the best way, only for a laugh, this is the chart we did for earnings projections, and we stated Situation 3 used to be the possibly, the place enlargement would step down steadily:

In that type above, Situation 3, which we selected because the possibly long term trail for AWS gross sales, had AWS earnings at $98.8 billion in 2023 and at $123.5 billion in 2024. So, Jeff and Andy, excellent task, you virtually met our expectancies. . . .

The article that has us scratching our heads is that the funding in AI tools each and every quarter and each and every 12 months is greater – and significantly higher at that – than the working source of revenue of AWS for the ones occasions. The ratio of IT investments to working source of revenue averaged 1.72X in 2024 and averaged 1.58X in 2023; infrequently, the ratio is two times as massive. In This fall 2024, as an example, that ratio of IT spending for AWS to working source of revenue for AWS used to be 2.3X, as an example.

How is that this sustainable? Neatly, it’s important to spend cash to earn a living.

For AI servers and the datacenters that wrap round them, as we’ve proven right here, for each and every $1 you spend for an AI cluster and its datacenter (together with its energy and cooling), you get 87.8 cents again once a year that you just hire that AI cluster out to consumers, assuming an inexpensive mixture of on-demand and reserved example hours and a $9.40 in step with GPU-hour charge. In 410 days, you get your bait again on all the AI datacenter funding should you hire the entire GPUs out. The type we created (riffing on an Nvidia type) presentations that for the 3 years after that, the 87.8 cents in step with 12 months is going proper into your pocket. After that, it’s important to pay some incremental energy and cooling and operations value outdoor of the 5 years. Name it 75 cents benefit once a year. Stay the GPU within the box for a decade – and there’s no explanation why to consider this is not going to occur with Nvidia “Hopper” H100 GPUs – and also you get to pocket about $6.25 for that $1 funding over a decade.

It might be exhausting to discover a higher industry. Which is why we see the tech titans all plowing such a lot cash into AI {hardware} and the datacenters that wrap round them. In addition they need to earn a living promoting AI fashions, which is a special (however comparable) tale.

So let’s take the inputs from the Large 4 and spot what the outputs are. Microsoft’s $80 billion plus Meta Platforms’ $65 billion plus Google’s $75 billion plus Amazon’s estimated $86 billion (from our monetary type) is $306 billion. The output, in the case of earnings, over the following decade from renting that giant AI server capability, assuming there isn’t a cave in in pricing, is $1,912.5 billion. Assuming worth cuts through the years which might be modest, name it $1.5 trillion of output. If you might want to build up your cash through 5X over a decade at the AI gravy teach, wouldn’t you?

This is the reason Amazon, and subsequently AWS, has the competitive angle that it has.

“The majority of that CapEx spend is on AI for AWS,” Amazon leader govt officer Andy Jassy stated at the name. “It’s the best way the AWS industry works. The way in which the money cycle works is that the speedier we develop, the extra CapEx we finally end up spending as a result of we need to procure datacenter and {hardware} and chips and networking tools forward of once we are in a position to monetize it. However we don’t procure it until we see important indicators of call for. And so, when AWS is increasing its CapEx, specifically in what we expect is this kind of once-in-a-lifetime form of industry alternatives like AI represents, I believe it’s in reality rather a excellent signal medium-to-long time period for the AWS industry. And I in reality assume that spending this capital to pursue this chance, which from our viewpoint, we expect just about each and every utility that we all know of nowadays goes to be reinvented with AI within it and with inference being a core construction block identical to compute and garage and database.”

See? All of this spending is a number one indicator of increase occasions to come back.

A bit later within the name, Jassy had this additional to mention about this humungous AI funding and the truth that AWS could be extra competitive if it weren’t for provide chain problems:

“It’s exhausting to bitch in case you have a multi-billion buck annualized earnings run charge industry in AI like we do and it’s rising at a triple digit share year-over-year. It’s exhausting to bitch. Alternatively, it’s true that we might be rising sooner if now not for one of the crucial constraints on capability. They usually come within the type of — I might say, chips from our third-party companions are available a little bit bit slower than ahead of with numerous midstream adjustments to take a little bit little bit of time to get the {hardware} in reality yielding the share wholesome and fine quality servers we predict. It comes with our personal large new release of our personal {hardware} and our personal ships in Trainium2, which we simply went to basic availability at re:Invent, however the majority of the quantity is coming in actually over the following couple of quarters.”

So numerous that capital spending in 2025 is to compensate for Nvidia “Blackwell” device orders and to pay for the Trainium2 ramp, which is going on to give a boost to AI type maker Anthropic in addition to different consumers the usage of the AWS SageMaker and Bedrock AI type products and services.

Having stated all of that, let’s drill down into the effects for the fourth quarter.

In This fall, AWS revenues had been 28.79 billion, up 18.9 % 12 months on 12 months and up 4.9 % sequentially. Working source of revenue used to be $10.63 billion, up 48.3 % in comparison to the prior duration and representing 36.9 % of the earnings circulation, which is lovely excellent for an amalgam of a {hardware} producer and a instrument provider, which is what the AWS cloud is.

We predict that because of the expansion of cloud computing normally and AI coaching particularly, the compute portion of the AWS industry is booming, and that the corporate’s charges for garage and networking had been happening and that spending on upper stage instrument also are knocking down. It will glance one thing like this:

We concede that this chart is only a wager, now not in keeping with anything else rather than our hunches. Within the absence of actual knowledge, guesstimations should be made. Like this:

Kirk: Mr. Spock, have you ever accounted for the variable mass of whales and water on your time re-entry program?

Spock: Mr. Scott can’t give me precise figures, Admiral, so… I will be able to make a wager.

Kirk: A wager? You, Spock? That’s abnormal.

Spock: [to Dr. McCoy] I don’t assume he understands.

McCoy: No, Spock. He signifies that he feels more secure about your guesses than maximum other folks’s info.

Spock: Then you definately’re pronouncing. . .

[pause]

Spock: This is a praise?

McCoy: It’s.

Spock: Ah. Then, I will be able to attempt to make the most productive wager I will.

McCoy: Please do.

In any tournament, as firms embody AI fashions curated through or created through AWS and use them to coach AI fashions and put them into manufacturing on their precise workloads, you’ll see that compute earnings at AWS stage off as worth/efficiency curves are ridden down. You’ll additionally see that instrument earnings curve flex up once more because the funds shifts extra in opposition to instrument and clear of {hardware}.

Those are transient stipulations for compute. Remember the fact that. Within the longest of runs, instrument all the time represents nearly all of the IT worth.

One last item: There is an engaging interaction of depreciation for datacenters and warehouses taking place at Amazon.

Olsavsky stated that AWS larger the “helpful existence,” a technical accounting definition, for a few of its servers in 2025, which boosted AWS working margins through two issues in This fall 2024. Apparently, AWS took a troublesome have a look at the helpful lifetime of its AI methods and shall be lowering the helpful lifetime of older server and networking tools from six years to 5 years efficient in 2025, which can lower full-year 2025 working source of revenue through $700 million. Olsavsky stated that Amazon additionally data a This fall 2024 rate of $920 million from speeded up depreciation for different server and networking apparatus, and that any other $600 million rate on an identical apparatus shall be taken through Amazon in 2025. To offset those fees, Amazon seemed round its success warehouses and took a troublesome have a look at the helpful lifetime of heavy apparatus used right here and made up our minds to increase the helpful lifetime of this tools from ten years to 13 years, offering a $900 million working benefit receive advantages for 2025, greater than offsetting the $600 million rate for the server and networking writeoffs coming this 12 months.

Signal as much as our E-newsletter That includes highlights, research, and tales from the week at once from us for your inbox with not anything in between.

Signal as much as our E-newsletter That includes highlights, research, and tales from the week at once from us for your inbox with not anything in between.

Subscribe now

Similar Articles